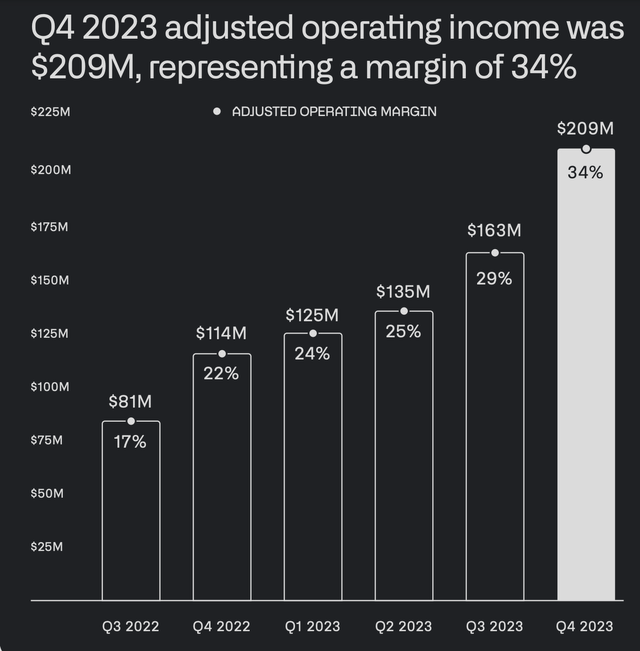

At first glance, the valuation assigned to Palantir Technologies Inc. (NASDAQ:NYSE:PLTR) looks very inflated. Palantir has a market capitalization of $52 billion with 2023 revenue of only $2.2 billion and top-line growth of only 17%. Operating income was $209 million (non-GAAP). Thus, PLTR stock trades at 24x sales (ttm) and 62x operating income (run-rate) with tepid revenue growth. How can this valuation make sense?

In this article, I take a closer look and explain why Palantir’s high valuation is ultimately justified. Specifically, given the scalable nature of its software business, Palantir doesn’t need to perform any heroics for profitability to properly catch up with its current valuation within 5 years. Even fairly modest growth should suffice. Moreover, since Palantir’s growth is accelerating amidst the AI boom, there is a good chance that Palantir’s fundamentals will more than catch up with its current valuation and generate excess returns. As a result, I consider Palantir to be a very compelling long-term investment, and rate PLTR stock a strong buy.

Slow And Steady Is Good Enough

As noted, Palantir’s top-line growth in 2023 clocked in at a tepid 17%. However, 2023 was a slow year for Palantir, and in previous years, its top line had grown more quickly: 24% in 2022, 33% in 2021, and 47% in 2020. Moreover, in Q4 2023, Palantir’s growth accelerated, with revenue growing 20% year-over-year (9% sequentially). Even more impressively, Palantir’s commercial business grew 32% year-over-year (13% sequentially) and its U.S. commercial business grew 70% year-over-year (12% sequentially).

The accelerating growth is great news for investors, and I will discuss it in more detail in the next section. But the first point I want to make is that even if Palantir’s growth is quite modest over the coming years, its profits would most likely still grow enough within 5 years for its fundamentals to catch up with its high current valuation. Recognizing this point shows that investors are still paying a fairly reasonable price for Palantir shares, in my opinion, despite the surge in share price over the last few quarters.

The most important fact about Palantir’s business model is the scalability of its software business. The nice thing about a software licensing business is that once a piece of software is developed, the marginal cost of licensing it to one additional customer (or machine) is negligible. Of course, there are research and development costs for the initial production and eventual updates of the software, but these do not scale much with revenues – they are more or less fixed for a piece of software.

This means that if Palantir can license its software to more customers, then the incremental revenues should make their way to operating profits relatively intact (aside from increased SGA overhead). These incremental operating profits should then make their way relatively intact to net profits (aside from increased taxes). What this means is that if Palantir can keep adding customers even at a relatively modest pace, its profitability should still increase quite substantially because most of the incremental revenues will reach the bottom line relatively intact. Please note that currently, Palantir is doing a great job at customer acquisition, and its customer count grew 55% year-over-year and 22% sequentially in Q4.

We can see the scalability of Palantir’s business reflected quite clearly in the company’s financial statements. The figure below shows how Palantir’s costs have barely budged as its revenues have grown over the last few quarters. Both cost of goods sold and SGA overhead have remained impressively flat despite Palantir’s customer count going up quite a lot. Only research and development costs have seen a steady increase (which investors probably want to see in a growing technology firm anyway).

Seeking Alpha

Additionally, if we compare Q4 2024 to Q4 2023, Palantir increased its revenue by $100 million during this time. As readers can see below, its non-GAAP operating profits increased by $95 million. This means that a whopping 95% of Palantir’s incremental revenues ended up as operating profits. This is very impressive scalability.

Palantir Q4 2023 earnings presentation

What all this means is that even if Palantir grows at a very modest pace of, say, 15% annually for the next 5 years, its profits would still grow enough to justify the current valuation. Let’s run through the numbers.

If Palantir grows at 15% for 5 years, its revenue would roughly double from a run-rate of $2.4 billion last quarter to a run-rate of $4.8 billion. That’s $2.4 billion of incremental revenue. Even if we conservatively leave a very healthy margin of error and say that only 70% (and not 95%) of this incremental revenue would end up as operating profit, this gives us an additional $1.7 billion of operating profits. This would bring the total operating profits to $2.5 billion in 5 years – slightly more than 3x the current run-rate.

At this level of profitability, Palantir’s current valuation of $52 billion would represent a 21x run-rate operating profits. While 21x may not be cheap, it is not an unusual multiple for a fast-growing technology firm. Hence, it seems fair to say that even with modest growth, Palantir’s fundamentals will eventually catch up to its current high valuation.

Palantir Has A Lot Of Tailwinds

There is also a significant chance that Palantir will grow faster than the 15% figure used above. In Q4 Palantir’s growth accelerated to 20% year-over-year. Palantir also guided 2024 revenues of $2.65 billion-$2.67 billion, representing 19-20% top line growth.

In addition, it seems quite possible that Palantir’s growth could be boosted past 20% by the multiple tailwinds at its back:

- Palantir’s commercial business is starting to see excellent growth (32% year-over-year last quarter) as global investments toward AI continue to expand rapidly. It is possible that investments in 2024 and beyond could turn out to be larger than currently expected. In particular, if early adopters of Palantir’s AI-based commercial products, including AIP (Artificial Intelligence Platform), see clear financial benefits, others could follow suit quite quickly. Management noted on the last earnings call that they have “never before seen the level of customer enthusiasm and demand that we are currently seeing from AIP in US commercial.” We will have to wait and see how things go, but as an early mover, Palantir is well-positioned to capture more AI-based demand should it materialize.

- Palantir has recently introduced Bootcamp, which aims to onboard new customers quickly. Palantir claims that the company can now get to useful functionality with new customers within five days. On the earnings call, management noted that they “are already seeing evidence of bootcamps helping to significantly compress sales cycles and accelerate the rate of new customer acquisition.” Again, we will have to wait and see how successful Bootcamp turns out to be, but there could be more upside here.

- Palantir’s commercial business is growing faster than its government business (32% vs. 11% year-over-year last quarter), and has now reached almost the same overall size. As the commercial segment grows to be a larger proportion of Palantir’s revenues in coming years, Palantir’s overall growth could see a further boost (since commercial is growing faster).

- The U.S. government is taking AI very seriously in connection with its military applications, as evidenced by increasing restrictions on AI-related exports to China. As global tensions continue to rise and the U.S. military shifts its focus from counter-insurgency to international conflict among the major powers, it seems plausible that there could be further increases in AI-related efforts, especially as warfare becomes less reliant on humans and more reliant on machines.

- The U.S. government is also growing more interested in developing space-based military capabilities, as evidenced by the formation of the Space Force. We could see more spending in this area as competition against the great powers intensifies. Palantir’s MetaConstellation puts it at the forefront of the development of AI-based military capabilities in space, and positions it very well to capture further demand for space-based capabilities should it arise.

In light of all these tailwinds and opportunities, I believe Palantir could realistically grow at 25-30% over the next few years. Let’s run the numbers to see where that would bring its fundamentals in 5 years.

25%-30 annual growth over five years would take revenues from the current run-rate of $2.4 billion to $7.3-8.9 billion. This would imply incremental revenues of $4.9-6.5 billion.

If again we conservatively assume that only 70% of this incremental revenue would make its way to operating profits, then Palantir’s operating profits would increase by $3.4-$4.6 billion, arriving at a total of $4.2-$5.4 billion.

It is easy to see that if Palantir had operating profits of $4.2-5.4 billion, then its current valuation of $52 billion would be more than justified. Given that Palantir’s operating profits would have 6x in 5 years, a multiple of 20-30x would be quite reasonable. That would give us a market capitalization of about $100-150 billion, or a share price of about $48-$72. Hence, if Palantir’s growth re-accelerates, which it very reasonably could, then there is still plenty of upside here.

Palantir’s Risk Profile Is Compelling

Of course, all investments have associated risks, but overall for Palantir the risks currently seem acceptable. Below, I discuss the major elements of Palantir’s risk profile as I see them.

One positive from a risk point-of-view is the diversification between Palantir’s government and commercial businesses, and then further diversification within each of these businesses. The company’s products and services span many different areas, from data gathering via satellites to combat operations support, factory automation, and hospital management. This diversification exposes Palantir to a variety of industries, customers, and use cases, and limits the company’s reliance on any single product. Overall, diversification should limit the downside risk associated with Palantir.

Another positive from a risk point-of-view is the defense business, even though it has been growing slower than the commercial business. Palantir’s position as an increasingly prominent defense contractor further limits downside risk. The defense industry is difficult to break into, but once a company establishes itself as a significant defense contractor – as Palantir has done – then its defense business tends to be sticky. The U.S. government relies heavily on contractors to function properly, and normally does not look to end its relationships with them – in fact, the government tends to keep returning to established contractors with relevant projects. Palantir’s important role in defense, especially as automation and artificial intelligence continue to reshape modern warfare, should again limit the overall downside risk for Palantir investors: the defense business, at least, is likely to be a very steady one for years.

Having noted the positives, I do think there are three risks that investors should monitor over time. First, there is a great deal of uncertainty surrounding the AI boom and the expected pace of growth in this area over the coming years. It is possible that current expectations could be inflated (of course, this uncertainty cuts both ways – it is possible that AI could keep generating positive surprises as well).

Second, as more firms ramp their investments toward AI, Palantir could face intensifying competition, particularly in its commercial business. This is a material risk. Still, Palantir’s early mover advantage could help it maintain solid growth even in the face of intensifying competition, especially if overall demand for AI-based software keep growing.

Third, there is some risk of scandal with Palantir. Given the nature of some of the defense work that Palantir undertakes, it seems possible that some of its work could court controversy (as it has in the past). A serious scandal in the future could potentially tarnish Palantir’s brand, and this could impact both its government and commercial businesses.

Conclusion

As we have discussed, even with tepid growth over the next few years, I believe Palantir’s fundamentals would likely grow sufficiently to justify its current valuation. Moreover, given the likelihood that Palantir could post strong growth in coming years, there is significant upside potential as well. And although there are certainly risks associated with the firm, Palantir’s risk profile is quite compelling. Hence, overall, I rate Palantir stock a strong buy for long-term investors.

Read the full article here