Introduction

Rockwool A/S (OTCPK:RKWBF) is a Danish company focusing on the production of insulation, which accounts for 77% of its total revenue. That was a problem in 2023 as the sharp increase in inflation and key interest rates reduced the demand for insulation products as fewer homes were built or renovated. Interestingly, the company’s margin widened as Rockwool reported a higher EBIT on a lower revenue.

The other 23% of the company’s revenue comes from the Systems segment which manufactures products to soundproof office spaces; the Rockfon brand produces stone wool acoustic tiles which is a pretty nice niche business but as the main application for those products is in the office renovation business, this segment is hurting as well.

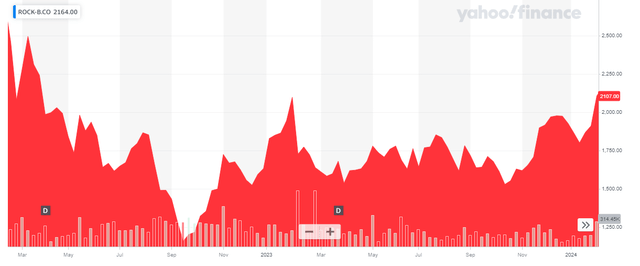

Yahoo Finance

Although Rockwool is a Danish company with its most liquid listing on the Danish Stock Exchange, it presents its financial results in Euro. I will use the Euro as base currency throughout this article and where applicable, I will convert Euros into DKK using an EUR/DKK exchange rate of 7.45 DKK per Euro. The ticker symbol in Denmark is ROCK-B and the average daily volume for Rockwool on its primary exchange is 35,000 shares. There are currently 21.6M shares outstanding (10.8 million A-shares with 10 votes and 10.8M B-shares with one vote – the B-shares are more liquid and that’s the equity class I will refer to throughout this article), resulting in a market cap of 46.7B DKK which is approximately 6.3B EUR.

Unfortunately, the company’s website contains quite a few ‘download only’ links, but you can find all relevant information I will refer to on this page.

A slowdown in the construction market weighs on the outlook

Rockwool’s financial results for FY 2023 were a mixed bag. On the one hand, the revenue was hit by the slowdown in construction and renovation activities throughout the world but that didn’t really matter as the company’s EBIT and EBIT margin increased sharply thanks to lower energy prices.

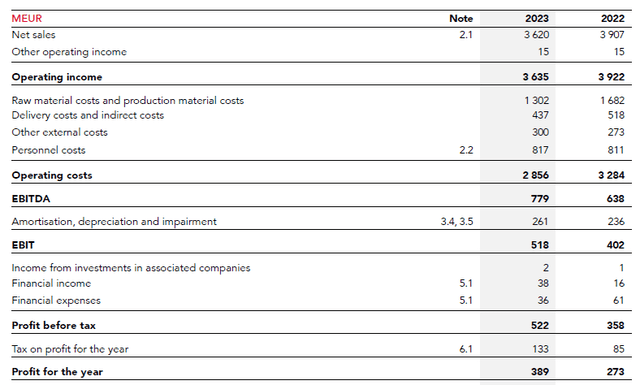

As the income statement below indicates, Rockwool reported a total revenue of 3.64B EUR which is a 7% decrease compared to the previous financial year. But there’s no need to worry as the raw material costs decreased by in excess of 20% while the delivery costs fell by almost 16% to 437M DKK. The total amount of operating costs decreased by a stunning 13% and this resulted in an EBITDA of 779M EUR which represents a 22% increase compared to FY 2022. That’s why I don’t particularly mind the lower revenue; there will always be volatility in the company’s numbers as some years will be better than others. But as long as Rockwool is able to protect its margins, I’m not too worried.

Rockwool Investor Relations

Although the depreciation and amortization expenses increased by approximately 10%, the EBIT still jumped by almost 30%. And with a net finance income of 4M EUR compared to a 44M EUR net expense in FY 2022, Rockwool was also able to benefit from this to post a pre-tax income of 522M EUR and a net profit of 389M EUR. This represents an EPS of 18 EUR per share which is an increase of almost 42% compared to the EPS result in 2022.

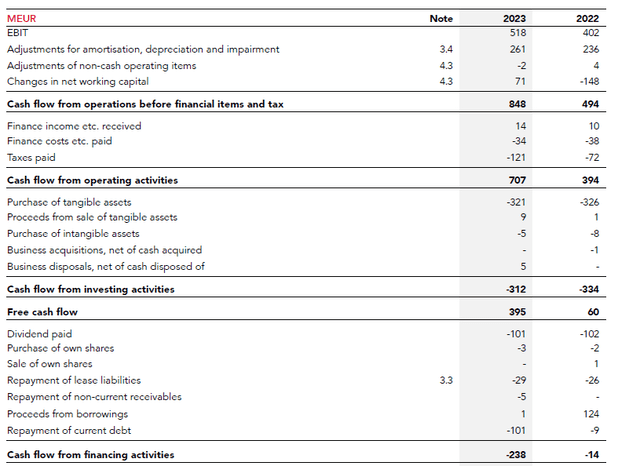

Interestingly, Rockwool continues to invest in expansion. As the cash flow statement below shows, the company spent about 350M EUR on capex and lease payments although its total depreciation and amortization expenses were just 261M EUR.

The reported operating cash flow was 707M EUR but this includes a 71M EUR working capital release. After deducting that 71M EUR again, and after deducting the 29M EUR in lease payments, the adjusted operating cash flow was 607M EUR. And if you’d also use the amount of taxes owed rather than the cash taxes paid, the underlying operating cash flow was 595M EUR.

Rockwool Investor Relations

The total capex was 321M EUR which results in a net free cash flow of 274M EUR. Divided over the 21.6M shares that are currently outstanding, the net free cash flow was 12.7 EUR per share. That’s just under 95 DKK per share.

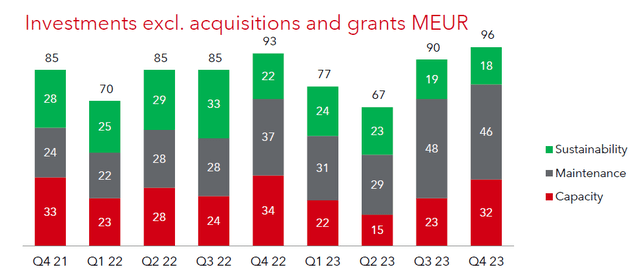

If we would look into the capital expenditures in more detail, we see the total sustaining capex was just 154M EUR. The company also spent 84M EUR on sustainability and 92M EUR on capacity expansion. If we would assume the investments in sustainability are also ‘sustaining’ capital expenditures, the total capex excluding capacity expansion was 228M EUR. Applying this to the aforementioned adjusted operating cash flow calculation results in a net free cash flow of 367M EUR or 17 EUR per share.

Rockwool Investor Relations

We could also argue that not all of the sustainability investments should be counted as maintenance capex. According to Rockwool, the majority of the sustainability capex is related to the preparation for the electrification of a French plant and the installation of an electrical melter in Switzerland. These are all non-recurring items and investments so perhaps they shouldn’t be seen as ‘pure’ sustaining capex.

Thanks to the strong cash flows, Rockwool currently has a net cash position of almost 240M EUR. This means the recently announced share buyback program to the tune of 160M EUR is fully funded by the existing cash position while the incoming cash flow in the current financial year will obviously also help. Rockwool will only be repurchasing the B Shares which carry one vote each.

Rockwool is also proposing to pay a dividend of 43DKK per share which represents approximately 5.8 EUR. The dividends are subject to the standard Danish dividend withholding tax of 27%.

For the current financial year, Rockwool is expecting a stable revenue in local currencies with an EBIT margin of ‘around 13%’. That’s somewhat disappointing compared to the 2023 EBIT margin of just over 14% but the 13% EBIT margin is really just reversing to the mean as the margin was very consistently 13-13.5% in the 2019-2021 era. It is also entirely possible the Rockwool management is quite cautious given the relatively limited visibility in the first half of the current financial year. And should the situation improve, we can likely expect a guidance hike.

Investment thesis

Using the EBIT margin guidance and a 1% revenue increase, the EBIT will likely decrease by approximately 43M EUR. Applying an average tax rate of 25%, the net profit and net free cash flow would be hit by approximately 32M EUR or 1.50 EUR per share, resulting in an anticipated EPS of 16.5 EUR per share. This would also indicate the sustaining free cash flow (excluding growth and excluding sustainability investments) would be approximately 20 EUR per share. That’s roughly 150 DKK at the current exchange rate which means Rockwool is currently trading at an underlying free cash flow yield of 6.9% which really isn’t bad at all.

That’s relatively attractive considering I expect the demand for insulation products to continue to increase. And although 2024 may be a tough year due to the prohibitive interest rate environment, I expect Rockwool to be able to show a revenue and EBIT increase from 2025 on again. Meanwhile, the share repurchase program will help to improve the performance on a per-share basis although I hope the company will be selective when it buys back stock and aggressively repurchases shares on weak moments.

I currently have no position in Rockwool, but my interest in the company and stock has now been triggered. I will for sure keep an eye on this company.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here