Shares of Lattice Semiconductor (NASDAQ:LSCC) have come to life since the 2010s. Like so many peers which all cater to the wider sector, this was a small business and stock in the 2010s, but has seen solid growth post-pandemic. The latest moves higher come amidst growth (and anticipation thereof) around the AI Hype, and the role which the company and its products can play in this craze.

Investors, however, have to take a leap of faith here, as the near-term results are set to cool off, while expectations continue to rise, which requires that investors really have to believe that new products and innovation will drive growth later this year, something which I am not yet willing to do here.

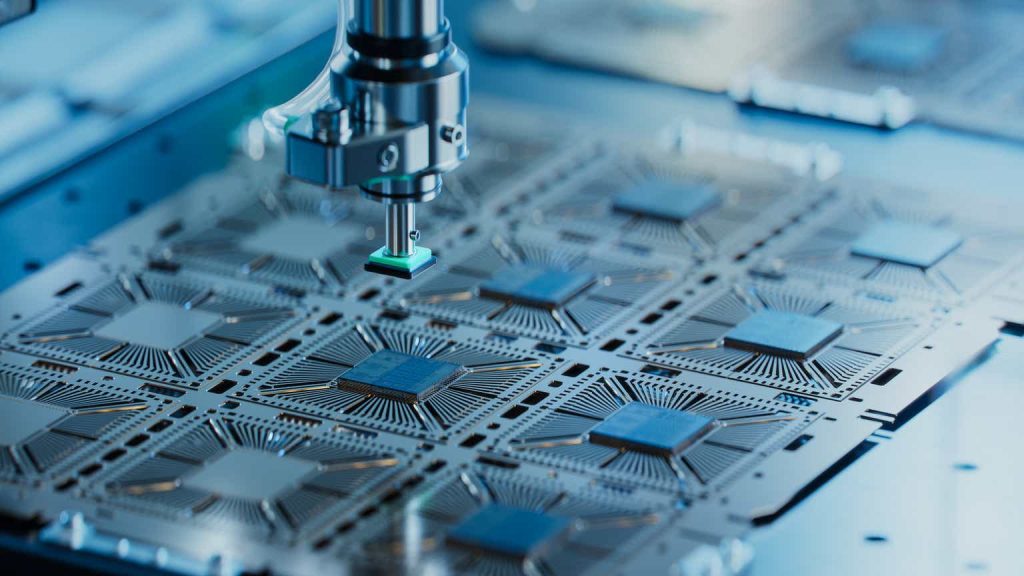

Low Power Programmable Leader

Lattice Semiconductor is a so-called low power programmable leader. The company enables secure control, flexible connectivity, and low power compute acceleration. Most of these applications are going to serve industrial and automotive markets, responsible for nearly 60% of sales. Communication & computing is responsible for a little over a third of sales, with the consumer segment making up for just 6% of sales.

The supplier has global operations, serving a wide range of blue-chip customers like Amazon, Bosch, Canon, Ericsson, HP, Samsung, Schneider Electric, among many others.

The portfolio of products focuses on the smallest size, lowest power requirements, highest security, reliability, and ease of use. Categorized under the Lattice Avant and Lattice Nexus family names, the company serves a wide range of applications and many customers.

The company has seen steady growth over the past decade, a period during which the company essentially doubled its sales to three-quarters of a billion. After posting largely break-even results a decade ago, the company has become solidly profitable, with operating margins having expanded to about 30% of sales.

The company has largely relied on distributors to show this growth, a channel which makes up nearly 90% of sales, although that the direct sales component rose to 18% over the past quarter, boding well for further margin gains over time.

The Market Likes It…

The advancement in sales, but certainly margins, have driven a huge rise in the share price, this just being a mid-single digit stock in the mid-2010s. Shares advanced to the $20 mark pre-pandemic, but have seen huge gains ever since.

Shares rose to levels just a few dollars short of the $100 mark in 2023, fell to the $60 mark in the fall, but now have recovered to the $75 mark, actually trailing many semiconductor names (at least in recent times) which have set fresh highs amidst the new AI craze early in 2024.

… But Not So Much Recently

There is a reason for the hesitant share price action as of recent, as the same hesitation is seen in the reported rules. The company just reported its results for 2023, a year in which revenues rose by nearly 12% to $737 million, with GAAP operating income rising by 13% to $212 million. Net earnings came in higher than operating earnings at $259 million, equal to $1.85 per share, as the higher number is largely due to a tax refund. Frankly, I peg realistic earnings in closer to the $200 million mark, for more realistic earnings around $1.50 per share.

Solid double-digit growth for the year stood in sharp contrast to fourth quarter sales being down 3% to $170 million and change. Moreover, operating earnings of $43 million were somewhat on the weaker side. Worrisome, first quarter sales are seen down to $130-$150 million with decelerating momentum standing in sharp contrast to the momentum seen by other suppliers, weighing on profitability as well.

The company clearly indicated on the conference call that this is not just due to inventory balancing by customers but due to genuine weaker demand as well. This outlook missed consensus estimates quite a bit, as executives foresee similar sales in the second quarter, triggering a high single-digit decrease in the share price in response to the earnings report over the week.

All this has to do with well documented inventory normalization trends among customers, but it shows that Lattice is not catering to the hottest segments of the marketplace here, of course.

At current levels, the 139 million shares of Lattice grant the business a $10.4 billion equity valuation, a number which includes a relatively modest net cash position of $128 million here. With a $10.3 billion operating asset valuation, it is needless to say that valuation are demanding at 14 times 2023 sales, with a weaker first quarter on the horizon.

Investors Are Asked To Put In A Giant Leap Of Faith

The truth is that Lattice trades at a huge 15 times sales multiple and a far more demanding earnings multiple, realistically coming in around 50 times based on the 2023 results. What is clear is that the first quarter, and likely the first half of 2024, is going to be much softer in terms of the performance, only pushing up expectations.

Hence, investors have to perform a balancing act between a sky-high valuation from the start, weaker near-term momentum, but the potential which is evident as well as a result of an improving positioning. The potential has to come from Avant, the group of solutions which not only focuses on just low lower end applications, but also focuses on mid-end applications as well. This does not just increase the addressable markets, which will roughly double, but it also gets the business into higher growth segments like datacenter applications.

This is conformed by the adoption of its solutions for Nvidia’s Orin platform, which of course raises a lot of enthusiasm these days, but still has to translate into the results, at least not expected to happen in the coming quarter.

Amidst this balancing act, with unknown growth seen in the second half of the year, investors are required to take a leap of faith here, quite a big one if you ask me. This makes me cautious, as while Lattice has a solid growth track recovered, momentum might have been carried away a bit too much across the wider sector here.

Read the full article here