Introduction

Cytek Biosciences (NASDAQ:CTKB) is a pioneer in cell analysis solutions, revolutionizing the field with their Full Spectrum Profiling [FSP] technology, embodied in their flagship Aurora and Northern Lights systems. This novel technology enables high-resolution, high-content, and high-sensitivity cell analysis, significantly enhancing the multiplexing capabilities of traditional flow cytometers. FSP has advanced research in critical fields such as oncology and immunology and facilitated a more profound understanding of complex biological systems. Since its commercial launch in 2017, Cytek’s platform has been adopted by top pharmaceutical companies, biopharma companies, and research organizations worldwide, demonstrating its broad appeal and transformative impact on cell analysis.

Recent developments: Cytek Biosciences’ board greenlighted a $50M stock buyback program, contingent on market conditions and liquidity.

The following article covers Cytek Biosciences’ pioneering cell analysis technology, financial performance, recent developments, and strategic growth initiatives, along with an investment recommendation.

Financial Performance

Cytek Biosciences reported Q1 2023 revenues of $37.1M, a 6% increase YoY, including $3.4M from the recent Luminex acquisition. Excluding this, organic revenue was down 4% due to weak performance in the U.S., countered by growth in the EMEA and APAC regions. Gross profit increased by 4% to $21M, while operating expenses saw a 47% rise to $33.2M due to business growth investments. Net loss stood at $6.8M, with adjusted EBITDA at negative $2.5M. The cash position at the end of the quarter was $299M, after paying $44.9M for the Luminex assets. The company lowered its 2023 revenue forecast to $205M-$220M due to macroeconomic uncertainties.

Stock Assessment

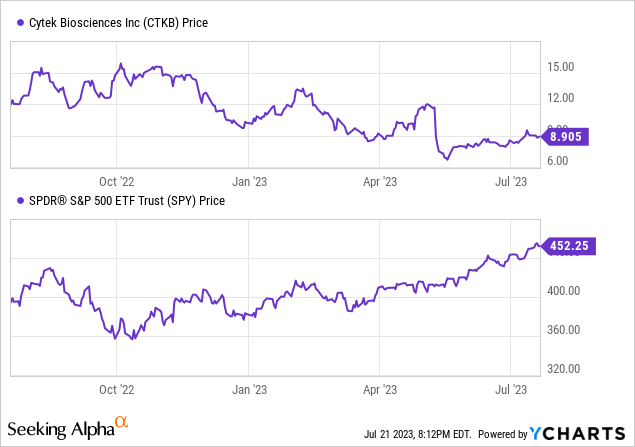

Per Seeking Alpha data, Cytek Biosciences (CTKB) exhibits promising growth prospects with its forward-looking revenues and EPS both projected to increase YoY, and an impressive three-year revenue CAGR of 41.51%. However, its valuation, indicated by a high P/E ratio of 50.21, suggests that the stock may be overvalued. The company’s profitability is fair with a high gross profit margin of 61.32%, but negative margins for EBIT and net income, and negative returns on equity and assets reveal areas for improvement. Momentum has been weak with the stock down over the past year, underperforming the S&P 500.

However, the company’s capital structure is relatively stable, with a $1.20B market cap, manageable debt of $17.26M, and a healthy cash position of $299M. The recently approved stock buyback program may also provide a boost to the stock price.

Growth Initiatives

In the latest earnings call, Cytek Biosciences’ management discussed their Q1 2023 performance and future outlook. Despite a 6% increase in total revenue to $37.1M, including $3.4M from the Luminex acquisition, they experienced a 4% decline in organic revenue due to pressures in the U.S. market. They expect full-year revenue to be between $205M and $220M, a 25% to 34% YoY growth, but slower than initially projected. Management expressed confidence in the underlying demand for their Full Spectrum Profiling [FSP] platform and commitment to diversifying revenue streams. The company’s four-pillar growth strategy – instruments, applications, bioinformatics, and clinical – has enabled them to install 1,766 instruments and achieve 145 peer-reviewed publications. Despite facing challenges, they anticipate continued growth and are focused on integrating the Luminex business and introducing new combined technology products. They aim to establish their technology as the standard for both research and clinical applications. Management is optimistic about their contributions to critical research, medicine, and the potential to extend human lifespan.

Aurora and Northern Lights: Overview & Market Potential

The Aurora and Northern Lights systems by Cytek Biosciences operate in the cell analysis market, which is estimated at ~$20 billion in US according to MarketsandMarkets Research, a sector that is seeing increasing demand due to advancements in biotechnology, medical research, and personalized medicine. These systems bring novel capabilities with their Full Spectrum Profiling [FSP] technology, offering a level of multiplexing and resolution that is far beyond traditional flow cytometers.

There are multiple factors driving the market potential for the Aurora and Northern Lights systems:

-

Pharmaceutical & Biotech Companies: These organizations need high-end cell analysis tools for research and drug development processes, making them key customers. Cytek’s systems can help accelerate the process of drug discovery and improve the efficacy of therapeutics, particularly in areas like immunotherapy.

-

Academic Research Centers & Clinical Research Organizations (CROs): The cutting-edge technology of Cytek’s systems is highly suitable for groundbreaking research and clinical trials, making these entities potential customers.

-

Rising Demand for Personalized Medicine: Personalized medicine is about tailoring medical treatment to the individual characteristics of each patient. It is the future of healthcare and requires an in-depth understanding of individual cells, something Cytek’s systems are designed to provide.

-

Need for Efficient Cell Sorting: Efficient cell sorting is an essential requirement in many areas of biology and medicine. The Aurora system, for example, has the capacity to rapidly isolate living cell populations with great sensitivity, fulfilling this need.

-

Emerging Markets: Emerging markets such as Asia-Pacific countries represent significant growth opportunities. Cytek already reported strong growth in these regions, indicating potential for further expansion.

However, Cytek also faces challenges like any other company in a competitive market. It will need to continue innovating to stay ahead of competitors, maintain its technology’s ease of use and cost-effectiveness, and address any market-specific regulatory requirements. In the U.S., for example, securing FDA approval for clinical use of its products could significantly expand its market reach.

My Analysis & Recommendation

In conclusion, Cytek Biosciences presents a mixed bag of opportunity and risk. The company operates within an expanding market, capitalizing on the increasing demand for advanced cell analysis solutions. Its innovative Aurora and Northern Lights systems offer unique capabilities and could potentially transform areas such as immunology, oncology, and personalized medicine. The firm’s market growth, particularly in the Asia-Pacific region, coupled with its robust cash position and manageable debt, is promising.

Despite these optimistic prospects, several worrisome factors remain. While Cytek’s revenue and EPS are anticipated to expand on a yearly basis, the high P/E ratio signals a possible overvaluation. Even more troubling is the negative EBIT and net income margins, alongside negative returns on equity and assets, all of which hint at a pressing requirement for enhanced operational effectiveness. The recent slump in the U.S. market, coupled with a downward revision of their 2023 revenue forecast due to macroeconomic uncertainties, contribute further layers of risk. It’s crucial to point out that the perceived overvaluation could potentially be offset by its anticipated revenue growth, but it’s an aspect investors need to monitor closely in the future.

In terms of investment recommendation, given the combination of positive growth prospects, yet significant risk factors, I’d suggest a ‘Hold’ position on Cytek Biosciences. The company’s future performance could be substantially influenced by its ability to integrate the Luminex acquisition effectively, capitalize on market growth opportunities, and improve its operational efficiency.

Therefore, investors should keep a close eye on Cytek’s progress with the integration of Luminex’s assets, the development of new products, and their endeavors to diversify revenue streams. Also, it will be important to monitor how Cytek navigates the macroeconomic uncertainties and challenges in the U.S. market. It’s the blend of these growth opportunities and risks that lead to my ‘Hold’ recommendation. Ultimately, whether Cytek can capitalize on its growth opportunities while effectively mitigating its risks will determine if this company becomes a promising investment in the long run.

Read the full article here