The following segment was excerpted from this fund letter.

Microsoft (NASDAQ:MSFT)

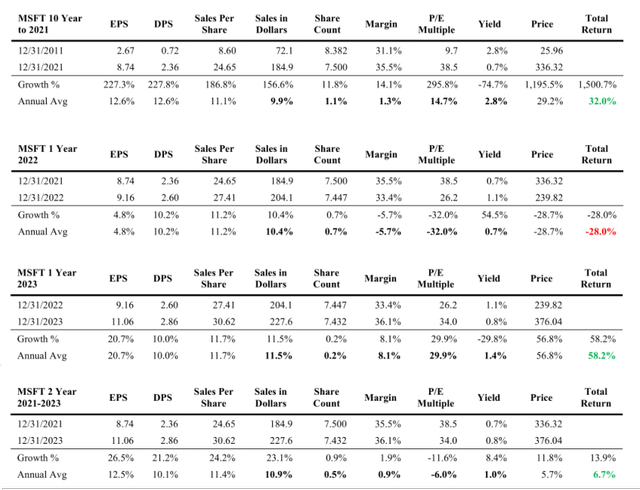

Microsoft enjoyed a phenomenal ten years to 2021, the stock compounding by 32.0%. Sales grew 9.9% annually, margins grew from 31.1% to 35.5% and investors bid the stock up from a bargain basement single-digit 9.7x earnings to 38.5x. Multiple expansion alone contributed 14.7% per annum to return.

The business had gone through the doldrums following the tech bubble. Revenue growth slowed while margins and multiples both contracted. By 2015 half of profits were being paid as dividends. The share count peaked in 2004 at almost 1 1 billion outstanding and now resides 33% lower. During the ten years to 2021 the company retired 10.5% of shares, contributing 1.1% to annual return.

Like the other Magnificents, Microsoft’s shares tanked in 2022 and reverted back up last year, returning 6.7% annually over the two years. More than all of the stock’s positive return came from ongoing strong sales growth, which grew by nearly a quarter over the two years, adding 10.9% to annual return.

Offsetting gains in revenues was a contraction in Microsoft’s P/E from 38.5x to 34.0x, harming return by 6.0% a year. The dividend payout is back to roughly 25% of annual profit, but like Apple (AAPL) and its high price, a tiny earnings yield also means a tiny dividend yield, which averaged 1.0%. Also, like Apple, repurchasing shares at high prices, even with large portions of operating cash flow, doesn’t dent the share count by much – Microsoft’s shrank by only 0.5% a year, not adding much to return.

Unlike Apple, Microsoft has found a use for big money outside dividends and share repurchases. Azure, Microsoft’s cloud business, is a beast and absorbing a mountain of capital which for now is extremely profitable. It’s a great example of a management team knowing where to spend its money and how to reinvent itself at the same time.

Why buy shares at a 3% earnings yield or why send profits out as dividends if the next data center or R&D spent on software produces incredible returns? From an investment and future return standpoint, how much more than sales growth can be expected when a 36.1 % profit margin is capitalized at 34x?

| SEC-registered investment advisory firms are now required to disclose 1-, 5- and 10-year returns, or the time period since performance composite or portfolio inception, if shorter. The new rule seeks to prevent “advertisers” from cherry-picking time periods that make returns appear more favorable. As short- and intermediate-term returns change frequently due to beginning and endpoint sensitivity, we have chosen to disclose all yearly intervals from the current 1-year return all the way back to inception. Intra-year periods will likewise be shown annually back to inception. Better, in our opinion, to provide more data than less. We are augmenting the mandated disclosure with the full data set – not to confuse – but if we must provide a few defined numbers, to the extent anybody uses them in decision making, we want you to have the information we’d want if our roles were reversed. The yearly return intervals are italicized and shaded in blue. Information presented herein was obtained from sources believed to be reliable, but accuracy, completeness and opinions based on this information are not guaranteed. Under no circumstances is this an offer or a solicitation to buy securities suggested herein. The reader may judge the possibility and existence of bias on our part. The information we believe was accurate as of the date of the writing. As of the date of the writing a position may be held in stocks specifically identified in either client portfolios or investment manager accounts or both. Rule 204-3 under the Investment Advisers Act of 1940, commonly referred to as the “brochure rule”, requires every SEC-registered investment adviser to offer to deliver a brochure to existing clients, on an annual basis, without charge. If you would like to receive a brochure, please contact us at (303) 893-1214 or send an email to [email protected]. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here