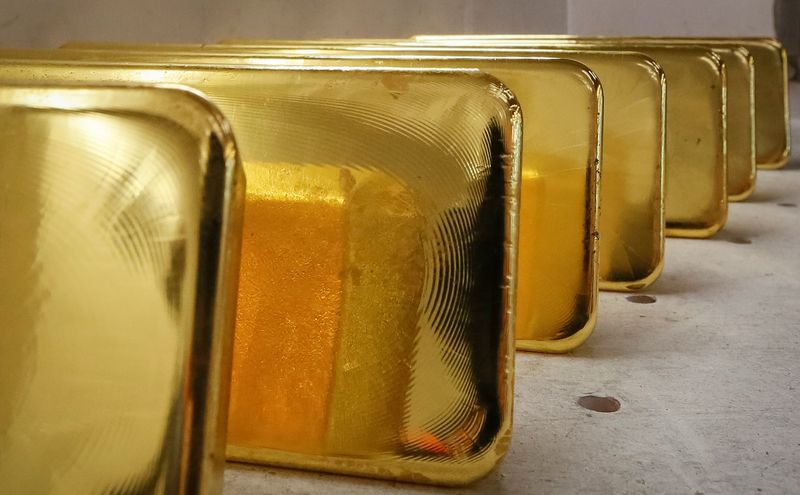

Investing.com– Gold prices rose in Asian trade on Monday, extending a rebound from one-month lows after recently breaking below a key support level, although fears of higher-for-longer U.S. rates kept prices largely rangebound.

The yellow metal had briefly broken below the $2,000 an ounce earlier in February, as stronger-than-expected U.S. inflation readings saw traders largely price out the prospect of early interest rate cuts by the Federal Reserve.

While gold rebounded back above the support level over the past two sessions, it still remained largely within a $2,000- $2,050 an ounce trading range established since mid-January. The yellow metal has struggled to make headway in the face of sticky U.S. inflation and a hawkish outlook for interest rates.

rose 0.3% to $2,019.95 an ounce, while expiring in April rose 0.4% to $2,031.15 an ounce by 00:37 ET (05:37 GMT).

Strength in the weighed on gold, as the greenback remained in sight of a three-month high after stronger-than-expected inflation data on Friday.

The reading came just days after a stronger-than-expected inflation reading for January. Sticky inflation gives the Fed less impetus to begin immediately loosening monetary policy, with a swathe of Fed officials having warned as much in recent weeks.

Focus is now on the for more cues on interest rates. The Fed had largely downplayed all bets on early rate cuts during the meeting.

Higher-for-longer rates bode poorly for gold, given that they increase the opportunity cost of investing in the yellow metal.

This notion weighed on other precious metals. fell 0.3%, while fell 1.3%.

Copper prices slip, China cues in focus

Among industrial metals, copper prices fell on Monday, but were sitting on strong gains from the prior week on hopes of improving economic conditions in China.

expiring in March fell 0.4% to $3.8083 a pound, after surging over 4% in the prior week.

Data showing increased consumer spending in China, over the Lunar New Year holiday, ramped up hopes over a broader economic recovery in the world’s largest copper importer.

Read the full article here