Last week, Leonardo (OTCPK:FINMF) (OTCPK:FINMY) reported its Q4 and Fiscal Year 2024 results. Since our initiation of coverage, we recorded a plus 150% (including the dividend payment). Before updating our readers on Leonardo’s new target price, it is essential to report the latest defense company’s development.

Mare Past Analysis

Ongoing Upside

(Higher EU Defence Expense) Starting with the MACRO consideration, looking at the European defense sector, the Stoxx Europe Aerospace&Defense index continues to outperform, signing a plus 75% since Russia’s invasion of Ukraine. The ongoing Russian invasion and geopolitical tension in the Middle East are all factors pushing toward increasing European defense spending. Here at the Lab, we believe that NATO member countries will probably likely spend more than 2% of their GDP. Following Olaf Scholz (the German Chancellor), the EU defense industry is weakening compared to spending in the USA and Russia. According to a report by the International Institute for Strategic Studies, in 2023, global defense spending increased by 9% and reached a record figure of $2.200 billion. It grew by 4.5% in Europe, with an absolute value of 1.6% of the country members’ GDP. A further record is expected for 2024, thanks to four nations: the USA, China, Russia, and India. Europe is not on this list, and it must “spend more and better,” as the president of the EU Commission, Ursula von der Leyen, said on 28 February. Therefore, implying a 2% GPD expense, we might predict that Europe will spend $380 billion on defense, with an increase of $80 billion (+27%) compared to the past years.

Here at the Lab, looking at the EU alliance, we recognize that France has a policy of autonomy in defense. In contrast, despite having some partnerships with Italy, the UK has historically been closely aligned with the United States. Germany is a critical opportunity for Leonardo. Hensoldt’s equity stake is a clear step towards this country, as well as the recent partnership with KNDS (December 2023).

Looking at the MICRO upside, we report the following upside:

- (M&A flexibility and stronger Balance Sheet) Leonardo partially exited the US subsidiary Leonardo DRS. Total proceeds are now at €340 million. The group’s net debt is down to €2.3 billion with a minus 23% compared to €3 billion in 2022. In addition, the company had a surplus in cash flow generation, and this proceeds will allow the company to continue on its debt reduction path. This partial disposal will enable Leonardo to increase its financial flexibility and focus on investment diversification for the Group. At the same time, thanks to a significant majority equity stake, Leonardo will continue to consolidate Leonardo DRS and maintain a significant industrial presence in the US, the world’s largest defense market.

- (New Alliance) To support our buy rating and to follow 1) Positive Catalysts Likely To Price In and 2) Supportive Order Pipeline, Leonardo announced a memorandum of understanding with Saudi Arabia. This agreement is a collaboration opportunity in aerospace and defense, signed at the World Defense Show in Riyadh. Leonardo is developing new technologies and implementing enabling demonstration projects, such as remotely piloted systems, integrated sensors, and digital technologies. Once again, we believe this agreement was signed as a first step to accelerate Saudi Arabia’s air defense development.

Q4 and FY Results

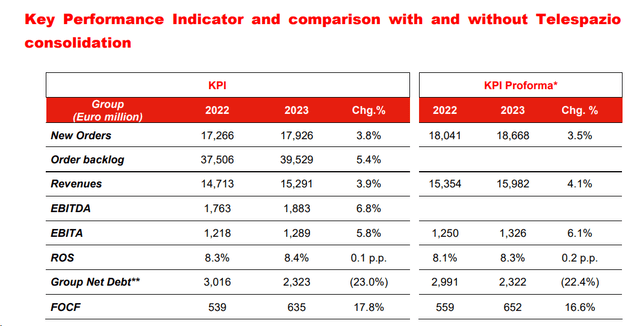

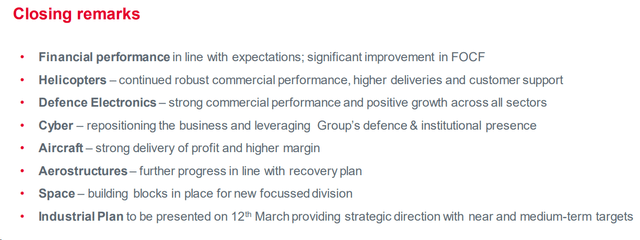

Briefly, Leonardo closed 2023 with numbers above the guidance. New orders reached €17.9 billion with a plus of 3.8% compared to the 2022 results. The company delivered a book-to-bill of 1.2x. Therefore, Leonardo’s sales were at €15.3 billion, reflecting growth across all the Group’s divisions.

Going down to the P&L, Leonardo’s EBITA was at €1.29 billion, and more importantly, the company’s free operating cash flow reached €635 million with a plus 17.8% compared to last year. This performance was ahead of Wall Street consensus guidance and was mainly driven by investment and cost discipline.

Going into detail, the new orders backlog was driven by the European component in security electronics, while 2023 revenues benefited from the recovery of Aerostructures. Sales were also supported by better performance of helicopters.

Leonardo FY 2023 results in a Snap

Source: Leonardo Q4 Results

Looking back, the former CEO set the company’s objectives at 1) a sales CAGR of 4/5% and 2) a high-single-digit EBIT growth rate from 2023-2027.

Under the new CEO, the new 2024-2028 industrial plan will be updated on 11 March. Here at the Lab, we believe new targets will be revealed. Current targets, set in early 2022, call for a cumulative free cash flow of €3 billion over the 2021-2025. We currently expect a cumulative free cash flow of $4.7 billion. That said, there is uncertainty over the distribution of capital. Therefore, we anticipate that investors will pay close attention to shareholders’ remuneration. Currently, Leonardo ranks well below other European defense competitors’ payout. Looking at Bae Systems, Thales, and Dassault Aviation, Leonardo has a payout of 10% with no buyback in place. This strategic update allows management to present Leonardo as a transformed, high-quality company. If successful, we think this could have a much more significant impact on the stock than any higher-than-expected financial target.

Leonardo Guidance

Valuation

Despite a stock price appreciation of 150%, Leonardo (still) trades at a considerable discount. Leonardo remains a deep-value stock with an EV/EBITDA multiple of around 6x. In 2022, the Italian defense company was at 4x, and this was a key value driver of Mare Evidence Lab’s supportive equity story. Still, Leonardo’s stock continues to trade at less than half the multiple at which US defense companies trade. Dassault Aviation SA, BAE Systems plc, and Thales SA are trading at an EV/EBITDA of 12.09x, 11.25x, and 9.79x. Valuing Leonardo aligned with EU peers (10x), we derived an enterprise value of approximately €19 billion. Considering the current net debt, our equity value is set at €16.7 billion. There is an additional capital appreciation opportunity of 43%. This valuation has not even been performed, considering Leonardo’s upside on a sum-of-the-part valuation.

Downside risks include lower expenses from the defense and lower funds from the European Union. In addition, we should report risks on raw material inflation, supply chain constraints, and wage inflation.

Conclusion

Higher EU GDP expenditure in defense, ongoing wars and geopolitical tensions, and a discrepancy in valuation with EU peers and USA players make Leonardo a buy. We increased our buy rating target to €28 per share, and we believe the new strategic plan will support a higher capital shareholders’ remuneration story.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here