Investment Thesis

Flow Traders Ltd. (OTCPK:FLTLF) could be an undiscovered gem for hedging purposes. As a liquidity provider, the company profits from quoting bid and ask prices on various ETPs. The wider the spread between the quotations, the more profits they make, particularly in times of heightened volatility.

Over the last year, the financial market has been experiencing low volatility, consequently harming Flow’s profitability. However, regardless of market conditions, they have been proven to always make money.

At its current valuation, Flow Traders presents an enticing opportunity, trading close to its book value. When I invest in a company, I always look at the risk-reward ratio, positioning myself in a way that if everything goes bust, I lose little, but if things turn out as they should, I make a lot of money, and Flow Traders aligns with these criteria exceptionally well.

The reason that brought me to search for a hedge is pretty simple. I do like the market craziness that has been going on in recent times. With limited options available for portfolio hedging, I found in Flow the perfect trade-off. Therefore, in the event of a market crisis or unexpected sell-off, I would be able to protect my investments.

Today’s Market Condition

We are currently living in a period characterized by significant uncertainty, marked by global conflicts, stickier-than-expected inflation, high interest rates, internal conflicts, soaring debt levels, and a labor market showing signs of weakening. Despite all that, markets continue to climb. We have reached new highs, and it feels like we are living in an everything bubble, where debt effectively underpins the economy and the stock market inflates seemingly without limit.

The financial markets are expecting soft lending. Yet, what if this assumption proves incorrect? What if circumstances diverge from expectations, leading central banks to maintain high interest rates for an extended period? Even worse, what if they opt to decrease rates, causing a resurgence in inflation and forcing them to raise rates once more?

Considering the aforementioned concerns, this is why I’ve been actively seeking a hedge for my portfolio. Given that I’m not a Hedge Fund manager, accessing certain financial instruments can be challenging, but Flow Traders appears to be a good alternative.

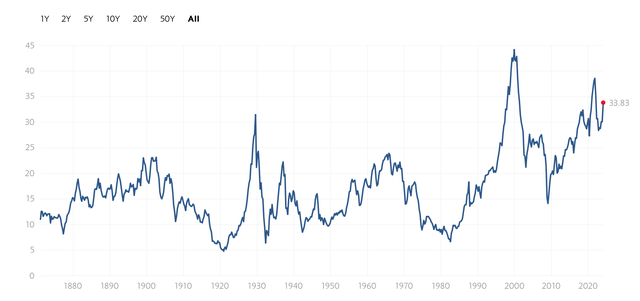

Shiller P/E

Source: Shiller-PE Ratio Multpl

If we take a look at the Shiller P/E, we can easily see that the stock market is everything but cheap. Shiller P/E ratio mean is around 15, now we are at ~34.

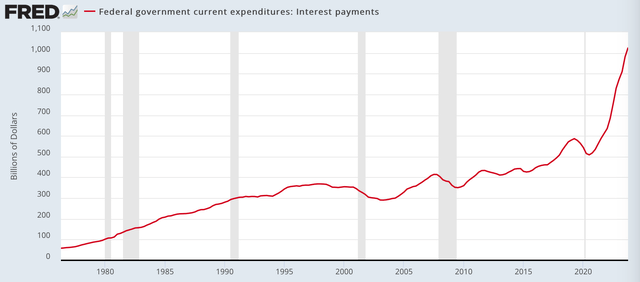

Debt

Another problem we are facing is the enormous debt we have been accumulating over the years. In the United States alone, the total national debt has soared to 34 trillion dollars, an astronomical figure.

This could pose a dilemma for the Federal Reserve when considering rate cuts. In order to refinance the substantial debt burden, they would need to offer attractive interest rates, potentially prolonging periods of elevated rates even further.

Source: fred.stlouisfed

Currently, the US is paying one trillion in interests on the debt.

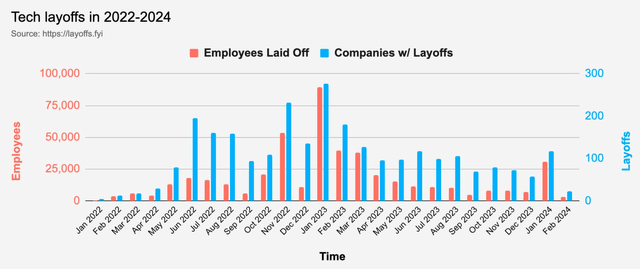

Labor Market

Up to now, we have witnessed over 100,000 announced layoffs. January 2024 recorded a total of 82,000 layoffs, marking the second-highest number for January since 2009. Concurrently, the US reported the creation of 353,000 jobs in January. However, a significant portion of these jobs are temporary or government positions, posing a challenge to sustained employment growth.

Source: Tech layoffs FYI

Business Model

Before diving into the analysis, let’s understand what they do.

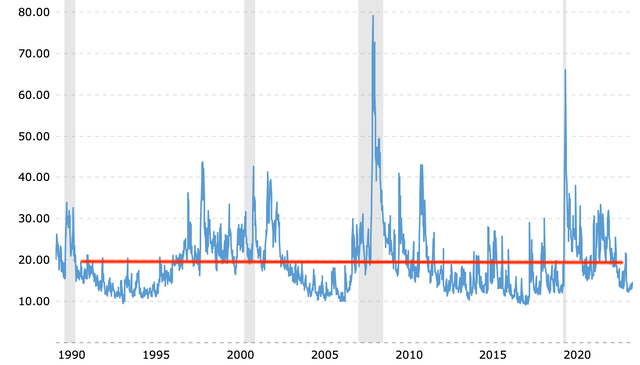

The company is essentially a market maker. Therefore they provide liquidity to the market, facilitating the transactions between sellers (ask) and buyers (bid). Flow Traders generates revenue from the spread between bid and ask prices, with wider spreads translating to higher profits. Therefore, most of their profitability does not come from the volume of the trades executed but rather from market volatility. One of the tools to understand whether there is high or low volatility is the VIX Volatility Index, also called “the fear index”. The higher it is, the better for them.

One of the things that I like about Flow Traders’ strategy is their approach to pricing the trades they make. They do not like to take risks. They are able to assess accurately whether a trade is worth it or not doing it and they do it fast. From what they say in the conference calls and from the annual reports, it’s clear to me that they do not lose money.

Financials

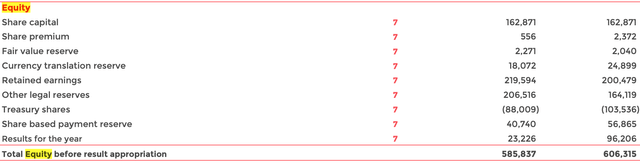

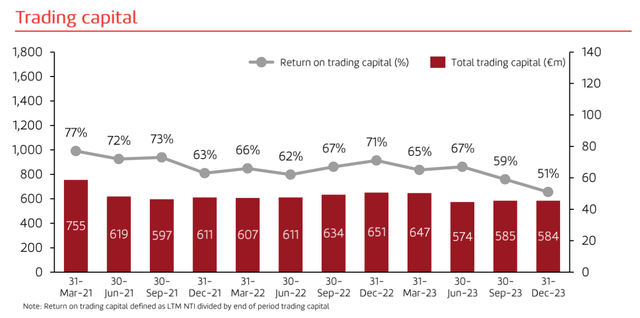

When analyzing the company’s balance sheet, we can see why Flow represents a safe play even in case of unfavorable market conditions. In the last quarter, the Equity stood at around €586 million. The trading capital was instead at €584 million. This indicates a high level of liquidity in the Equity, underscoring the company’s resilience.

Source: 10-K-2023 Flow Traders Annual Report

The decline in the value of equity compared to 2022 is primarily attributed to the retirement of treasury shares.

Flow Traders’ current market capitalization is closely aligned with its book value, standing at 0.73. This indicates a substantial margin of safety for investing in the stock. With cash and equivalents totaling €6.3 million and no long-term debt obligations, the company is in a robust financial position, making it very hard for them to go bankrupt anytime soon.

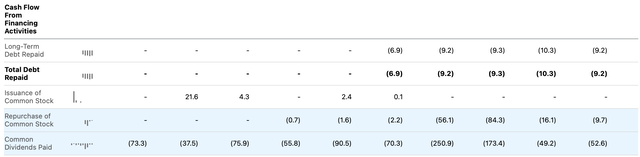

Examining the Cash Flow Statement, we can see that the company is very investor-friendly. The majority of earnings are allocated towards dividends or buybacks, highlighting the company’s commitment to shareholder value.

Source: Seeking Alpha FLTLF Income-statement

One thing worth noticing is the number of shares outstanding (45.5 million outstanding shares), compared to the actual number of shares with which dividends are paid (43.2 million ordinary shares). The difference is due to some of the shares being treasury shares and therefore not having the right to receive dividends. This is important to highlight because it makes the dividend yield for shareholders higher than what it might seem, even though the difference is not significant.

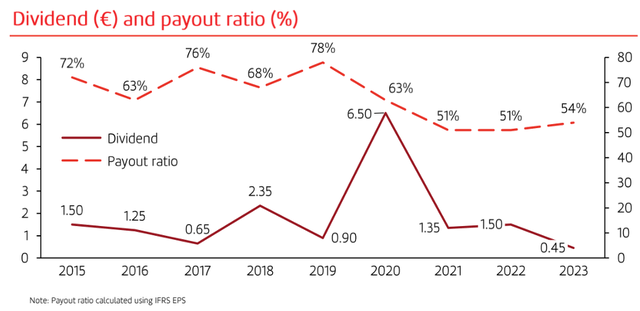

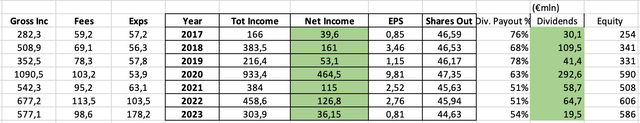

The Company endeavors to pay out at least 50 percent of the company’s net profits realized for a financial year. Here is the payout ratio over the last few years:

Source: Q4-2023 Flow Traders Presentation

Competition

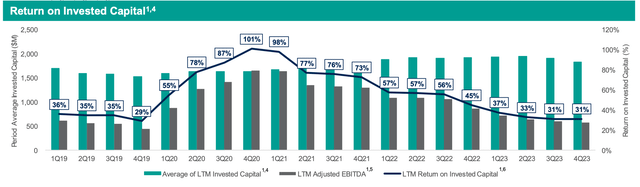

Flow competes with many market makers around the World, but just a few of them are publicly traded or are more or less of the same size. One of them is Virtu Financial, Inc. (VIRT). The two companies share some similarities in their business model, but Flow Traders focuses more on the niches of the market. The strength of Flow Traders is trading complex products and pricing them where others can’t (multicurrency, multimarket, and so on) and they do it fast. This surely reflects on the return on invested capital of the two companies. As we can see in the charts, Flow has a higher return.

Source: Q4-2023 Virtu Financial Presentation Source: Q4-2023 Flow Traders Presentation

Another thing that is worth pointing out and that makes me pick Flow over Virtu is the long-term debt. Virtu has $1.7 billion in debt, which is partly offset by the cash position. Flow Traders’ long-term debt is instead $0. This tells me a lot about how the two companies are managed. I would rather go with someone who does not use leverage at all, and grows organically, rather than the opposite. Furthermore, we do not know how long this period of low volatility will last, therefore I see a better margin of safety and risk-reward ratio with Flow.

Valuations

When it comes to assessing a business like Flow, it is very hard to come up with proper estimations, due to the unpredictable nature of cash generation, which is heavily reliant on future market volatility. Now, since nobody knows what Mr. Market will do, but knowing that volatility is a constant feature of financial markets, one approach could be to forecast the minimum amount of money Flow Traders would generate during periods of low market volatility.

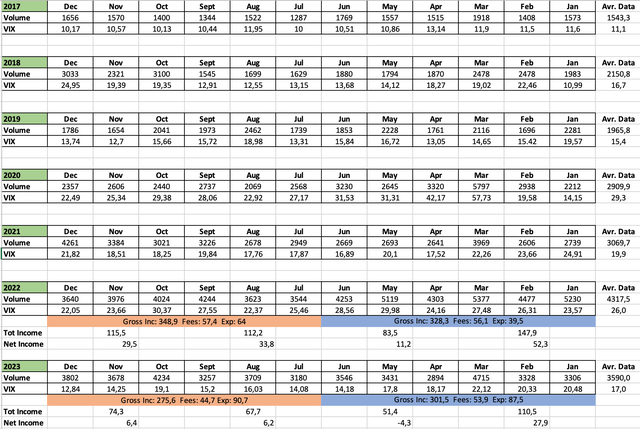

Let’s examine the company’s average Volatility, and the trading Volumes over the past few years, and analyze their annual earnings:

Statistics of Volumes and Volatility (Image created by author using data from Flow Traders latest annual reports) Flow Traders results from 2017 to 2023 (Image created by author using data from Flow Traders latest annual reports)

Over the last two quarters of 2023, the volatility levels have been quite low. With the VIX averaging around 15, Flow Traders managed to generate approximately €6 million per quarter. Assuming this level of volatility persists, this would translate to an annualized earnings estimate of around €25 million. At the current market valuation of €800 million, it would result in a gross 3,1% return, if we assume that part of it would be distributed to shareholders.

So we are getting a stock close to book value (approximately €600 million) that pays us a dividend and at the same time gives protection against market downturns. Usually, hedging a portfolio (for instance with put options) may incur high costs, due to the premiums that one might have to pay. Additionally, put options have expiration dates, limiting their effectiveness as a long-term hedge. Therefore by investing in Flow, we are hedging ourselves for free and without an expiration date.

At the present valuation, the potential reward outweighs the risk, with minimal downside and substantial upside potential. It’s only a matter of time before volatility will revert, in the meantime, I enjoy the dividend and wait patiently.

Coming to the assessment itself, it’s crucial to consider the normal level of volatility in the markets. According to Reid Steadman, Former Managing Director and Global Head of ESG & Innovation S&P Dow Jones Indices, the normal level is around 20. Although the article may be dated, it remains relevant for today’s market dynamics. However, it’s worth noting that some economists anticipate this number to decrease in the coming decades as markets become more efficient and frictionless.

Image edited by the author. Source: macrotrends vix-volatility-index-historical-chart

When the VIX averaged around 20 in the past, Flow Traders was able to generate over €100 million, as indicated in previous data. Assuming they can maintain this level of earnings on average each year, and applying a conservative multiple of 15 due to their debt-free status and commitment to growth and technology investment, this would bring us to an evaluation of €1.5 billion or €33,6 per share, not far from historical trading levels. However, it’s important to emphasize that this intrinsic value is hypothetical, given the unpredictable and nonlinear nature of earnings forecasts for Flow Traders. If valuations were to approach the €30s, I would definitely get rid of the shares. Nevertheless, if we anticipate they can achieve similar earnings again, at current market valuations we would be sitting on a yield of 12,5% or a P/E of 8.

Management

Flow’s management is very competent and capable. I really like how they manage the company and the philosophy they follow. They are growing the company organically making little but aimed investments. Furthermore, the selection to work for the company is very tight. Accepting less than 1% of the applicants. This shows how serious and diligent they are in the selection of their employees. Moreover, the employees’ number has declined to 646 at the end of Q423, compared to 658 in the previous quarter. This should save them a couple of millions annually.

In the last 6 months, the management has been buying back shares aggressively, as we can see from their Press Releases. This highlights their capability of being great capital allocators.

The Stock & Conclusions

In the last few months, every time Flow has released its pre-close script, the stock price has dropped, bottoming around 16€.

Source: Google Finance Flow

Personally, at current prices, given that I already have a position in the stock, I would wait for more speculative levels, since there has not been much volatility during the last quarter. At the end of March, the company will share its pre-close script. If the stock reaches the €16s level once again, I will be a buyer and increase my position. Nonetheless, even at this price, the stock is extremely attractive. If I were a new buyer, I would start a position and buy some shares.

Flow Traders have all the credentials to be a good hedge alternative if one wants to protect their portfolio from market uncertainties. The company has no debt and is very well managed. I am more than happy to make this bet considering the minimal downside risk associated with its solid financial position.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here