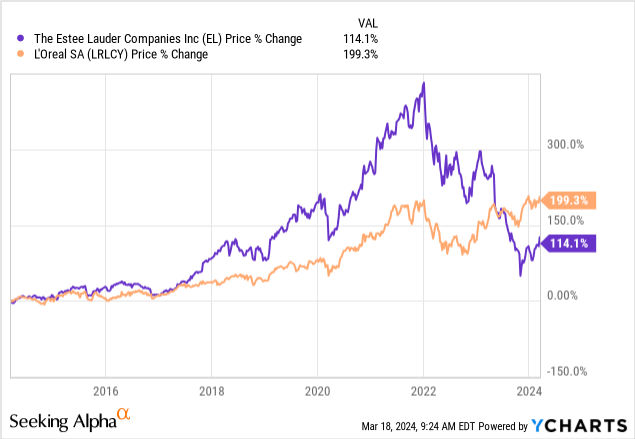

After falling precipitously in 2022 and 2023, The Estée Lauder Companies Inc.’s (NYSE:EL) share price has somewhat stabilized in recent months. With EL stock now trading at levels last seen in 2019, it might seem now is a good time to buy.

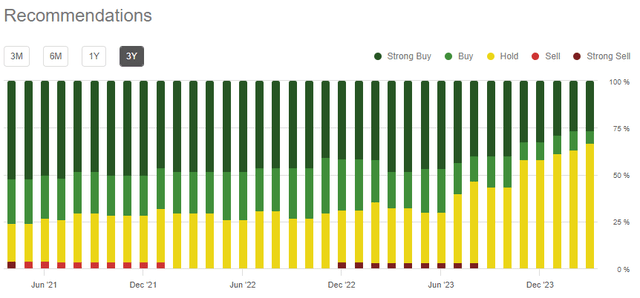

The contrarian thesis for EL is also supported by the recent capitulation of sell-side analysts, who retained their buy ratings during the first selloff in early 2022 but are now rushing to downgrade the stock.

Seeking Alpha

Although this creates favorable conditions for short-term deviations in the stock price, the company has a long way to go before becoming a solid buy. First and foremost, as I’ve shown before, the extreme geographical concentration as well as the company’s heavy dependence on the skin care segment creates a major risk for long-term shareholders.

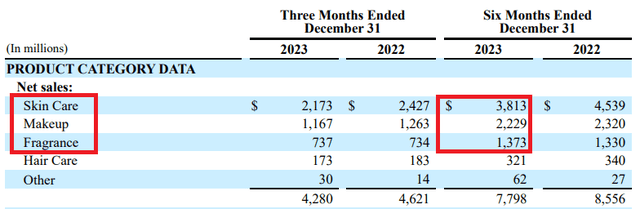

When looking at the revenue figure, EL might seem as a well-diversified business from a product segment point of view.

Estee Lauder SEC Filing

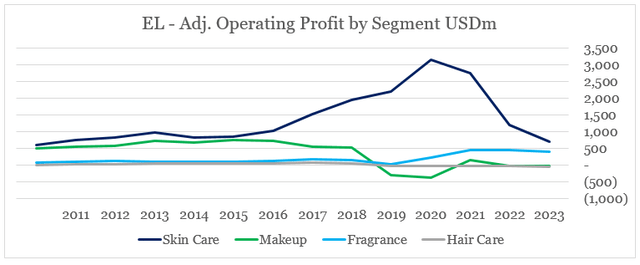

However, the majority of profits come from skin care brands, and as we have seen lately, these profits are subject to sharp reversals.

prepared by the author, using data from SEC Filings

The main problem for EL shareholders, however, stems from the fact that the company is still a long way from returning to its prior levels of profitability, and at the same time the stock is already pricing in a notable recovery.

Hardly A Bargain

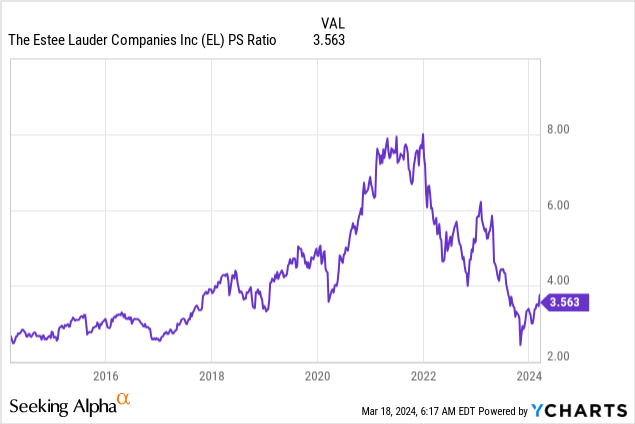

The sharp fall in Estee Lauder’s share price in recent years was unprecedented with both sales & profits collapsing and the share price multiple contracting. The sales multiple, for example, has fallen from 8.0 in late 2021 to 3.6 as of today.

Inevitably, this creates a halo effect that the stock must be trading cheaply at the moment. However, before we jump to conclusions we would need to establish what the current multiple pricing in for the future.

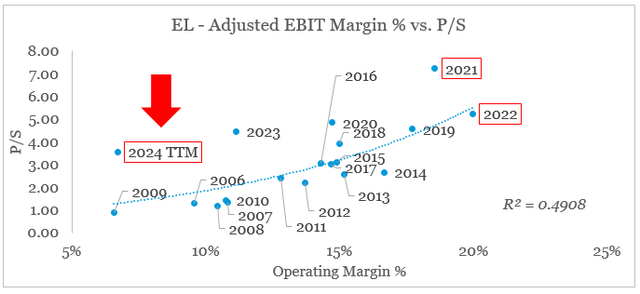

One of the easiest ways to do that is by comparing the multiple against business fundamentals – both on a historical (time series) and against peers (cross-sectional) basis.

In the former case, we could establish a relatively strong relationship between Estee Lauder’s operating margin and its price/sales multiple. As we see on the graph below, the current sales multiple lies well above the long-term trend line and is also at similar levels to the stock’s multiple at the end of FY 2018, when the operating margin stood at 15%.

prepared by the author, using data from SEC Filings and Seeking Alpha

Based on this relationship EL’s margins should improve from roughly 7% for the past 12-month period to around 15% in order to justify the current sales multiple. As we will see later on, there are early indications that this could happen over the course of the next 2-year period, but the negative expected revenue growth rate would be a major obstacle.

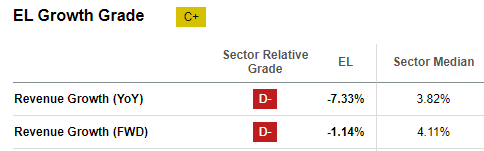

Seeking Alpha

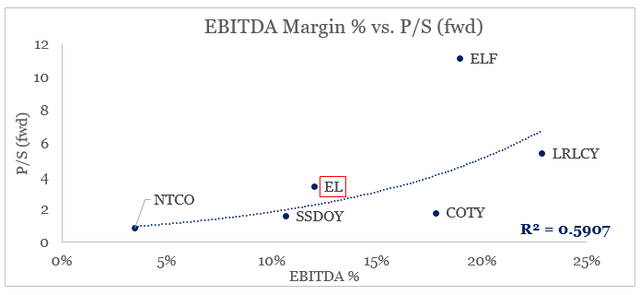

On a cross-sectional basis, it is a better practice to use EBITDA margins as companies differ in their M&A activities which leads to differences in annual amortization expense. When compared against the small number of pure-play beauty and cosmetics players, EL once again trades at a premium sales multiple when considering current EBITDA margins

prepared by the author, using data from Seeking Alpha

Estee Lauder is the only stock within the group that sits above the trend line on the graph above, with the exception of e.l.f. Beauty, Inc. (ELF), which is expected to grow at a rate of nearly 50%.

All that is a clear indication that Estee Lauder’s current share price is already pricing in a notable improvement in margins which limits any potential upside.

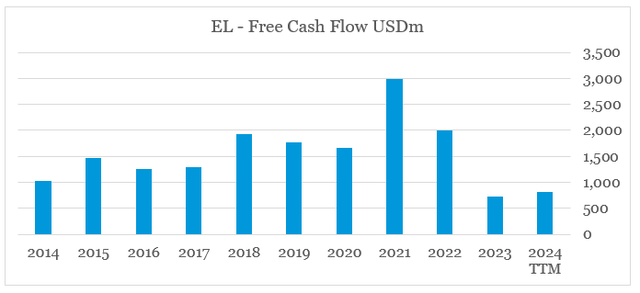

Even if investors rely on a forward-looking discounted cash flow model, they would have to rely on very optimistic assumptions about the future given the wide gyrations in Estee Lauder’s free cash flow, which fell from $3bn in FY 2021 to as low as $800m over the past 12-month period.

prepared by the author, using data from SEC Filings

Improving Margins And Cash Flow

When evaluating the company’s prospects of improving margins and returning to its previous levels of profitability, we should consider the various levers at the management’s disposal.

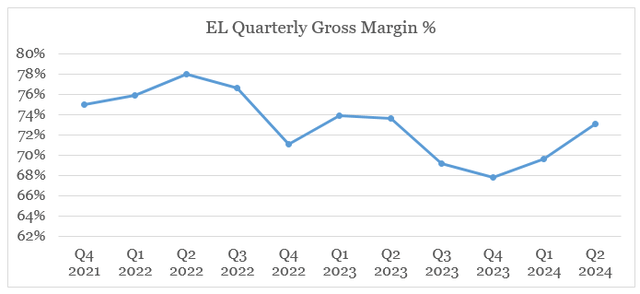

With the gradual recovery of travel retail, Estee Lauder has also been implementing pricing initiatives in recent quarters and this had a positive impact on gross margin, which has improved for a second quarter in a row and is now close to its previous highs.

prepared by the author, using data from Seeking Alpha

It appears that EL’s management would prioritize opportunities that are accretive to its margins at the expense of revenue growth which in my view is a net positive for long-term shareholders, but will have a dampening effect on the top line figure.

(…) even under the profit recovery plan, making sure that our new product launches actually are accretive to our overall margin, so we have actually cut some of our new product launches that were planned for fiscal ’25 in order to do that, and re-looked at our innovation pipeline to make sure that what we are launching is in fact accretive.

Source: Estee Lauder Q2 2024 Earnings Transcript (emphasis added).

Given the lower revenue growth prospects, reducing fixed costs would be a major priority for Estee Lauder’s management as selling, general and administrative (SG&A) expenses have remained relatively flat in recent years, even as total sales fell from $17.7bn in FY 2022 to $15.2bn over the past 12-month period.

That is why, the success of the recently announced two-year restructuring program will be the main focus for investors. EL is now expected to incur significant charges over the coming quarters with annual gross savings forecasted to be in the range of $350m to $500m.

The restructuring program is designed to right-size and streamline select areas within our organization, which unfortunately necessitates us making the difficult decision of an expected net reduction in positions globally of 3% to 5%.

The restructuring program is expected to begin in the third quarter and continue for the duration of the profit recovery plan. We expect to take charges of between $500 million and $700 million and generate annual gross savings of $350 million to $500 million before taxes.

Source: Estee Lauder Q2 2024 Earnings Transcript.

In my view, EL is in a very tough spot right and the management would have to prove to investors that they could achieve annual gross savings at the high end of the above range, if not even more. The reason being that at current sales of $15.2bn, assuming annual gross margin of 73% and a reduction in SG&A expenses of $500m, we end up with operating margin of 13%. Based on the historical relationship between EL’s margins and sales multiple, this would not be enough to justify the current multiple.

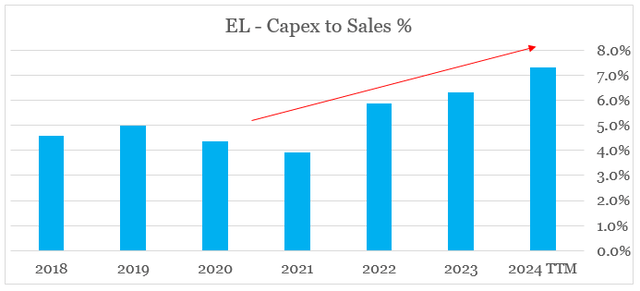

From a cash flow point of view, things are not looking good either. After years of capital expenditure standing at roughly 4% to 5% of sales, the company is now spending more than 7% of revenue on capex.

prepared by the author, using data from SEC Filings

With the need for new distribution and online capabilities, EL management expects this ratio to come down to 6%, which would still be much higher than prior periods.

Capital expenditures are planned at approximately 6% of forecasted net sales as we expect to fund new distribution and online capabilities, further enhance our manufacturing and distribution network, including the completion of our first manufacturing facility in Asia located in Japan to support the development of our Asia Pacific region.

Source: Estee Lauder Q4 2023 Earnings Transcript.

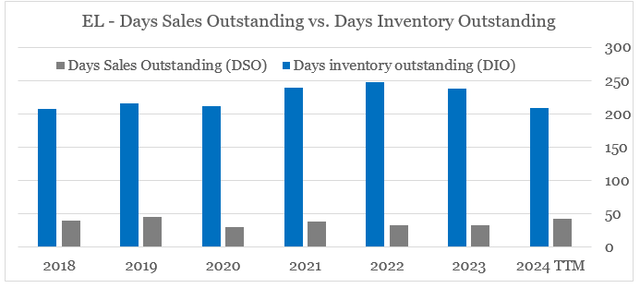

It appears that capex would continue to be a headwind for free cash flow and working capital tailwinds would also be short-lived. During the last quarter, EL’s management indicated that inventory levels are expected to normalize by the end of the next quarter.

We made meaningful progress with trade inventory levels in Asia travel retail and continue to expect to be a normalized trade inventory levels by the end of the third quarter of this fiscal year.

Source: Estee Lauder Q2 2024.

This makes sense given the fact that the company’s days inventory outstanding (DIO) is already at pre-pandemic levels.

prepared by the author, using data from SEC Filings

Thus, the cash flow tailwind that we have seen in the first half of the current fiscal year is expected to continue for one more quarter.

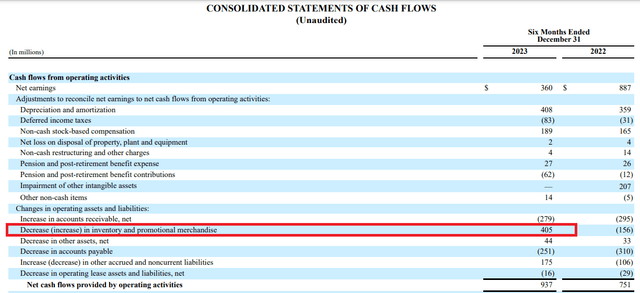

Estee Lauder SEC Filing

Therefore, an improving dynamic between accounts receivable and payable would be of critical importance in the second half of FY 2024 as inventory tailwinds slowly subside.

Overall, I see little optimism for Estee Lauder’s free cash flow going forward, unless notable progress is made on reducing fixed costs and improving operating margins going forward.

Conclusion

After falling sharply in 2022 and 2023, Estee Lauder stock does not appear as a bargain for long-term investors. The current share price assumes a notable profitability improvement, and EL’s management would have to prove that it could meaningfully reduce costs, without sacrificing growth and the overall positioning of the business. Although short-term spikes in the share price are a possibility as investors adjust their expectations, the long-term risk-reward profile of The Estée Lauder Companies Inc. stock remains unattractive.

Read the full article here