Introduction and investment thesis

Last time I’ve covered Snowflake (NYSE:SNOW) following its FY24 Q3 earnings release, where I rated the company’s shares as a Strong Buy. Important new product launches, some of which are already contributing to revenues combined with stabilizing consumption trends and a decreased valuation premium have been my main arguments in favor of buying shares.

Although the share price reaction following the FY24 Q4 earnings release proved my previous Strong Buy recommendation premature, I am still bullish on the company’s prospects with even more conviction than before.

First, my previous fears of RPO deceleration and stagnation in larger new account growth have been defied by the Q4 earnings print. Second, the FY25 guidance, which disappointed investors seems unusually conservative to me, setting up Snowflake for beat-and-raise quarters. Third, the CEO transition is a positive in my eyes preparing the company for the AI-era.

I believe that the melt-up in the share price over the past month has been overdone, and there is a good opportunity now to initiate a long position or add to existing ones. It’s true that important product launches could be generally available for customers for the second half of the year meaning that revenue could reaccelerate more visibly in H2. However, I believe that the share price will recover most of its post-earnings losses by that time.

Comforting Q4 earnings with ultraconservative FY25 guidance

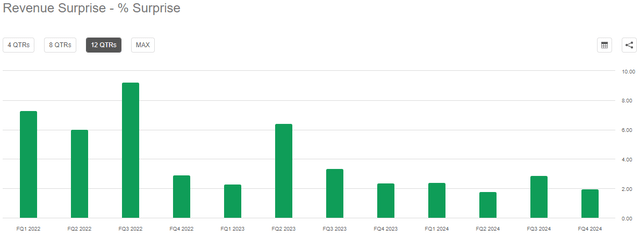

Snowflake reported revenues of $774.6 million for its recently closed FY24 Q4 quarter beating the average analyst estimate of $760.4 million. The magnitude of the beat has been in line with previous quarters, despite management comments on the Q4 earnings call that consumption picked up slower coming out of the holidays:

Seeking Alpha

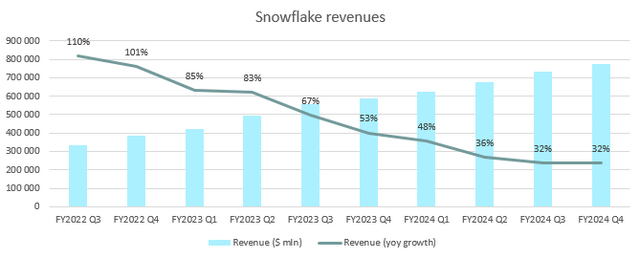

After the usual December-January slowdown consumption picked up again to pre-holiday levels, but still below where it has been before FY24 when cost optimizations didn’t play such an important role in the software space. Revenues have grown 32% yoy in the quarter just like a quarter before, which has been an encouraging sign after several quarters of topline growth deceleration:

Created by author based on company fundamentals

Improving revenue growth has been driven by stabilizing consumption trends, which has been more pronounced in the back half of FY24. In Q3, 9 out of top 10, in Q4, 8 out of top 10 customers have grown their consumption by Snowflake sequentially, showing increasing confidence to spend more. A recent important change on this front has been the restructuring of sales reps’ incentives, which is now more weighted towards generating consumption from customers rather than bookings. 55% of reps are compensated now for driving consumption at existing customers, while 35% are focused on new client acquisition, with the remaining 10% working hybrid. I believe directing the sales force with incentives into this direction should have a meaningful effect on increasing growth in consumption.

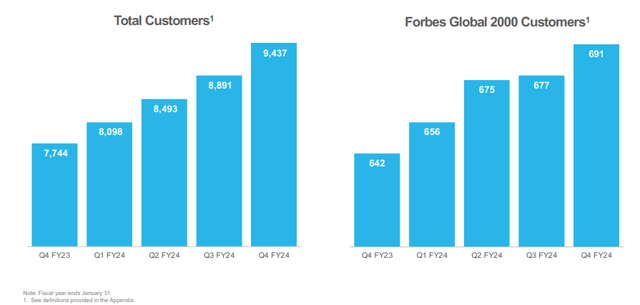

One could fear that bookings and new customer acquisition could fall back due to somewhat decreasing focus, but recent results show that’s not case for now. Based on the company’s earnings presentation total number of customers grew by 546 in Q4, the highest figure in recent quarters:

Snowflake FY24Q4 earnings presentation

Meanwhile, the number of Forbes 2000 customers increased by 14 sequentially defying concerns from the previous quarter that large customer acquisition is stagnating.

Another important component of sales growth turnaround is Snowflake’s own developer framework called Snowpark, which enables developers writing code directly in Snowflake without the need of transferring data in to and out of the platform. Snowpark captures more and more workloads from Apache Spark, which has been the go-to tool for big data workflows before the announcement of Snowpark. For data residing in Snowflake using Snowpark results in significant cost efficiencies, better security, faster time-to-market and easier set up, which provide an excellent incentive for customers to shift workloads from Apache Spark.

Although Snowpark is in general availability for more than two years, it managed to gain significant traction only recently. According to management it took time for the Snowflake sales team itself to get acquainted to the new technology and to discover with customers how it can be utilized most efficiently. Now it seems that the lessons have been learned as Snowpark revenues grew almost 50% qoq in the preceding Q3 quarter. Based on analysts comments the annualized revenue rate from Snowpark has been around $70 million in December, so it could meaningfully contribute to revenues next year. Officially, management guider for 3% contribution equaling around $100 million for FY25, but in the light of recent momentum this seems overly conservative.

Speaking of conservativism, I believe management didn’t only took a conservative stance when guiding for Snowpark revenues, but also when guiding for total revenue for FY25. Beside the CEO transition this has been the main reason that shares began a significant correction after the Q4 earnings release, so it’s worth to take a closer look into this topic.

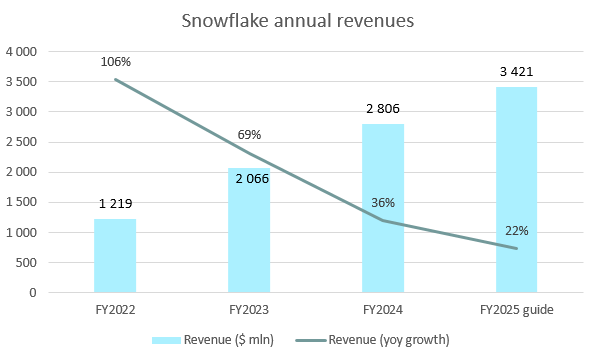

After posting revenues of $2.8 billion for FY24 Snowflake management guided for little more than $3.4 billion for FY25, which would equal a yoy revenue growth rate of 22%:

Created by author based on company fundamentals

This would mean continued significant slowdown from FY24 levels just as the yoy revenue growth rate began to show signs of stabilization in the Q4 quarter. Management acknowledged in the Q4 earnings call that they based their forecast on more muted FY24 consumption trends, even though the second half has been significantly better:

“I think we are definitely being more conservative this year given the consumption patterns we saw in ’24. And as we said at our Analyst Day last year, we needed to see consumption patterns more in line with what we saw pre-’24 to get to our longer-term goal. And as a result, we’ve decided to forecast this year based upon the consumption patterns we saw in ’24.” – Mike Scarpelli CFO on Q4 earnings call

As consumption patterns didn’t seem to deteriorate going into the FY25 Q1 quarter this equals a built-in buffer, I believe this should setup the company beat-and-raise quarters throughout FY25.

On the product forint I already mentioned that Snowpark revenue guidance seems overly conservative for FY25. However, what acts like another buffer is the fact that potential revenues from those products, which will hit general availability this year (e.g.: Snowflake Cortex, Snowpark Container Services, Unistore) aren’t factored into the FY25 sales guide at all. As most of these products will hit general availability in the middle of the year this should be a source of further revenue upside.

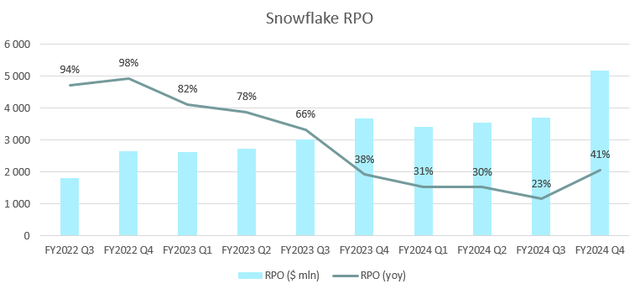

Finally, another sign that recent revenue trends are tracking well is the significant increase in RPO in the Q4 quarter that reached almost $5.2 billion growing a very strong 41% yoy:

Created by author based on company fundamentals

Although this has been partly the result of longer than usual commitments from customers, like the 5-year $250 million record deal in the quarter, it’s still an important sign that confidence towards Snowflake is increasing.

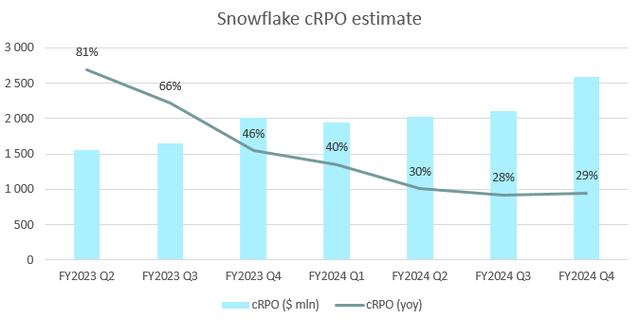

Looking at the estimated current portion of RPO, which outstrips the effects of multiyear deals we can see the same trend than in the case of revenues for the Q4 quarter:

Created by author based on company fundamentals

cRPO grew ~29% yoy in Q4 approximately at the same rate than in the previous two quarters. As bookings don’t necessarily translate to consumption on Snowflake’s platform in the close future, they are not an accurate forecaster of revenues, nevertheless the trend is encouraging.

To sum it up, the admittedly overconservative guidance from management (not factoring in upcoming product launches into guidance, conservative estimate for Snowpark, calculating with average FY24 consumption trends instead of most recent trends) and the positive trend in bookings point into the direction that Snowflake could easily beat sales estimates over the upcoming quarters. This coupled with recent correction in the share price provides a rarely occurring buying opportunity in my opinion.

Risks of falling short of FY25 guidance

However, let’s not forget that there are also downside risks for achieving these goals, which I want to discuss in the following. First, in the case of Snowflake new product launches don’t necessarily mean increasing revenues as sometimes these enable cost savings for customers. An important example for this is Iceberg tables, which could enter general availability around June. Iceberg tables enable customers to store their data in an external cloud storage outside of the Snowflake platform thereby avoiding storage costs. In this case the customer is responsible for the management and security of the data stored in these tables. Snowflake connects through an external volume to Iceberg tables and enables customers to utilize its services even on data in an external cloud environment.

On the one hand, this has the potential to bring new business to the Snowflake platform. On the other hand, customers will have the option to decrease their storage costs with Snowflake if they think they have a good alternative to manage and secure their data. Currently, 10-11% of Snowflake’s revenues are derived from storage services, so a part of these could be at stake with this innovation. Management assumes customers will utilize this service rather in the case of new workloads, so it shouldn’t have a significant impact on topline growth.

Another feature, which has been introduced to Snowflake’s largest customers in Q3 is tiered storage pricing, which is a volume discounting methodology for Snowflake’s largest customers (minimum annual $1.2 million spent on the platform). Snowflake did this already before announcing this feature, however this is a more transparent and official way of doing it. This will negatively impact revenues in FY25 to some extent, which effect has been more muted in FY24 as it has been only introduced recently.

According to Mike Scarpelli, CFO these performance enhancing initiatives for customers could result in 6.2-6.3% revenue growth headwind for Snowflake this year. The risk factor in this case is that customers will utilize these cost savings to a larger extent in the current cautious IT spending environment pressuring topline growth to a greater extent. So, it’s important to track the effects of these initiatives closely.

Another important risk factor for Snowflake is competition, which primarily consists of the large cloud providers’ own services (Amazon Redshift, Google BigQuery, Azure Synapse) and Databricks. In the case of cloud migration workloads from on-prem solutions like Teradata or Hadoop Snowflake tends to compete with the hyperscalers, while in the case of workloads concerning data scientists the competition is Databricks. Even Snowflake admits that in the case of these workloads Databricks has a very competitive offering, but I believe that with the new tech-savvy CEO Snowflake could emerge as a strong competitor in this space as well.

So, currently Snowflake excels in creating an easy-to-use data platform for data engineers, which is the foundation of a company’s data strategy. This consists of managing the data, building pipelines and preparing data for analysis. Using this data for analytical workloads, which support management decisions is the next important step. At this point Databricks is a strong competitor, but if a customer already has a significant part of its data ecosystem build up in Snowflake it’s a practical decision to use it for analytical workloads or for training ML/AI models as well. Especially that the product offering of the company is becoming increasingly competitive in this field as well.

CEO transition: Right person at the right time

Together with publishing Q4 earnings Snowflake announced that Frank Slootman, the almost legendary CEO of the company for the past 5 years is stepping down and will be replaced by former Neeva Founder and CEO Sridhar Ramaswamy. After Slootman’s success at ServiceNow, which has been followed by a similar success story at Snowflake investors could have been disappointed about his decision even if he continues to assume the position of the Chairman of the Board. However, I believe Snowflake has made the right step as the deep technical expertise of the new CEO in search and AI comes in handy in the current environment.

Sridhar Ramaswamy and Snowflake crossed their ways when Snowflake acquired Neeva, an ad-free search engine startup last year. Ramaswamy has been the head of Google’s advertising business for many years and managed to grow it with his team from $1.5 billion to over $100 billion. However, ha wasn’t satisfied with Google’s ad practices, which created a conflict between the interests of users and the shareholders of the company. He decided to quit, and created his own company, Neeva, where he could do search in the way he imagined. Despite creating an ad-free, relevant search experience powered by AI the company didn’t manage to attract enough subscribers to stay afloat. However, the technical expertise residing within has been a great integration opportunity for Snowflake, which continued with the recent appointment of Sridhar as the new CEO.

Originally, Sridhar has been charged with leading the development of Snowflake’s fully managed AI/ML service, called Cortex, which will be generally available to customers around June. It took his team 7 months until Snowflake Cortex hit private preview recently, which is an amazing performance in my opinion. Cortex is a core platform layer and enables customers to use LLMs to perform different tasks (e.g.: analyzing, querying, translating, etc.) on their data residing in Snowflake. Besides, there are several ML-based functions available as well, which can be utilized through writing a simple code in SQL. Among the many new product launches this could be the one that attracts the most attention from customers and contributes the most to sales growth already this year.

Having Sridhar as the new CEO positions Snowflake strongly for the current AI are in my opinion, it has been the right move at the right time.

Valuation

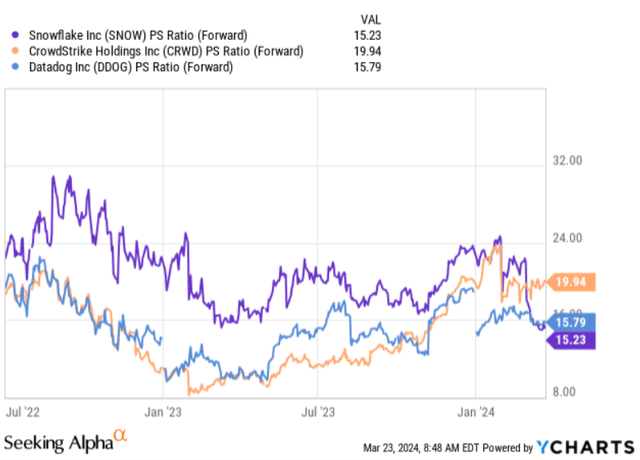

Looking at FY24 fundamental data Snowflake closed the year as Rule of 66 company, when adding 38% yoy product revenue growth and 28% FCF margin. There are not many public companies in the SaaS space that reached these highs. As an example, there is CrowdStrike (CRWD) closing FY24 as a Rule of 67 company, or there is Datadog (DDOG) coming in somewhat shy as a Rule of 55 company. What’s interesting is to compare the valuation of these companies with each other for which I have chosen the forward Price/Sales ratio:

YCharts

From the chart above we can see that over the past two years Snowflake had the heftiest price tag by far until the beginning of 2024 with a forward P/S ratio above 16 for most of the time. In the light of strong long-term growth prospects this has been justified in my opinion. However, after the recent Q4 earnings release the correction of the share price brought the P/S ratio down to 15.2, while the valuation of the two competitors remained stable during this timeframe.

As I have shown above the recent earnings release didn’t point to any meaningful deterioration in Snowflake’s medium-/long-term growth prospects, it has been the CEO transition and the overconservative guidance of management that could have unsettled investors. Based on this, I believe the correction presents a good buying opportunity from a valuation standpoint as well. Investors can acquire Snowflake’s shares at a slightly lower valuation than that of Datadog, despite Snowflake having significantly higher FCF margin and stronger revenue growth. Snowflake fundamentals are rather comparable to CrowdStrike’s, whose shares trade 31% higher based on the forward P/S multiple.

I believe this mispricing won’t last long as Snowflake will manage to accomplish consecutive beat-and-raise quarters over FY25 as upside risks dominate downside risks by a significant margin.

Read the full article here