When it comes to the oil and gas exploration and production market, investors have different preferences. Some, for instance, might prefer a company that is a pure-play on a specific region. Some might prefer a more diverse player. Some might prefer a company that has midstream assets included in the picture or that operates with royalty acreage. Frankly, an entire article could be dedicated to all the different types of options that are available out there. But for investors who do prefer a more diverse player that has a rather large market presence, you need look no further than Devon Energy (NYSE:DVN).

Back in November of last year, I decided to revisit an earlier thesis that I had regarding Devon Energy. From the time I had written that earlier thesis in October of 2020 until late last year, shares of the business had seen upside of 499.3%. That dwarfs the 34.2% rise seen by the S&P 500 over the same window of time. Much of the growth that the business had achieved was by means of acquisition. But regardless of the growth, I felt as though additional upside was warranted. That led me to reiterate the ‘buy’ rating I had on the stock at that time. Since then, the company has underperformed the broader market, with upside of only 5% compared to the 12.3% rise seen by the S&P 500 over the same window of time. But when you factor in new data provided by management that includes guidance for 2024, it’s difficult to imagine shares not appreciating further from here. Because of this, I have decided to keep the business rated a ‘buy’ even in light of recent underperformance.

The picture looks solid right now

The primary focus of my last article on Devon Energy was to cover the overall operations of the firm and to discuss why that meant additional upside was warranted. My objective here is not to rehash much of that analysis. In fact, I would recommend you go back and read that prior article before continuing this one if you haven’t read it already. The short version is that while a lot of the emphasis by management is currently on the Delaware Basin within the Permian Basin, Devon Energy is a large and diverse firm that also has assets located in other regions such as the Eagle Ford, the Anadarko Basin, the Powder River Basin, and the Williston Basin.

Devon Energy

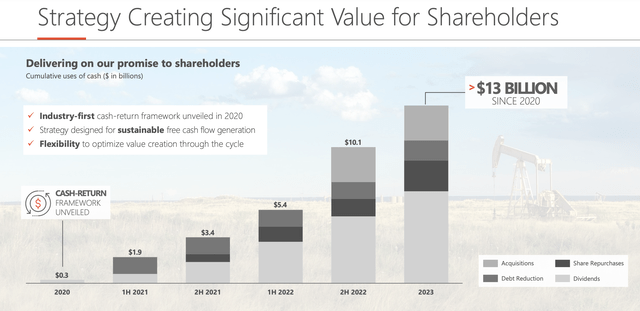

The company is also one known for delivering significant returns to shareholders. Since 2020, for instance, the firm has spent around $13 billion on a combination of acquisitions, share repurchases, debt reduction, and paying out dividends. Acquisitions, combined with production from continued capital spending, allowed the company to achieve 7% production growth in 2023 relative to 2022. And all of this occurred at a time when the company’s share count continued to drop. In fact, from the third quarter of 2021 through the end of 2023, the business reduced its share count by 41 million units, or roughly 6%. As for what the future holds, the picture is a little different.

Devon Energy

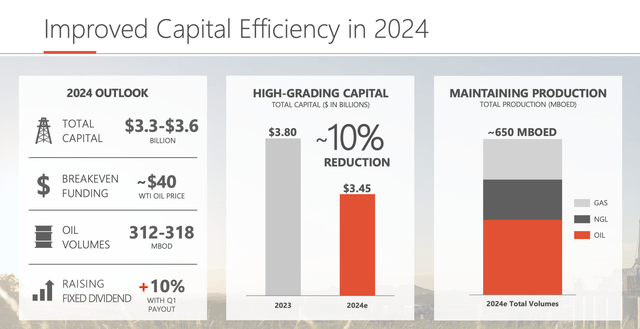

In announcing financial results for the final quarter of the 2023 fiscal year, management came out with guidance for 2024. The current expectation, according to management, is to keep production flat for the time being. It’s unclear whether this will continue in perpetuity or not. But what’s really impressive is that the company is planning to do this in a way that is expected to keep spending lower than what one might anticipate. For 2024, management is forecasting capital expenditures of between $3.3 billion and $3.6 billion. At the midpoint, this should be about 10% lower than the $3.80 billion the company spent last year. In return, the extra cash flow the company is expected to generate will be used to reward shareholders directly and, presumably, to decrease debt. In fact, management already announced that, as of the first quarter of this year, they are raising the fixed component of its fixed and variable dividend by 10%.

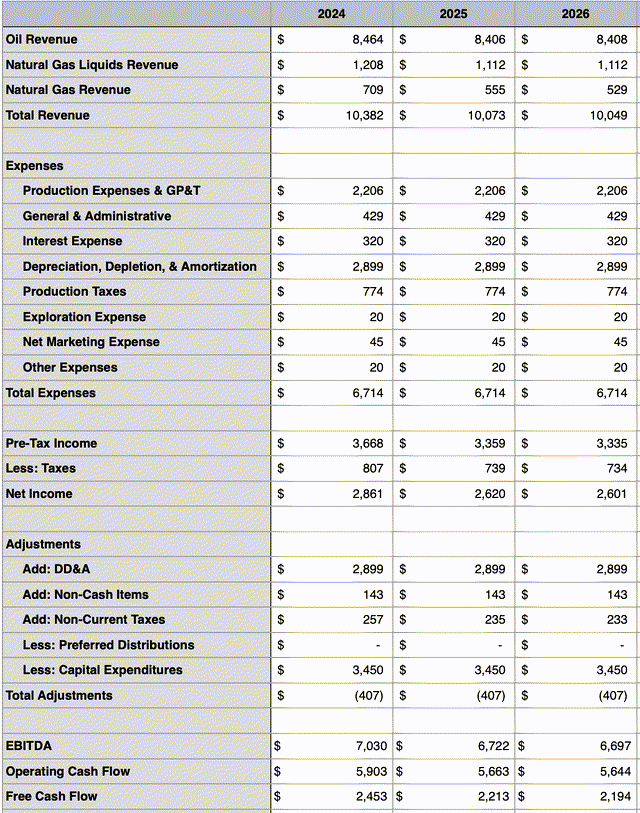

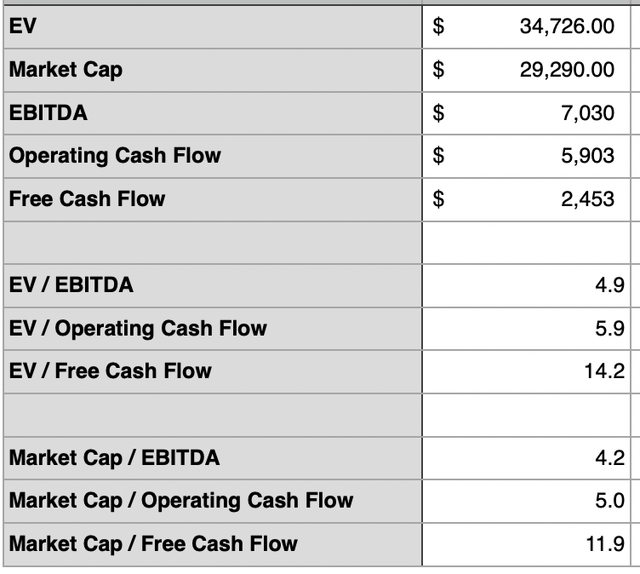

Author – SEC EDGAR Data

Using management’s guidance, combined with factoring in data regarding industry conditions, I was able to project out what kind of cash flow the company should achieve. I did this for 2024, 2025, and 2026, all assuming that production remains flat line in perpetuity with a flat spending plan. Since we don’t know what all the excess capital will be used for, I assumed that it will be returned to shareholders in the form of dividends. In the table above, you can see the result of my work in a scenario where oil prices are expected to average $75 per barrel and natural gas is expected to average $2.00 per Mcf.

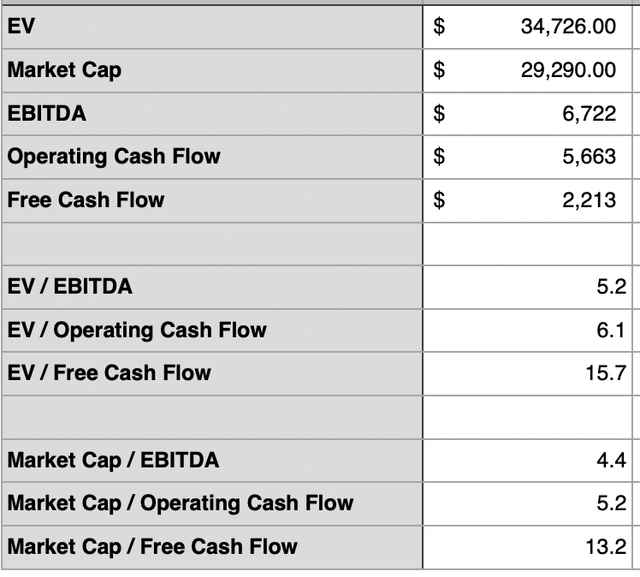

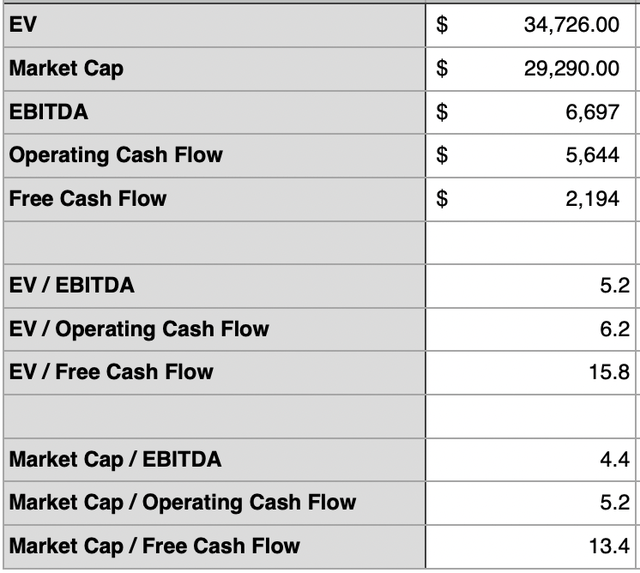

This year, EBITDA it’s expected to be around $7.03 billion. As certain hedges roll off the books, this should drop to be around $6.70 billion by 2026. Other profitability metrics followed a very similar trajectory. Adjusted operating cash flow, for instance, should fall from $5.90 billion to $5.64 billion. And most importantly, we have free cash flow. It should be around $2.45 billion this year. But by 2026, we are looking at around $2.19 billion. Of course, if management decides to use some of this toward growth, which is highly probable, then the picture could be even more appealing.

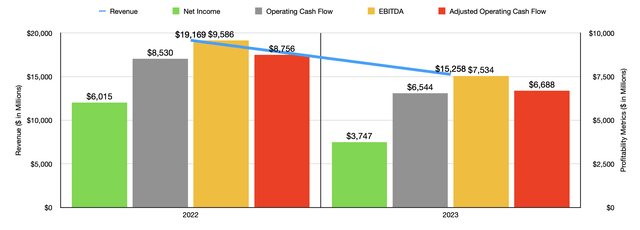

Author – SEC EDGAR Data

Before I move on, I would like to point you to the chart above. In it, you can see financial performance for the business for the last two fiscal years. What this shows is that the estimates that I calculated for this year and beyond are not terribly different from what management has been able to achieve. Admittedly, oil and gas prices play a role in this. Higher prices result in stronger cash flows, and vice versa. But in general, this confirms that my own projection for 2024 is highly trustworthy if we assume that energy prices don’t deviate terribly from what I am using.

Author – SEC EDGAR Data

In the table above, you can then see how shares are priced using the 2024 estimates. In the first table below, you can see the same thing for 2025. And in the table below that, you can see it for 2026. Obviously, shares do get more expensive in these scenarios because cash flow is expected to fall as the aforementioned hedges roll off. These trading multiples are definitely not in the bargain bin in terms of what the rest of the industry is going for. However, the pricing is also not unrealistic. That’s especially true for a firm with a market capitalization of $29.29 billion. Some other big deals as of late have been priced similarly. The buyout of Pioneer Natural Resources (PXD) by Exxon Mobil (XOM) was announced at a price to operating cash flow multiple of 4.9 and at an EV to EBITDA multiple of 5.1. And the buyout of the privately owned Endeavor Resources by Diamondback Energy (FANG) was done at an EV to EBITDA multiple of 5.

Author – SEC EDGAR Data Author – SEC EDGAR Data

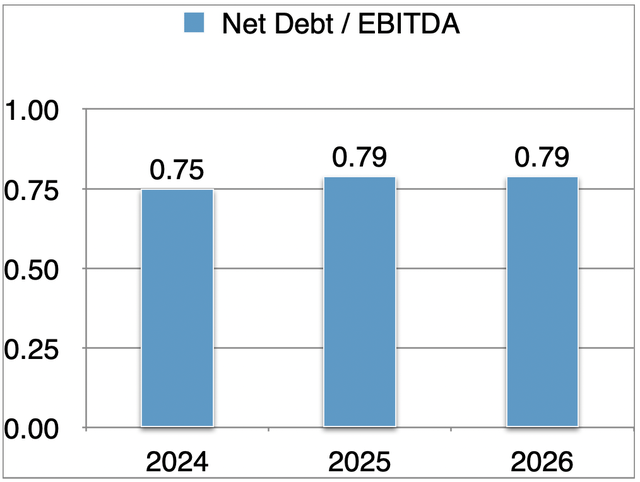

Of course, one thing we should talk about briefly is leverage. High amounts of leverage can kill an opportunity, while low amounts can justify a premium. The good news is that the net leverage ratio of Devon Energy is quite low at this time. In the chart below, you can see that, for 2024, the net leverage ratio of the business is 0.75. Using the 2025 estimates, it’s a bit higher at 0.79 Good and using the 2026 figures, it’s also at 0.79. Obviously, this picture could change if management retains the cash or uses it to reduce debt further. But I would prefer not to assume that to be the case. Alternatively, if the firm uses this capital to grow further, then the picture could be even more appealing.

Author – SEC EDGAR Data

Takeaway

Based on all the data provided, I must say that I am quite optimistic when it comes to Devon Energy. No, the company is not the best prospect on the market. It’s certainly healthy and is likely to weather any storm quite well. But there are cheaper opportunities that are, admittedly, not as high quality. For those who want stability and strong cash flows, Devon Energy is definitely worth considering. But for investors who want something that’s in the deep value category, there are better prospects to consider.

Read the full article here