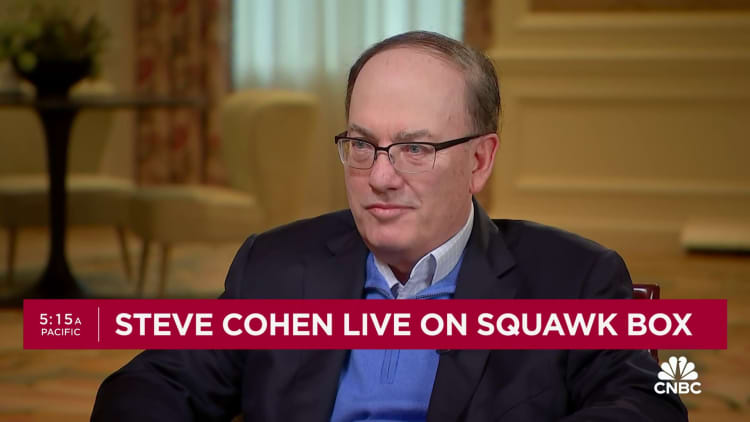

Billionaire hedge fund manager Steve Cohen said Wednesday that it will be difficult for the Federal Reserve to get inflation back down to its 2% goal.

“The Fed thinks it’s eventually going to come down to a 2% inflation rate. … I think that’s going to be hard,” Cohen told CNBC’s Andrew Ross Sorkin on “Squawk Box.”

Inflation was falling in late 2023, but there were several upside surprises in that data during the first quarter of this year. That has led to concern among economists and traders that inflation may prove to be “sticky” above the Fed’s target level, complicating the path for rate cuts.

The Point72 CEO said Wednesday that there’s a lot of “underemployment” in the country, which could create upward pressure on inflation if economic growth remains strong.

“If growth is too fast, then you start getting constraints on labor and wages go up, and that may be a problem. … We’re in one of these problems where I don’t think many people know exactly what is going to happen,” Cohen said.

Despite his concerns on inflation, Cohen said he doesn’t disagree with market estimates of three cuts this year.

“I think inflation’s been somewhat contained, and I think ultimately it will come down to: is that a true statement or not,” Cohen said.

Cohen also expressed general confidence in the stock market. He said the current market rally is not a bubble like 1999’s dot-com boom and is instead due in part to investors pricing in future growth from artificial intelligence.

Cohen said that AI is a “really durable theme” that will make an impact on a wide variety of companies.

“If you’re a company and you’re not thinking about this, you’re going to wake up one day and go ‘we’re in trouble,'” Cohen said.

Cohen has a long history of successful stock trading, and he made much of his fortune as a hedge fund manager at S.A.C. Capital before the firm was shuttered after a regulatory investigation. He also owns the New York Mets.

Read the full article here