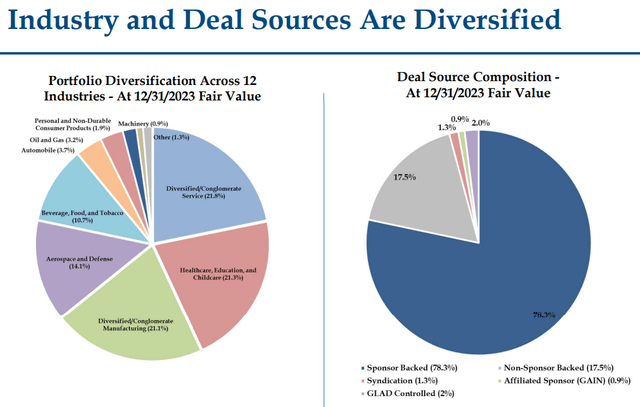

In this article, we highlight the business development company (“BDC”) Gladstone Capital (NASDAQ:GLAD). GLAD operates in the lower middle-market segment, targeting companies with EBITDA of $3-25m. Its top sectors are Healthcare, Education and Manufacturing. An absence of significant Technology sector lending is one key difference between this and most other BDCs. About 80% of its lending is in sponsor-backed (private equity-owned) deals.

GLAD

GLAD trades at a 10% yield and a 3% premium to book with a net income yield on price of 11.04%.

Quarter Update

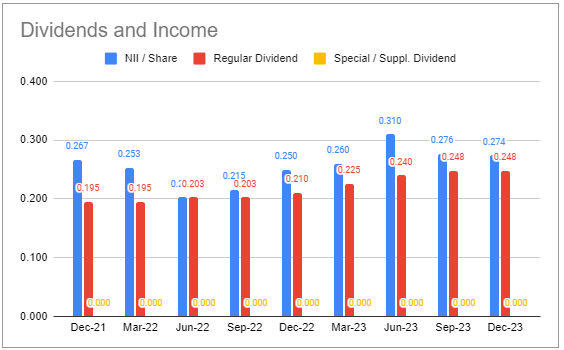

Over the December quarter, the company delivered net income of $0.27 – about the same as the previous quarter. Net income has leveled off as short-term rates have stabilized over the last few quarters. Another reason for the drop-off since June is the large equity issuance which has pushed leverage lower, diluting income. Once the company puts the capital to work and leverages it, we expect net income to rise back up, all else equal.

Systematic Income BDC Tool

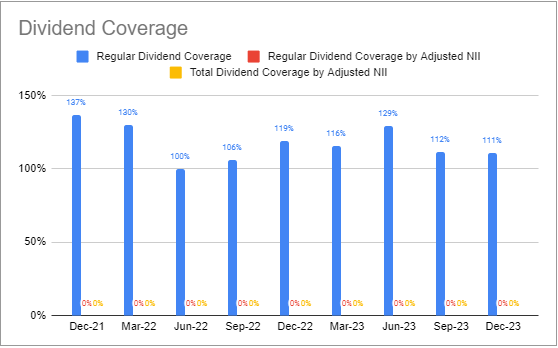

In this light, coverage is a respectable 111%.

Systematic Income BDC Tool

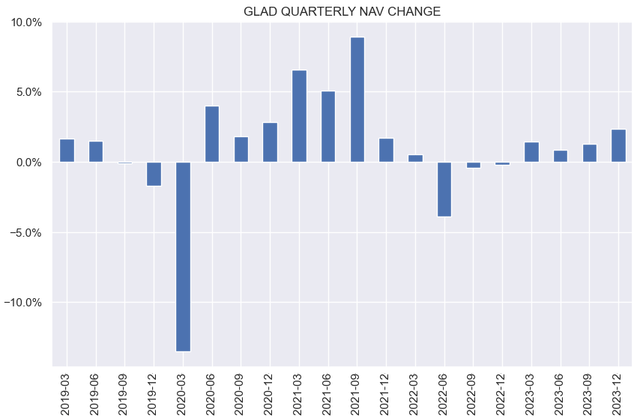

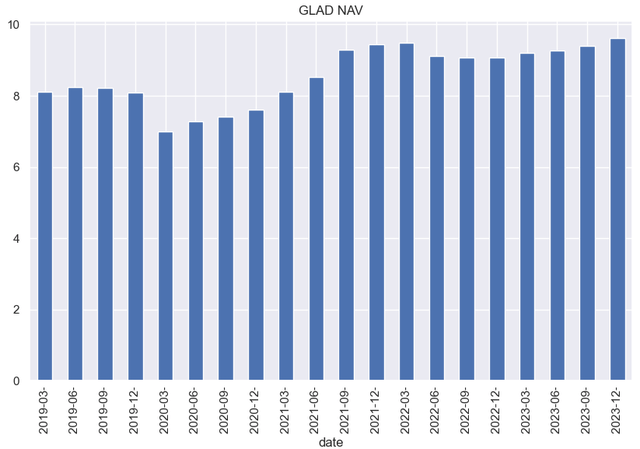

The NAV rose by 2.3%, primarily due to appreciation of debt investments. It was the fourth quarterly rise in a row.

Systematic Income BDC Tool

The NAV is back to a decade-high level.

Systematic Income

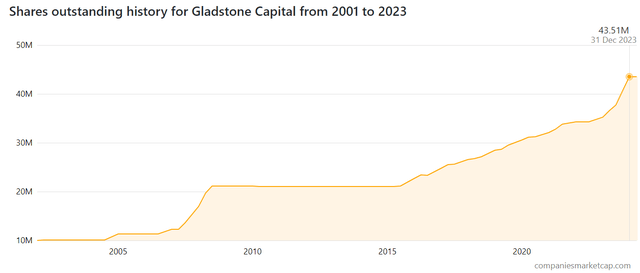

The previous quarter, the company issued 4.9m shares – a 13% increase over the previous quarter. Because of this issuance, the company nearly hit its authorized share issuance. This is very likely what prompted its 1:2 reverse split, halving its outstanding shares. This can create some confusion for investors comparing the price to the NAV, at least until the NAV is adjusted as well in the next quarter.

Marketcap

Income Dynamics

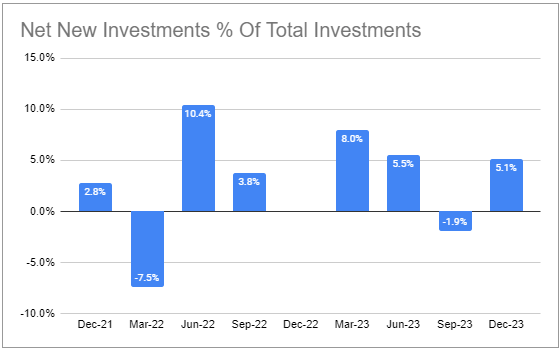

Originations rebounded last quarter to $58m, coming in well above repayments of $22m, for a net investment of $37m.

Systematic Income BDC Tool

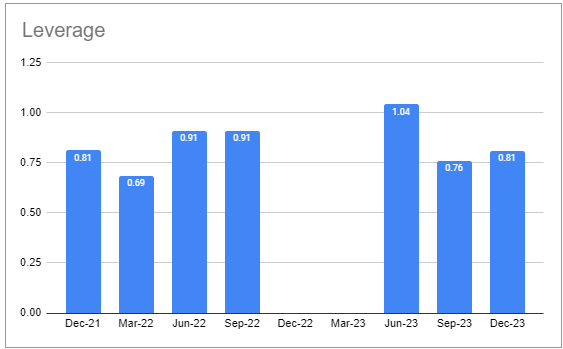

This increased leverage marginally after it fell sharply in the June quarter as a result of the large equity issuance and has not moved much since then. It is well below the sector average of around 1.05x. This gives management a good amount of dry powder.

Systematic Income BDC Tool

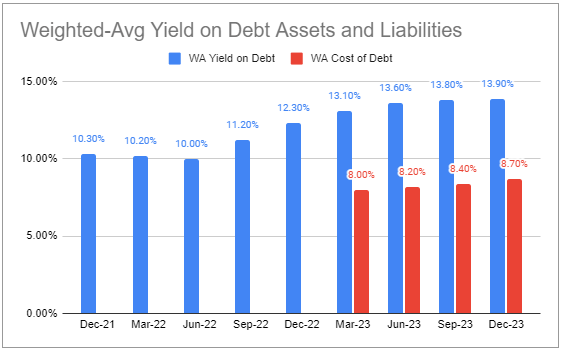

The weighted-average portfolio yield has not changed a lot at 13.9% given the stable profile of short-term rates over the last few quarters. The company’s net yield of 5.2% (13.9% – 8.7%) is well below the sector median of 6%. However, this is mitigated by the fact that the company’s leverage is very low, which means its overall net income is more efficient even if it is not as high as that of the average BDC.

Systematic Income BDC Tool

It’s fair to say that overall, the company’s net income production has a number of headwinds. One, interest expense is about 2% above the median level. This likely owes to a below average first-lien allocation as well as the company’s relatively small size. Two, leverage remains fairly low. And although this makes income production relatively efficient, it does mean overall income production is on the lower side. Three, the company’s management fee is on the high side at 1.75% at a time when BDCs are coming to market with fees of 1% or less. Incentive fees are also relatively high at 20%.

All of this results in a below-average NAV net income yield of 11.4% or about 2% below the sector average.

Portfolio Quality

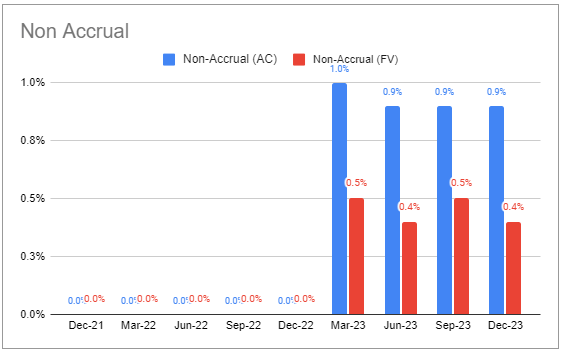

One holding was on non-accrual, representing 0.4% of the portfolio on a fair-value basis, below the median level of 1.7% and one of the lowest figures in our coverage.

Systematic Income BDC Tool

PIK income was 6% – below the sector average level.

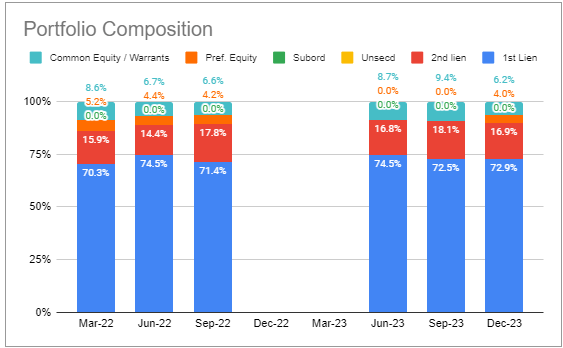

The company’s secured loan allocation has increased moderately over the last few quarters, mostly at the expense of equity and warrants.

Systematic Income BDC Tool

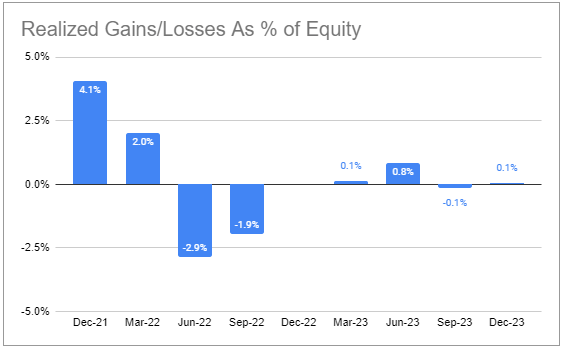

Net realized gains/losses have been relatively well-behaved and positive in cumulative terms over the last few years.

Systematic Income BDC Tool

Return And Valuation Profile

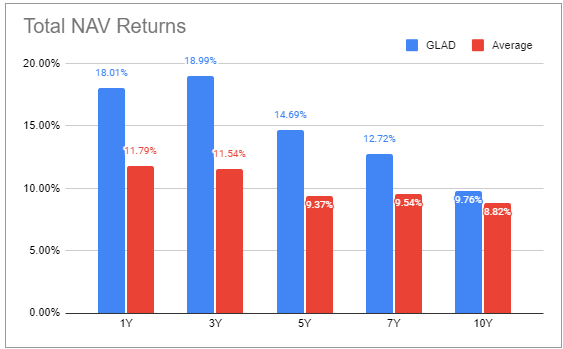

GLAD has been one of the strongest performers across the BDC sector over various time periods, outperforming the sector by a significant margin, particularly more recently.

Systematic Income BDC Tool

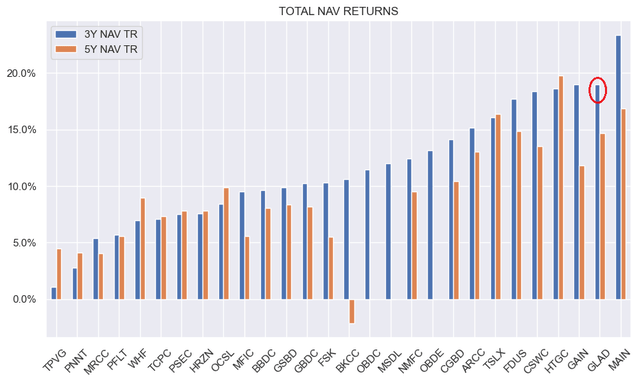

Across BDCs in our coverage, its 3-year total NAV return is in second place.

Systematic Income

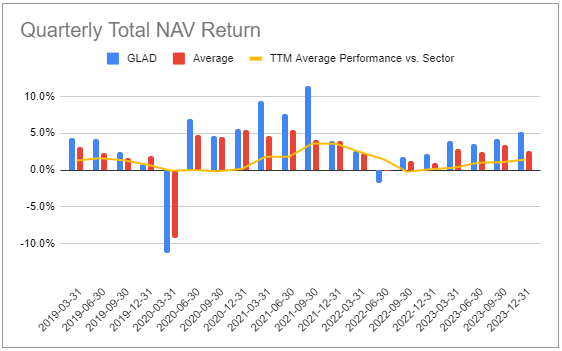

Its outperformance has been notably consistent (yellow line remains above zero).

Systematic Income BDC Tool

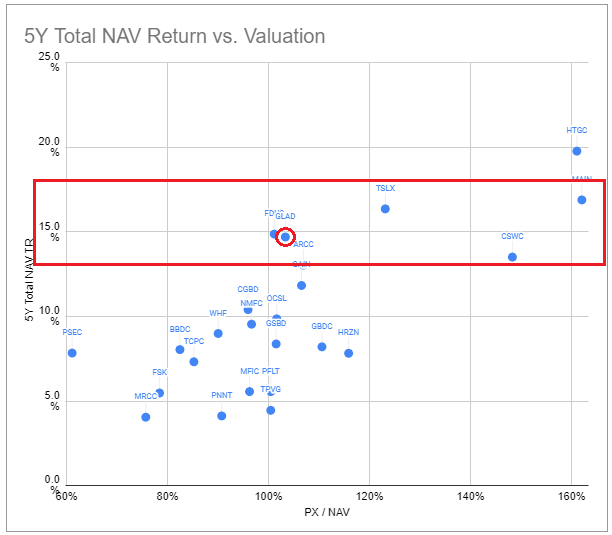

Across BDCs with a 5-year total NAV return in the ballpark of 15% per annum, it is only more expensive than Fidus Investment (FDUS), another BDC we continue to hold, and miles cheaper than something like Capital Southwest (CSWC), which it has outperformed.

Systematic Income BDC Tool

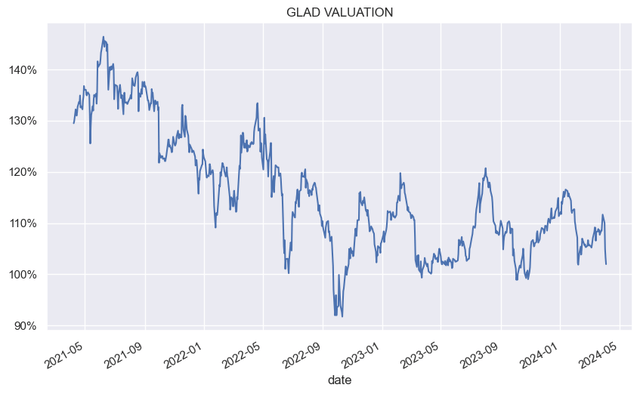

Despite very strong performance, the company’s valuation is not far off its multi-year low outside a short period in October of last year.

Systematic Income

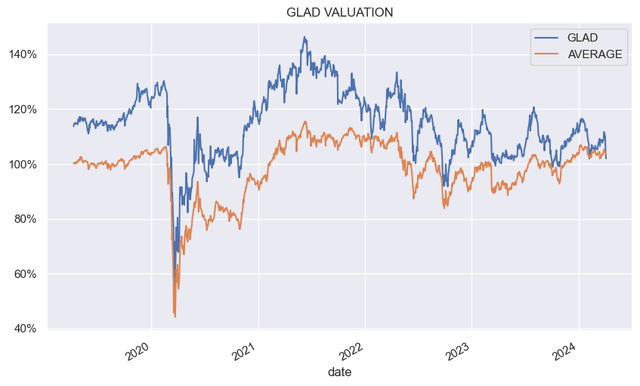

The following chart shows that the stock has tended to trade at a premium to the broader sector; however, this has now been fully erased and then some.

Systematic Income

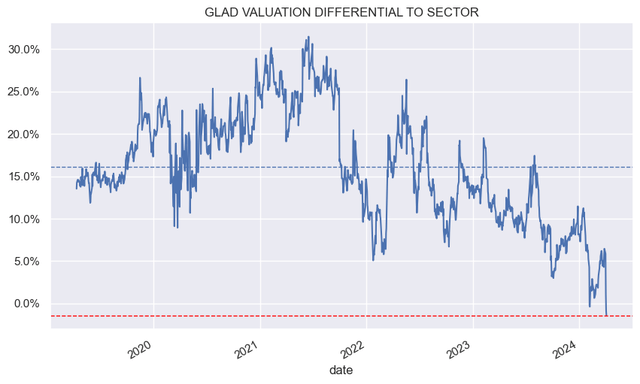

We can see this more clearly in the following chart which shows that versus an average valuation premium of 16% to the sector, the stock is now trading at a discount valuation (103% vs. 104% sector average) – an unusual situation.

Systematic Income

Stance And Takeaways

In our view, Gladstone Capital is an appealing holding in the BDC sector. It has generated one of the strongest levels of performance, particularly over the last few years.

There are a couple of risks to keep in mind. One, the company’s portfolio does carry a lower level of equity / warrant holdings which may make it difficult to generate a similar level of outperformance, though it’s not miles off. Two, the portfolio is less diversified than the typical BDC, with only 51 holdings (vs. 139 median in our coverage). Further, the top 5 investments constitute a very chunky quarter of the overall portfolio.

With this in mind, Gladstone Capital stock is worth a look for tactical as well as more risk-tolerant investors.

Read the full article here