Executive Overview

Throughout 2022, Mercury General (NYSE:MCY) faced significant challenges, resulting in a dividend reduction and the loss of its “dividend aristocrat” status. The company’s operational performance suffered, impacting both profitability and stock value. However, Mercury General recently released its fourth-quarter results, revealing a notable improvement in underwriting margins.

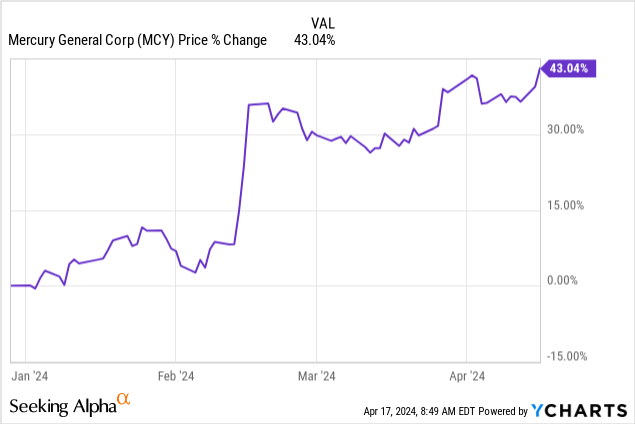

Despite ongoing losses, the reduction in these losses signals a positive trend. Investors have responded with enthusiasm to the company’s efforts to enhance the performance of its California insurance portfolio. On a year-to-date basis, the stock price surged by over 43% in the last month, indicating a potential path to recovery.

As previously noted in November 2023, the company has reaped the benefits of the remediation plans and underwriting actions aimed at reducing losses across its various insurance portfolios.

During the analysis conducted in November 2023, I decided to maintain a “hold” rating due to the poor overcycle operating performance and the company’s persistence in paying a modest quarterly dividend, despite encountering operational challenges.

Shareholders should bear in mind that Mercury General still maintains a loss-making insurance portfolio, albeit with a significant improvement observed in the second half of the year. Looking ahead, there is potential for the insurance portfolio to return to profitability. However, given the current optimism and expectations of investors, as well as the resulting valuation of the company, I don’t find sufficient justification to upgrade the rating to “BUY” at this time.

Operational Challenges: Continued Remediation Efforts

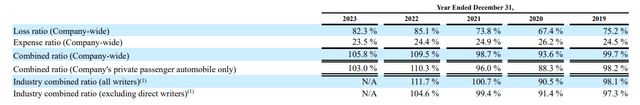

Over the past decade, Mercury General has grappled with operational challenges, struggling to consistently improve profitability. While there was a temporary improvement in 2020 amid reduced claims during the COVID-19 pandemic, the return to normalcy led to a sharp increase in the loss ratio, resulting in a combined ratio of 108.7% in 2022.

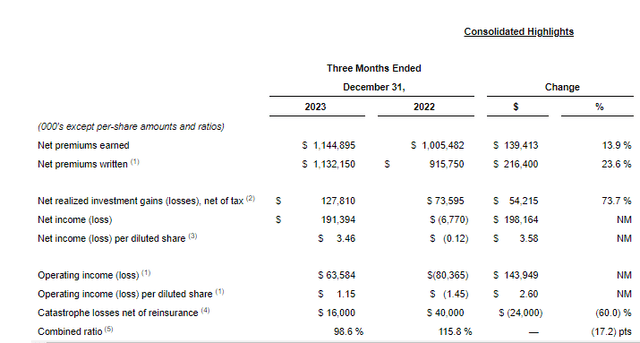

During the fourth quarter, the company managed to mitigate underwriting losses, achieving a net underwriting gain of approximately $16 million and a combined ratio of 98.6%.

Mercury General’s Q4 2023 Results

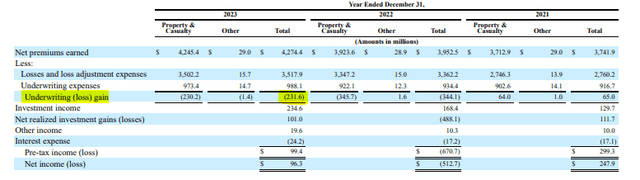

However, on a year-to-date basis, underwriting performance remained negative, as rate increases take time to materialize.

Mercury General’s 2023 Annual Report

Therefore, the underwriting performance for FY 2023 remains in negative territory, with a $231 million underwriting loss.

Mercury General’s 2023 Annual Report

The company continues to implement rate adjustments and other measures to bolster underwriting results. In January 2024, the California Department of Insurance approved significant rate increases for Mercury Insurance Company (“MIC”) and California Automobile Insurance Company (“CAIC”), expected to become effective in late February 2024.

These rate increases, specifically 22.5% for MIC and 3.8% for CAIC, are focused on the private passenger automobile line of insurance business, representing approximately 48% and 5%, respectively, of the company’s total net premiums earned in 2023. These adjustments are anticipated to have a positive impact on underwriting performance in the latter half of 2024, subject to catastrophe losses and claims inflation levels.

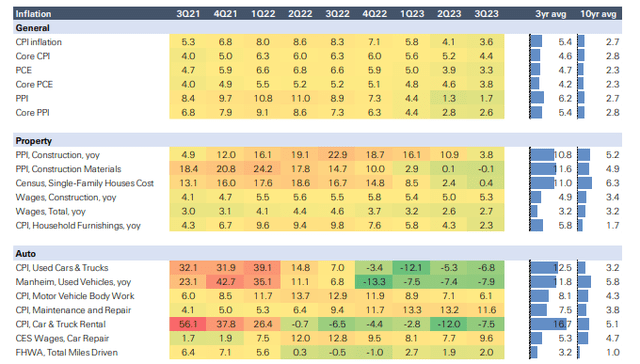

Swiss Re’s latest report suggests that property and personal auto insurance lines of business are expected to benefit from disinflation, potentially improving personal auto margins. Recent data also indicates a decline in used car prices and a decrease in repair costs, further supporting potential improvements in underwriting margins.

Swiss Re’s report

However, the first quarter of 2024 may face an impact from increased catastrophe losses due to a series of atmospheric river rainstorms experienced in California in late January and early February 2024.

It’s important to note that the insurer is currently unable to estimate the potential loss or a range of loss resulting from these storms, as many claims associated with them have not yet been reported to the insurance company.

Nevertheless, the company is scheduled to report its first-quarter results in two weeks, which should provide clarification on the uncertainty surrounding catastrophe losses. Additionally, I anticipate an improvement in the attritional loss ratio (i.e., the loss ratio excluding the impact of catastrophe losses), attributable to the effects of prior underwriting measures.

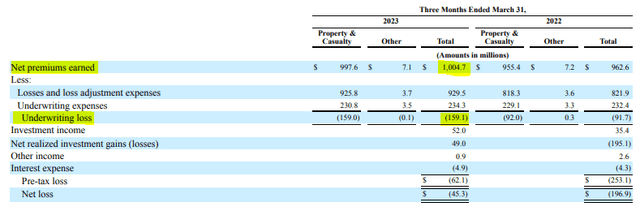

In Q1 2023, the company reported an underwriting loss of $159.1mn or a combined ratio of 115.8%, largely caused by the claims inflation partially offset by the first effects of the remediation plans launched in 2022.

Mercury General’s Q1 2023 Report

The full effects of the remediation plans are expected to positively impact the loss ratio for the first quarter of 2024, leading to a reduction in the loss ratio, despite the adverse effect of claims inflation.

While it is challenging to precisely model the full effects of the price rate changes, given the implementation of several rates, an acceptable expectation would be a weighted-average price increase of 10 to 12%. With claims inflation ranging from 2 to 4%, this suggests that the loss ratio for Q1 2024 would fall within the range of 84.2% to 87.5%. Factoring in an expense ratio of 24%, this would result in a combined ratio landing at 108.2% to 111.5%. Hence, it is possible that the insurance portfolio could still yield a loss-making performance during the first quarter of 2024.

Valuation Considerations

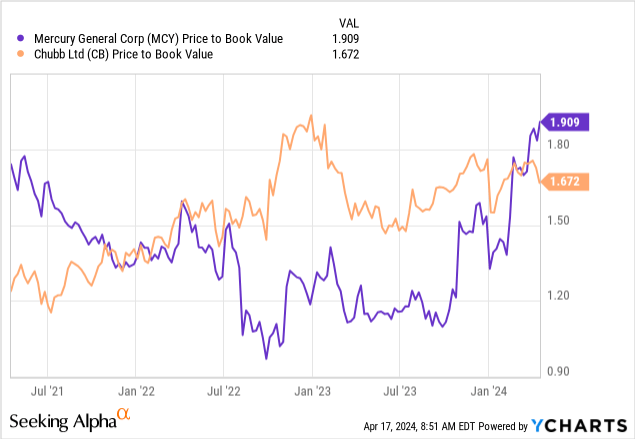

Mercury General’s market capitalization is approximately $2.96 billion, with an annual premium turnover of around $4.4 billion. Its shareholders’ equity stands at $1.55 billion, resulting in an intriguing price-to-book ratio of 1.9.

However, it’s crucial to evaluate factors such as profitability, underwriting performance, and dividend sustainability.

Comparatively, competitors like Chubb (CB) currently trade at lower valuations.

However, Chubb consistently outperforms Mercury General, particularly in terms of its operational performance, capital redistribution, and shareholders’ capital redistribution policy.

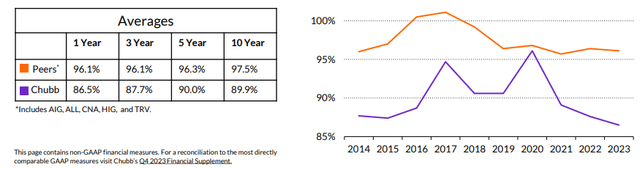

For instance, Chubb maintained an average combined ratio of 89.9% over the past ten years, whereas its peers recorded an average loss of 97.5% over the same period.

Chubb’s Q4 2023 Presentation

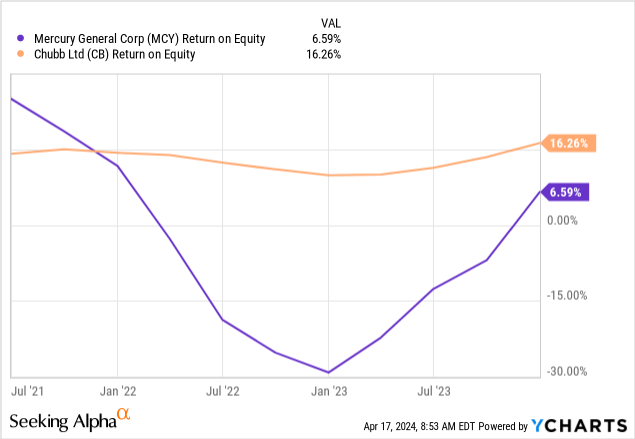

In comparing return on equity metrics, Chubb has outperformed Mercury General, attributed to Chubb’s superior over-the-cycle underwriting performance compared to Mercury General.

Despite Chubb benefiting from its diversified position, encompassing a global footprint and involvement in specialized markets like agricultural insurance in the U.S., Safety Insurance (SAFT) emerges as a potentially more suitable peer due to its status as a regional insurer operating in both motor and homeowners’ insurance markets.

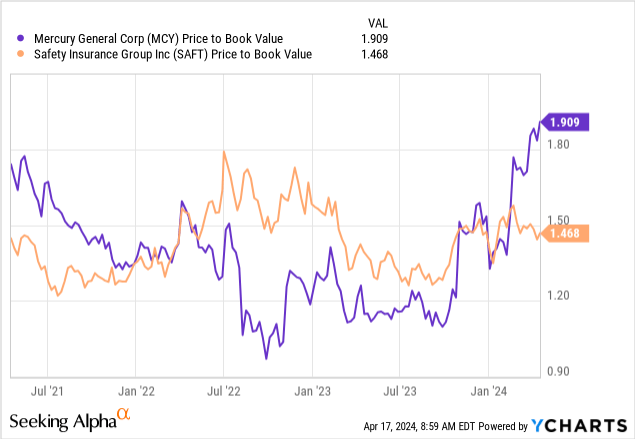

When comparing the price-to-book value metrics, it becomes evident that Mercury General is traded at a higher multiple than Safety Insurance.

However, it’s worth noting that the Massachusetts-headquartered insurer has achieved a superior over-cycle combined ratio. From 2012 to 2022, Mercury General maintained an average combined ratio of 100.5%, whereas Safety Insurance experienced underwriting losses only in 2015 and achieved a 10-year average combined ratio of 96.6%.

However, despite this, Mercury General outperformed Safety Insurance in terms of underwriting performance in 2023, largely attributed to the remediation plans initiated in 2022 and 2023.

Therefore, it appears that the current higher valuation multiples of Mercury Group compared to Safety’s stem from the success of the remediation plans implemented by Mercury. In my view, Mercury is being traded without a safety margin, despite the favorable trends observed in terms of underwriting initiatives. I would tend to favor Chubb or Progressive (PGR), which are larger and more resilient insurers with a stronger long-term position compared to Mercury.

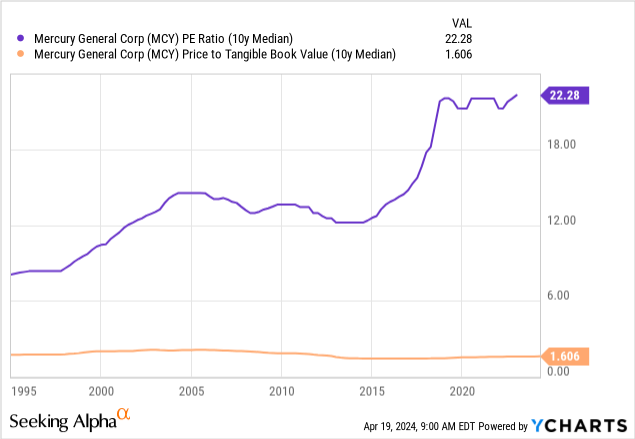

However, it’s worth noting that Mercury might outperform both insurers in the short or midterm perspective, as investors might appreciate Mercury’s efforts to remediate the insurance portfolio. Taking a long-term perspective, it is anticipated that Mercury would be considered fairly valued at approximately 1.5 – 1.6 times the book value and around 20 times the earnings.

The drivers of this valuation encompass:

- Over-cycle poor operating performance attributed to a lack of geographical diversification. The operating performance may improve in the future with the implemented rate changes.

- Dependency on the California insurance markets and potential threats related to regulatory decisions of the California DOI (Department of Insurance)

- Absence of superior advantages compared to other property and casualty insurers. For instance, Cincinnati Financial (CINF) does not demonstrate a superior underwriting performance (with only an over-cycle combined ratio of around 97%), but outperforms its peers in terms of asset allocation, with a higher exposure to equity markets.

Final Considerations

Mercury General’s efforts to reposition itself are starting to show positive operational results. However, challenges persist, and 2023 was not a profitable year in terms of underwriting performance. Nonetheless, the second half of the year demonstrated the effects of the remediation efforts undertaken by the underwriting team across various portfolios.

In 2024, there is potential for a comeback in terms of underwriting performance, with a projected combined ratio ranging between 97% and 99%, contingent upon maintaining control over catastrophe losses and claims inflation.

Moreover, the investment income could bolster higher earnings, notwithstanding the recent decrease in long-term interest rates. Potentially, higher realized capital gains could serve as an additional boost to investment results.

While current shareholders have enjoyed the stock rally over the past year and the beginning of 2024, they will remain vigilant and closely monitor the situation.

Read the full article here