Investment Thesis

Starbucks (NASDAQ:SBUX) has always felt to me like a special American company. Up there with Ford (F), Nike (NKE), McDonald’s (MCD), Levi (LEVI), Apple (AAPL) and Visa (V) among those blue chips that are so ubiquitous and international that the brand has always carried a reassurance, a safety. Anywhere in the world where I’ve seen one, I’ve known what I’m going to get. It’s a familiar friend in foreign lands.

Being British, the Coffee Shop ‘home from home’ idea was quite alien to me until I first watched the TV show Friends. Howard Schultz, inspired by his experiences in espresso bars in Italy, saw the company as a “kind of ‘third place’ where they [the customer] can escape, reflect, read, chat or listen.” and spread the concept across vast swathes of the developed world.

The world has changed a lot in the 20 years since that quote, and the company has started to aggressively modernise – drive throughs, smartphone apps and ordering, delivery coffees, and global expansion. In this article, I will investigate the modernisation of the company and look at a couple of the major new markets into which the company is expanding. I will conclude by trying to objectively calculate whether Starbucks can offer market-beating results for a potential investment made today.

Moving from the third place to any place

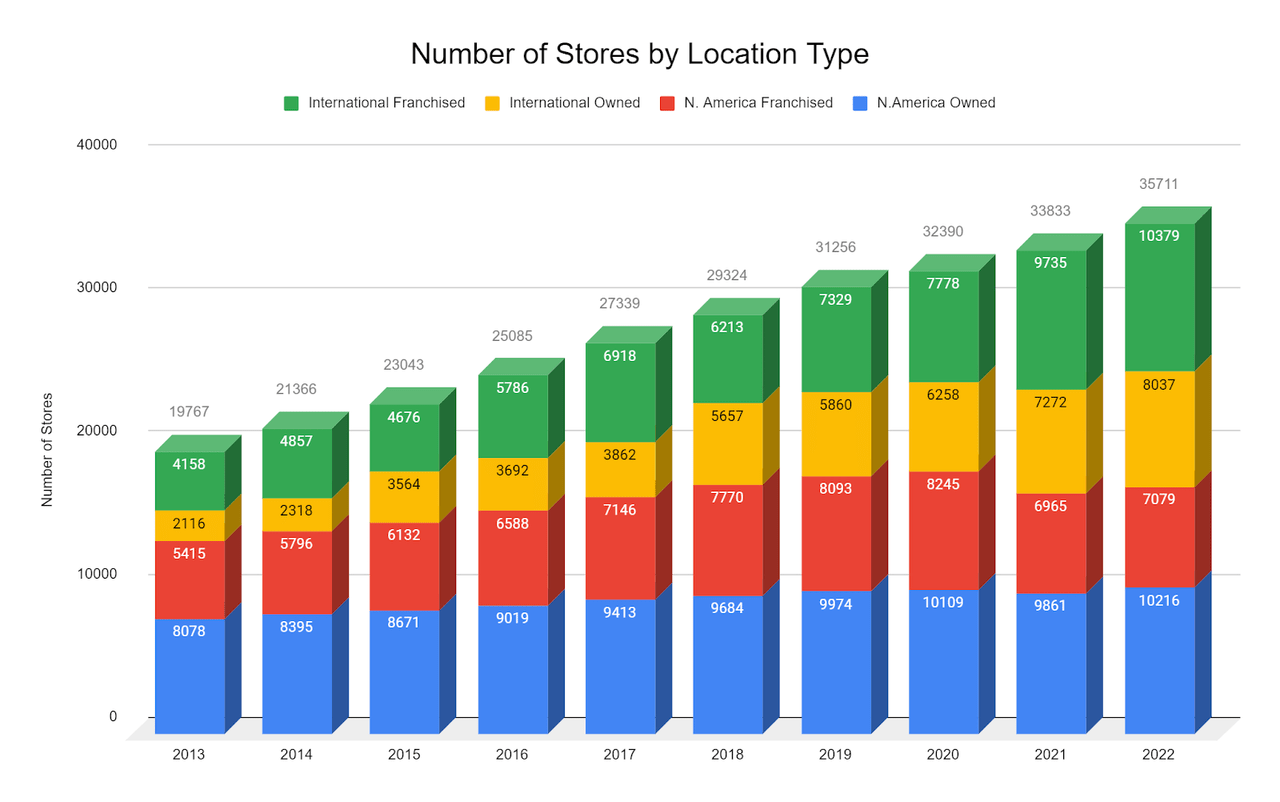

Author’s calculations from Starbucks Annual 10ks

I want to start by sharing this chart, simplifying store count data from the last 10 years of the company’s annual reports (10ks). The red and blue parts represent the store count growth in North America in the past decade. It is growing at roughly a 2.5% CAGR, but I would argue that the company is reaching a saturation point in terms of store count. Although it currently has the 2nd highest store count of any food and drink franchise (after Subway), in the post Covid years, net franchised stores have actually decreased, whilst owned stores are essentially flat. On the other hand, international stores, shown by the yellow and green parts, are growing at a 12% CAGR and will likely continue to grow at that rate for a while, particularly in China and India.

Before we go to Asia, I want to look at what the company is doing to increase its earnings in North America and how it used the restrictions during the Covid-19 pandemic as an opportunity to expedite moves into technology and automation, particularly as it saw large numbers of its coffee shops forcibly closed by state mandated lockdown measures around the world during this time. As consumers began to leave their homes again, a comfortable middle ground for getting fast food and drinks was drive throughs, the opportunity to order their favourite coffee without leaving their cars and also offering the company the chance to increase its store efficiency. Around 90% of new stores have drive through options now.

Lockdown also saw a surge in home delivery companies, with customers keen to get groceries and hot food and drink without the risk of leaving their homes. Even though these concerns have largely waned, the longer term trend of paying for convenience has also offered Starbucks another outlet for getting its products to its customers – home (and workplace) delivery of coffee, including a recent trial with Doordash becoming increasingly available to more stores across North America.

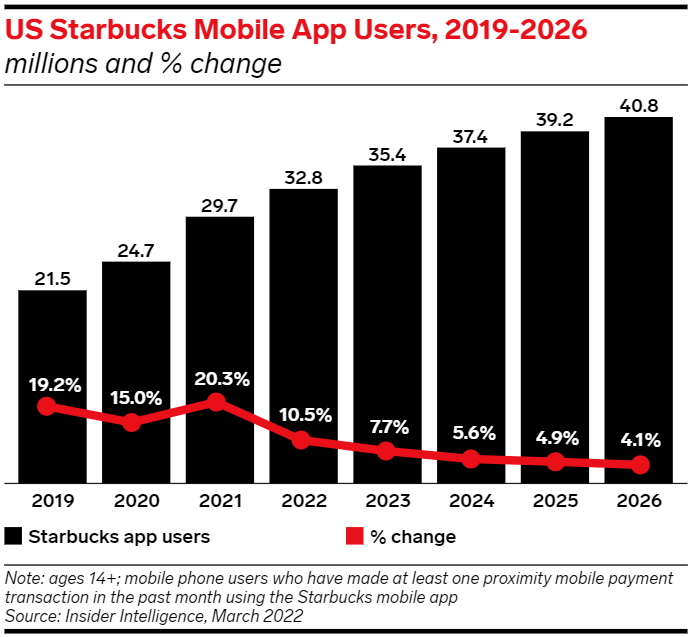

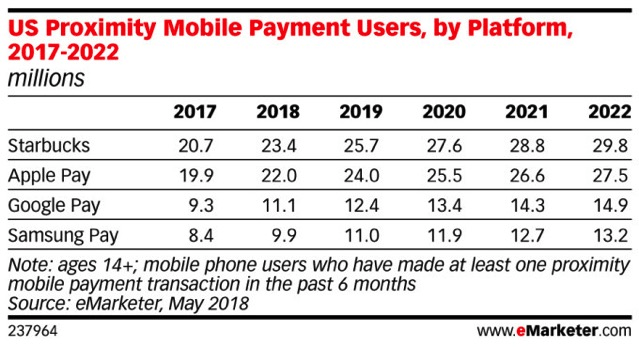

This move to convenience can be seen with the company’s mobile app, which in the US alone has over 30 million active customers, almost 1 in every 10 Americans, and this is expected to further increase. The app allows customers to order in advance to save themselves time as well as accumulate ‘stars’ as part of their rewards programme that leads to free drinks. This loyalty programme is very clever, as it rewards additional points for those customers who preload their accounts with money and then use their apps to make their purchases. This retained credit for pre-purchased and future drunk coffees can then be used by the company as essentially an interest free overdraft, which helps them to also keep an eye on their already rising debt levels. The in-app payment system is so popular that it used more than Apple Pay and more than Google Pay and Samsung Pay combined.

Insider Intelligence emarketer

Technology has also been integrated in many Starbucks stores in order to increase the efficiency of the coffee making process as well as to generate vast amounts of data that can be used by the company to optimise its operations. During Schultz’s most recent spell as CEO in which he went on a charm offensive to persuade employees working in company owned stores not to unionise, he was keen to discuss the importance of automation and more advanced machinery in helping to save barista’s time and energy when making drinks. This has the dual benefit of relieving some of the pressure on employees as well as ultimately improving margins in North American stores. Fortunately, we have not heard a lot of further talk about Starbucks wasting too much money in entering the metaverse.

International Growth Opportunities

This article began with a simple chart showing store count growth in North America and ‘International’, a merging of China, India, Latin America, Turkey, Indonesia and other growth markets for Starbucks. The red and blue represented a slight saturation within North America and the yellow and green showed the very aggressive international growth that the company has been pursuing across the world. I want to focus now on what I believe are the two most exciting markets.

China

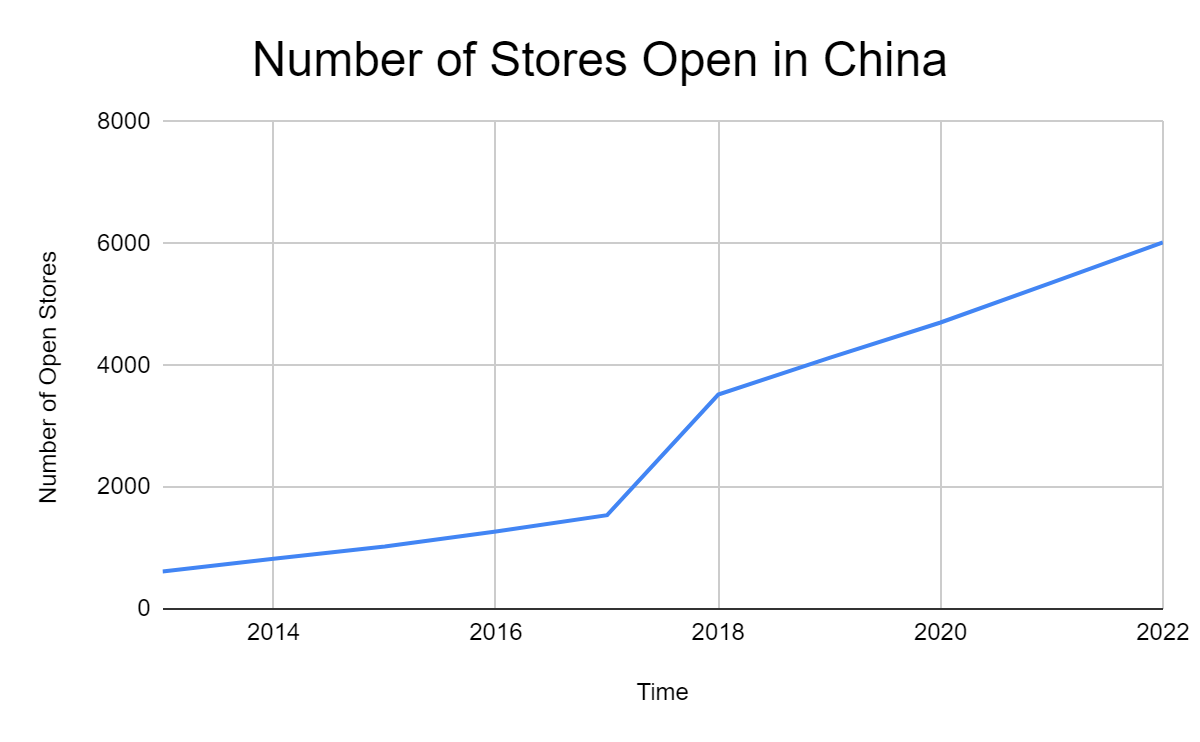

I believe that China is one of two main growth markets for Starbucks. It has a huge population and a quickly growing middle class that could add another 80 million people before the end of the decade. Currently, it has a 25% CAGR in net store count over the last decade and still has plenty of room to grow.

Belinda Wong, Chairwoman of Starbucks China discussed in their most recent investor day the flywheel of more affluent people drinking more coffee per day at higher prices and the company’s aim between then and 2025 to open a new store every 9 hours reaching around 9000 in total, which is roughly where its major rival Luckin Coffee is at the moment. This quick and aggressive expansion in their store count would see around 50% growth in the next few years, and I wouldn’t bet against that number growing for years or even decades to come.

Author’s calculations from Starbucks Annual 10ks

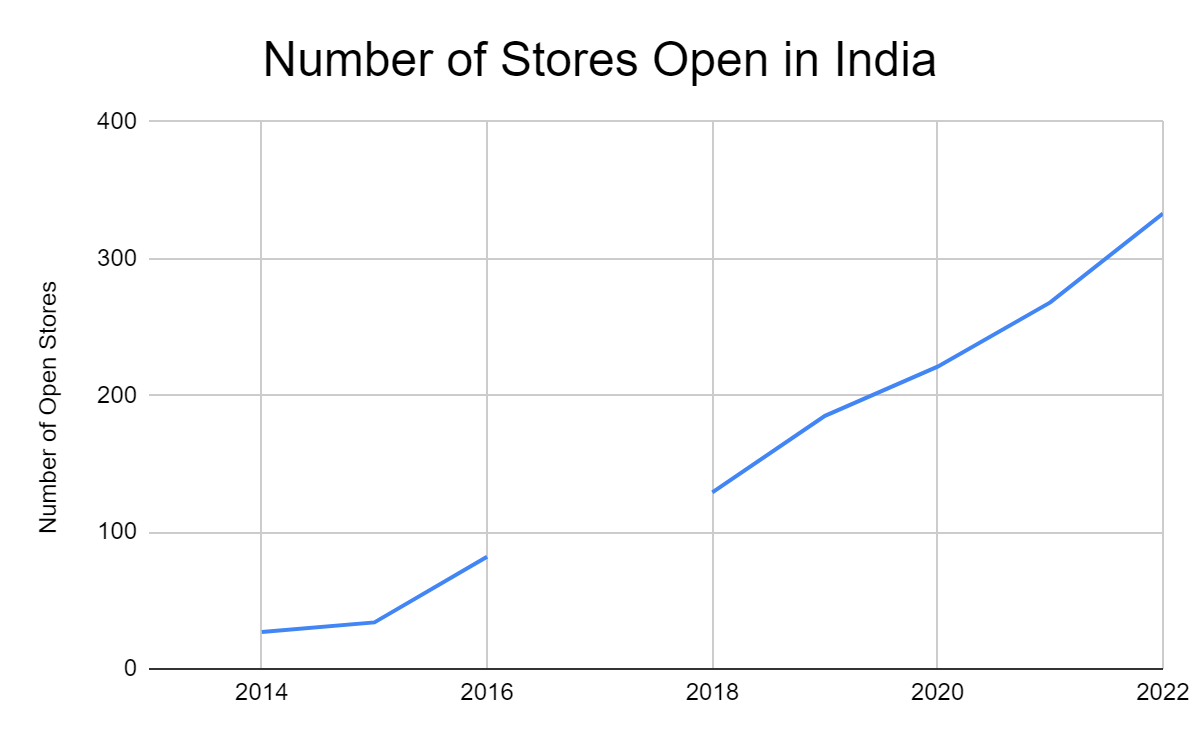

India

India is famously a country devoted to tea. It is also the largest population in the world and the largest middle class opportunity for premium goods such as coffees, there could be around 400 million potential customers and this number is rapidly increasing. And how many Starbucks stores do you think there are for that opportunity? Just a little more than 330; that’s less than the store count only in New York City. When compared to the 9000 likely to be open in China within the next few years, you get a sense of just how big the opportunity could be. The chart below was (painstakingly) gleaned from the simply awful Tata Starbucks Investor Relations page, the 50% partner for Indian expansion, hence the gap in the middle when I gave up on trying to find the number of opened stores for 2017.

Author’s calculations from Starbucks Annual 10ks

Starbucks’ new CEO Laxman Narasimhan joined the company recently and although it is of course too early to make too much commentary on the job he is doing, but there are 2 things that I find quite exciting. One, he is half Indian. Two, the summation of his 19 years working at McKinsey prior to joining Pepsi in the company’s most recent 10k: “where he focused on its consumer, retail and technology practices in the U.S., Asia and India“. In my opinion, opening up 300 stores in a decade in a major new market is at best disappointing. The appointment of Mr. Narasimham will hopefully bring some clarity as to how this growth can be expedited and the opportunity executed.

If you revisit the China graph, they went from 614 stores in 2013, which isn’t too far away from where India is now, so it isn’t beyond possibility that the aggressive growth seen in China will be replicated. Early signs are promising: according to Tata Starbucks, they are currently in the stage of getting the brand more widely known and “expanding its presence in the coming years”. There has recently been a marketing campaign within which the company was heavily advertising plant based food items and a special ‘Divali Blend’ of coffees that they hope will appeal to local patrons and attract them to their stores.

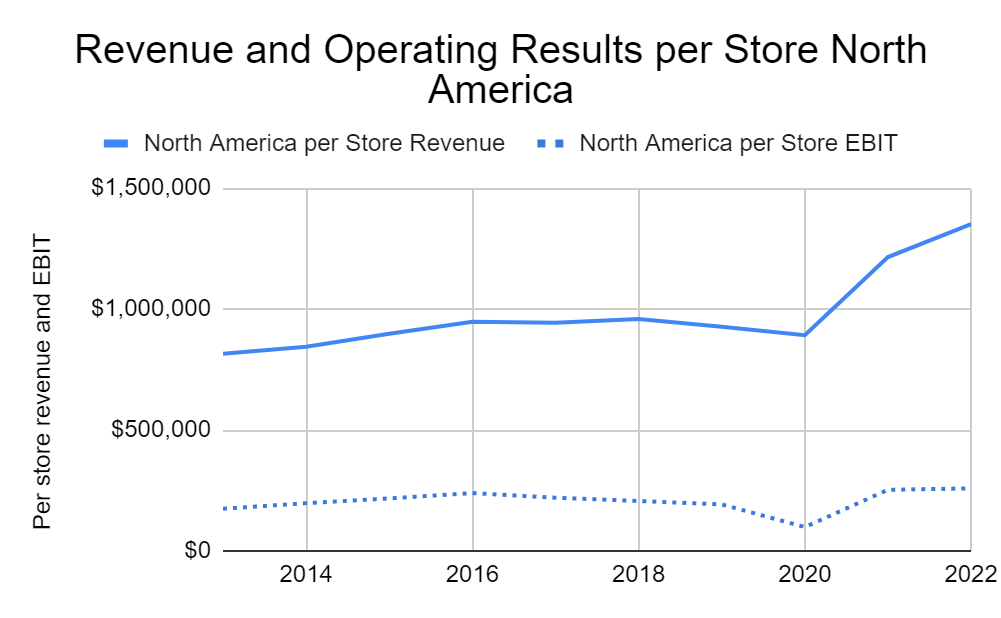

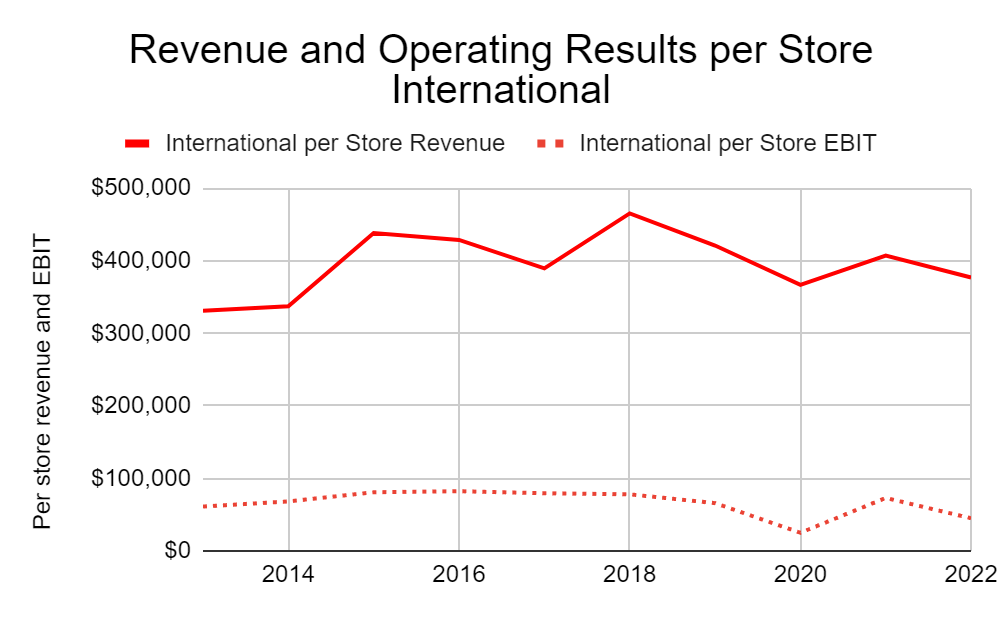

Unit Economics

In the US, the majority of the company’s growth is coming from price increases, efficiencies and extra value offerings, such as snacks. Whilst international markets offer the afore-discussed growth prospects in store counts, it is perhaps unsurprising that as the company moves into less strong economies, their unit economics suffer. The following 2 charts show the revenue and EBIT per store and how they have grown over the past decade; the blue details North America, the red shows International.

In North America, we can see the impact of technology, automation and offering new ways for customers to get their coffees having strong positive impacts on the amount each store generates. This is not translating as well in international markets, where operating results are actually lower per store than they were a decade ago. We have recently reached the inflexion point at which the total number of international stores have surpassed those in North America, it will be important to watch the unit economics of each store very closely to ensure that overall margins for the company do not see major compressions.

Author’s calculations from Starbucks Annual 10ks Author’s calculations from Starbucks Annual 10ks

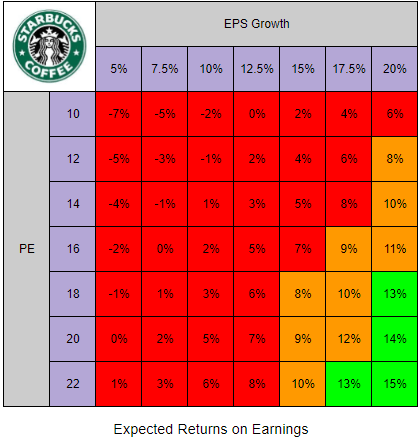

Valuation and Chances of Beating the Market

With the increased efficiencies happening in North America and the aggressive growth of store counts in international markets, what are the likely investment returns for Starbucks, and as we are all here to achieve Alpha over the market in our investing journeys, will the company likely outperform over a long time horizon.

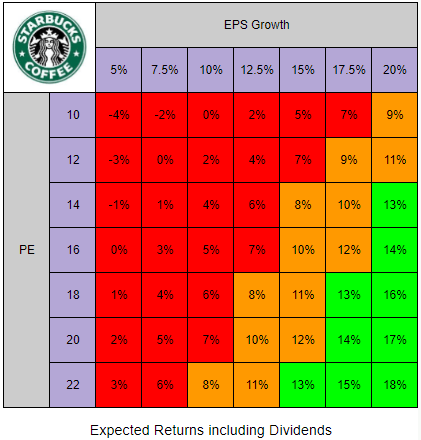

Below we have 2 grids. The first details the market returns from today’s price (as of time of writing) out 10 years, and shows the expected annual rate of return compounded to 25th July 2023. The second shows the same but the returns include the dividends paid out (no tax applied and the assumption is that these are not reinvested). As the company should start to focusing on deleveraging, I have assumed an annual growth in the dividend of 8%.

Red shows an expected annual return rate of below 8% and will probably underperform the market.

Orange shows that it will return somewhere between 8%-12% and will probably be in line with long term market returns.

Green shows what I believe will be the alpha that we are looking for, with returns about 12% per year.

My own forecast is that the company will grow at around 12.5% per year for the next 10 years, which is around the current growth rate. I also believe that there will be a small retraction in PE from the current 32 to around 20/22.

Therefore, I believe that a purchase of Starbucks today, including dividends will return around 10-11% per year for the next 10 years.

Author’s Calculations Author’s Calculations

Investment Summary

According to my research, the market has accurately priced in the next decade of growth into Starbucks’ stock price. It is an ideal company for those looking for safe dividend payers as well as those with long term mindsets who value the compounding powers of time, as I believe that the Starbucks brand will outlive most of us currently using this platform.

However, as I think there are better opportunities in the market that offer increased chances of alpha, it is a hold for me. I am a happy long term shareholder and see no reason to sell; although, I will be looking forward to seeing the new CEO’s plans for growth as well as hopefully a reduction of debt, the interest of which is currently taking around 10% of the company’s operating profits.

Read the full article here