Temu

PDD Holdings Inc. (NASDAQ:PDD) just released its earnings for the first quarter. The release showed a 131% increase in revenue and a 202% increase in adjusted EPS. Both figures exceeded analysts’ expectations by wide margins. The EPS growth in particular was nearly double what analysts expected. The stock, however, achieved just minor gains after the release came out. As I will show in a later paragraph, the tepid reaction to all of this explosive growth was not necessarily irrational, as there was plausible cause to question the earnings figure reported.

A lot was at stake before this release came out. Chinese stocks had been rallying on new stimulus initiatives from the Chinese government. Although the government hadn’t cut rates, it had launched a number of fiscal stimulus initiatives and instructed the “national team” to buy stocks to support the market. These initiatives, along with a relatively good earnings performance from Alibaba (BABA), kicked off a new bull market in Chinese stocks. PDD’s strong earnings performance provides cause for hope that the rally might just last.

With all that being said, PDD’s release, though impressive, may not drive near term gains. After its second most recent earnings release came out, PDD not only beat expectations, but beat them by wide margins. It crashed during the subsequent trading day anyway.

Today’s trading was relatively similar. At the time of this writing, the stock was up for the day, although not by anywhere near the percentages you’d expect after seeing earnings double the analyst consensus. I think a small but positive gain is about the correct reaction here; the earnings were good but, as I wrote on X, investors are likely suspicious of the net income number. PDD’s earnings grew faster than revenue in a period when the company’s main growth driver, TEMU, was unprofitable. That type of thing can arouse feelings of mistrust in the investor community.

It’s for this reason that my opinion on PDD has actually dimmed slightly, rather than improving. I plan to keep holding my shares, but I am not eager to buy more.

As for what others should do: I do not recommend short-term trading in PDD, either short or long. Sometimes people bet on stock prices immediately after their earnings come out, seeing the rally as an opportunity to make a quick buck. It may sometimes work, but often it doesn’t. Chinese companies beating earnings hasn’t exactly been a consistent predictor of subsequent stock performance lately. In my previous article on Alibaba, I wrote that Chinese stocks have been trading more based on macro news than earnings performance lately. PDD’s performance after today’s earnings would seem to confirm that. The company beat estimates by wide margins, but its stock rose by only a small percentage.

When I last covered PDD Holdings, I rated it a “Strong Buy” because it was very cheap using metrics that incorporated its high growth rates. These observations still hold: for example, the company has a 0.27 PEG ratio. However, PDD stock has run up 20.3% and outperformed the S&P 500 since I last covered it. Additionally, I share the concerns that the company’s earnings might not be trustworthy, to a limited extent. For this reason, I am downgrading my rating from “Strong Buy” to “Buy.”

Earnings Recap

In the quarter just reported, PDD Holdings delivered:

- $12 billion in revenue, up 131%.

- $3.59 billion in operating profit, up 257%.

- $3.87 billion in GAAP net income, up 246%.

- $4.2 billion in adjusted net income, up 202%.

- $2.83 in adjusted EPADS (“EPADS” is like EPS but for an American depository share (ADR)).

These numbers were all very good on the surface of it. Revenue and earnings both beat estimates, with EPS in particular coming in at about double what analysts expected. On the other hand, the company’s cash position saw a net outflow of about $1 billion. That might have been part of the reason why the post-earnings trading was underwhelming, as I will explore in the next section.

Accounting Concerns

The big question hanging over PDD’s earnings release–and the likely reason why the stock’s trading was lukewarm after the release came out–is whether the earnings figures can be trusted. Some analysts on the call seemed to be concerned about this. Kenneth Fong, for example, asked how the high EPS growth was possible amid rising competition. A related question I’d have asked if I were on the call is, “how are earnings growing faster than revenue at a time when TEMU is unprofitable?” That’s difficult to explain. Fong suggested a possible answer when he mused that the marketing spend had been cut. That could explain the earnings growth, but management did not actually confirm what Kenneth said, merely saying that it “compelled return of investment in different markets.” Likewise, the decline in cash despite high earnings growth raises questions about earnings quality (normally, earnings are considered sustainable if they are well backed by cash flows, and that quality was not present in PDD’s recent release).

I am not suggesting that PDD is acting improperly here. Many of the surprisingly high numbers can be explained. The high revenue growth was consistent with Alibaba’s AliExpress growth in the same period (60%), and a reduction in marketing spend could explain the earnings growth. The cash outflow does appear to cast doubt on the company’s earnings quality, though. So I’d say investors can reasonably be concerned about whether this kind of performance can continue.

Competitive Landscape

Having shared my reaction to PDD’s earnings release, I can now move on to more evergreen factors. A logical place to start is the company’s competitive landscape.

In general, competition has increased in the Chinese e-commerce scene over the last few years. In the past, Alibaba was basically the only game in town. Now, BABA, JD and PDD all compete for a slice of the market. The industry therefore is more competitive than it was, let’s say, 10 years ago. However, PDD was only founded in 2015. Its entire growth story and recent move toward profitability occurred during the period in which Chinese e-commerce got more competitive. This seems to imply that PDD has a competitive edge.

What is PDD’s competitive edge? One advantage it possesses is its asset-light business model. The company’s balance sheet lists no inventory at all, minimal PPE (just 2% of equity) and minimal debt (5.4% of equity). This lack of costly assets and interest-bearing debt leaves PDD with a lot of cash to spend directly on revenue generating activities: marketing, sales and vendor recruitment. By contrast, JD and BABA have much more debt and PPE to contend with.

Valuation

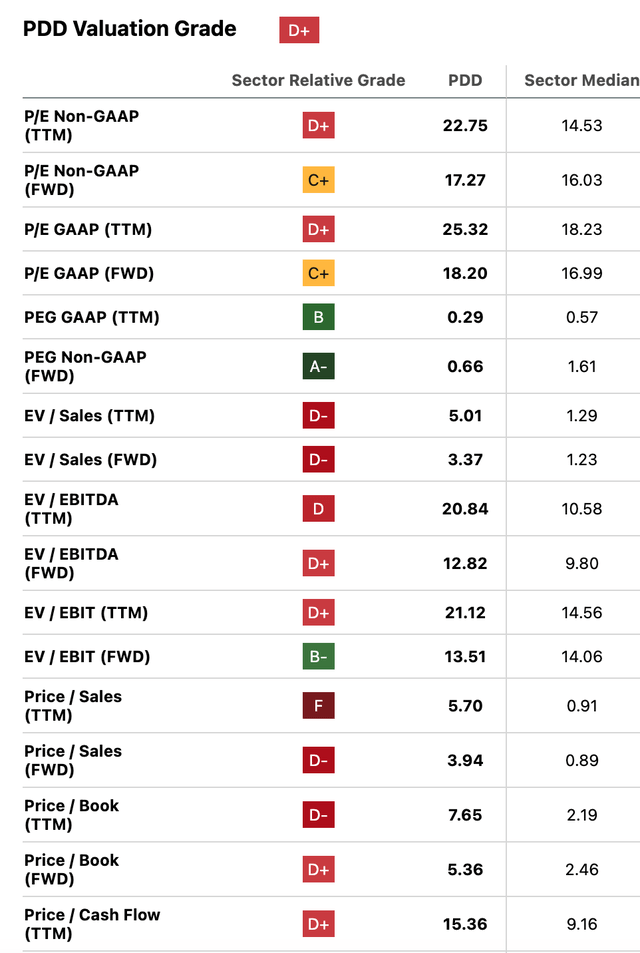

Having estimated PDD’s upcoming earnings and evaluated its competitive position, I can now move on to a valuation. First, let’s look at the multiples Seeking Alpha Quant has on file:

PDD valuation metrics (Seeking Alpha Quant)

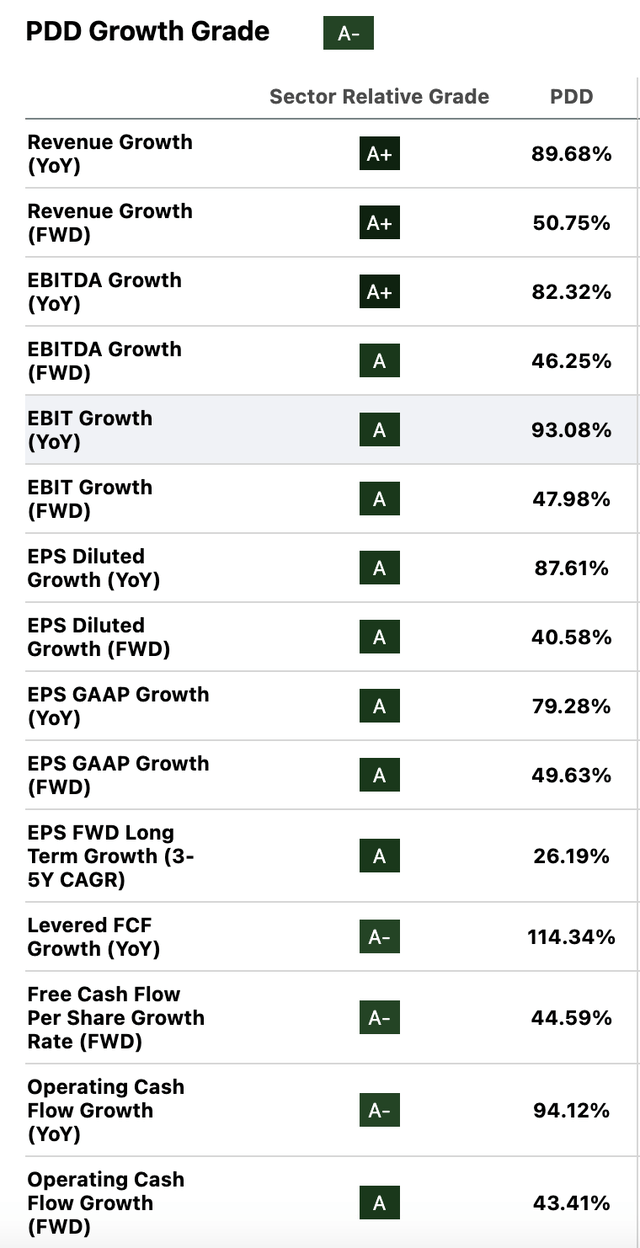

PDD scores a relatively weak “D+” on valuation in Seeking Alpha Quant. Some of the multiples are fairly high: for example, the 7.65 price/book ratio looks more like a pricey U.S. tech stock than a typical Chinese value name. However, if you look at the growth figures in the image below, you will see that they are high enough to justify high multiples. If PDD’s high-double digit growth continues, then its 22.75 P/E ratio isn’t too high.

PDD growth metrics (Seeking Alpha Quant)

PDD also holds up fairly well in discounted cash flow (“DCF”) model. According to Seeking Alpha Quant, PDD Holdings had $9.74 in free cash flow per share in the trailing 12-month period. The five year CAGR growth rate in FCF was 59%. If we assume that that growth rate declines to 25% over five years (a massive amount of deceleration), assume a 5% terminal growth rate, and discount PDD’s cash flows at a 10% discount rate, then we get a $379 fair value estimate. All of this assumes far less growth going forward compared to in the past. The 10% discount rate is also more than double the 10-year treasury yield (US10Y). The assumptions here are quite conservative given PDD’s size and historical results. So, there is a good case to be made that PDD Holdings Inc. stock will be worth more in the future than today.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here