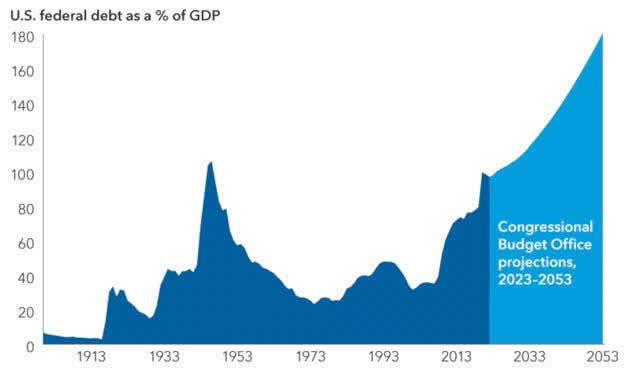

Economic growth has cooled noticeably in recent quarters. GDP growth clocked in with an impressive 4.9% reading in the third quarter of last year. In the fourth quarter, growth fell to 3.4% before being chopped more than half to 1.6% in the preliminary reading of 1st quarter GDP growth. In addition, inflation has been stubbornly ‘sticky‘ so far in 2024 after falling consistently since the CPI peaked at 9.1% in June 2022. The case for Stagflation is certainly growing, as I noted in a recent article.

U.S. GDP Growth By Quarter (Statista)

However, stocks continue to rise as most investors still believe in the predominate “soft landing“ narrative that has propelled equities forward since a summer swoon in the markets ended late last October. However, some prominent voices have publicly started to dissent from this prevailing base case economic theme in May. They should be listened to and heeded in my opinion.

Jamie Dimon of JPMorgan Chase & Co. (JPM) came out last week and stated that investors are ‘underestimating the strength of inflation and the potential for the Federal Reserve to move interest rates higher‘. He also cautioned that the market is pricing in a much higher chance of a soft landing occurring than it deserves. Tuesday, he suspended JPM’s stock buyback program as with the bank stock selling at 2.3 times book value, it simply wasn’t reasonably valued. The stock fell over four percent on that announcement.

The Goldman Sachs Group, Inc. (GS) CEO also recently cast doubt on the odds of the much hoped for soft landing. Today, he was out forecasting zero cuts to the Federal Funds rate in 2024 as “government spending and AI investments have lessened the impact of higher rates on the U.S. economy.”

As I previously stated, I believe there is a much higher probability of the economy moving into a period of Stagflation than there is of the U.S. central bank achieving an almost mythical soft landing, which they have managed to do arguably one time (1995) in my nearly 58 years on earth.

Outside geopolitical events (EX, the conflict in Ukraine escalating further, China moving on Taiwan, a regional war in the Middle East, etc.) There are three themes that, I think, could tilt the economy into a recession as well.

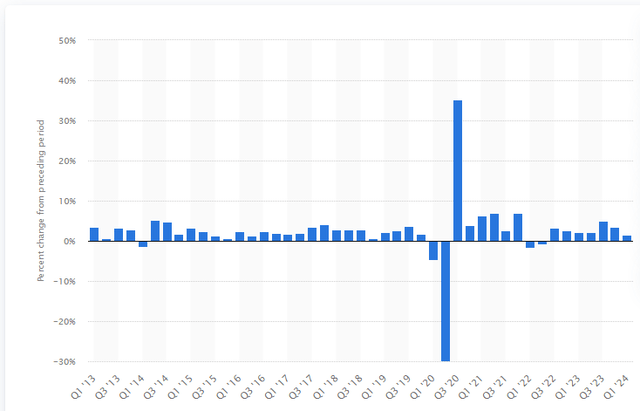

CBO/Capital Economics

The first is around the massive and growing debt levels of the federal government, which I covered in this recent article.

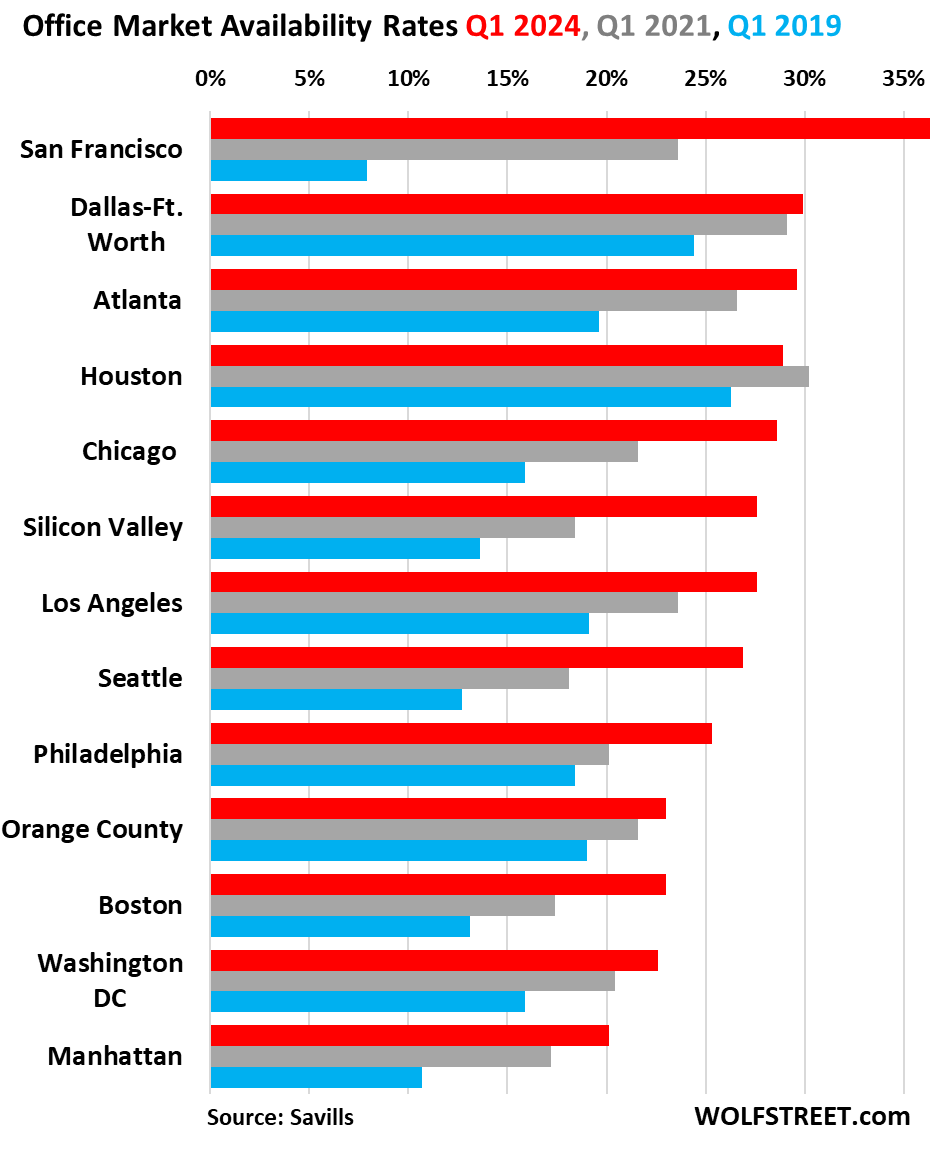

Office Vacancy Rates In Major U.S. Cities (Savills/WolfStreet)

The second is the continued deterioration of the commercial real estate sector [CRE] and its potential impact on myriad community banks and a few regionals that could result in additional bank failures. More than $900 billion of CRE debt needs to be refinanced at much higher rates in 2024. This will remain a headwind to the economy, which I highlighted in this recent piece on Seeking Alpha.

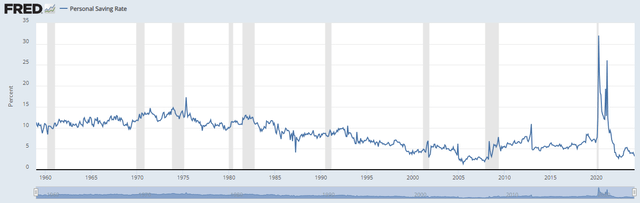

U.S. Personal Savings Rate (Federal Reserve Bank Of St. Louis)

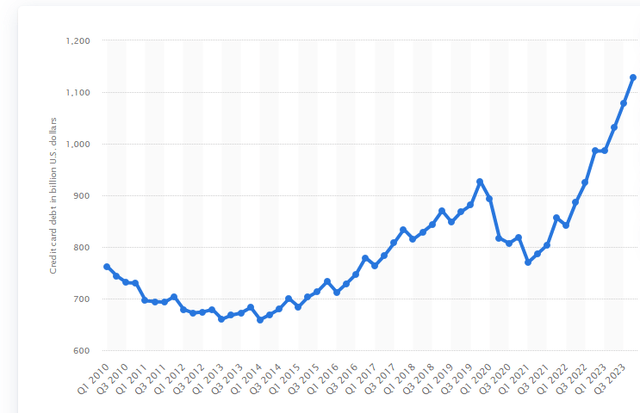

Finally, we have increasing duress in many consumer segments (especially lower- and middle-income consumers) which I covered earlier this month. Given consumer spending makes up nearly 70% of U.S. economic activity, this is probably the most likely potential recession trigger. The continued deterioration of consumer health was also quite evident in both the disappointing Q1 results and management commentary this earnings season from well-known consumer stalwarts like Target Corporation (TGT), Starbucks Corporation (SBUX), The Home Depot, Inc. (HD), and McDonald’s Corporation (MCD) during earnings season.

U.S Credit Card Debt (in Billions) (Statista)

Admittedly, standing with Jamie Dimon and Goldman Sachs is a very lonely space for an investor to inhabit right now as the market continues to plumb all-time highs. However, my portfolio continues to be conservatively positioned, as I also believe investors are pricing a much higher probability of a soft economic landing than they should. Roughly half of my holdings are in short-term treasuries, yielding nearly 5.4%. The rest is largely held within covered call holdings around the relatively few stocks I feel are reasonably valued.

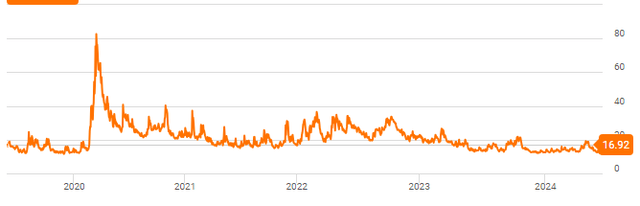

I also have roughly two percent of my holdings on the long-dated, out-of-money bear put spreads against the SPDR® S&P 500 ETF Trust (SPY) that will pay off massively should we get a 15% to 20% pullback in the S&P 500 over the next year. That should insulate the rest of my portfolio from any losses in that scenario. I consider this strategy to be cheap “portfolio insurance” with the S&P VIX Index (VIX) hitting four-year lows this week. A classic sign of investor complacency.

VIX (Seeking Alpha)

For those still bullish investors out there, I propose this thought experiment. If one had told the average investor at the beginning of the year that:

- There would be no cut in the Fed Funds rate (compared to the 6-7 25bps cuts expected at the end of 2023) in 2024.

- That GDP growth would ebb to 1.6% in the first quarter, compared to 4.9% in 3Q2023.

- Inflation levels would continue to be just about where they were at the beginning of the year.

- The fiscal deficit would come in at over $1T in the first six months of the federal government’s fiscal 2024 year.

- The yield on the 10-Year Treasury (US10Y) would be near 4.5%

- 6. Delinquency rates across CRE debt would continue to rise.

Would they say that equities would likely run up to all-time highs in this scenario, or would they look at you as if you had three heads?

For those optimists on the markets, can you come up with three major positive surprises around the economy that should logically counteract the negatives profiled in this article? The caveat is outside the build out of AI, which has powered impressive growth as a few large tech concerns. That I will grant upfront. We got another reminder of this paradigm shift after the bell Wednesday within the blowout Q1 results from NVIDIA Corporation (NVDA).

If an investor cannot come up with at least three major unanticipated positive economic surprises so far in 2024, I suggest they are engaging in trading based on momentum and/or FOMO. And “riding the wave” has been the right investment decision year to date. However, if a “soft landing” doesn’t materialize later this year, I highly doubt it will continue to work going forward.

Read the full article here