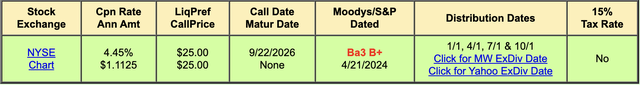

Vornado Realty Trust (NYSE:VNO) Series O Preferred Shares (NYSE:VNO.PR.O) offers one of the best risk-and-reward profiles of any publicly listed REIT preferred series as it is trading at a steep discount to par value of around 48% with an annual coupon of $1.1125 for an 8.5% yield on cost. The discount to par means the preferreds are essentially swapping hands for 52 cents on the dollar despite Vornado’s near-fortress balance sheet, the positive trends being seen in Manhattan office real estate, and the resumption of the dip in consumer inflation. Hence, I’ve swapped my Series N Preferred Shares for the O’s to capture the greater upside to par as the bullish thesis looks set to play over the next decade.

QuantumOnline

The discount is out of step with the depth of its balance sheet, even after adjusting for the low headline coupon rate of 4.45%. VNO’s preferreds are rated non-investment grade at “BB-” by Fitch Ratings albeit with VNO losing its investment grade rating in August last year.

Commercial Observer

Manhattan office trends look set to improve as new office developments collapse, with new office square feet coming online expected to trend below 1 million square feet through to 2029. This is from higher interest rates discombobulating the pipeline for new office developments, even as demand for Class A office space from a broad flight to quality picks up pace. Further, office properties have essentially been blacklisted by institutional capital, reducing the liquidity available for developers in the sector and further eroding downstream supply. A 2025 IPO boom could also disproportionately benefit job creation in Manhattan. The commons are down 16% since I last covered the REIT.

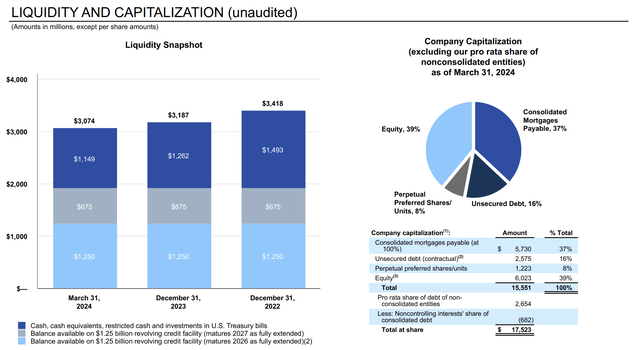

Balance Sheet Depth And Free Cash Flow

Vornado Realty Trust Supplemental Fixed Income Data

VNO liquidity at the end of its fiscal 2024 first quarter stood at $3.07 billion, down sequentially from $3.19 billion but representing a significant level of depth against the REIT’s $4.92 billion market cap. It’s great news for the Series O preferreds which cost $13.35 million per year in coupon payments, 3.86% of VNO’s trailing 12-month levered free cash flow of $345.7 million as of the end of the first quarter. The coupon rate, Fed funds rate, and the creditworthiness of the underlying issuer drive the level of discounting on preferred shares. VNO Series O preferreds trading for 52 cents on the dollar with an 8.5% yield is odd with the level of coverage from free cash flow and VNO’s extremely high-quality Class A property portfolio situated in one of the most dynamic and in-demand real estate markets in the US.

Vornado Realty Trust

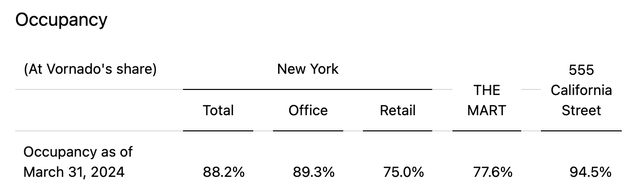

VNO’s total occupancy at the end of its first quarter stood at 88.2%, down from 89.4% sequentially, with its New York office occupancy at 89.3% at the end of the quarter. Dipping occupancy represents a significant risk for VNO and the REIT has yet to stabilize this figure. However, its office occupancy still sits far above the national US office vacancy rate of 18.3% in April. The REIT’s New York office leasing activity during the quarter was 291,000 square feet at an initial rent of $89.23 per square foot and a long-dated weighted average lease term of 11.1 years. There was another 36,000 square feet of New York retail space leased during the quarter.

Vornado Realty Trust Fiscal 2024 First Quarter Earnings

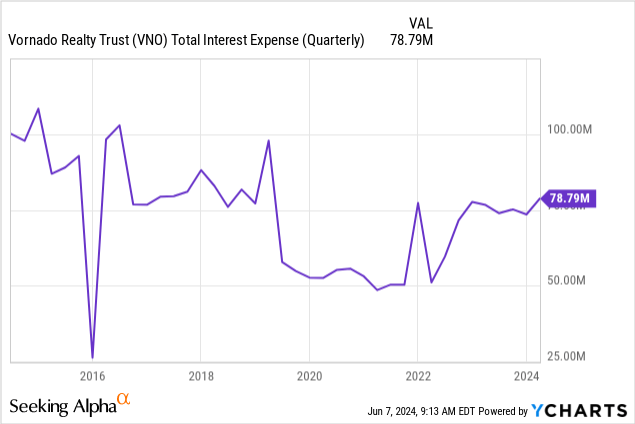

VNO generated first-quarter revenue of $436.38 million, down 2.1% over its year-ago comp, with funds from operations (“FFO”) of $0.55 dipping from $0.63 per share in the fourth quarter. The erosion of FFO is reflective of higher base interest rates driving a remarkable rise in total interest expenses for the REIT. This was $78.8 million during the first quarter, the highest level since 2019, and is expected to move higher as VNO refinances its debt maturities at higher rates against the backdrop of higher for longer.

Manhattan Office Real Estate

Colliers

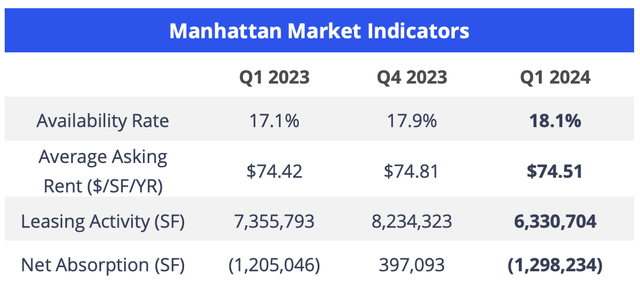

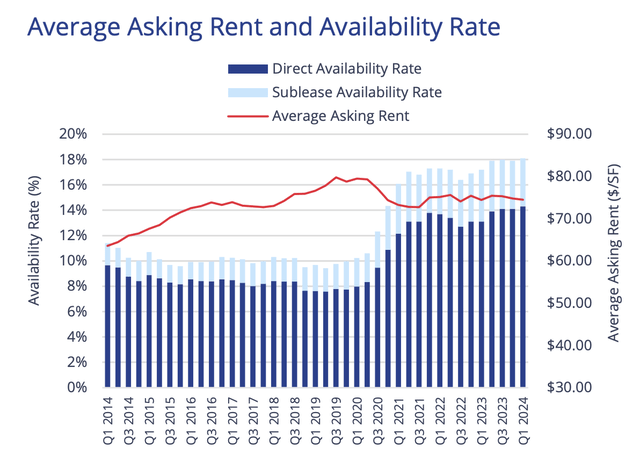

VNO does face a better real estate environment in Manhattan as the borough continues to recover from the effects of the pandemic. The average asking rate per square foot was $74.51 during the first quarter of 2024, up 9 cents from its year-ago comp, even as the availability rate increased to 18.1% from 17.1%. Net absorption was negative at 1,298,234 square feet, but the borough has hit a plateau with its availability rate, which is now forming a flat line.

Colliers

VNO faces a potential switch in currently dipping occupancy once the underlying positive trends from a collapse of new office supply and demand for Class A office properties surpass the hangover from the effects of the pandemic. I think the Series O preferreds now form the best way to gain exposure to VNO and what’s set to be a brighter outlook for Manhattan Class A office owners.

Read the full article here