Overview

Kenvue (NYSE:KVUE) was created as part of a spinoff from Johnson & Johnson’s (JNJ) consumer health business. To get an idea of the products that shifted as part of this spinoff, we need to focus on the key word “consumer”. Think about products like mouthwash, headache medicine, face creams, and first aid items. The business includes a portfolio of products that can be used every day, which means that it has a wide reach in terms of potential customer base. The spinoff from JNJ was a result of company restructuring and a shift to focus on their businesses core operations, which was the pharmaceutical segment.

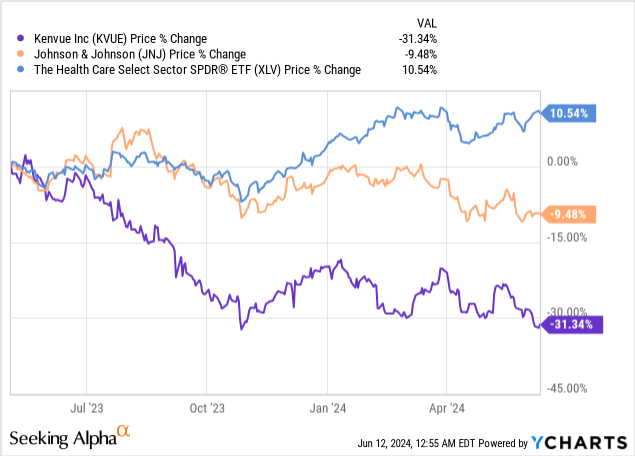

Kenuve’s spinoff is only about a year old, with inception dating back to May 2023. Since then, the price of KVUE has fallen by over 30% as it seems like the price struggles to gain any upside momentum. Similarly, JNJ has trended in the same direction, although at a lesser amount. However, I believe that KVUE’s price decline is mostly caused by the fact that its reputation is still linked to JNJ. So any ongoing litigations or negative news that happens for JNJ, also effects KVUE. There is a risk that the association between the two will never really sever from one another, and KVUE’s price remains vulnerable to whatever headwinds JNJ has going on.

KVUE’s currently dividend yield sits at a solid starting point of 4.3%. While KVUE hasn’t been listed long enough to have established any sort of dividend growth yet, I do believe that it has the potential to eventually grow into a dividend compounder once market conditions improve. KVUE went public during a time of high inflation, lower consumer spend, and a decade high-interest rates, so to its credit, the stock hasn’t really had a chance to prove itself yet.

I do see some vulnerabilities at the moment that could be the source of uncertainty and risk. For example, some segments within KVUE’s business relies on the reputation and popularity of some key products to drive sales. By delaying the innovation and development of new products, KVUE opens up the risk of getting marketshare taken away by store-branded generics that are cheaper and typically provide the same exact results. Before we get into that, let’s first dig into the company’s financials and segment performance.

Segment Performance & Financials

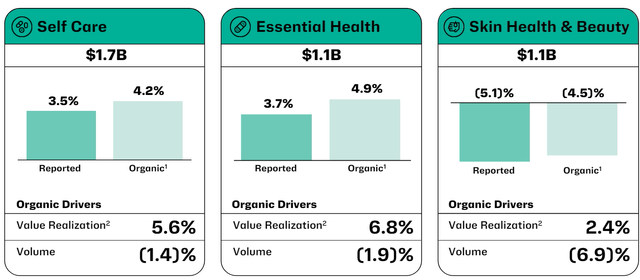

KVUE reported their Q1 earnings at the beginning of May and the results were better than expected. Revenue grew by 1.1% year over year, to a total of $3.9B. Earnings per share came in at $0.28 while organic growth increased slightly by 1.9%. Kenvue operates within three main segments: Self Care, Skin Health & Beauty, and Essentially Health.

The Self Care segment focuses on products such as Tylenol. The segment saw organic growth of 4.2% over the quarter, and it seems to lean heavily on brand reputation to drive growth here. While this can certainly be a viable strategy during positive economic times, I believe this presents a big vulnerability in the segment. A way to offset this would be to simultaneously invest in the innovation and development of new products and brands to sell within the space, but I do not see any clear communications that this is a point of focus.

Additionally, with inflation remaining higher than normal, consumer spend is remains suppressed. If consumers are able to buy more affordable store-branded alternatives, where does this leave the brands under KVUE’s umbrella? The data supports that people are more likely to buy the generic branded items, especially within the over-the-counter medicine category.

KVUE Q1 Presentation

The Skin Health segment saw a decrease in organic sales of 4.5% from last quarter. This can be attributed to lower volumes, but management is actively trying to offset this by expanding their presence in stores with better displays and placements. Additionally, they are working with a larger volume of dermatologists to get engagement and support from a credible source. The main driver here is the Neutrogena skin care creams and lotions. Lastly, they are actively trying to boost their reputation with customers by hosting popup events and other marketing techniques to get customers engaging with the products within.

Lastly, the Essential Health segment saw organic growth at 4.9%. This growth was led by oral care products such as Listerine. However, this growth can also be attributed to the success of their new product lineup called Aveeno. This is a lineup of different soaps, shampoo, conditioners, body washes, and more. The product category is aimed at capturing the market of products that are developed and sold for children.

KVUE Q1 Presentation

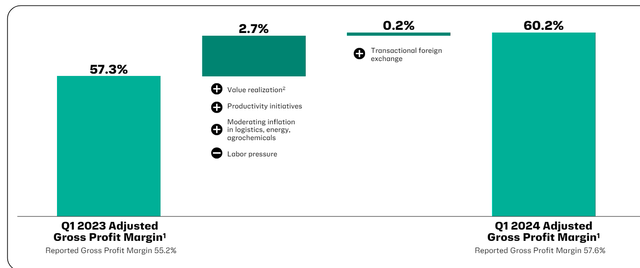

Free cash flows sit at the lowest levels seen so far, totaling approximately $2.7B. However, liquidity remains solid, with cash and cash equivalents sitting at $1.15B. Meanwhile, KVUE maintains a long-term debt total hovering around the $7B mark. Gross profit margins have slightly increased over the last year, and this should eventually contribute to higher levels of free cash flow.

Dividend & Valuation

As of the latest declared quarterly dividend of $0.20 per share, the current dividend yield is 4.3%. While the stock hasn’t been around long enough to establish any sort of dividend growth record or trajectory yet, I do believe that KVUE has the financials and product portfolio to deliver the growth needed to eventually become a dividend compounder.

For now, though, I do believe that the current dividend rate can be sustained until macro conditions improve. The current dividend payout ratio sits around 65%, and while high, this can be significantly improved with better segment performance. We received confirmation on the last earnings call that the dividend remains a top priority for management.

Importantly, as I am sure you may have the question, there is no change to our capital allocation priorities. Our healthy balance sheet allows for strategic investment in our business for growth, our number 1 priority, in addition to commitments to a strong dividend, our delivering program and share buyback to offset dilution. – Paul Ruh, Chief Financial Officer

While it may be a bit too early to run any technical valuation methods, I do believe we can come up with an estimated valuation for KVUE. For instance, KVUE currently trades at a price to earnings ratio of about 15x. This undercuts the sector median price to earnings ratio of 17.5x, which may indicate undervaluation. Additionally, Wall St. has an average price target of $22.54 per share. This represents a potential upside of over 22% from the current level. For reference, the highest price target sits at $25.50 per share and the lowest price target sits at $18 per share.

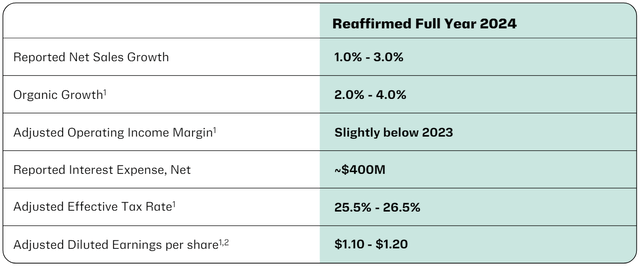

KVUE Q1 Presentation

Net sales are expected to grow at a modest rate between 1% to 3% over the fiscal year, while adjusted diluted earnings per share is estimated to fall in the range of $1.10 – $1.20. Right now, it seems like the main priority for KVUE is to offset these low growth estimates with cost-saving initiatives. They’ve already begun to slash the workforce by about 4% to reduce costs. This is estimated to bring in about $350M in cost savings that be used to increase capex spend, go towards the dividends and lowering of the payout ratio, or build a cash position.

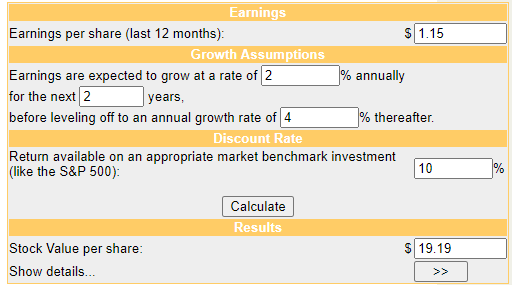

Discount Cash Flow Calculation (Money Chimp)

Based on management’s provided guidance, I decided to go with a middle of the road approach by inputting EPS at $1.15 as well as an estimated growth rate of 2%. This gives us an estimated fair price value of $19.19 per share, assuming this 2% growth rate is met and then conditions improve to a 4% growth rate as sales volume and margins improve. This means KVUE may actually be closer to fair value already.

Risk Profile

KVUE’s reputation is still closely tied to JNJ and therefore, KVUE is likely to remain vulnerable to the ongoing litigations happening. For example, the latest issue is the $45M that JNJ and KVUE are required to pay towards the talc-related cancer claims. While KVUE is responsible for 75% of this settlement, despite the product itself being a part of the spinoff from JNJ. I also can’t help but feel that the spinoff of KVUE was primarily done to separate the weaker part of JNJ’s business into its own entity so that it doesn’t drag down the performance of JNJ.

With that in mind, KVUE also remains highly sensitive to consumer spending patterns. I’ve already discussed how consumer spend is tight in this higher interest rate and high inflationary environment, but when you couple this with the fact that many of their products can be swapped out with generic branded items, this presents a threat to KVUE’s staying power.

This creates the need for everlasting development of new product lines with different strategies to acquire new customers. For instance, the recently launched Aveeno brand that is marketed more towards children use is a good start. However, if KVUE is unable to continue promoting new products, this leaves room for marketshare to be stolen from alternatives that may be more affordable. While interest rates remain elevated, this may deter the company from borrowing additional capital to fuel the research and development or acquisitions of these new product lines.

If we are in a higher for longer interest rate environment, and they are unable to increase sales and volume, we may see KVUE trade even lower until consumer spending shifts. To their benefit, at least they are efficiently managing these unfavorable conditions by cutting costs and remaining at a strong liquidity profile.

Takeaway

In conclusion, Kenvue has the solid product portfolio and solid balance sheet to navigate through any ongoing headwinds in the market. However, they heavily lean on a few specific brands to produce a bulk of the sales in each segment, and this creates an environment where they must also be actively seeking new product lines to promote. A lot of their product sales and volume remain vulnerable to consumer spending patterns, and we’ve seen this shift over the last year with inflation higher than expected and the prolonged higher interest rate level. Generic brands have the ability to steal away marketshare from KVUE in some segments, and data already supports that more people are opting for the more affordable store-branded generic route. Additionally, from a valuation perspective, KVUE seems to be near fair value at the moment and doesn’t present much potential upside from here. I will be awaiting on the sidelines until segment growth shows signs of improvement.

Read the full article here