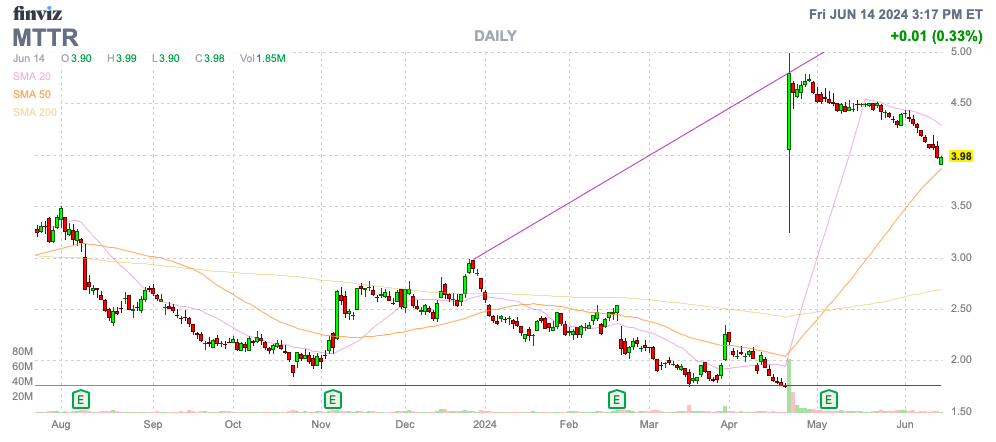

Matterport, Inc. (NASDAQ:MTTR) recently fell off investors radars following a buyout agreement with CoStar Group (CSGP). Oddly, though, the stock has slumped to where the deal now offers a large premium and appears to signal the risks of the deal closing is somehow rising. My investment thesis is still Neutral on the stock, but the recent dip highlights the importance of dumping stocks before losing deal premium during the closing process.

Source: Finviz

Big Deal Premium

Back on April 22, Matterport agreed to a deal with CoStar Group at a transaction value of $5.50 per share for a stock trading below $2. The deal values the spatial data company at an estimated equity value of $2.1 billion with an enterprise value of $1.6 billion based on a large cash balance. The deal was 50% for both cash and stock, providing investors with $2.75 in cash and the rest dependent on the price of CoStar stock.

CoStar is a $30 billion real estate company that runs Apartments.com and Homes.com, but the stock has slumped from $90 to below $74 since the deal was announced. Naturally, the stock portion of the deal has seen the value dip, leading to a current deal value of $5.38 ($2.75 cash, $2.63 shares).

Since the deal has a 10% symmetrical collar based on a price of $86.02 per share, Matterport shareholders will get at least 0.03552 shares of CoStar, no matter how low the stock trades from here. Matterport has traded down below $4, providing a 35% premium to shareholders on the deal closing.

CoStar recently withdrew and refiled the HSR notification for the Matterport deal. The waiting period under the HSR Act is now set to expire on July 3, only slightly more than 2 weeks away.

The size of Matterport would suggest limited regulatory issues, not to mention the company has been a money losing operation since going public back in 2021. The risk to investors is, naturally, the deal somehow failing to close.

Downside Risk

Matterport is focused on immersive 3D digital twins and AI to offer customers a better way to manage real estate assets. The challenge has always been for the small company to turn this massive digital opportunity into a strong business, rewarding shareholders.

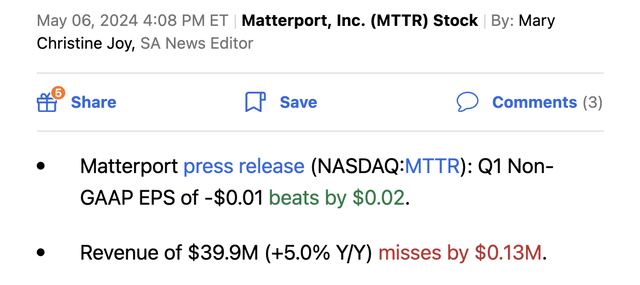

The company reported Q1 ’24 results that were again disappointing. Sales missed targets slightly and the company only has annualized revenue in the $160 million range for business bought for an EV of $1.6 billion.

Source: Seeking Alpha

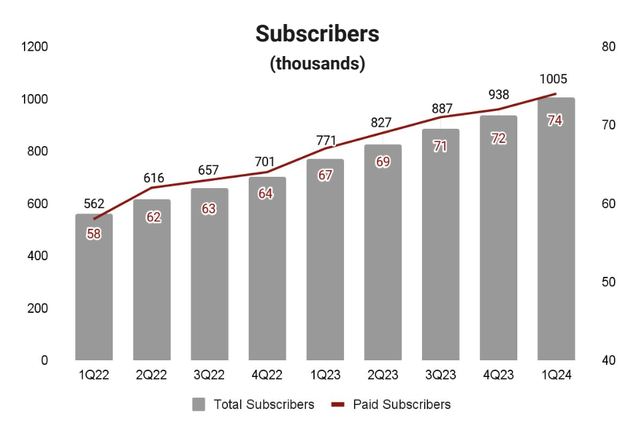

Matterport grew Q1 subscribers by 30% to reach 1.0 million, and other crucial stats again showed 20% to 30% growth. As an example, key spaces under management were up 24% to reach 12.3 million.

Source: Matterport Q1’24 presentation

In essence, the key metrics driving subscriptions are growing at a 30% clip with subscription revenues up 21% to reach $24 million, or $96 million on an annualized basis. The problem with the financials has been lumpy product revenue with such revenues down nearly 30% in Q1 ’24 leading to the overall revenue growth rate of only 5%.

With quarterly gross profits of only $20 million, Matterport probably could use better management to improve operations and possibly remove some duplicate costs by incorporating the service into an existing real estate business. The company spent over $60 million in operating expenses in the quarter, though the number dips to just $31 million when stripping out massive stock-based compensation expenses for the limited revenue base.

The downside risk is a 50% cut to the stock price back to the prior levels below $2. The weak financials will leave investors fleeing the stock again.

The upside potential is 35% with an 80% to 90% likely outcome, while the downside risk of 50% is very limited, maybe not even as high as 10% to 20%.

Takeaway

The key investor takeaway is that investors that quickly unloaded Matterport at $4.80 following the deal announcement now don’t face the downside risk of the merger not being approved by shareholders. Investors still in Matterport, Inc. stock have rather solid upside potential with the deal likely closing, but an investor now faces the risk of Matterport never trading as high as $4 again in the future.

Read the full article here