Investment Thesis: I rate the stock as a Hold at this time.

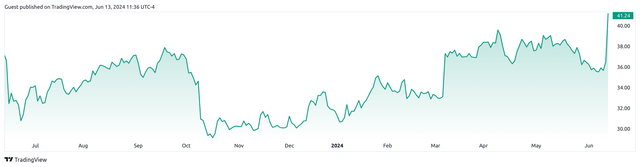

John Wiley & Sons (NYSE:WLY) – an American multinational publishing company that is well known for its “For Dummies” titles – has seen a significant rally to $41.24 at the time of writing.

TradingView.com

With the company now seeing significant interest from companies to leverage its content to train AI and machine learning models along with the company having exceeded FY24 earnings guidance, this has resulted in a significant boost to the stock. The purpose of this article is to determine the potential growth trajectory for the stock from here.

Performance

When looking at fourth quarter and full year fiscal 2024 results for John Wiley & Sons, adjusted revenue was up by 4% to $441 million from that of the prior year quarter, while adjusted earnings per share was up by 2% to $1.21 over the same period.

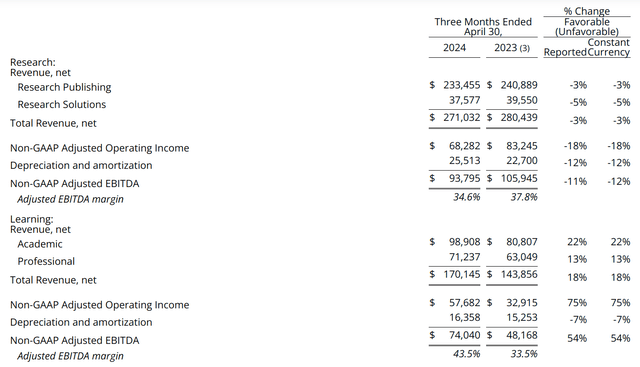

When analysing by segment, we can see that total revenue for the Research segment was down by 3%, while that of Learning saw growth of 18% over the same period.

Wiley Press Release: Fourth Quarter and Fiscal Year 2024 Results

The decline in revenue across the Research segment was down to a number of what the company deems “unusual challenges” this year, including timing issues stemming from publication delays due to COVID, as well as declines in ancillary print and licensing revenue. However, the company also states that submissions were up by 15% on a trailing 12-month basis (excluding Hindawi) and output is accelerating. In this regard, I take the view that this segment shows significant potential for recovery going forward in spite of temporary challenges.

On the Learning segment side, this segment saw a return to growth and margin expansion due to several favourable factors, including strong growth in digital content and courseware, growth in undergraduate enrollment in the United States for the first time since the COVID pandemic, as well as strong publishing demand an interest in leveraging the company’s learning content to train GenAI Large Language Models.

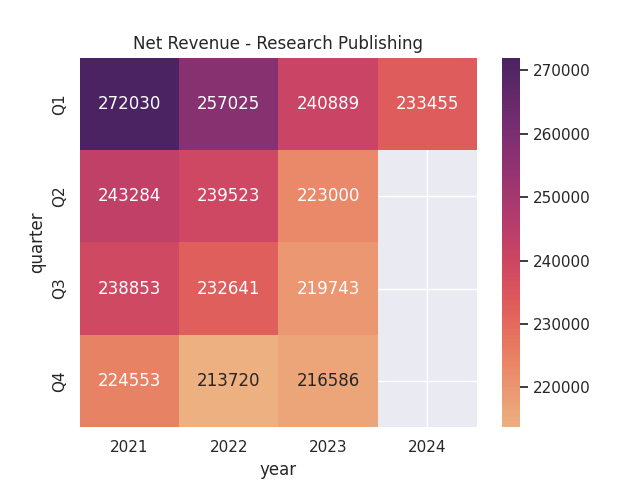

In terms of net revenue by quarter for the research publishing segment, we can see that net revenue is down by just over 3% from that of the prior year quarter and has largely seen a downward trend since Q1 2021.

Figures sourced from historical quarterly Press Releases for John Wiley & Sons. Heatmap generated by author.

From a balance sheet standpoint, we can see that the company has seen an increase in its long-term debt to total assets ratio as compared to the prior year quarter.

| Apr 23 | Apr 24 | |

| Long-term debt | 743,292 | 767,096 |

| Total assets | 3,108,810 | 2,725,495 |

| Long-term debt to total assets ratio | 23.91% | 28.15% |

Source: Figures sourced from Wiley Press Release: Fourth Quarter and Fiscal Year 2024 Results. Long-term debt to total assets ratio calculated by author.

Additionally, cash and cash equivalents saw a decrease from $106.7 million to $83.2 million over the same period.

From this standpoint, we see that while net revenue across Research Publishing segment has come under pressure and we have seen an increase in long-term debt – the stock has ultimately seen a spike on the basis of future growth prospects.

Looking Forward and Risks

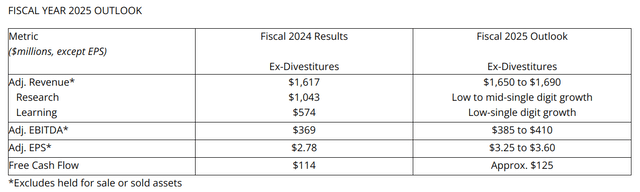

With Research Publishing being the largest segment in terms of net revenue, John Wiley & Sons anticipates that this segment could drive growth in adjusted revenue for Fiscal 2025 – on the basis of growth across open access and institutional models, as well as new business in Research Solutions, along with strong growth in digital courseware and assessments in Learning.

Wiley Press Release: Fourth Quarter and Fiscal Year 2024 Results

In my view, the fact that the company is teaming up with major technology companies to leverage its content for artificial intelligence is encouraging. What will ultimately determine whether this initiative is successful is the degree to which the company can successfully integrate this technology into the Research Publishing side of its business.

For instance, the company is currently looking to integrate AI into its scholarly publishing solutions with the aim of ultimately improving the author experience – such as allowing editors to locate appropriate peer reviewers, or allowing research authors to use AI for brainstorming purposes, as well as allowing peer reviewers to identify manuscript improvements.

With 58% of instructors or students already using AI in classroom-based settings, the technology holds significant promise. One potential risk in this regard is the inherent scepticism that academia may place on AI as a technology – given the need to protect against issues such as plagiarism and ultimately uphold academic integrity in scholarly submissions – AI may create the potential for this to be abused.

From this standpoint, the company’s ability to offer AI-based solutions across its Research Publishing platforms needs to be balanced with safeguards to allow confidence in the use of these tools in the academic world – Wiley is taking steps to balance these risks with human intelligence and ultimately use generative AI in an ethical manner. While there are high hopes for Wiley’s use of AI – I take the view that we will ultimately need to see evidence of a rebound in net revenues across the Research Publishing segment to justify continued upside in the stock over the longer-term.

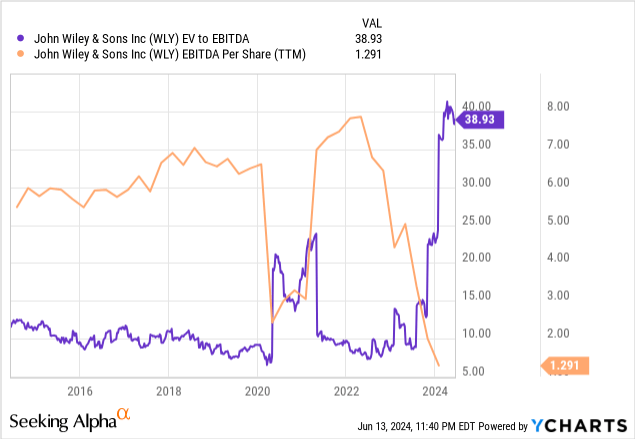

When looking at the company’s long-term earnings trend, we see that the company’s EV to EBITDA ratio is almost at a 10-year high, while EBITDA per share is at a 10-year low.

ycharts.com

From this standpoint, while the company shows an optimistic outlook for earnings growth from here – I ultimately take the view that the recent growth we have seen in the stock remains speculative at this point, and we will need to see evidence of a rebound in earnings growth from here to justify further upside.

As regards the outlook for the publishing industry going forward, one potential challenge for the industry is that as the industry has become increasingly digital – so has demand for open access publishing technologies – which is broadly an initiative to make research materials available to researchers at no cost, with the aim of encouraging further research.

Given that John Wiley & Sons works in the academic publishing sphere specifically, the company has also started to operate in the Open Access sphere through its offering of “Gold open access”, whereby the author pays a publication charge and gains access to a program of fully open access journals. This method still faces competition from Green open access, whereby the author can access an article freely after an embargo period of typically 6 to 24 months after the article has been published. However, the disadvantage is that the author does not get to keep copyright of their work and readers must wait before being able to access the final version.

Given growing competition between Gold and Green in the open access space, we could see potential pressure on revenue growth across this space going forward.

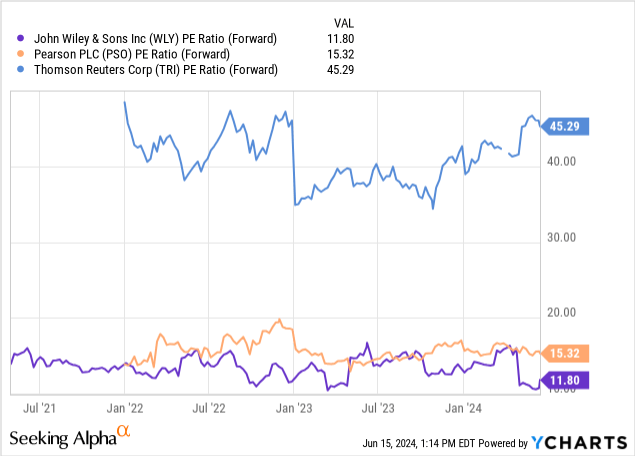

When comparing the company’s forward P/E ratio to that of competitors Pearson PLC (PSO) and Thomson Reuters Corp (TRI), we can see that the company is trading at a lower P/E ratio than its peers.

ycharts.com

This indicates that the company may be more attractively valued on an earnings basis relative to its peers. However, my view remains that we will need to see a significant rebound in earnings growth to justify upside from here.

Conclusion

To conclude, John Wiley & Sons has seen encouraging growth in its stock price as a result of the company’s AI initiatives. With that being said, I take the view that the company now needs to show evidence that it can ultimately grow net revenue across the Research Publishing segment as well as show a rebound in earnings. On this basis, I rate the stock as a Hold at this time.

Read the full article here