Today, we are putting small-cap biopharma Avadel Pharmaceuticals (NASDAQ:AVDL) in the spotlight as the company has potential catalysts ahead of it and is at an inflection point. Avadel Pharmaceuticals is headquartered in Dublin, Ireland. The company’s primary asset is a compound called LUMRYZ, which is a formulation of sodium oxybate and is taken once a day. In the summer of 2022, the FDA gave its ‘tentative‘ approval to LUMRYZ for the treatment of excessive daytime sleepiness or cataplexy in adults with narcolepsy. Final approval was granted in May 2023. The stock currently trades just below $16.00 a share and sports an approximate market capitalization of $1.5 billion.

May 2024 Company Presentation

Pending Legal Decision:

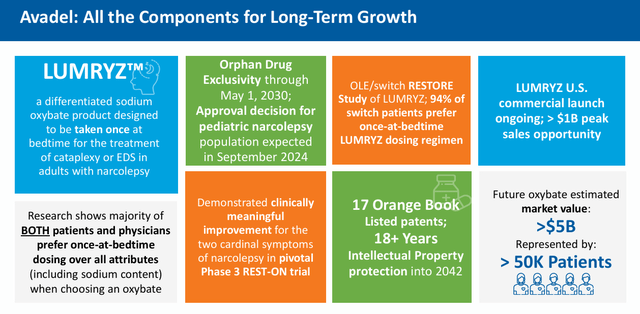

The company has been locked into a vicious litigation battle with Jazz Pharmaceuticals (JAZZ) whose flagship drug Xyrem is approved for the same indication as well as for Xywav which is an improved version of Xylem which is coming off patent. Xywav was granted Orphan Drug status which usually imparts seven years of market exclusivity, which would take its protection into 2027. The FDA approved LUMRYZ despite this, and the two companies have been in litigation since.

A jury in Delaware agreed that LUMRYZ infringed on one patent in March of this year. But in a huge disappointment to Jazz’s shareholders, the jury only awarded the company a 3.5% royalty rate from LUMRYZ commercialized sales. This was a pittance from the 27% royalty rate Jazz Pharmaceuticals was seeking. This matter is now in front of a U.S. District Judge. Based on the judge’s questioning in the case to date, Jefferies believes there in only a 25% probability that Jazz will prevail.

May 2024 Company Presentation

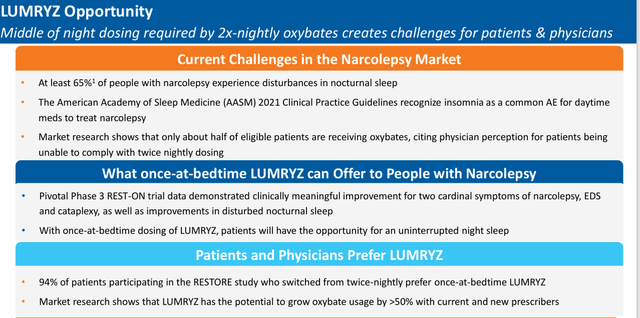

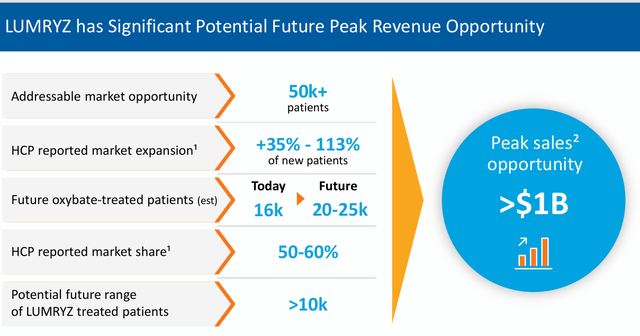

If/when this legal obstacle is removed, LUMRYZ should see considerable traction in garnering market share in this space, given a one daily dosage regime is clearly superior to two-dosages to get through the night for individuals with this affliction. To help put in perspective, Xyrem/Xywav did nearly $2 billion in sales in each of Jazz’s last two fiscal years.

Recent Results:

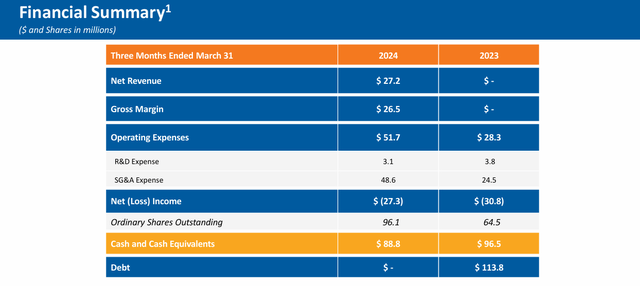

The company posted its Q1 numbers on May 8th. Avadel had a GAAP loss of 30 cents a share, the consensus was expecting the company to only be in the red by a penny a share. Revenues of just under $27.2 million, were slightly above expectations, it should be noted. The company had 1,700 patients on LUMRYZ at the end of the quarter, a 70% rise sequentially from the fourth quarter of last year.

The company posted a net loss of $27.3 million in the first quarter. The first patient should be enrolled in a pivotal Phase 3 study evaluating LUMRYZ to treat idiopathic hypersomnia sometime in the second half of this year. Management will also pursue a sNDA for LUMRYZ in pediatric narcolepsy in the near future.

Analyst Commentary & Balance Sheet

The analyst community is universally positive on the company’s prospects. Since Avadel posted its Q1 numbers on May 8th, a half dozen analyst firms including Oppenheimer and Leerink Partners have reissued/assigned Buy/Outperform ratings on the stock. Price targets proffered range from $20 to $29 a share. Here is the view from LifeSci Partners, who assigned a new Buy rating ($26 price target) on AVDL on May 10th:

We are encouraged by the continued progress among more than 1,700 patients that had therapy, up 500 patients from the latest update in January 2024. We note that this number is distinct from patients on therapy. It is important to acknowledge that some receive benefit from free drug programs and some discontinue treatment. The discontinue rate remains numerically lower than what we see historically with twice-nightly products (.”

May 2024 Company Presentation

Avadel Pharmaceuticals ended the first quarter with just under $90 million worth of cash and marketable securities on its balance sheet.

Conclusion

Avadel lost two bucks a share on nearly $28 million in revenue in FY2023. The current analyst firm consensus has the company reducing losses to 50 cents a share in FY2024 as revenues rip higher to $168 million. They project a profit of 78 cents a share in FY2025 on sales growth just north of 75%. It should be noted, there is wide variance in projections for earnings and sales among analyst firms around Avadel.

May 2024 Company Presentation

I expect Avadel to prevail in its legal dispute with Jazz Pharmaceuticals. However, the company is also likely to do a capital raise over the next 12 months based on cash on hand and demands for a larger marketing rollout. In our last article on Avadel in September of 2022, the stock traded around $6.50 a share. The recommendation was to accumulate a small position in the stock via covered call orders. Options against this equity are both lucrative and liquid. That turned out to be a nicely profitable trade in hindsight. And as my late father liked to quip, ‘If it ain’t broke, don’t fix it’. Given this, that continues to be the recommendation on AVDL stock.

Read the full article here