Dear readers/followers,

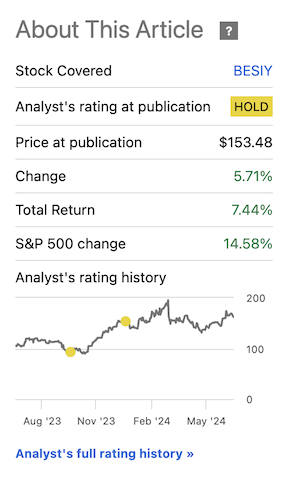

I’ve been covering BE Semiconductors (OTC:BESIY), or just straight ‘BESI’ for a few years at this point, and I’ve also been an active investor in the company for a few years as well. In my last article, I maintained my neutral “HOLD” recommendation for the company and clarified that I was rotating my position in the company due to overvaluation.

Since that time, this stance has outperformed. The company was by the market considered overvalued and has moved sideways – up 5.44% exclusive of dividends since my last article in December, which you can find here. The market at the same time is up almost 15%.

Seeking Alpha BESI Article RoR (Seeking Alpha BESI Article RoR)

So from this perspective, the company has actually outperformed by quite a bit – and could potentially continue to outperform. That is what I want to look at during this time – if the company is justified in the valuation that it holds, and whether we should invest more.

My impulsive answer here is “No”, I still believe the company to be significantly overvalued at this time – but let’s look at the recent results, and what upside potential from the “wave” of AI we could see for BESI that could justify this sort of valuation.

Going in, our base case and circumstance are as follows. BESI is currently overvalued, trading at a normalized P/E of over 60x. The company’s earnings have declined by 20%+ while the share price has tripled in less than a year. Analysts struggle to forecast BESI’s performance, and this causes some trouble with the upside and potential that’s there.

Let’s look at what we have here.

BE Semiconductor – The results do not necessarily justify 60x P/E.

BESI is undoubtedly a great business. Not just a great, but a fascinating business in its own right. In fact, this entire sector is fascinating, especially given the trends we’re now going into. In essence, what you’re investing in here is betting on just “how high” the trends from things like AI and continued digitization are going to drive the results of companies within the sector.

This is one of the companies that is positioned to take advantage of these trends without being one of the primary exposures – which is one of the ways that I love investing. The company’s share price tripled before I sold off my last shares of the company.

That’s right – I do not currently own any shares in BESI, nor do I have immediate plans to invest at this time. But I love the company.

BESI, as the leading assembly equipment supplier with a #1 and #2 position in key markets and a 30% market share of AM, has one of the more attractive portfolios and profiles out there. 70% of systems used for advanced packaging applications are BESI-based, and BESI is represented in 7 countries with over 1,700 employees, headquartered in the Netherlands.

For the LTM period, based on May 2024, we have LTM revenue of almost €600M from which the company makes an income (net) of over €176M. BESI also has nearly half a billion worth of cash deposits (euro), and is a net cash position company, with net cash of over €180M. Very positive. The company has also executed €2B worth of dividends and share repurchases since 2011, making it a very shareholder-friendly company.

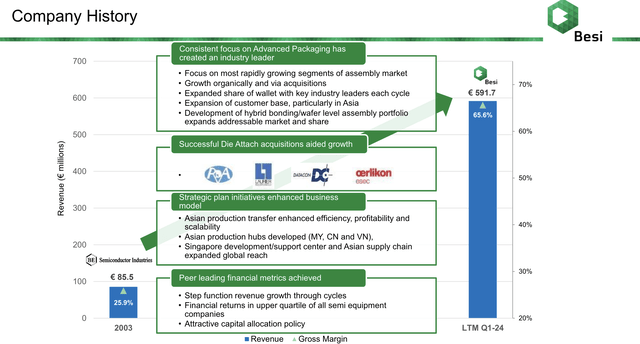

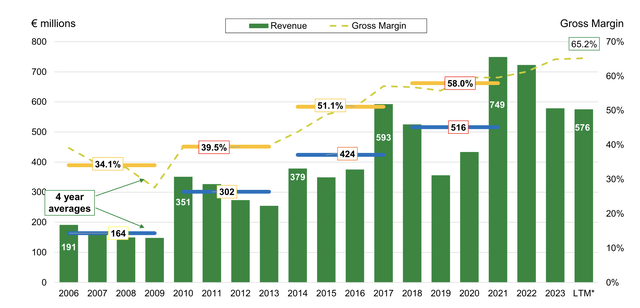

Here is the company’s history, which should be considered.

BESI IR (BESI IR)

Since one of my last “BUY” articles, and before I sold my position, the company was up well over 150% in total RoR, and this was over a 2-year basis. Recognizing such undervaluation is key.

But is the company undervalued now?

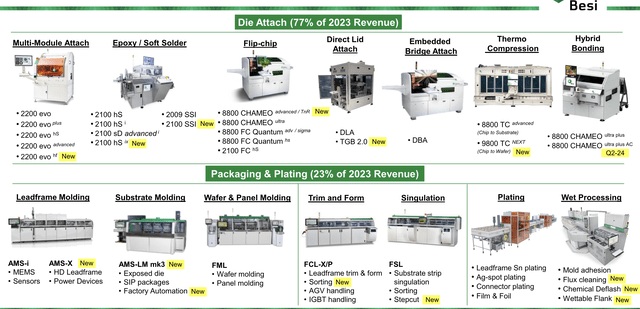

The company has without a doubt an industry-leading portfolio in both Die Attach and Packaging and Plating, the latter of which is likely set to expand.

BESI IR (BESI IR)

Customers number in the dozens, and they include the leading companies in every relevant ecosystem here, including Nvidia (NVDA). From processed wafers to assembled chips, the company’s product can be found in every step of the Die attach, packaging, and most of the plating processes.

The Semi manufacturing equipment market is an annual $110B+ industry (as of 2023), and BESI has found its niche in this market – the assembly process which is less than 4% of those costs (most of it, over 90% is front-end costs, with 6% being test costs, which BESI also isn’t involved in).

Recent 1Q24 financials include increased revenue, profitability, and market share on a per-cycle basis. The exact numbers saw nearly a 10% revenue growth, but a moderation in net income which warrants consideration here.

There was a higher quarterly shipping of 2.5D and 3D apps, with some record-level GM levels going up to 67.2%, but net was impacted by SBC and other concerns – though SBC for this company isn’t at any sort of “worrying” level as such. The company saw attractive gross and net margins, with margins maintained mainly due to a favorable sales mix, cost control, and other company strategies.

In short, the pressures here are ongoing. There is a slower-than-expected recovery of the assembly equipment market orders – with orders down 10.1% on a forward basis due to ongoing smartphone weaknesses and trends.

We’re going into/already are in a company downcycle here, the upcycle peaking in 2021-2022, which is when I was invested. There is a “lag” here for BESI in how the market cycle moves and how the share price moves in turn. I don’t think the trough this cycle will be as deep, thanks to AI and other trends, but I also don’t see the company’s gross margin levels rising far above 68%. Even if they scaled up further, there’s a limit to how high these KPIs can go, and it seems to me that the company is pushing that, especially seeing how the GM growth has sort of flattened out since 2016-2017.

BESI IR (BESI IR)

Revenues have declined from 2022 highs, and this has to do with lower demand in mobile, computing, automotive, and spares/services, with only industrial being slightly up. However, the performance is clearly above the last downturn, and this is what is giving investors and the market encouragement here – that and the company’s continued attractive capital allocation policy.

The company has also expanded its shareholding to both the US and the UK – it has become more international, less of a “hidden gem” with mostly NL-based or Europe-based shareholders which during 2016 made up over 50% of the total shareholders of the company.

Going forward, I expect BESI to continue to do well, and I expect the market downturn or trough to be far lower than it was during the last cycles, but I also want to point out that the overvaluation of the business is far higher than it has been previously – so this remains the main problem for BESI.

BE Semiconductors – The valuation is too high here

Most of the recent articles on the company here on Seeking Alpha have been bullish in nature. I do not doubt that some can see a believable upside for the company here, but unfortunately, I am not one of those investors.

The company still, literally, trades at over 60x P/E normalized. The only reason to in any way accept such a valuation for any company is if the growth rates permit or justify this.

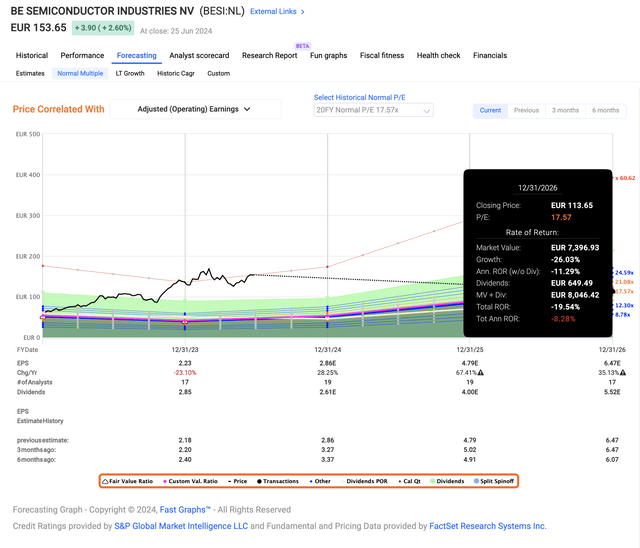

Some would argue that BESIs do because the current expectations are for a growth rate of 45% per year until 2026 (Paywalled F.A.S.T Graphs Link). However, I would be very careful with such an estimate because the company has a 50% negative miss ratio over a 10-year period of time, even with a 10-20% margin for error. This means that BESI either beats or fails to hit its target by a considerable margin. Forecasting this company accurately has been a very challenging task.

So when someone says that the expectations are for this sort of outperformance, I would more point to historical valuation multiples.

And do you know how high the company, on average, has traded on a 20-year basis (which also includes the latest years’ worth of outperformance)? It’s at 17.5x P/E.

Even with the current growth estimates, that would entail a total RoR of negative 20% for this investment.

BESI Upside F.A.S.T graphs (BESI Upside F.A.S.T graphs)

This is a problem, and a valuation-related one, as I see it. Even if you were to forecast at something like a 25-28x P/E, which is the 5-year average, you only get 4-6% annualized RoR. It just isn’t good enough at this time to where I would consider this a solid investment on the basis of any historical or prospective realistic forward valuation.

I do not believe that companies generally deserve 60-70x P/E ratios. I say that these are a product of exuberance, and anyone finding themselves invested in a company at such prices or multiples should take a very serious look at what they’re looking for in terms of targets.

What about other analysts than here on Seeking Alpha? What are they saying?

S&P Global analysts forecast BESI at a target range of a low of €108, which a year ago was €45, and a high of €215, which a year ago was about €95. The average here is €158/share, a year ago, it was €70-€80. This illustrates the insane changes that this company has gone through in terms of valuation and expectation – and shows you perhaps why I do not consider these new targets all that likely. Only 5 out of 17 analysts consider the company to be a “BUY” here, with over 11 considering it either a “HOLD” or an “Underperform”. One of the analysts has even moved to a “SELL” target.

So while targets are up, the general sentiment is one I can get behind, and the “SELL” target isn’t illogical at this price point either.

My last price target was €84/share. I am upping this at this time to allow for some further outperformance and market share gain, to around 23x P/E with a double-digit earnings growth for 2025-2026, and I am now considering the company a “BUY” at or below €95/share.

But for the time being, I would say that this company is an obvious “HOLD” with the following thesis.

Thesis

- BESI is a class-leading and market-leading company in the semi-sector, with several advantages over peers and similar companies. It has excellent RoR and a good yield but needs to be bought at a good valuation to offer a compelling, long-term upside. It can also be sold as a sort of trading play, offering good returns in the short term as well.

- However, the current valuation calls for a “HOLD” for the company, my PT is €95/share, up from my previous share price target of €84/share.

- I have trimmed and removed any allocation to BESI in my portfolio and will wait to reenter at a more attractive price point.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

The company is neither cheap nor at an attractive enough upside. I’m calling it a “HOLD” here.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here