Receive free Bank of England updates

We’ll send you a myFT Daily Digest email rounding up the latest Bank of England news every morning.

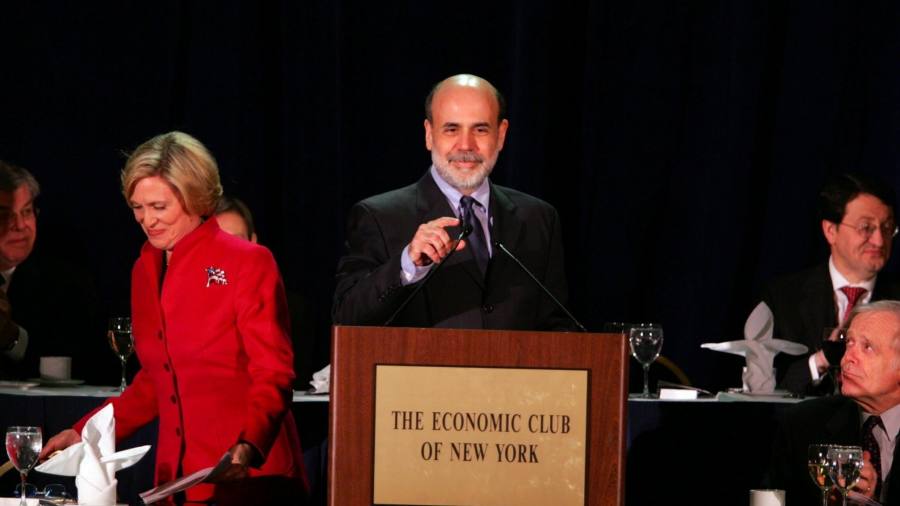

Ben Bernanke, the former chair of the US Federal Reserve, is to lead a review of forecasting at the Bank of England, the UK’s central bank said on Friday.

The review aims to strengthen the way BoE staff support the monetary policy committee in its forecasting and policy decisions “in times of uncertainty”, the bank said. It will consider “the role of the forecast and how procedures and analysis support the MPC’s deliberations and decision making”.

The BoE announced initial plans for the review last month after coming under heavy criticism for repeatedly failing to predict the rise and persistence of UK inflation.

Huw Pill, the BoE’s chief economist, told MPs in May that it was “almost inevitable” that models based on the past 30 years would go wrong in the face of big new shocks to the economy.

But the BoE often faces difficulties in communicating its policy decisions at times of big moves in markets. Its central forecasts for growth and inflation are built on market expectations for the path of interest rates and energy prices, and this can produce results apparently at odds with the policy stance.

Bernanke said he was delighted to be leading the work, as it was “right to review the design and use of forecasts . . . in light of major economic shocks”.

Andrew Bailey, the BoE governor, said the review would allow the BoE “to take a step back and reflect on where our processes need to adapt to a world in which we increasingly face significant uncertainty”.

Read the full article here