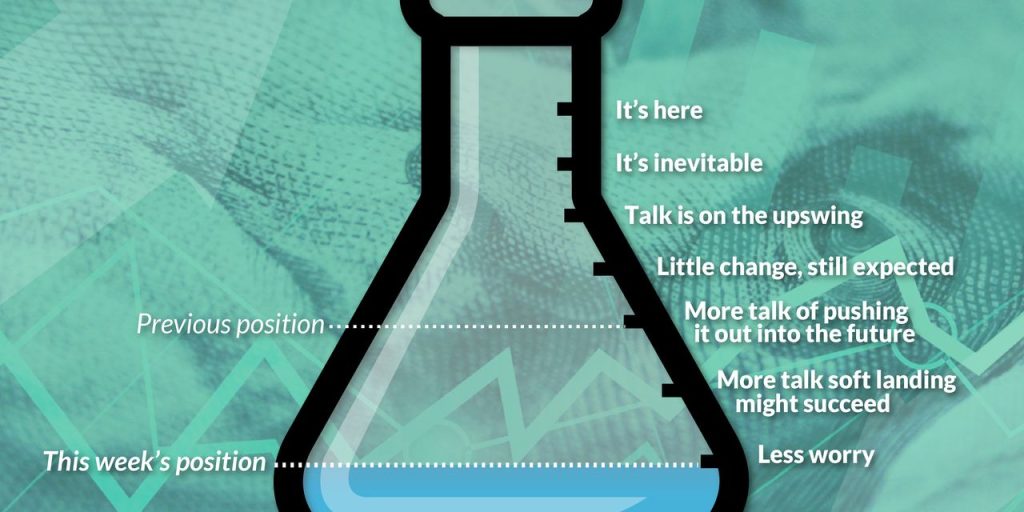

It has been a remarkable week, with the data showing a resilient U.S. economy and slowing inflation. Fears of a recession evaporated like a raindrop in the summer heat.

The big news came Wednesday when Federal Reserve Chair Jerome Powell disclosed that his staff is no longer forecasting a recession. None of the top Fed officials had ever publicly agreed with the staff’s forecast

“The staff now has a noticeable slowdown in growth starting later this year in the forecast…but, given the resilience of the economy recently, they are no longer forecasting a recession,” Powell told reporters.

The Fed chairman said that his own base case is a soft landing for the economy, where the Fed can get inflation down “without the kind of really significant downturn that results in high levels of job losses that we’ve seen in the past.”

Jason Furman, a former top Obama economic advisor and now a professor at Harvard, said that there is a growing chance of a “no landing” where the economy keeps expanding.

This could be good news. But it could also be bad news if is “reignites the cooling embers of inflation,” said Diane Swonk, chief economist at KPMG Economics. That would bring us back into recession watch because the Fed would be forced to raise interest rates higher and slow the economy sharply to quell inflation pressure.

Read the full article here