The first half of 2023 has proven to be rewarding for US equity investors with all major indexes up. The Nasdaq, led by mega-cap technology stocks, has been especially strong with a first half gain of over 30%. However, returns have not been as strong for smaller capitalization stocks. On a relative basis, both small indexes (Russell 2000 Growth, tracked by the ETF IWO

IWO

IWP

QQQ

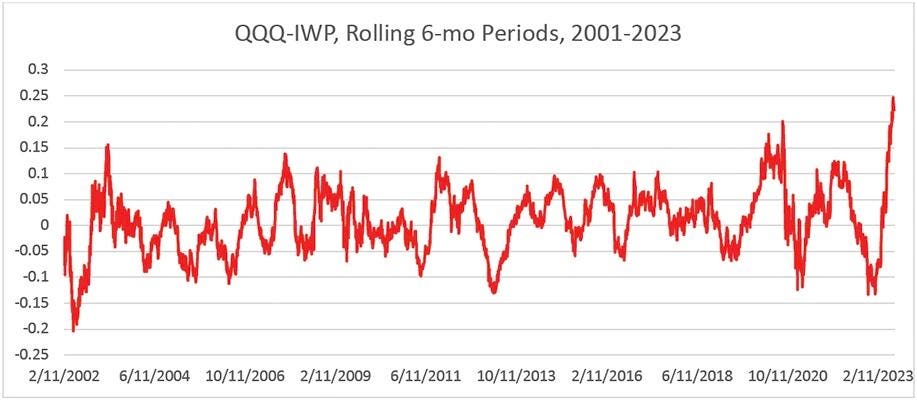

On a trailing one-year basis, the performance spreads are not as extreme. When combining the two periods, it does look like there is possibly a short-term reversion. Still, it is unclear about the longer-term relative turning point (Figures 3 and 4).

With this recent relative under-performance in mind, on a secular basis we still believe there are many opportunities for investors to obtain outsized returns in US small- and mid-cap stocks. The indexes have also just finally broken out of sideways ranges and into 52-week highs (Figures 5 and 6). The concept of significant “higher highs” confirms the broader market’s bull story.

The following are the investment themes O’Neil Global Advisors most favors within the US Small- and Mid-Cap universes.

Artificial Intelligence (AI) and Data Analytics

Acknowledging generative AI is all over the news lately, nonetheless it legitimately has accelerated the capabilities of data analytics and the interpretation of large data sets by making implementation easier and more effective. A growing array of functions will be impacted including coding, cybersecurity, marketing, and enterprise office work. According to Bloomberg Intelligence, data analytics software, powered by generative AI, is expected to grow at a 10-year compound annual growth rate (CAGR) of 69% and reach $280 billion by 2032. On the hardware side, server and storage, and related services are expected to reach a CAGR of 30%, while devices are expected to grow at 33% per year by 2032. In total, hardware could be a $600B+ market by 2032. Other smaller, but even faster growing segments include AI-based gaming, advertising, and drug discovery, each expected to compound by triple-digits annually over 10 years.

Stock ideas: The Trade Desk (TTD), Icon (ICLR), Nvidia (NVDA), Super Micro (SMCI), Integral Ad Science (IAS), Palo Alto Networks

PANW

BAH

DDOG

Robotics/Automation

The escalating costs of labor and the need for improved production efficiencies are fueling demand for increased automation in factories, particularly in the semiconductor industry. Given the delicate nature of silicon wafers, most manufacturing processes in this industry rely heavily on robotics. The recent announcement of construction of several mega factories in this sector indicates a projected surge in the demand for robotics specifically designed for semiconductor manufacturing. Furthermore, advancements in technology and continuous development of automation solutions are making them more accessible, affordable, and easier to implement in the manufacturing end-market. Another area witnessing significant growth in automation is warehousing. E-commerce companies are investing in upgrading their warehousing capabilities to ensure swift delivery times. With the constantly expanding range of products available online and the establishment of decentralized delivery networks, coupled with the ever-rising costs associated with warehousing staff, there is a strong impetus to shift towards automation in this sector.

Stock ideas: Rockwell Automation

ROK

ITRI

VT

Semiconductors: Autos Becoming Computers on Wheels

The automotive industry is going through major disruption as new technologies are rapidly emerging in the market. Trends such as electrification, connectivity, safety, and automation are creating new growth opportunities for semiconductor companies globally. IHS Markit

INFO

Stock Ideas: ON Semi (ON), NXP Semiconductors

NXPI

Global Infrastructure Development / Refurbishment:

Broadly speaking, global electrification is the process of using electricity as the primary power source rather than fossil fuels. The current proportion of electricity versus overall energy demand globally is about 20%. According to the International Energy Agency (IEA), this would need to rise to over 27% by 2030 to be on pace to meet the stated goal of Net Zero Emissions by 2050. Of course, advancing renewable energy options is part of the electrification equation. But here we will focus on two more indirect current advancements. These include the building segment transitioning to more efficient heat pumps (from gas boilers) and the transportation sector transitioning to electric-powered commercial and passenger vehicles.

- Heat pumps still only make up around 10% of global heating demand but are growing by double-digits annually. The Net Zero target implies a 20% share by 2030.

- Global electric vehicle (EV) sales have risen from under 1 million in 2016 to over 10 million in 2022 and are expected to reach up to 14 million in 2023. This would equal around 18% of total car sales. Many automakers target EV share of sales of at least 50% by 2030, with some like General Motors

GM

TSLA

Segments of the market that stand to benefit from global electrification include construction, electrical equipment, auto makers, auto parts, battery storage, and semiconductor makers.

Stock ideas: Xylem (XYL), Hubbell (HUBB), Generac (GNRC), MYR Group

MYRG

AAON

Lennox Intl (LII), Modine Manufacturing

MOD

GNTX

VB

US Infrastructure

Renovating aging key infrastructure, such as roads and highways, has become a primary investment focus globally. It is estimated that roughly 35% of the infrastructure investments will be on roads globally. One in five miles of highways, major roads, and approximately 45K bridges in the US require renovation or maintenance. The latest Infrastructure Investment and Jobs Act in the US, passed in late 2021, allocates $110 billion in additional funding for roads, bridges, and other major projects. This will drive demand for construction equipment, electrical equipment manufacturers, cement and steel producers, and equipment rental services. These additional resources have started driving growth estimates for FY23 evident in backlog increases in the mid- to high-single digit range in the recent quarters for the heavy construction and equipment makers.

The 2021 infrastructure bill also allocates significant additional spending to modernize the utility, telecom, and public transport sectors. Specifically:

- $73 billion in new spending to upgrade the electricity grid, new transmission lines, and smart-grid technologies. Of this, $21 billion will go towards clean energy technologies such as hydrogen and carbon capture.

- $66 billion in new rail funding for Amtrak with a focus on high-speed rail and safety improvement, particularly along the Northeast corridor. This is an 11x increase from previous funding levels.

- $65 billion to address the availability of broadband nationwide. The majority of spending is earmarked to connect underserved areas.

- $55 billion in new water infrastructure funding for projects like lead pipe removal and a 3x jump in clean drinking water-related spending.

- $39 billion in new funding to modernize public transportation including bus/metro stations, tracks, and vehicles.

Stock ideas: Quanta Services

PWR

EXTR

SCCO

MLM

In conclusion, while US small- and mid-cap stocks have lagged mega-cap technology stocks year to date, there are many exciting secular investment themes that investors should explore. O’Neil Global Advisors believes the themes discussed above represent excellent opportunities for rapid economic growth and investment returns over coming years in many unexploited small- and mid-cap stocks.

Kenley Scott, Director, Global Sector Strategist at William O’Neil + Company, an affiliate of O’Neil Global Advisors, made significant contributions to the data compilation, analysis, and writing for this article.

Read the full article here