Key News

Asian equities were mixed overnight on light summer volumes as Japan outperformed and Hong Kong underperformed following a steep selloff in US-listed China stocks on Friday.

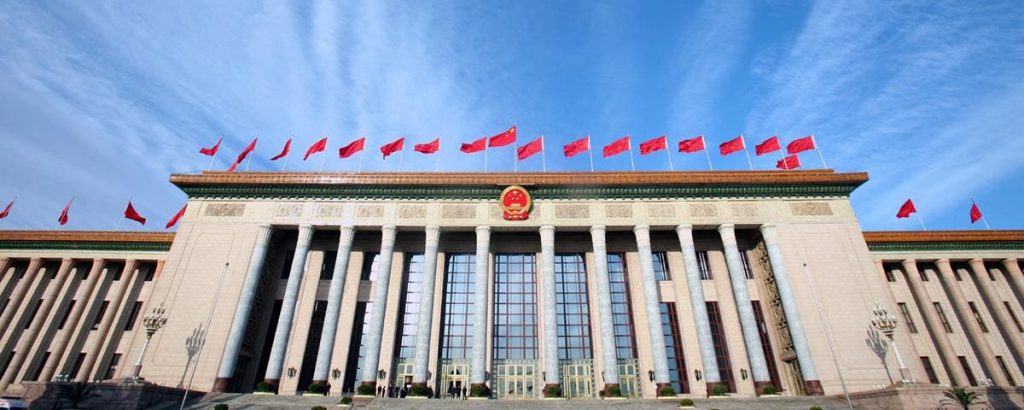

There was no catalyst for today’s drop other than investors anticipating the Politburo meeting at the end of the month. Mainland China was off but not nearly as much as Hong Kong in our typical foreign investor freak out while Mainland investors shrugged their shoulders.

After the close, it was announced that President Xi chaired the Central Committee to “analyze the current economic situation and make arrangements for economic work in the second half of the year.” Expanding domestic demand was a focus as policymakers pledged to “boost the consumption of automobiles, electronic products, household goods….and to promote the consumption of services…”. Sharp-eyed readers noticed that the “housing is for living, not for speculation” was omitted following the increased chatter of several cities easing purchase curbs.

A Mainland media source hinted that Commerce Secretary Gina Raimondo might visit China in another sign of US-China diplomatic green shoots.

Hong Kong’s most heavily traded stocks were Tencent, which fell -2.4%, Alibaba, which fell -1.92%, despite news that the company will not sell its shares in Ant Group despite the latter’s share buyback program, and Meituan, which fell -2.5%. Only one stock was positive out of the top fifty. Mainland investors bought the dip in Hong Kong with a healthy net purchase of $1.26 billion worth of Hong Kong stocks and ETFs via Southbound Stock Connect, including a large net buy in a Hong Kong-listed ETF. Mainland China was off, but not significantly. It is feeling like a light week until the month end Politburo meeting.

The Hang Seng and Hang Seng Tech indexes fell -2.13% and -2.18%, respectively, on volume that increased +22.03% from Friday, which is 83% of the 1-year average. 101 stocks advanced while 396 declined. Growth and value factors were mixed while large caps outperformed small caps. Healthcare was the only positive sector, gaining +0.23%. Meanwhile, real estate fell -5.28%, communication services fell -2.34%, and materials fell -2.11%. The only positive subsector was pharmaceuticals, while real estate, insurance, and semiconductors were lower. Southbound Stock Connect volumes were light as Mainland investors bought a net $1.26 billion worth of Hong Kong stocks and ETFs, including Country Garden, which was a small net buy, Tencent, Meituan, and Kuiashou, which were all small net sells.

Shanghai, Shenzhen, and the STAR Board fell -0.11%, -0.37%, and -0.52%, respectively, on volume that decreased -7.16% from yesterday, which is 73% of the 1-year average. 2,347 stocks advanced while 2,365 stocks declined. Growth and value factors were mixed as large caps outperformed. Healthcare and utilities gained +0.35% and +0.29%, respectively, while materials fell -1.37%, real estate fell -1.34%, and consumer discretionary fell -0.94%. The top-performing subsectors were computer hardware, pharmaceuticals, and the highway industry. Meanwhile, fertilizer, agriculture, and base metals were among the worst-performing. Northbound Stock Connect volumes were light as foreign investors sold a net -$715 million worth of Mainland stocks as Kweichow Moutai was a small net buy, Shanxi Fen Wine was a moderate net sell, and Foxconn was a small net sell. CNY eased versus the US dollar to 7.19 CNY per USD, agreeing with gains in the Asia Dollar Index. Treasury bonds rallied, while steel gained and copper fell.

Upcoming Webinar

Join us on Thursday, August 3rd for our webinar:

Revving Up: EV Sales, Growth Potential, and Battery Innovation

Please click here to register.

Last Night’s Performance

Last Night’s Exchange Rates, Prices, & Yields

- CNY per USD 7.19 versus 7.19 Friday

- CNY per EUR 7.97 versus 8.00 Friday

- Yield on 1-Day Government Bond 1.30% versus 1.35% Friday

- Yield on 10-Year Government Bond 2.59% versus 2.61% Friday

- Yield on 10-Year China Development Bank Bond 2.74% versus 2.73% Friday

- Copper Price -0.38% overnight

- Steel Price +0.85% overnight

Read the full article here