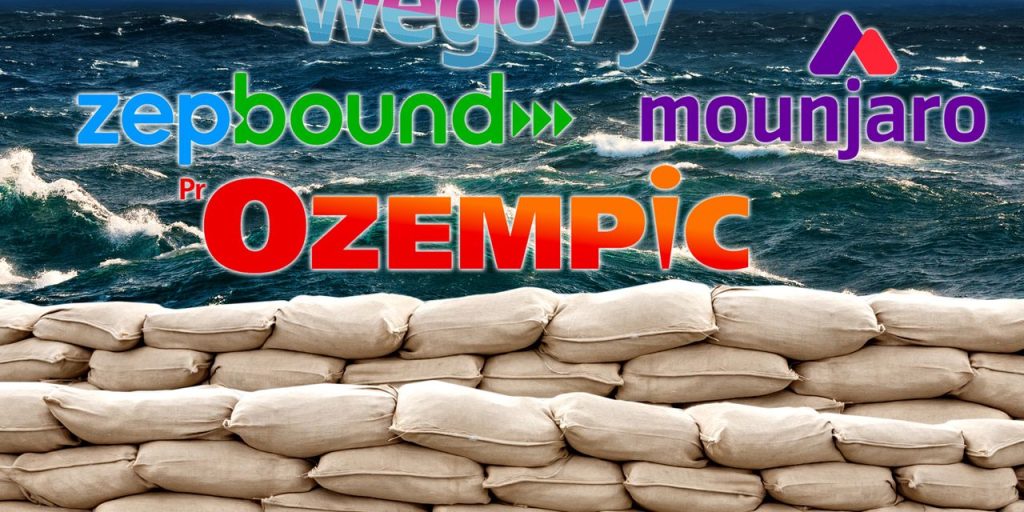

That’s the message from many corporate executives who have lately been peppered with questions about how Wegovy, Ozempic and other drugs widely used for weight loss may impact their bottom line.

On earnings calls in recent weeks, companies ranging from beverage giant Anheuser-Busch InBev

BUD,

to medical-device maker Abbott Laboratories

ABT,

have faced a chorus of analysts intent on tracking every investment implication of the obesity and diabetes medications categorized as GLP-1s — and in many cases, those companies have tried to shrug off the notion that the drugs will pinch their profits.

At Anheuser-Busch, “we don’t see any impact so far in the business,” said CEO Michel Doukeris on the company’s late October call with analysts. What’s more, he said, “we are not in the indulgence business,” noting that the company has an “incredible range” of low-calorie, low-carb and nonalcoholic options.

One company even opened its earnings call by asking analysts to please shut up already about the GLP-1s. “I’m aware that there is with GLP-1s one dominant topic in healthcare research overall,” Dominik Heger, head of investor relations at dialysis company Fresenius Medical Care AG & Co.

FMS,

said near the start of the company’s call. “But we would appreciate if we could focus in this call on the quarterly business developments.”

The plea didn’t work: Analysts asked about GLP-1s anyway.

While the questions pile up, drugmakers Eli Lilly & Co.

LLY,

and AstraZeneca PLC

AZN,

are pumping up the volume on the obesity-drug buzz. Lilly’s Zepbound got a green light Wednesday from the U.S. Food and Drug Administration and will be available right after the Thanksgiving holiday, the company said this week. And AstraZeneca said Thursday that it is licensing an experimental obesity and diabetes treatment from Shanghai company Eccogene as it seeks its own entrant into the GLP-1 drug race. The GLP-1 chatter could get even louder this weekend, when Novo Nordisk

NVO,

is set to release new data on cardiovascular outcomes among patients taking Wegovy.

With questions remaining about how many people will take these drugs over the longer term, especially given supply constraints, side effects, costs and spotty insurance coverage, some analysts are taking up the theme that the GLP-1 impact has been overblown. In consumer-staples stocks, “there seems to be an over-focus from investors on the caloric reduction and overall negative impact on food consumption” tied to the drugs, BMO Capital Markets analysts wrote in a late October report, adding that data point to a potential decline in food volume of about 0.1 to 0.2 percentage point per year over the next 12 years.

Among medical-technology stocks, which have lost more than $200 billion in market value as GLP-1 fears have mounted, “the sell-off has been excessive,” Raymond James analysts said in a note Wednesday. While doctors are expecting a moderate drop in procedure volumes, “the market is pricing in a much more dire impact,” the analysts wrote.

Facing GLP-1 questions on earnings calls in recent weeks, executives have turned to a few popular defenses. Many, like Anheuser-Busch’s Doukeris, say their products are relatively healthy, so they’re not threatened by the GLP-1 craze. What’s more, many executives say, the whole issue is overhyped because relatively few people currently take these medications, and there’s not enough data to show how the drugs might affect consumer behavior over the long term.

At Mondelez International Inc.

MDLZ,

whose brands include Oreo, Belvita and Philadelphia cream cheese, CEO Dirk Van de Put used all three of those arguments in responding to an analyst’s question about the drugs during the company’s Nov. 1 earnings call. “I think the whole topic has been overblown,” Van de Put said, adding, “We see absolutely no short-term impact on our results.” Even assuming significant adoption of the drugs longer term, he said, the impact on Mondelez volumes would likely be about 0.5% to 1% in 10 years. He also noted that “portion control is a big part of our strategy,” with 20% of sales coming from snacks that are less than 200 calories, and said that the company has healthier alternatives “that fit perfectly into the diet of a GLP-1 patient.”

Likewise, Chipotle Mexican Grill Inc.

CMG,

CEO Brian Niccol tackled an obesity-drug question on the company’s October earnings call by saying the company’s food is “clean, it’s not fried, it allows people then to customize the meal that would fit their diet that they’re trying to achieve, whether they’re on GLP-1 drugs” or a particular diet.

At PepsiCo Inc.

PEP,

the maker of Tostitos, Doritos and other snacks, CEO Ramon Laguarta also responded to an analyst’s question about GLP-1s on the company’s October earnings call by emphasizing the company’s efforts to make its products healthier. Over the past five or six years, he said, the company has cut sodium, fat and sugar and trimmed portion sizes. So far, he said, the impact of the drugs “is negligible in our business.”

Several food and restaurant companies facing down GLP-1 concerns have also said that customers have emotional ties to their products or services that can withstand the weight-loss mania. Asked about the drugs on the company’s late October earnings call, Hershey Co.

HSY,

CEO Michele Buck said the company feels good about “the emotional nature of our categories and our brands and the role that they play in moments of celebration.” The company will continue to adapt its products “to make sure that we are providing consumers with what they’re looking for,” she added.

“Full-service dining occasions are driven by desire to connect with family and friends,” Darden Restaurants Inc.

DRI,

CEO Rick Cardenas said when asked about the GLP-1 drugs on the company’s late September earnings call. The company, which operates Olive Garden, Longhorn Steakhouse and other chains, doesn’t see the drugs having a meaningful impact, he said, “because of the celebratory nature” of dining out.

Some companies have emphasized that there’s not enough data yet to draw any conclusions about the drugs’ impact. “We’ve spent a lot of time digging into the most robust data that’s available,” Keurig Dr Pepper Inc.

KDP,

CEO Robert Gamgort said in response to a GLP-1 question on the company’s October earnings call. The data “is really limited at this point,” he said. Even so, he added, “in the beverage industry, I really think that there is little to be concerned about here.”

Asked about the drugs on the company’s early November earnings call, DoorDash Inc.

DASH,

CEO Tony Xu said, “We don’t see any immediate or noticeable impacts in the business” from the drugs. “It’s been really hard to size any one macroeconomic factor,” he added, “whether it’s a headwind, a tailwind or a sidewind.”

Crown Holdings Inc.

CCK,

which makes beverage cans and food packaging, posited that no drug could significantly disrupt Americans’ consumption habits. CEO Timothy Donahue said on the company’s October earnings call that he found it hard to believe “that any drug is going to have an impact on Americans’ desires to eat the food they want to eat and drink and gather and have a good time.” In a $120 billion can market, he added, any impact from the drugs “is a speck on the market.”

Medical-device makers, whose stocks in some cases have suffered more direct hits from GLP-1 anxieties, have fired back with more data-driven arguments. At Teleflex Inc.

TFX,

products that have potential direct exposure to increased use of GLP-1 drugs account for about 1% to 2% of the company’s total revenues, CEO Liam Kelly said on the company’s early November earnings call. And “the potential impact should be less than that,” Kelly added, as GLP-1 drugs could reduce usage of, but would not completely eliminate the need for, the affected products.

“Investors are probably branding everybody as GLP-1-impacted right now, just because of all the hype about it,” Kelly said on the call.

Some companies say the trend is their friend. Abbott Laboratories, which makes continuous glucose monitors for diabetes patients, has lately emphasized data showing that people taking GLP-1 drugs while using the company’s Freestyle Libre glucose-monitoring system have a higher rate of use of both products. “While we traditionally think of therapy choices as having to compete against one another, this is a good example of a complementary relationship” between products that help improve diabetes treatment, Abbott CEO Robert Ford said on the company’s October earnings call.

“There’s obviously a lot of investor angst here,” Ford said later in the call. Thoughts about the future implications of new technologies are often “impacted more by emotion than facts and data,” he said. “And I think that’s what you’re seeing right now today as it relates to GLP-1 and med-tech markets.”

Read the full article here