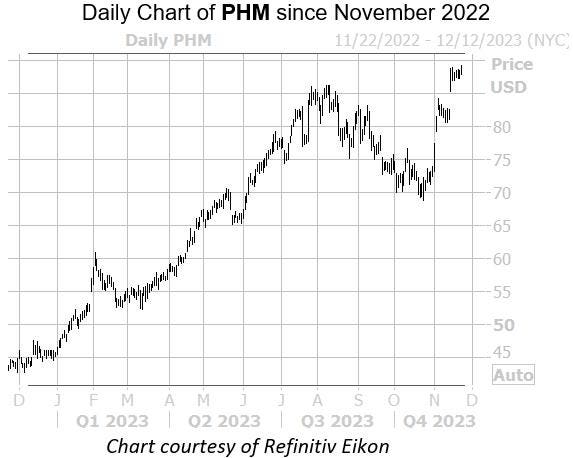

Homebuilder stock PulteGroup (NYSE:PHM) has been gapping up the charts this month, after consolidating above the $70 mark through October. Today, the stock hit a fresh record high of $89.16, and there is reason to believe it could extend those highs, if past is precedent.

Yesterday, a bull signal sounded for PHM, as its record levels came amid low volatility, which has been a historically bullish combination in the past. Per Schaeffer’s Senior Quantitative Analyst Rocky White, there were eight other signals over the past five years when Pultegroup stock was trading within 2% of its 52-week high, while its Schaeffer’s Volatility Index (SVI) stood in the 20th percentile of its annual range or lower, as was the case last session. The shares were higher one month later after 63% of these signals, averaging a 4.4% rise.

Plus, though short interest has been unwinding, down 20.2% during the most recent two-week reporting period, the stock has still rallied, pointing to a solid technical foundation.

An unwinding of short-term options traders’ pessimism could also generate additional tailwinds. This is per PHM’s Schaeffer’s put/call open interest ratio (SOIR) of 1.50 that sits in the 75th percentile of readings from the past 12 months, suggesting a bearish bias amongst these traders.

Read the full article here