The Biden administration has announced $130 million in new student loan forgiveness for thousands of borrowers. The announcement comes on the heels of an additional $39 billion in student debt relief the Education Department unveiled earlier this month.

The administration approved the relief for students who enrolled at a school that officials accused of making “widespread misrepresentations.” Borrowers who are eligible for student loan forgiveness under the initiative will receive their discharges automatically.

Here’s what borrowers should know.

New Group Discharge Will Result In $130 Million In New Student Loan Forgiveness

The relief centers on students who enrolled in Colorado-based locations of CollegeAmerica.

“The U.S. Department of Education (Department) found that CollegeAmerica’s parent company, the Center for Excellence in Higher Education (CEHE), made widespread misrepresentations about the salaries and employment rates of its graduates, the programs it offered, and the terms of a private loan product it offered,” said the Education Department in a press release on Tuesday announcing the relief.

The department relied in part on evidence gathered by the Colorado Attorney General’s Office in legal proceedings against CEHE. Citing this evidence, the department concluded that CEHE had misled prospective students about their earnings prospects, and “inflated and falsified job placement rates.”

“This announcement means a clean slate for thousands of students hurt by CollegeAmerica’s widespread misconduct,” said the the Education Department’s Federal Student Aid Chief Operating Officer Richard Cordray in a statement. “We will continue to work to deliver targeted student loan relief to borrowers whose schools take advantage of them.”

Who Qualifies For Student Loan Forgiveness Under The Group Discharge

The relief is being provided through Borrower Defense to Repayment, a federal student loan program that provides loan forgiveness and other debt relief to borrowers who the Education Department concludes were misled or defrauded by their school.

The Education Department estimates that 7,400 students will qualify for federal student loan forgiveness under the initiative. These are students who enrolled at Colorado-based locations of CollegeAmerica between Jan. 1, 2006, and July 1, 2020.

Those who qualify for student loan forgiveness will receive the relief automatically. “Borrowers will receive this relief regardless of whether they have filed a borrower defense to repayment application,” noted the department.

New Borrower Defense to Repayment regulations that went into effect on July 1 now make it easier for the Education Department to grant group discharges to similarly-situated borrowers, without necessarily needing to review individual applications. The new rules also broaden the types of school misconduct that can qualify borrowers for student loan forgiveness under the program.

Latest Wave Of Student Loan Forgiveness By Biden Administration

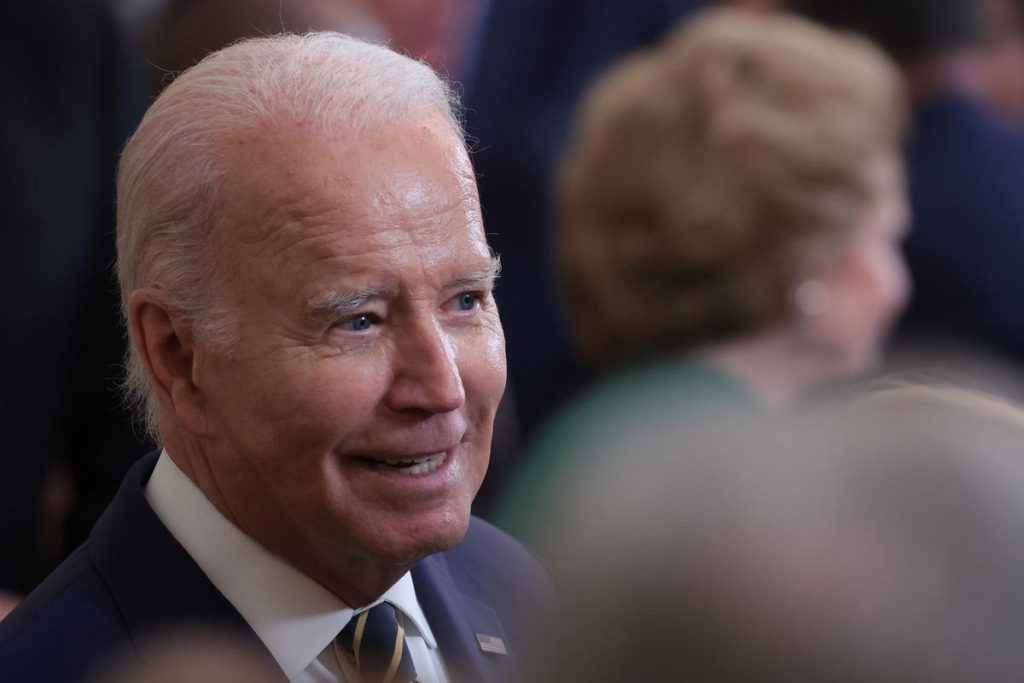

The millions in new federal student loan forgiveness is just the latest wave of student debt relief initiated by the Biden administration.

“The Biden-Harris Administration has approved $14.7 billion in relief for 1.1 million borrowers whose colleges took advantage of them or closed abruptly,” said the department. This includes billions in student loan forgiveness for hundreds of thousands of borrowers who attended Corinthian Colleges and ITT Technical Institutes, national for-profit college chains that collapsed several years ago following allegations of widespread fraud and misrepresentations. The Education Department is still working through a backlog of debt relief under the Borrower Defense to Repayment and Closed School Discharge program.

The school-based debt relief is, in turn, part of broader efforts by the Biden administration to wipe out federal student loan debt. Despite a recent Supreme Court ruling striking down Biden’s signature mass student loan forgiveness plan, the administration has forged ahead with other programs that collectively have provided over $116 billion in student debt relief to an estimated 3.4 million borrowers.

Earlier this month, the Education Department began notifying over 800,000 borrowers that they qualify for student loan forgiveness under the IDR Account Adjustment, one of the administration’s more significant student debt relief initiatives. More borrowers may receive loan forgiveness under that program in the coming months.

Further Student Loan Forgiveness Reading

New Changes Expand Student Loan Forgiveness For Public Service Borrowers

Your Student Loan Payment Plan Could Get Eliminated — Here’s Why

Here’s When Student Loan Payments Resume, And What Borrowers Should Do Now

4 Big Student Loan Updates When Payments Resume (And They Resume Soon)

Read the full article here