Recently, I spoke with an 85-year-old widow who did not need any of the money in her portfolio. Her income was sufficient to meet her needs. Her assets were in case she had a medical emergency or needed a new car. Whatever was left over would go to her children. She would sell her home if she needed to move into a retirement home. She was very conservative and did not need nor want to change her conservative investments.

Her current investments contained very few stocks, but she was also unhappy with her portfolio’s returns. Her disappointment was unsurprising given that the first quarter of 2022 had some of the worst bond returns.

However, her average expense ratio was 0.53%, so I knew we could improve on her asset allocation just by making it cheaper.

Portfolio construction begins with the most basic allocation between investments that offer a greater chance of appreciation (stocks) and those that provide portfolio stability (bonds). Decisions made at this level are the most critical in determining how well behaved your portfolio returns will be.

A stability allocation helps you have enough money to meet your withdrawal needs by dampening the volatility of stock returns. An appreciation allocation helps you have enough growth in your portfolio to compound your savings to meet your financial goals.

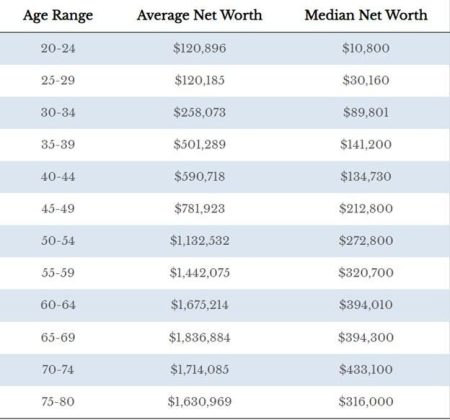

If you are behind on your savings, you may not be able to afford moving more conservative as you might need a higher expected return to meet your financial goals. However, if you have more savings than is necessary, like the woman I was talking to, then you can afford to have a more conservative asset allocation if you desire one.

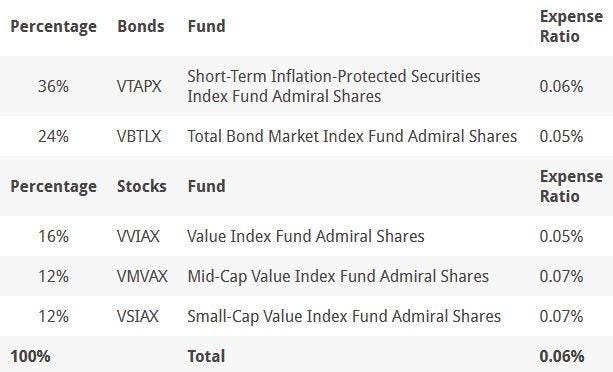

After listening to her goals and collaborating with her on her risk and return opinions, I recommended an asset allocation of 60% Stability (bonds) and 40% Appreciation (stocks).

From that general asset allocation I formulated this Gone-Fishing mutual fund portfolio of Vanguard funds:

These Vanguard funds have an expense ratio of just 0.06%, saving her 0.47% annually.

With her funds housed at Vanguard, these mutual funds should also allow her to reinvest dividends and interest without incurring transaction fees. This will help keep her portfolio fully invested and set as much of her investments on autopilot as possible.

While she was originally reviewing us as a prospective client, I recommended that she invest using this simple automatic process instead. She has enough investing experience to be able to set up and maintain a diversified mutual fund portfolio at Vanguard, and without specific withdrawal needs or financial goals for her assets, she doesn’t need as much financial planning and benefits from saving our fee by doing it herself.

I share this story here in case others in a similar situation may benefit from seeing this example.

Disclaimer: Both the authors and the clients we manage often invest in the investments mentioned in these articles.

Read the full article here