Co-authored by Rida Morwa.

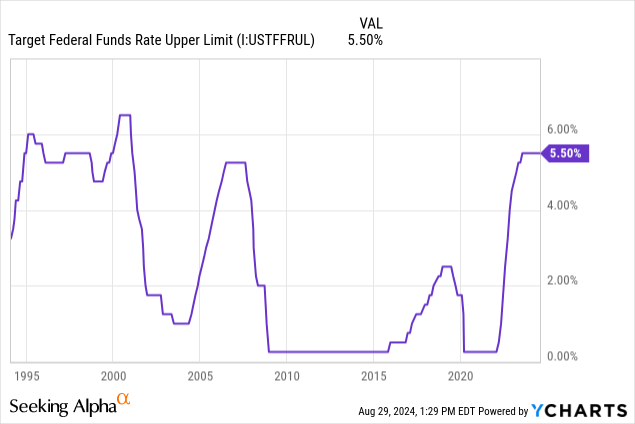

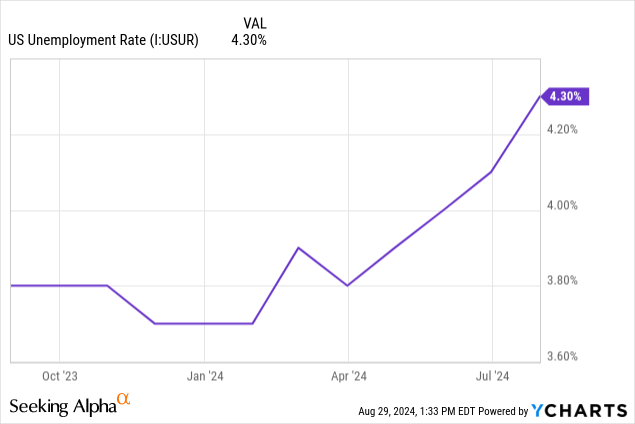

The Fed has finally signaled a pivot on interest rate policy and is widely expected to start cutting interest rates in September. The question has changed from whether the Fed will cut interest rates, to how far and how quickly it will cut them.

Over the past several decades, the Fed has tended to cut rates very quickly. Usually, it is faster and steeper than the market expects. Certainly, every investor should consider the possibility the Fed could cut interest rates substantially within the next year.

If the Fed does cut quickly, that is likely bad news for the economy. The most obvious reason that the Fed would be cutting rates quickly would be if unemployment continues along its current trend and keeps going up.

So if the Fed is cutting rates like it did in 2001 or 2008, odds are the stock market is going to struggle as well because the cuts will be paired with a weakening economy. In general, investors can expect to see a lot of red in their portfolio if this happens. Certainly, a sell-off of 30%+ for the indexes is on the table.

What Flavor Will The Next Sell-off Be?

As a potential recession is on the horizon, what should investors do about it? Some might be tempted to sell everything and “sit on the sidelines” with their cash. However, that strategy can blow up in your face if a recession doesn’t happen. While I believe that a recession is imminent, it is impossible to know the future with certainty. As investors, we must know the difference between what we believe and what we know. The market has an unpleasant way of humbling people who confuse the two.

Another alternative is to focus on buying up investments that are relatively cheap. The higher an investment is, the more it has to fall. During the “Dot-Com” bust, it was the dot-com companies that took a nasty hit to their valuations and were crashing the most. The companies that were hit hardest consisted of Growth stocks with large market capitalizations.

During the Great Financial Crisis, it was the opposite. Large-cap Growth stocks sold off as part of “everything”, but generally saw smaller dips and faster recoveries. It was banks, REITs, and other financials that were crushed and fell much more than the S&P 500 index.

People often ask me which stocks are best to hold through a recession, and the answer is “Which recession?”.

Consider Valuations

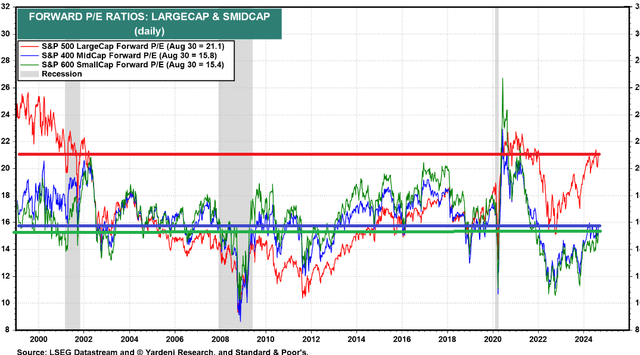

What is relatively expensive today?

Large-cap stocks are trading at a higher price/earnings ratio than they have for most of the past 20 years. They are slightly lower than they were in 2001, but much higher than they were going into the GFC: Source

Yardeni

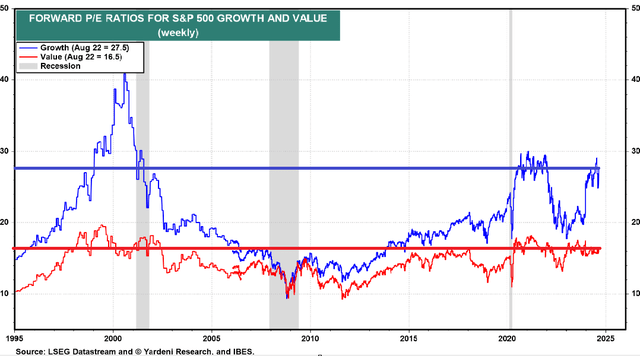

The other major divide in stock market valuation is Growth vs. Value: Source

Yardeni

This is less definitive, though it is interesting that both Growth and Value stocks are trading at approximately the same P/E they were at immediately before the 2001 recession. Note that Growth stocks had fallen considerably in 2000, while the rest of the market was relatively stable. So before the recession, a strong downward trend was already underway for Growth stocks. Today, Growth stocks are closer to a peak and haven’t been trending downward.

We probably won’t see an 80%+ crash in the Nasdaq, valuations aren’t that inflated. However, it is clear that two features are prominent in stocks that are trading at P/E ratios that are high relative to where they have been over the past 20 years: Large-cap and Growth.

On the other hand, small-cap and mid-caps are trading at valuations that are below average and very similar to where they were in 2001. Value stocks are trading a bit higher than they have over the past 20 years, but are about the same place as they were in 2001.

We have to remember that we are looking at high-level averages. Many large-cap stocks are Growth stocks, but not all of them. For example, Walmart (WMT) is a Value stock but also a Large-Cap. It is trading at a forward PE ratio of 31x. That is definitely at the higher end of its historical valuation range. There are plenty of other examples of the larger cap stocks that would fall into the Value category, but are trading at relatively high valuations, even as many other Value stocks are trading at their lowest valuations in decades.

History Doesn’t Repeat, But It Sure Does Rhyme

If there is a recession, the stocks that are expensive relative to their own histories are likely going to be the ones that fall the most. That has certainly been the case with historical recessions. Today, the companies that are most expensive tend to be large-caps, growth stocks, or both. The companies that are the least expensive are small/mid-caps, Value, or both.

This setup is most similar to what we saw in 2001. I’ve been filling my portfolio with holdings that are most similar to those that did very well through the 2001 recession. Here are a few stocks I’ve been buying that absolutely crushed it through the 2001 recession, and are trading at low valuations today.

Realty Income

Realty Income (O) is a real estate investment trust that utilizes triple-net leases. It has grown into the largest REIT in its category, and has rewarded investors with frequent dividend hikes.

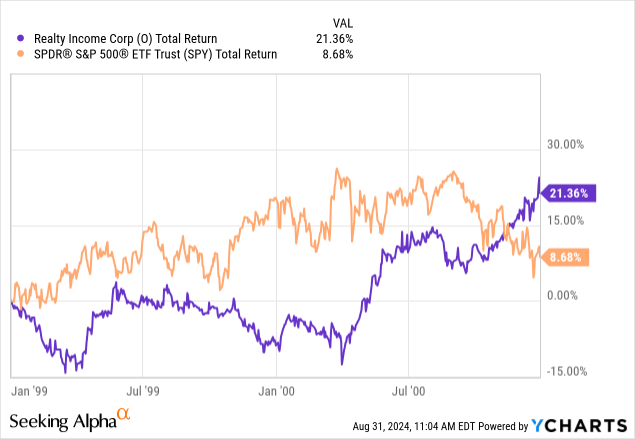

Like many REITs, O lagged the market significantly in the late 1990s. Investors were in the red even as the indexes were reaching all-time highs. A scenario that people tell me leads to a lot of frustration.

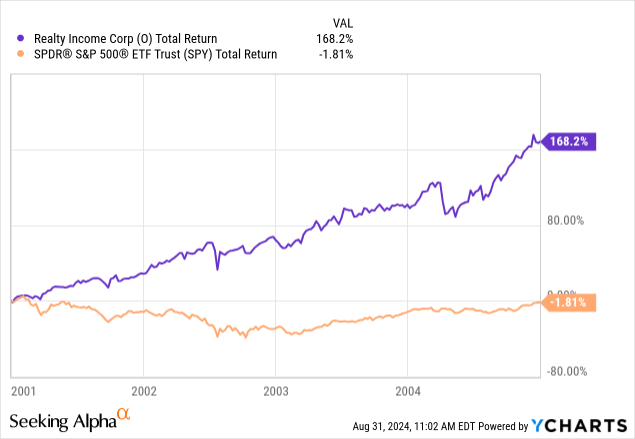

In late 2000, O started catching up. In 2001, once the Fed started cutting rates in January, O didn’t look back. It ran forward as the S&P 500 and other indexes fell.

Investors who were burned by falling Growth stocks were attracted to O’s growing dividend, the stability of its business model, and its low valuation.

Today, O is trading at a higher valuation than it was in 2000. It is trading around 15x FFO. However, O is undeniably a stronger company and much lower risk than it was 25 years ago. Over the past few decades, O has gained scale, efficiency, an A- credit rating, and much more acceptance among investors. Remember, in 1999, REITs weren’t even a recognized sector in the S&P. The sector was new and foreign to all but the most savvy investors.

From O, we can expect continued dividend growth averaging 4-5%/year and there is ample room for the valuation to climb in the low 20x price/FFO range.

EPR Properties

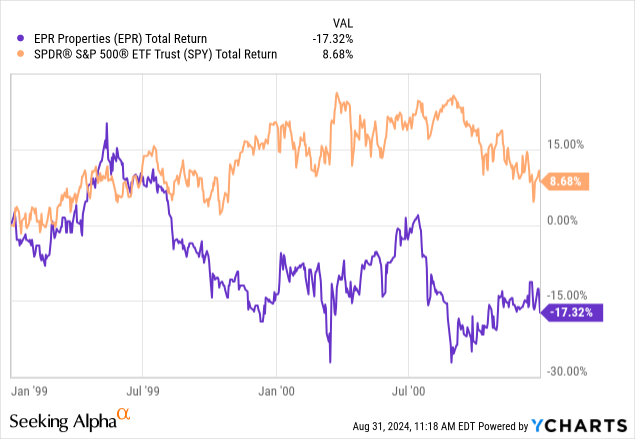

In 2000, EPR Properties (EPR) was a REIT that focused solely on movie theaters. Like O, EPR underperformed the S&P 500 in 1999. It fell a lot more, which is likely due to it being a newer REIT at the time.

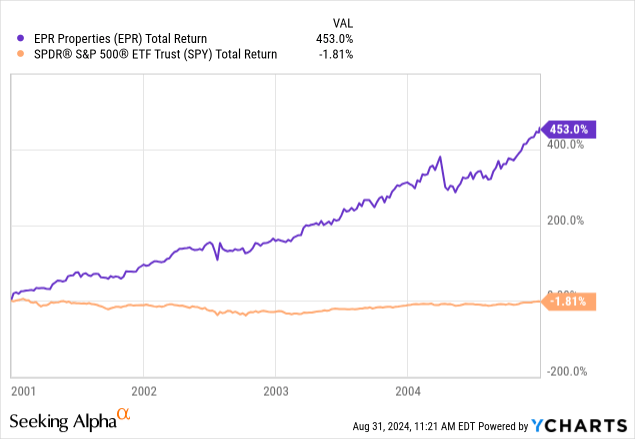

Also, like O, that turned around in early 2001 as the Fed cut rates and the recession started:

Note that during this period, EPR outperformed the S&P 500 and outperformed O. The company that fell more had more upside.

Today, EPR has lagged peers like O since COVID. With its focus on “experiential” real estate, defined as places where people go to do things, EPR was hit much harder than most other REITs. At one point, it collected only 20% of revenues as its properties were more highly targeted by government shutdown orders. However, EPR navigated that period without issuing more debt or equity. As a result, EPR has less debt and fewer common shares outstanding today than it had in January 2020. In short, EPR didn’t make any capital decisions that would permanently impair future earnings.

EPR is sitting on over $1 billion in liquidity and has ample room to leverage up. With a high cost of capital, EPR’s management has remained patient rather than forcing growth for the sake of growth. As interest rates come down, EPR has the option to start growing. Conditions that are quite similar to the early 2000s when EPR was a new company looking to grow while interest rates were being cut.

Annaly Capital

Annaly Capital (NLY) is a REIT that invests in agency MBS. Agency mortgage-backed securities are MBS that are filled with mortgages that are guaranteed by the agencies – Fannie Mae or Freddie Mac. If a borrower defaults, the agency will buy back the mortgage at par value. NLY invests in this asset class on a leveraged basis. As a result, they are not taking any credit risk, but end up with significant interest rate risk.

NLY has a history of periods of absolutely exceptional performance, interspersed with years of mediocre performance. Agency mortgage REITs are the best recession insurance that you can buy because the periods when agency MBS thrive, are the periods when the market indexes are collapsing.

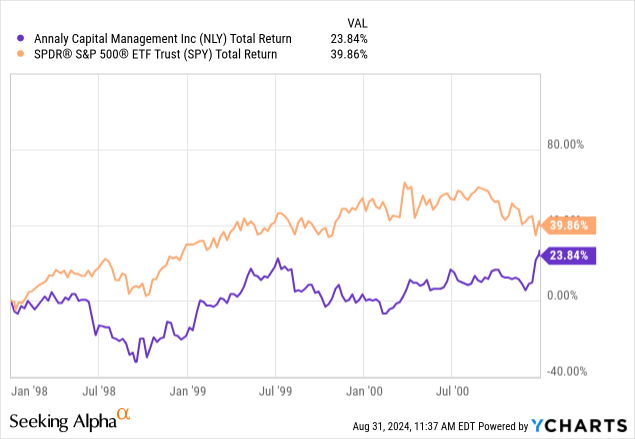

Going into 2001, NLY had been underperforming the S&P 500 since 1998.

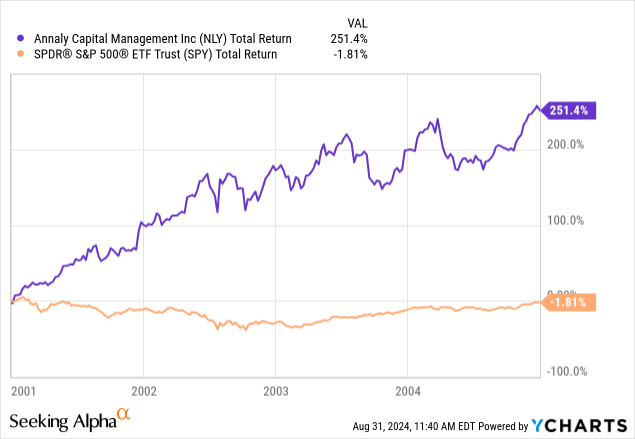

When the recession started in 2001, NLY worked its magic.

While the market was red, NLY was rallying, more than doubling in price. At the same time, it raised its dividend 150%.

NLY is investing in an asset class that is considered a “flight to safety” asset. It has no credit risk. As a result, agency MBS does best when bond investors are fearful and are running to safety. When investors are brave and are running into risk assets, agency MBS tends to underperform. As a result, NLY is an investment that is truly counter-cyclical. It performs best when the stock market is a disaster. It tends to underperform when the economy is strong and the stock market is generally bullish.

Conclusion

O and EPR are situational picks. They are capable of outperforming in some recessions. In particular, O and EPR will struggle during a GFC style recession where financials are being punished, and it becomes difficult to borrow money. They will perform relatively well in recessions where banks have good liquidity and a credit freeze is not a concern.

NLY is a company that I will probably hold in my portfolio for the rest of my life. It has the potential to outperform in every recession, regardless of the cause. The reason is that agency MBS is an asset class where money runs to when fear is high.

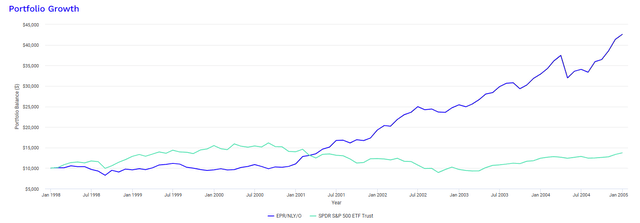

These three picks together underperformed the S&P 500 in the years leading up to the 2001 recession, but dramatically outperformed during and after the recession:

Portfolio Visualizer

That outperformance overcame the underperformance from 1998-2000.

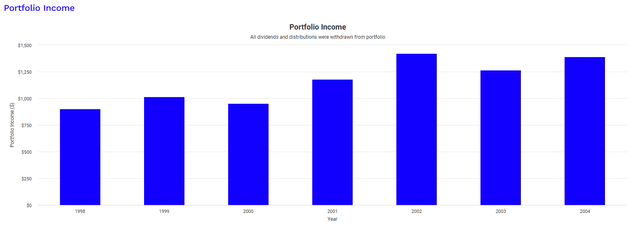

More importantly, from an income investor’s perspective, the dividends paid by these investments climbed even without any reinvestment:

Portfolio Visualizer

If we see a recession, I believe these three picks are well-positioned to repeat that exceptional outperformance. If somehow the Fed does manage to engineer a “soft landing”, by buying at relatively low valuations, shareholders are setting themselves up to have reasonable total returns and a high level of income.

In theory, stocks that are trading at high valuations can keep going higher. Buying investments that are trading at low valuations doesn’t always lead to immediate gains. Sometimes, cheap gets cheaper, and expensive gets more expensive. Yet, in the long run, investors who are buying stocks that are trading at low valuations will do better. Buy low, sell high: It starts with buying low.

Read the full article here