Investment Overview

AbbVie Inc. (NYSE:ABBV) is set to report its Q2 2023 earnings this week, on Thursday 27th July. Of the U.S. Big Pharma concerns, AbbVie has been faring the worst – in terms of share price performance – in the face of industry headwinds and in terms of overall performance in recent months.

The Pharma’s share price is down 11% year-to-date, and 3% year-on-year, although its 5-year performance remains strong – up by 60%, which more or less matches the performance of the S&P 500 (SP500) over the same period.

In January, AbbVie raised its quarterly dividend – from $1.41, to $1.48 – up 5% – and the annual payout of $5.92 offers a current yield of >4%, based on AbbVie’s current traded share price of $143.

The issues the company is confronting as it prepares to announce Q2 2023 earnings do represent a serious challenge for the company and its market valuation, however – perhaps the most significant challenge the company has faced since it was spun out of Abbott Laboratories (ABT) in 2012.

Since then, AbbVie’s share price trajectory has been primarily up and to the right – reaching a pinnacle of $162 in March last year, and trading at $159 as recently as March this year.

In this post, I’ll discuss AbbVie’s upcoming earnings in the context of the issues AbbVie has been facing – most notably the patent expiration of its >$20bn (in 2022) selling autoimmune / dermatology asset Humira, and pressures on drug pricing, the plans management has put in place to solve these issues, and why there is disconnect between AbbVie’s internal expectations and the market’s hopes for company performance.

A Quick Look At AbbVie’s Q1 ’23 Performance & The Humira Question

There are 2 ways of looking at AbbVie’s Q1 ’23 earnings – through the company’s eyes, and through analysts’ eyes.

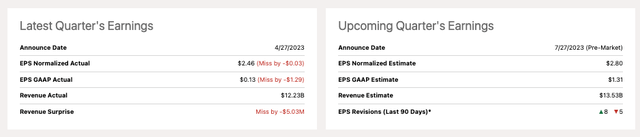

AbbVie earnings – last quarter and forecast for upcoming quarter (Seeking Alpha)

As we can see above, AbbVie missed analysts targets on revenues – which were $12.23bn, normalized EPS of $2.46, and GAAP EPS of $0.13.

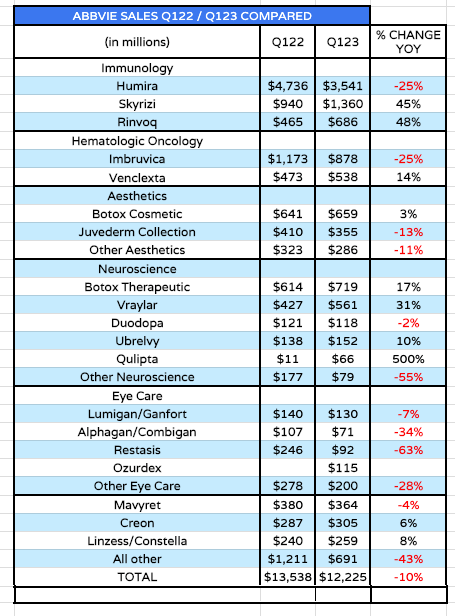

AbbVie revenue by product (source: Q123 10Q submission)

As we can see above, AbbVie’s total revenues fell by 10% year-on-year in Q1 ’23, but this was to be expected, as its most important drug, Humira, lost its patent protection at the beginning of this year.

Humira – approved in multiple indications including Rheumatoid Arthritis (“RA”), Psoriatic Arthritis (“PsA”), Ankylosing spondylitis (“AS”), Psoriasis (“PsO”), Hidradenitis suppurativa (“HS”), Crohn’s Disease (“CD”), and Ulcerative Colitis (“UC”) – earned revenues of $19.9bn, $19.2bn, $19.8bn, $20.7bn, and $21.2bn between 2018 – 2022 – nearly $100bn over a 5-year period, and well over a third of AbbVie’s total revenues in each year.

AbbVie had managed to preserve Humira’s market exclusivity for much longer than expected, allowing it to dictate pricing and dominate market share, but from the beginning of 2023 that changed fundamentally. Amgen (AMGN) launched the first Humira biosimilar in February this year, and that will be followed by Organon’s (OGN) Hadlima, in July, then Cyltexo, developed by Boehringer Ingelheim, and Coherus BioSciences’ (CHRS) Yusimry, and Viatris’ (VTRS) Hulio, also July, and then Novartis’ (NVS) Hyrimoz, in September, and Pfizer’s (PFE) Abrilada, in November.

Typically, a drug with an expired patent will see revenues decline by at least 25%-35% per annum, and that is precisely what we saw happen to Humira in Q1 ’23, as shown in the table above. Things will undoubtedly get worse across the remainder of 2023 as more biosimilar are launched, with much cheaper price points than the original drug – after all, none of the biosimilar drug manufacturers have had to fund any R&D to develop their drugs, they have simply copied AbbVie’s “recipe.”

AbbVie has tried to make the case that patients may prefer to remain on Humira as it is the established incumbent, and biosimilars may not offer an exact like-for-like replacement tailored to their specific requirements. For example, during a fireside chat at the Goldman Sachs Global Healthcare Conference, AbbVie’s President and Vice Chair Rob Michael told the audience that:

looking at 26%, 27% erosion, I would say a vast majority is price, very little volume

In other words, in AbbVie’s estimation, Humira is as popular as ever, and the falling sales are related to its own pricing decisions as opposed to lost market share. Michael continued to make that case at the GS conference, discussing the efficacy of biosimilars and why physicians may not want to switch patients to cheaper alternatives:

HUMIRA, we are able to easily beat those levels of efficacy around clinical remission. For example, in ulcerative colitis, we are seeing 52-week remission rate of 50% endoscopic improvement, 60%. And then what’s really emerging is also being very important is steroid-free remission of 70%. So these numbers are unprecedented in the ulcerative colitis space.

And I think what Jeff can speak to is depending on the jurisdiction, some patients may be taking it after an anti-TNF or a biologic. But in Crohn’s and UC 60%, 70%, 80% of the patients have already seen an anti-TNF. So, it’s already a very strong setup for these patients looking for very high levels of efficacy, mucosal healing and then getting them off very rapidly off of steroids and that leads to a very, very good, strong profile for clinicians.

There may be a case to be made here, but when we consider the fact that some biosimilars are planning to price themselves at an 85% discount to Humira – Coherus BioSciences, for example, via the Mark Cuban Cost Plus Drug Company – and that the FDA has approved 8 biosimilars, and given some of them – Cyltelzo, for example – the precious interchangeability tag, meaning they can be swapped for Humira at a pharmacy – the case for Humira is getting weaker and weaker.

The reality is that Humira sales will be worse affected in the second half of 2023 – and management has tacitly acknowledged that, forecasting that overall revenues from the drug will be down 37% across FY23, and down 27% year-on-year in Q2 ’23, meaning the drug will earn ~$3.9bn of revenues. On the Q1 ’23 earnings call, Scott Reents, AbbVie’s Chief Financial Officer forecasted Q223 as follows:

we anticipate net revenues of approximately $13.5 billion, which includes U.S. Humira erosion of 27%. At current rates, we expect foreign exchange to have a 0.6% unfavorable impact on sales growth. We are forecasting an adjusted operating margin ratio of 48.5% of sales. We are modeling a non-GAAP tax rate of 15.4%. We expect adjusted earnings per share between $2.90 and $3.00.

Skyrizi, Rinvoq, & The Dispute Around Earnings Targets

Luckily for its shareholders, AbbVie is not simply reliant on Humira fighting off generic competition. The company has developed 2 news drugs in Skyrizi and Rinvoq that it believes offer a superior alternative to Humira – and by extension, Humira biosimilars – across nearly all of Humira’s indications.

Skyrizi – an interleukin-23 (“IL-23”) inhibitor – is already approved to treat Plaque Psoriasis, Psoriatic Arthritis, and Crohn’s Disease. Ulcerative Colitis and Crohn’s Disease are further targets. Rinvoq – a Janus kinase (“JAK”) inhibitor – is approved to treat Rheumatoid Arthritis, Psoriatic Arthritis, Atopic Dermatitis, Ulcerative Colitis, Crohn’s Disease, Ankylosing Spondylitis.

AbbVie management has stated publicly that it believes that by 2030, combined sales of Skyrizi and Rinvoq will be greater than Humira in its peak years, essentially meaning AbbVie will maintain its dominant position in the dermatology and autoimmune markets despite the biosimilar assault, and drugs released by Big Pharma rivals, such as Johnson & Johnson’s (JNJ) Stelara, Bristol-Myers Squibb’s (BMY) Zeposia, Pfizer’s Xeljanz, Eli Lilly’s (LLY) mirikizumab, etc. etc.

Naturally, that means that analysts are constantly monitoring sales of these 2 assets, and it is here where there was a slight disconnect between analysts expectations, and AbbVie’s internal expectations last quarter. In short, analysts expected sales to be growing faster, whereas AbbVie’s insists it is happy with the growth trajectory. Here is a quote from Vice Chair Rob Michael, again from the GS conference:

I think where things went wrong, we will say, in the first quarter was when you look at just sell-side consensus and the expectations, the full year was okay. The full year, the growth rates were right in line with our guidance. So, there wasn’t a disconnect there. That was around, we will call it, the mid-40s revenue growth for both SKYRIZI and RINVOQ on a full year basis.

But the first quarter we had some analysts modeling 80% to 90% growth, greater than prescription growth in the first quarter. And so we printed a number that was ahead of our guidance. We did a little bit better on demand. It was consistent on price. And yet the reaction was we missed expectations because sell-side models had very significant growth for some reason, the first quarter, not for the full year.

In terms of share price, the market opted to believe the street rather than AbbVie, as shares fell after Q1 earnings were announced on April 27th, from ~$164 per share, down to $132 per share by early July – a loss of 20%.

As we can see, however, expectations for Q223 appear to be much more aligned between analysts and the street – in fact, AbbVie’s forecast for EPS of at least $2.9 per share, is higher than the Street’s forecast, and AbbVie’s revenues forecast of $13.5bn broadly matches the street’s.

What To Look Out For When Q2 2023 Earnings Are Released – The Street Wants More Action, AbbVie Wants To Stock To Plan

When an all-time best-selling drug such as Humira loses its patent protection, it is not necessarily surprising that the company that markets and sells that drug will suffer a correction to its share price.

That has been the case with AbbVie, and things may get worse before they get better, because the company will inevitably suffer a “trough” year – i.e., a year in which revenues fall year-on-year – in 2023, and possibly 2024 as well, before Skyrizi and Rinvoq, and AbbVie’s other divisions, e.g. its aesthetics business acquired via its >$60bn buyout of Allergan, its eye care business, and its oncology business post strong enough revenue gains to offset falling Humira sales.

The market would clearly like to see AbbVie make more moves to offset the Humira losses sooner, rather than later, possibly through M&A activity. That may help to lift the share price in the short to medium term, but AbbVie is sticking to its guns and maintaining it has all the assets it needs to meet its targets. At a recent Bank of America conference, AbbVie’s Michael responded to a leading question about M&A as follows:

But look we like the portfolio we have today. We’re not sitting here saying we need to do something. We feel like with the portfolio we have today we can deliver on the long-term growth objectives of high single-digits in the second half of this decade returning to robust growth in 2025. And so it’s not out of need, but we have the flexibility. And if we see something that strategically fits and generates a strong return, we have the financial wherewithal to pursue it.

In other words, AbbVie does not believe it needs to try to spend its way out of trouble, and frankly that is a good thing, because the company is still paying down debt accumulated as a result of the Allergan deal. As of Q1 ’23, the company reported current liabilities of $27.6bn, and long term debt of $59.6bn, versus current assets of $26.5bn.

The market does not necessarily like it when a company pushes back on their own strategy for growth and says “trust us, we already have everything we need”, as AbbVie appears to be doing. And in fairness to the market, there are some areas of concern. Within the oncology division, sales of imbruvica, its hematological cancer drug were down 25% year-on-year, and AbbVie is pessimistic about the drug’s future.

The performance of the aesthetics division is another concern, with a slower than expected recovery post-pandemic, although management says there are plans to release faster acting, and longer lasting versions of Botox in the coming years.

Year-on-year sales declines across the eye-care division in Q1 ’23 also look concerning, although the performance of the neuroscience division – particularly Vraylar and Quplita – the former expected to drive peak sales of >$5bn long term – have been encouraging. AbbVie wants to become a migraine powerhouse – Chief Commercial Officer Jeff Stewart told the Bank of America conference:

So on the back end, we historically had obviously Botox Therapeutics, which right now is the leading drug in terms of in-play capture for the most severe form of migraine where you have 15 more migraine days a month. That’s the chronic migraine. Then for episodic migraine, we’ve had QULIPTA in the middle. And we’ve also had UBRELVY, which is the leading oral CGRP on the front-end. And what we’re going to see over time is all those markets are going to continue to develop. It’s pretty exciting.

To summarize, what AbbVie needs to do in Q2 ’23 is show more consistent performance across the board, try to meet Street analysts at least half-way on Skyrizi and Rinvoq growth, provide transparency on Humira sales not just in the back end of 2023, but if possible, 2024 and 2025, and assuage the market’s fears that further M&A is required by highlighting strengths of its main 5 divisions – immunology, oncology, aesthetics, neuroscience, and eye care.

Concluding Thoughts – Is ABBV A Buy, Sell, or Hold Ahead of Q2 2023 Earnings

For me, it’s a hold. I own AbbVie stock and must admit that I have considered selling as inevitably, the post Humira patent expiry is going to be tough for the company – Humira was a once-in-a-generation drug that enjoyed rare market dominance.

In my last post on Humira in early June, I advised investors not to panic, however, sharing detailed product-by-product revenue forecasts – including pipeline assets I expect to see approved – and provided detailed discounted cash flow calculations implying a target price for AbbVie stock of $145.5.

My revenue projections suggest it could be several years – perhaps not until 2028 – until AbbVie will be able to deliver a higher annual revenue figure than it did in 2022. That may sound worrying, but it is in line with management’s plans, and management has rarely let shareholders down. My “guesstimate” is that revenues may grow rapidly in the last few years’ of the decade.

There is likely more pressure on AbbVie Inc. management than ever to offset falling Humira revenues and meet the street’s expectations, and my price target of $145.5 may not offer much upside potential, but there is a still a generous dividend payout in play, and once this touch post-patent expiry period has been negotiated, and if drug pricing pressures created by the Inflation Reduction Act eased, as may likely happen now the Big Pharma industry has begun to push back via the courts – it may be time to revise the target price upwards.

Read the full article here