On our last coverage of Alibaba Group Holding Limited (NYSE:BABA) we felt that the low valuation was offset by the macro risks in China. The cloud pricing wars would be extremely negative for longer term profit margins in their most hyped segment. While the crowd was also enamored with the plans to split the company into 6 segments, we saw that as an actual negative.

We think that this “six degrees of separation” idea of spinning off all these units by BABA might reduce regulatory risk but will substantially increase overhead costs. It will also decrease pricing power further. We rate the stock a hold and think that those bullish should play it using covered calls.

Source: Six Degrees Of Separation

The company did report their Q1-2024 (fiscal year end March 2024) that exceeded expectations. We look at the results and update our thesis.

Q1-2024

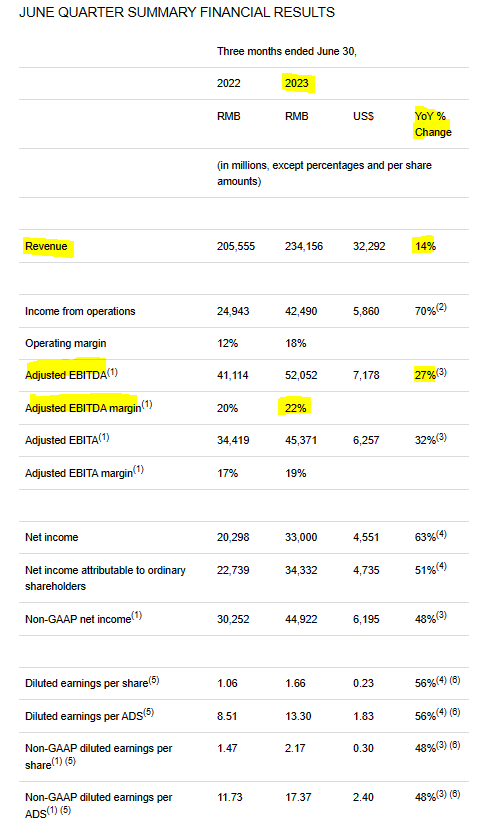

A 14% revenue bump for a large company like BABA is no easy task to accomplish, but that is precisely what it delivered. More importantly, it maintained and actually enhanced margins as adjusted EBITDA rose 27%.

BABA Q1-2024 Press Release

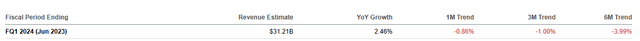

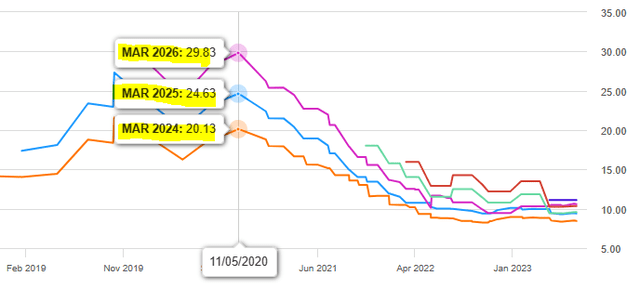

The non-GAAP (don’t we all love that), diluted earnings per ADS were up 48% to $2.40. Certainly some of this “beat” was the layup that analysts worked hard to setup. Consensus revenue estimates for this quarter had dropped about 4% in the last 6 months and then BABA came in right where analysts were back then, setting up a “beat”.

Seeking Alpha BABA Estimates

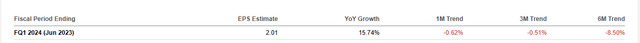

EPS numbers were also similarly setup as you can see by the trend of forecasts, though BABA did do far better on this metric than what most envisioned.

Seeking Alpha BABA Estimates

Segment Analysis

Taobao and Tmall Group, the lynchpin of the BABA’s growth plans, grew revenue grew +12% year over year, defying the odds. The key metric here was the growth in daily users which rose 6.5%. Both metrics were driven by a hyper aggressive customer-acquisition program. The impact to the bottom line was even more as BABA did a small round of layoffs recently.

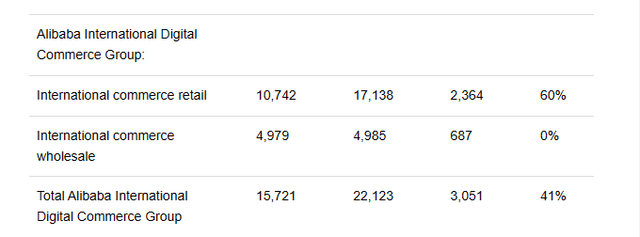

Alibaba International Digital Commerce Group, which includes Lazada, AliExpress, Trendyol, and slew of other businesses, did even better with a 41% jump in revenues. This segment is small at present and segment revenues are just around 10% of total revenues, but the showing was extremely impressive.

BABA Q1-2024 Press Release

The one area which actually came in lackluster was surprisingly the Cloud segment. With all the talk of “AI” (and BABA did not miss any opportunities to mention this either in their press release), Cloud Intelligence Group delivered just a 4% revenue growth year over year.

Outlook

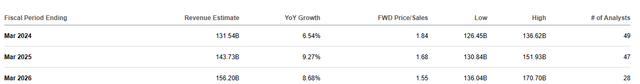

BABA is currently expected to grow revenues at a modest pace through the next 3 years.

Seeking Alpha

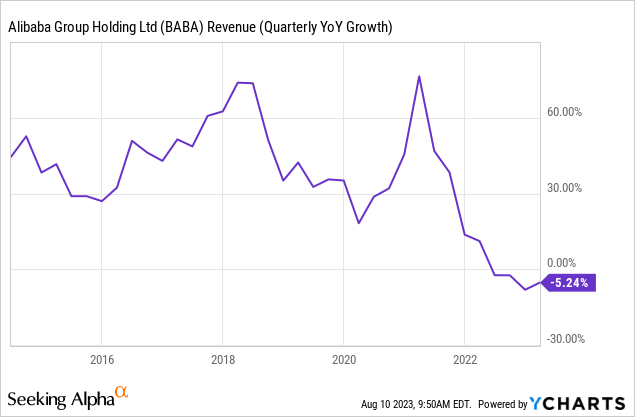

These numbers while still optimistic in our view, have some semblance of reality built in. It wasn’t long ago that investors took the 30% growth numbers for granted and extrapolated them for the next decade.

Earnings estimates were also divorced from reality.

BABA Earnings Revisions Over Time-Seeking Alpha

So BABA is better poised today to meet expectations than it was 3 years back. But there are still some serious headwinds here. The first being the absolute freefall in China’s property market. This sector is estimated to contribute between 25% to 30% of the total GDP growth and it is deflating from extremely high valuations.

Last month, Shanghai-based Shimao Group Holdings defaulted on a $1 billion bond. It also stopped the $1.8 billion project and there were no takers for this project, even at a solid discount.

A US$1.8 billion project by defaulted Chinese developer Shimao Group Holdings failed to find a buyer at a forced auction, underscoring the lack of investment appetite amid a weakening economy.

No buyers bid for a land portfolio spanning an area equivalent to 34 football fields, even though the asset was offered at a price 20 per cent lower than its appraised value, according to results posted on online auction site JD.com.

Source: South China Morning Post (emphasis ours)

Leaving aside the more important question whether those were actually football fields or soccer fields, you can bet that employment and hence retail sales will suffer as a result.

China’s number 5 property developer is in the same shaky situation.

The latest major industry player to get into trouble is Country Garden, once China’s largest developer.

Shares in the construction giant have plunged 16% in Hong Kong since Tuesday, after reports by Reuters and Chinese media that it missed interest payments on two US dollar-denominated bonds. Several of Country Garden’s yuan-denominated bonds were suspended from trading in Shanghai and Shenzhen on Tuesday after they dropped by more than 20%.

Source: CNN

Country Garden (probably reminds some investors of our own notorious Countrywide Financial), has liabilities of $1.4 trillion Yuan ($200 billion USD) and that is about 4 times as much as the first domino that started this chain reaction.

“Any default would impact China’s housing market more than Evergrande’s collapse as Country Garden has four times as many projects,” Bloomberg Intelligence analyst Kristy Hung wrote in a report Wednesday. “Any debt crisis at Country Garden will have a far-reaching impact on China’s housing market sentiment and could significantly weaken buyer confidence on solvent private developers.”

Source: Fortune

So for us, the macro matters and it matters a lot. China’s property bubble is easily 10X the size of the US 2006 property bubble at its peak. How does all of this play out for China’s GDP, unemployment and retail sales over the medium term? That remains the trillion Yuan question and one we think bulls won’t like the answer to. The latest numbers look really bad but no one appears to be paying attention. For example, Chinese exports plunged 14.5% in July year-over-year, while imports dropped by 12.4% in US dollar terms. Exports to the US fell 23.1%. Exports to the EU fell 20.6%.

Verdict

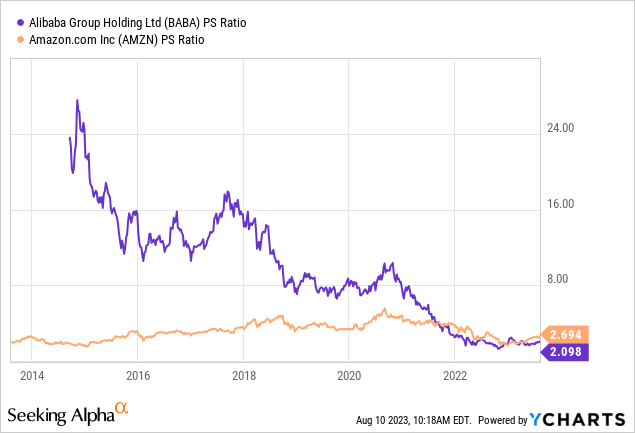

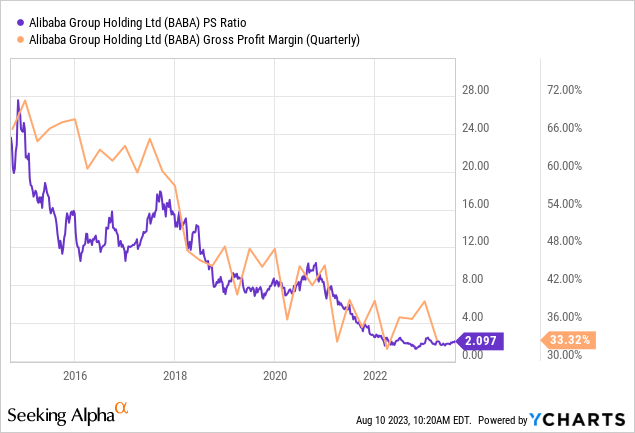

There is no denying here that BABA has grown into its valuation as price to sales has compressed to well under that seen for Amazon (AMZN).

Investors might get nostalgic for the days of 10X sales, but the valuation compression is well deserved. Don’t believe us? Well, how do you explain the next chart then?

You are obviously not going to command the same sales multiple at a 70% gross margin as you do with a 33% gross margin. BABA has also retained a lot of profits on its books and that reduces downside risk, even in an exceptionally poor economy. At the current price of $101, the stock is not expensive, even if it produces little to no-growth over the next 12-24 months. We like the idea of playing it with covered calls as we had previously suggested. Those expecting the glory days of $300 per ADS to return are likely to be disappointed though.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here