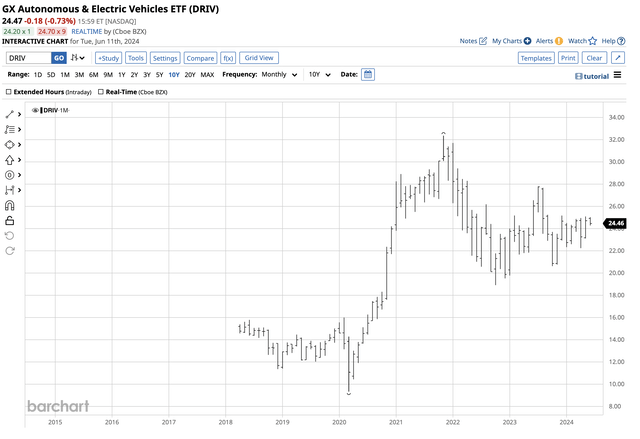

In a November 7, 2023 Seeking Alpha article on the Global X Autonomous & Electric Vehicles ETF (NASDAQ:DRIV), I highlighted the ETF’s significant price correction from the November 2021 $32.37 high to the October 2022 $18.91 low. I concluded the article with:

The bottom line is DRIV, and the EV industry face many roadblocks in late 2023. However, the ETF has declined to near the midpoint of the March 2020 low and the November 2021 high, offering value. DRIV is a contrarian investment in November 2023, but betting against technological advances has been a mistake for years.

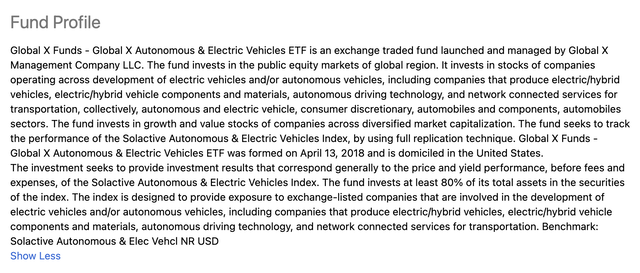

DRIV was trading at $22.08 per share on November 7, 2023. DRIV’s fund profile states:

Fund Profile for the DRIV ETF Product (Seeking Alpha)

DRIV has moved higher since November 2023, but it is not running away on the upside, and the ETF’s composition has changed.

DRIV edges higher since November 2023

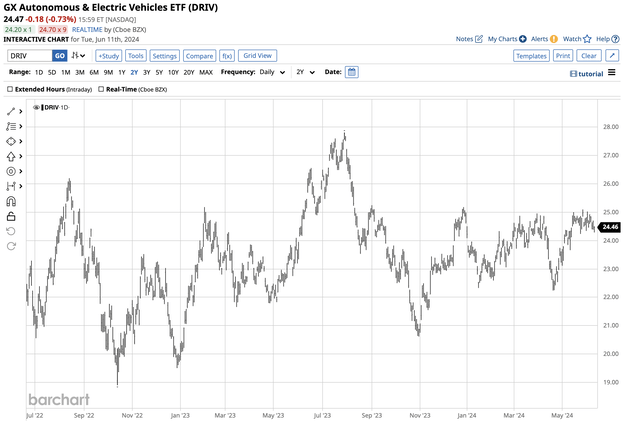

At the $24.46 level on June 11, DRIV has gained over 10.5% since my November article, but it remains in a sideways trading range.

Two-Year Chart of the DRIV ETF Product (Barchart)

The two-year chart illustrates the slightly bullish trend of higher lows since October 2022. DRIV ran out of bullish steam on July 31 at $27.80 per share, but the pattern of higher lows remains intact in June 2024.

The composition of the holdings has changed – More chips and less car manufacturers

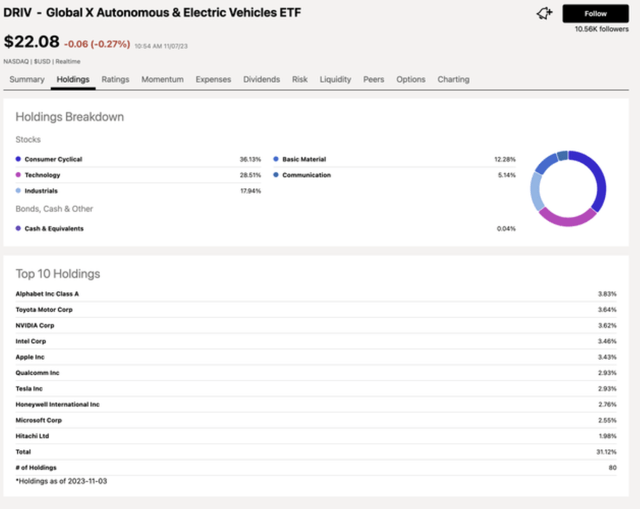

I spotlighted DRIV’s holdings in the November 2023 article:

Top Holdings of the DRIVE ETF Product in November 2023 (Seeking Alpha)

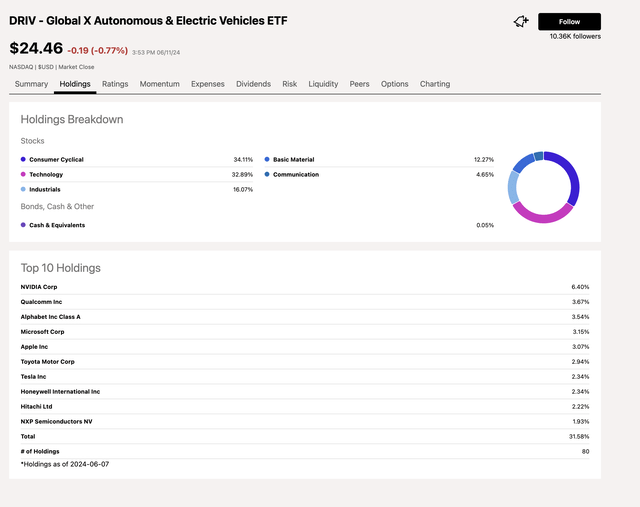

The ETF’s composition has changed since November 2023, accounting for its gain over the period.

Top Holdings of the DRIVE ETF Product in June 2024 (Seeking Alpha)

The charts show the following differences:

- NVDA exposure increased from 3.62% to 6.40%

- TSLA exposure declined from 2.93% to 2.34%.

- Toyota’s exposure fell from 3.64% to 2.94%.

- QCOM exposure grew from 2.93% to 3.67%.

- MSFT exposure increased from 2.55% to 3.15%.

The changed composition highlights the shift from EV manufacturers to chipmakers as the ETF is more weighted towards the technological underpinnings of the EV and autonomous vehicle business.

Oil and gasoline prices and concerns over EV’s future may be weighing on DRIV

While the trend in DRIV is marginally bullish, with the ETF making higher lows, it is not running away on the upside. One issue could be steady to weak crude oil and gasoline prices since November 2023.

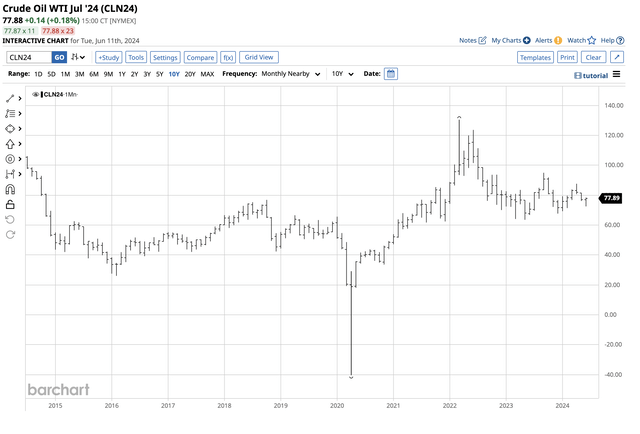

Monthly Chart of NYMEX Crude Oil Futures Prices (Barchart)

NYMEX crude oil prices traded in a $72.16 to $83.60 per barrel range in November 2023. At just below the $78 level on June 12, 2024, the commodity was in the middle of that range.

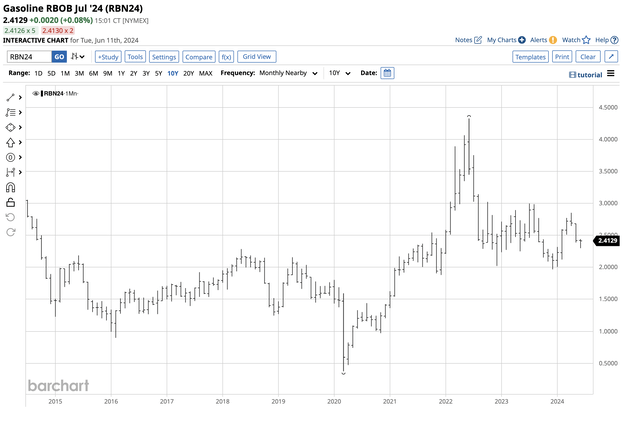

Monthly Chart of NYMEX RBOB Gasoline Futures (Barchart)

Meanwhile, NYMEX RBOB gasoline futures traded in a $2.09 to $2.2874 per gallon range in November 2023, a seasonally weak period as gasoline demand tends to fall in winter. At over the $2.40 level on June 12, gasoline prices are higher as the market moves into the peak driving season during summer.

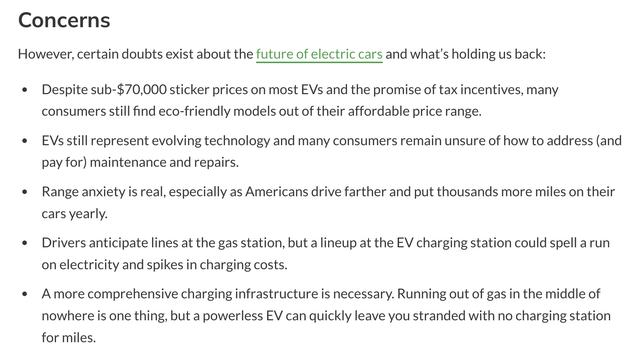

With no upside price spikes in crude oil and gasoline, the demand for EVs has not exploded. Moreover, high interest rates have caused a slowdown in consumer spending. While EV sales continue to increase, the following issues face the burgeoning market:

Issues and concerns facing the EV market (market watch-https://www.marketwatch.com/guides/insurance-services/electric-vehicle-statistics-2024/)

Meanwhile, cold temperatures across the Midwest of the U.S. during the recent winter have caused headaches for EV owners.

The November 2024 election could impact DRIV and the EV market

Energy is one of the most significant issues on the ballot in the November 2024 U.S. election. The incumbent administration favors alternative and renewable fuels, inhibiting hydrocarbons. A second term for President Biden would support EV ownership by continuing green energy regulations. Meanwhile, the opposition party favors a “drill-baby-drill” and “frack-baby-frack” approach to fossil fuels, supporting energy independence and increased revenues through exports. A second term for former President Trump would likely change the regulatory environment in the other direction, not supporting EVs to the same extent as the current Biden administration.

While EV ownership will likely continue to increase, the U.S. trajectory may depend on the November election.

I remain cautiously bullish, but DRIV is at the top end of its trading range

I remain cautiously bullish on DRIV, as the ETF’s composition has gently shifted from exposure to automakers to chipmakers. Nvidia’s spectacular rise to record highs likely accounted for the bullish performance from November 2023.

Meanwhile, DRIV remains in a range, with the ETF trading near the upper end of the trading band.

Monthly Chart of the DRIV ETF Product (Barchart)

The monthly chart shows that technical support and resistance levels are at $18.91 and $27.80 per share, respectively. On June 12, the stock was above the midpoint at the $24.47 level.

Aside from the upcoming election, high interest rates continue to weigh on consumer EV purchases. When the Fed begins cutting rates, lower financing costs could cause DRIV to rally and challenge the technical resistance at $27.80 per share. At $24.47, DRIV had over $540.7 million in assets under management. DRIV trades an average of over 80,000 shares daily and charges a 0.68% management fee. The $0.40 blended dividend translates to a 1.63% yield. I continue to favor DRIV as the shift toward chips makes the ETF more than an EV ETF.

Read the full article here