My dividend! I thought it was safe! There were like 100 articles assuring me it was safe! How could it be at risk after obvious signs that most analysts ignored in favor of writing another bad bull article?

Seeking Alpha is already flooded with articles on Medical Properties Trust (NYSE:MPW) because people keep clicking them. Got 10 bull calls wrong? Just publish more!

Sorry, whose article did you think you clicked? I say it how it is.

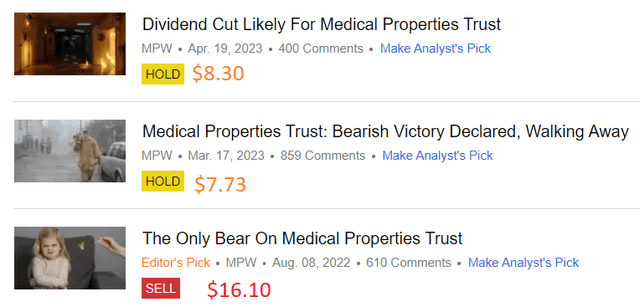

We don’t typically cover MPW. I’ve written only three public articles on the stock. Here they are, with the rating (Seeking Alpha premium feature) and the price at publication:

Seeking Alpha

Transparency is good. With so much interest in MPW, it would be great for every analyst to include their own image. Hmm? Too much snark? Never enough.

You didn’t follow me because I’m the most polite analyst on the site. You just like seeing someone hit calls. That’s cool. Me too.

Dividend Disaster

In April, I told readers a dividend cut was likely for Medical Properties Trust.

Now investors are waking up to the risk.

This was my quick take on the results:

Seems many bulls don’t know why it was going down. Two things jumped out at me.

1. FFO was supported by accepting equity in an investment instead of cash. Landlords want cash. If tenants can’t get cash, that’s a concern.

MPW especially should want cash given their debts and their dividend.

2. They’re providing more money to Steward. Part of a group providing these funds (which seems better than doing it solo, but I haven’t dug into that). The reason this is an issue is that MPW has an extremely high WACC if we assume a cost of equity anywhere remotely near what shareholders want to earn.

MPW could be using that cash to buy back its own debt at a big yield. That would not inflate near-term AFFO (gain on debt retirement is excluded). They would only get the interest savings instead of recording the actual yield on the debt. This would look weak to some of the bulls, but it would put pressure on the bears.

If they were exceedingly confident, they might use a bit on buybacks.

But the way to really wreck shorts is to retire their debt at huge discounts. It makes the balance sheet stronger and that wrecks the thesis for bears who really want the idea to play out quickly. Who wants to short a company with low debt and big cash flows? That kind of company never goes to zero.

Therefore, if management is competent, they wouldn’t spend their precious cash on something that makes them look bad unless they fear a worse outcome. If they aren’t competent, that wouldn’t be a good argument for bulls either.

Those are the reasons I see for MPW falling 14% on the day.

That quick assessment still looks good.

Cost of Capital

If MPW expected to maintain the dividend, they would assign a very high cost of capital to their equity. They would be inclined to sell off assets and split the capital between paying down debts and repurchasing shares.

Only repurchasing shares isn’t great because it drives up leverage. If you sell assets and spend everything on buybacks, leverage increases and creditors are unhappy. If you still want access to debt markets in the future, then creditors do matter.

However, MPW’s debt currently trades at yields around 10%. Specifically, I’m referencing two bonds.

First bond:

- The 5% bonds that mature on 10/15/2027 had a yield to maturity of 9.75% based on a price of $84.02.

- CUSIP: 55342UAH7.

- Symbol: MPW4539953.

Second bond:

- The 4.625% bonds that mature on 08/01/2029 had a yield to maturity of 10.04% based on a price of $76.13.

- CUSIP: 55342UAJ3.

- Symbol: MPW4860582.

MPW’s current annual dividend rate of $1.16 per share (paid at $.29 quarterly) is a 14.26% yield.

An investor could pretend that the cost of the bonds is only 4.625% to 5%, but that’s bad analysis. While MPW only pays that interest rate, they can repurchase bonds in the open market. They can choose each day whether they want to repurchase those debts or have them remain outstanding. They’re still outstanding.

For reference, those bond yields have been even higher. So MPW has passed on opportunities to retire that debt at even better rates.

Steward

Who actually wants to hear more about Steward? Yet they keep coming up because of the huge connection. Was lending money to Steward a better risk-adjusted rate of return than buying back their own debt near 10%?

However, that picture changes if you’re running MPW. If you’re running MPW, you want to plan on a roughly 0% chance of default. Therefore, your own debt represents your own risk-free rate. Is the rate paid on Steward, after adjusting for the risk of default, really better than getting 10% risk-free?

But wait, can MPW really save 10% by repurchasing that debt?

I believe MPW could actually save more. If MPW repurchases their own debt, they reduce their leverage. By reducing their debt, they become a better credit risk. That improves their ability to negotiate rates on any new debt/recurring debt.

Is MPW really getting a rate substantially above 10%? That would suggest Steward is in worse condition than they portray.

MPW described the rate by saying:

The lending group and the Steward facility, including MPT, will be paid monthly at double-digit rates. And as noted, our investment is collateralized by a borrowing base of government and commercial receivables.

So we can think of a few scenarios:

- The rate is materially higher than 10%.

- MPW’s management makes bad decisions.

- MPW was helping this deal go through to protect Steward because Steward going under would be very bad for them.

I think option 3 is most likely. MPW isn’t actually getting a return on the cash far enough above 10% to make it a good choice by itself. However, they’re already so heavily exposed to Steward that they want to protect their investment.

This is why I’m not a fan of the model. For trolls who shout about this being MPW’s model, I don’t care. I’m not obligated to care. The stock is down over 67%. The debt yields about 10%. There’s plenty of foreshadowing that a dividend cut is on the horizon. This model didn’t give shareholders what they wanted. I’m assuming they wanted dividend stability, right?

Options On the Table

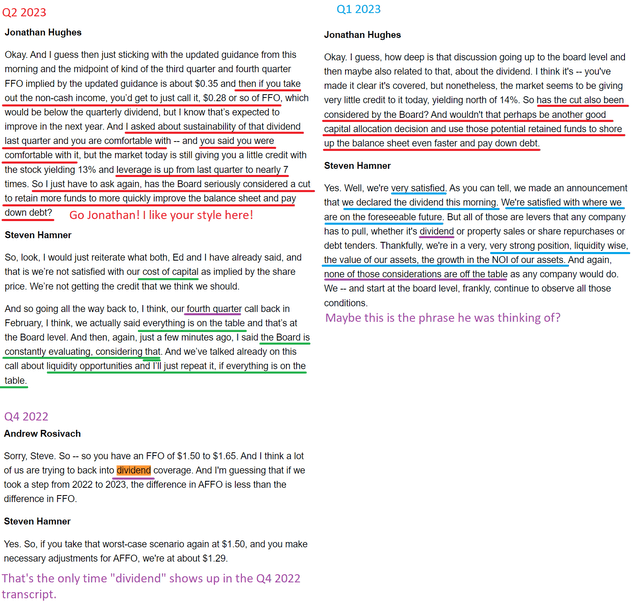

Management referenced all options being on the table. This time it felt much more direct than it was in Q1 2023. Back in Q1 2023, they were even declaring the dividend. Here are the relevant portions from each of the three calls:

Seeking Alpha Transcripts, The REIT Forum for highlighting and commentary

There are two obvious solutions:

- Cut the dividend.

- Get a buyout deal.

I expect many investors wouldn’t be happy with either. However, the second option would probably result in a much better price. I still believe that’s the primary risk to the bears. MPW’s real estate still has value and a big real estate investor could make a bid to buy the entire company.

I expect the company will eventually choose between those. It’s possible that they could pick both, but I find it very unlikely that they would be able to pick “neither” indefinitely.

I’m still neutral on shares because option 1 and option 2 have such dramatically different implications. There is no option for “neutral” as a rating, so it comes out as “hold”.

I’ll respond to a few comments, but MPW articles often draw hundreds. If I don’t respond to yours, please don’t take it personally. While I’ll ignore most of the dumb or clueless comments, I’ll miss plenty of great comments also. If you’re still reading, odds are your comment will be one of the better ones.

Read the full article here