The ARK Innovation ETF (NYSEARCA:ARKK) has built a concentrated portfolio in high-potential tech companies that could yield strong performance results for investors if the U.S. economy remains on an upward trajectory.

The performance of the ARK Innovation ETF has also improved lately, partially due to strongly performing portfolio holdings such as Robinhood Markets, Inc. (HOOD).

The ARK Innovation ETF is benefiting from its concentrated approach in its portfolio and though the fund flow picture looks a big negative, I see the exchange-traded fund as a promising, long-term ETF investment including the most promising tech companies in the market.

My Rating History

In my March 2024 piece on the exchange-traded fund “The ARK Innovation ETF: A Second Lease On Life (Upgrade)” I specified why I thought the ETF could be a promising investment for investors.

Particularly, the ETF’s investment in Coinbase Global Inc. (COIN) provided thesis support, primarily because the cryptocurrency market was on a tear, led by a recovery of the world’s largest cryptocurrency Bitcoin.

The U.S. economy appears to be in great shape right now, which adds fuel to procyclical, tech-focused ETFs with concentrated portfolio holdings.

Strong Performance Rebound

The ARK Innovation ETF has delivered wildly fluctuating returns in the last couple of years, as the exchange-traded fund’s exposure to high-growth stocks paid off handsomely during the pandemic. The fall-out of the pandemic, however, led to a deflating of the bubble in growth stocks, which in turn caused substantial underperformance for the ARK Innovation ETF.

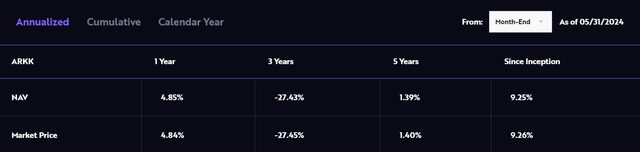

With that being said, though, it looks as if the fortunes of the exchange-traded fund are once again changing. The ARK Innovation ETF has produced a 4.85% return, based on net asset value, in the last year, which is substantially better than the annualized negative 3-year return of 27.4%.

The ETF suffered mightily from the compression of valuation multiples, particularly in the tech sector, but the ETF has rebalanced its portfolio and focuses on a few high-potential investments.

Annualized Returns (ARK Innovation ETF)

Top Ten Holdings

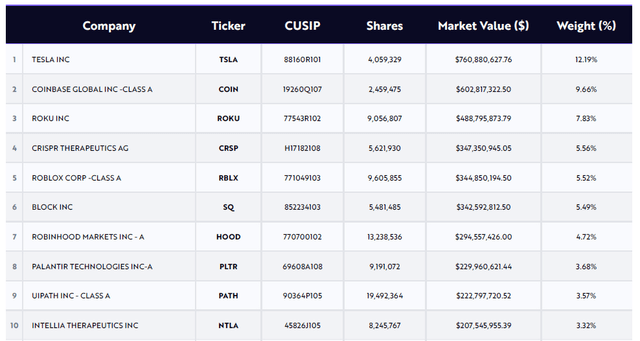

The ARK Innovation ETF continues to be highly concentrated in just a small number of high-potential stocks such as electric vehicle company Tesla Inc. (TSLA), which is the ETF’s largest holding with a portfolio weight of 12.2%, cryptocurrency marketplace Coinbase Global, streaming platform Roku Inc. (ROKU), software/AI company Palantir Technologies Inc. (PLTR) and fintech startup Block Inc. (SQ).

One investment that did particularly well for Cathy Wood’s flagship exchange-traded fund was Robinhood, which has delivered a 75% gain year-to-date and which profited from increased retail trading activity.

Top 10 Holdings (ARK Innovation ETF)

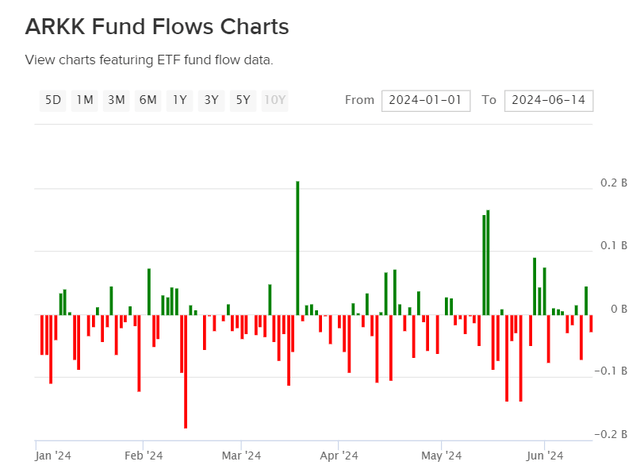

What doesn’t look so good is the ETF’s fund flow profile. Since the start of the year, the ARK Innovation ETF has suffered net fund outflows in the amount of $1.72 billion, which probably has something to do with the ETF’s improving performance.

ARKK Fund Flows Charts (ARK Innovation ETF)

With that said, though, I think the setup for the ARK Innovation ETF is very promising, particularly because the ETF’s top holdings consist of procyclical tech investments.

In May, employers added a whopping 272K new jobs (excluding farm jobs) which flew past consensus estimates of 190K new jobs. Strong job and economic growth are two pillars of support for a growth-oriented, tech-focused ETF.

Catalyst For Coinbase Global Holding

Cryptocurrency markets are performing well right now and continue to profit from growing adoption of the world’s largest currency, Bitcoin, which is changing hands for $65,000 at the time of writing.

The ARK Innovation ETF profits from this trend through its 10% holding in cryptocurrency marketplace Coinbase Global, which is used primarily by retail traders. Coinbase Global benefitted, just like Robinhood Markets, from increasing retail trading due to a surge in Bitcoin prices in 2024.

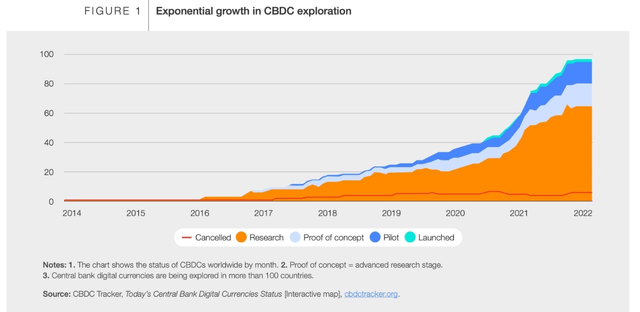

What I view as a potential catalyst for Bitcoin, and other cryptos, is an introduction of a central bank-backed digital currency, or CBDC, which could further support the adoption of decentralized financial products. Particularly, those investors, retail and institutional, that are critical of the surveillance and control aspects of a centrally issued CBDC could be pushed into cryptocurrencies like Bitcoin which heavily relies on a user’s anonymity. Growing demand and limited supply of Bitcoins could potentially be a catalyst for the cryptocurrency to see substantial price gains in the future.

As ARKK’s second-biggest holding in the portfolio, the exchange-traded fund could be a big beneficiary if central banks indeed go ahead and essentially launch their own cryptocurrencies. According to CBDC tracker, the interest in central bank digital currencies is rising exponentially.

CBDC Growth (CBDC Tracker)

The ARK Innovation ETF Has Cyclical NAV Upside

The ARK Innovation ETF has considerable net asset value upside in a growing economy, which is when tech-focused startups also tend to do well. As of June 17, 2024, the ARK Innovation ETF had a net asset value of $44.13 per share, which presently implies a 0.02% premium.

So far in the second quarter, ARKK has sold between a 0.06% premium to NAV and a 0.11% discount to net asset value.

Since ETFs are valued based on the sum of net asset values of their portfolio holdings, they typically only see small variations between market price and NAV.

Why The Investment Thesis Might Disappoint

There is a downside to the ARK Innovation ETF’s aggressive concentration approach: If the U.S. economy fell into a recession and growth estimates for fast-growing technology companies like Tesla were revised downward, the exchange-traded fund has a strong chance of under-performing the market by a wide margin. The concentration strategy can work both in favor and against the ARK Innovation ETF.

Slowing growth in the U.S. economy or weak job growth might be two indicators that the ARK Innovation ETF would be poised for harder times moving forward.

My Conclusion

The ARK Innovation ETF has the potential to see strong net asset value returns if the U.S. economy continues to grow, which as it would primarily benefit growth-sensitive technology plays such as Tesla, Roku, Block or Palantir Technologies.

The ETF’s fund flows, however, have been a disappointment, primarily because the ARK Innovation ETF’s performance is improving, at least in comparison to the previous 3-year period. I do anticipate, however, seeing positive fund inflows if the present bull run in stock markets continues.

I think that the ARK Innovation ETF’s recent performance rebound is a positive signal that shows investors that concentrated investment approaches have the potential to deliver strong gains and could deliver alpha for long-term investors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here