The recent resurgence in Treasury yield is likely to blame for both AT&T Inc. (NYSE:T) and Verizon Communications Inc.’s (NYSE:VZ) declines. As discussed in our previous coverage, we believe the performance of both telco stocks are closely pegged to movements in Treasury bonds with a consistent long-term average yield differential. But given their intact fundamental prospects coming out of a robust Q4, the recent declines represent an attractive setup to partake in quality dividend yield alongside upside appreciation.

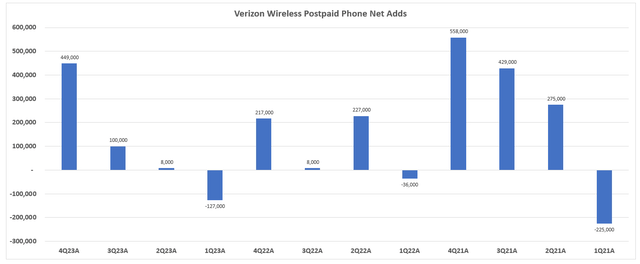

Heading into 2024, we see particularly strength in Verizon’s recovery, while AT&T is expected to remain resilient. Verizon has largely been the “underdog” among the big three national cellular carriers in recent years. It has consistently ceded market share in consumer wireless mobility to rivals AT&T and T-Mobile US (TMUS) since 2022. But the company is expected to post a breakthrough this year. After two consecutive quarters of reacceleration in consumer postpaid phone net adds, Verizon is expected to outshine its peers this year as they experience emerging exhaustion in mobility subscriptions. The latest results also reinforce new consumer division chief Sowmyanaraya Sampath’s ambitions for 1 million new customers for the segment this year. This is expected to complement Verizon’s improving average revenue per account with strong myPlan uptake, as well as its solid foothold in the 5G fixed wireless access (“FWA”) business.

Meanwhile, AT&T has started to experience some bumpiness in postpaid phone net adds in recent quarters. This suggests potential exhaustion to its eye-watering quarterly net adds previously observed through 2021 and early 2022. Meanwhile, its broadband business – which prioritizes fiber internet sales – is also starting to decelerate. In the meantime, its early push into 5G fixed wireless deployment through “AT&T Internet Air” has also yet to ramp towards the extent of dominant market share observed at Verizon and T-Mobile.

One tailwind that is shared between AT&T and Verizon is that both companies are poised to experience favorable cash flow expansion. With the peak of capex spend on 5G investments now behind them, both are better positioned to support their respective deleveraging goals and dividend payments this year. However, Verizon has seemingly emerged as the better buy this time around. In addition to a stronger FCF trajectory, the stock also maintains its historical yield differential to Treasury at current levels. It is also relatively better positioned than AT&T for upside potential underpinned by stronger operating performance prospects ahead.

Fiber vs. FWA

The focus on growth has primarily been felt in wireless mobility in recent years, given the telco industry’s pivot to monetize their yearslong investments into the build-out of a 5G network. But momentum in broadband is rapidly catching up. The trend is fueled by the combination of cord-cutters and the advent of nascent technologies like AI that have propelled demand for access to high performance, low latency connectivity. And this has been a boon for both AT&T and Verizon, which have been key beneficiaries in the era where connectivity comes first. This is also evident in both companies’ fundamental resilience in recent quarters, despite the shaky macro backdrop facing consumer end-markets.

AT&T

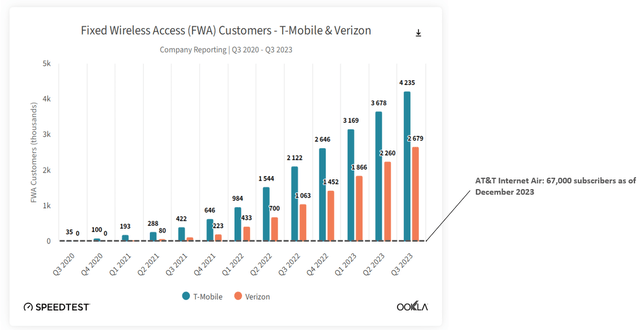

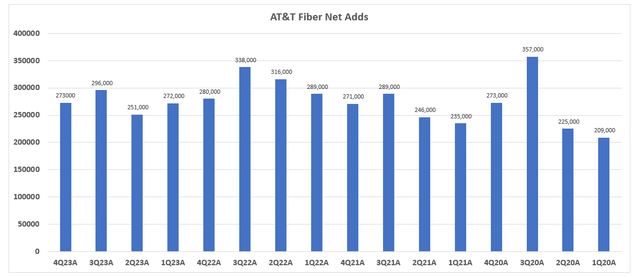

At AT&T, the company has long favored fiber-to-the-home, and has only recently expanded into the 5G FWA market in August. AT&T’s delayed expansion into 5G FWA is likely a reflection of restraints from its C-band coverage relative to Verizon and T-Mobiles. And this is likely to be a costly mishap for its broadband business. Specifically, the service – dubbed “AT&T Internet Air” – has quickly ballooned its subscriber count from 25,000 last reported in October, to now 67,000. But this remains a far cry from Verizon’s share of the FWA market.

OOKLA

Meanwhile, momentum in its core fiber deployments, which has accelerated in the past two years, has also started to show signs of exhaustion in recent quarters.

Data from investors.att.com

And increasing FWA adoption is also threatening the prospects of fiber. More than 80% of new broadband subscriptions in the U.S. have been FWA deployments over the past 1.5 years.

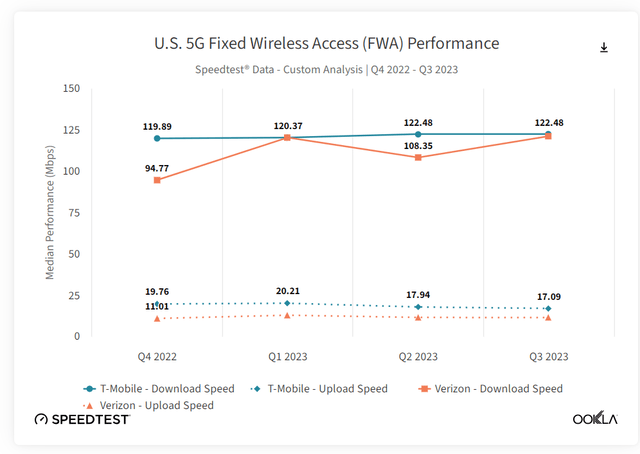

AT&T’s broadband offerings also are not as competitively priced as current FWA offerings in the marketplace. The company’s fiber plans start at $55/ month ($35/month bundle offering with wireless subscription) for 300Mbps, and goes as high as $80/month ($60/month bundle offering) for up to 1GIG speed. Meanwhile, AT&T Internet Air is priced at $55/month (or $35/month bundle offering), with underperforming download speeds between 40 Mbps to 140 Mbps. This compares to $60/month ($35/month bundle offering) at Verizon and $50/month ($30/month bundle offering) at T-Mobile, where both boasts higher median download speeds that exceed 150 Mbps in urban areas. Taken together, we expect some normalization in the pace of broadband growth at AT&T going forward, until AT&T Internet Air shows progress in ramping up deployments against competition.

Verizon

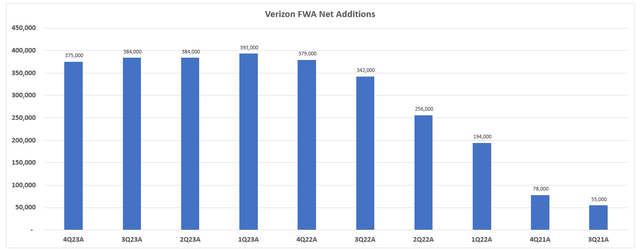

On the other hand, Verizon has been honing in on gaining share of FWA opportunities since its deployment of 5G coverage during the pandemic. FWA has been a key piece to Verizon’s 5G monetization strategy. It has played a key role in compensating for Verizon’s steepening market share loss to rivals in wireless mobility in recent years. Although Verizon currently trails T-Mobile in FWA market share, it still commands close to 40% of related broadband subscriptions in the U.S. And its quarterly FWA net adds have also remained resiliently above the 300,000-mark for six consecutive quarters counting the latest.

Data from verizon.com

The results continue to highlight Verizon’s role as a sustained share gainer amid rising FWA adoption, as secular declines in cable and DSL accelerate. Specifically, the “FWA value proposition” has been most felt across rural areas. Despite fiber’s typically superior performance to FWA, the latter has emerged as a higher performance alternative in rural areas – or “digital deserts” – with limited connectivity access. And Verizon FWA’s improving performance has been a key differentiator in said rural areas, with recent data showing its capture of more than 10% churn from T-Mobile.

OOKLA

We expect this competitive advantage to increase as Verizon ramps up full deployment of its “licensed C-band spectrum” across every market in the U.S., which was finalized in 2H23. This is corroborated by the latest results, which showed better performance in regions where Verizon has deployed C-Band. Specifically in the FWA business, 80% of gross consumer adds were from its first 76 C-Band markets. Over the longer-term, full C-Band deployment is expected to enable coverage for 158 “mostly rural” regions that will reach more than 40 million Americans, thus reinforcing Verizon’s prospects for further share gains. And the opportunity is expected to grow further as FWA transitions from a complementary service to pre-existing broadband solutions such as fiber, to a competitive threat as highlighted in the earlier section.

Wireless Mobility

AT&T

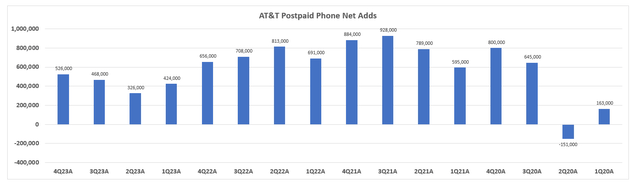

A similarly eerie trend of exhaustion is observed at AT&T’s wireless mobility business. Specifically, postpaid phone net adds, which has been gaining substantial share from Verizon through 2021 and 2022, have been mixed in recent quarters. Despite the choppy rebound observed in 2H23 – likely driven by the supply-constrained iPhone 15 debut and stronger-than-expected holiday season – postpaid phone net adds at AT&T are losing steam.

Data from investors.att.com

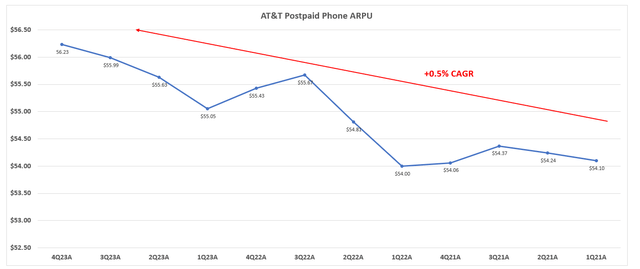

Over the same period, AT&T’s postpaid phone ARPU has also expanded at a quarterly CAGR of about 0.5%.

Data from investors.att.com

This likely been a key complement to subscription net adds in driving revenue growth and margin expansion at AT&T. But recent deceleration suggests that finding a balance in juggling pricing and demand remains a difficult sport for AT&T, especially amid tense competition.

As discussed in previous coverages, one of the key drivers of market share gains at AT&T in recent years is its competitive, yet balanced, promotional pricing strategy. This has especially been evident during new device releases. Instead of subscription price markdowns or device giveaways, AT&T has favored modest trade-ins and other “value proposition-led” promotional strategies that would encourage sign-ups on higher-margin Unlimited plans. But this “value proposition-led” competitive advantage is likely losing its luster to price sensitive consumers. Recent survey findings show an increasing preference for T-Mobile’s Magenta unlimited data plan, citing unmatched value for money. Although AT&T has the most comprehensive coverage across the country, T-Mobile boasts the “best 5G coverage.” This has accordingly played a role in dulling the appeal of AT&T’s premium pricing on its 5G plans.

Despite the utility-like nature of connectivity services in the digital era, the set-up underscores stiffening competition against AT&T. We think the company remains prone to further deceleration in the postpaid phone business within the near-term. The current situation is expected to be exacerbated by an impending contract renewal cycle, as previously locked-in pricing on ~36-month Unlimited plans during the pandemic near expiry. This is likely to introduce incremental pricing risks to mitigate against market share loss to rivals like T-Mobile or Verizon, which are also bolstering their respective value proposition.

Verizon

Meanwhile, at Verizon, the company has largely maintained a stable average revenue per account (“ARPA”) in recent years (Verizon does not separately disclose ARPU on consumer postpaid phone net adds). To enhance its value pros option amid rising competition, the company has increasingly opted for service bundles in recent years. In addition to FWA and Fios Fiber home broadband bundles, Verizon has also introduced value-adding subscription bundles for its wireless mobility offerings. They include partnerships with Apple (AAPL), Warner Bros. Discovery (WBD), Disney (DIS), Netflix (NFLX) and even Walmart (WMT) to bring Apple One, popular streaming platforms, and grocery shopping perks to postpaid phone subscribers.

This is likely to preserve its Unlimited plans’ appeal to the consumer end-market. Specifically, households are increasingly looking for ways to consolidate spending and realize incremental savings amid ongoing macroeconomic uncertainties. We believe this momentum was already evident in Verizon’s fourth quarter performance, with total “myPlan” bundle subscribers having reached 13 million. This has also been a boon for consistent ARPA expansion, which was a key complementary driver to wireless service revenue growth of 3.2% y/y in Q4. The ensuing impact on profitability and FCF has largely overshadowed the $5.8 billion headwind pertaining to a one-time impairment charge in Verizon’s business segment due to ongoing secular declines.

Inherent consumer sensitivity is on full display under the current macro backdrop, considering persistent, though easing, inflationary pressures and dwindling household savings. Recent data shows that the majority of Americans now have lower savings than they did before the pandemic. And the most affluent 20% are now only about modestly better off than pre-pandemic levels post-inflation, highlighting increasing weakness in consumer spending power ahead. Meanwhile, credit card debt has exceeded a record $1.08 trillion, up almost 40% in the last two years. There are also fewer cardholders who have been “paying off their balances in full,” thus contributing to the consistent rise in delinquency rates amid all-time high borrowing costs.

And tightening financial conditions are likely to make bundle savings offered by Verizon on critical day-to-day services a unique value proposition. Paired with the company’s improving ARPA, incremental subscription share gains could be a boon to 2024 top line prospects generated on postpaid phone adds and, inadvertently, underlying cash flows. Although the recovery may still be in early stages, the second consecutive quarter of accelerating wireless postpaid phone net additions in Q4 provides reinforcement.

Data from verizon.com

Down to the Cash Flows

Taken together, we believe Verizon demonstrates a stronger proposition in ensuring sustained cash flow expansion in 2024. This will be primarily underpinned by an improving fundamental outlook at the operating level. Meanwhile, we expect emerging risks of imminent market share loss at AT&T across both its wireless mobility and broadband businesses due to impending contract renewal, competition, and secular dynamics. While both companies are poised to benefit from the balance sheet perspective as peak 5G investment outlays are now behind them, Verizon’s anticipated business improvements mark an incremental accretive factor to its valuation prospects.

Specifically, Verizon ended 2023 with $18.7 billion in FCF, up 33% from $14.1 billion in the prior year. The company has maintained optimism for “continued strong FCF generation going forward,” while stopping short of providing a quantified guidance. In addition to a $1.5 billion capital intensity reduction pertaining to 5G deployments, FCF will also benefit from gradual ARPA expansion underpinned by accelerating share gains in the consumer business. While FCF expansion is critical to its deleveraging goals, it also reinforces prospects for further dividend expansion. The company had a FCF to dividend payout ratio of 59% in 2023 and has raised dividends for 17 consecutive years. The latest results make it safe to say that this trend will persist in the current year with durability.

Meanwhile, AT&T achieved $16.8 billion in full year 2023 FCF, which exceeds its previously increased guidance of “about $16.5 billion.” In addition to resilient subscription adds in 2H23 alongside ARPU expansion in its core consumer wireless business, the company has also achieved its target net annualized cost-savings run-rate of $6+ billion in mid-2023. Looking ahead, AT&T guides full year 2024 free cash flow of $17-$18 billion. The 2024 guidance is inclusive of contributions stemming from an additional $2+ billion annualized cost-savings run-rate targeted by mid-2026, alongside adjusted EBITDA expansion and a slight reduction in capital investments.

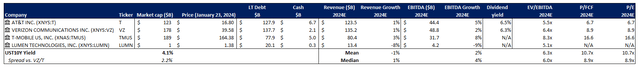

From a valuation and dividend yield perspective, the Verizon stock is also traded at a slight discount to the telecom carrier peer group average, likely reflecting its previous fundamental underperformance still.

Data from Seeking Alpha and S&P Capital IQ

We believe this provides a sufficiently de-risked opportunity and compensates for the impact of lingering macro uncertainties and competitive headwinds facing the industry. The Verizon stock’s current dividend yield at 6.3% is also reinforced by its sustained cash flow trajectory in our opinion. The Verizon stock’s yield differential to U.S. Treasury remains consistent with the historical average of about 3 points as well at current levels. Taken together, we believe Verizon offers a compelling set-up for investors to partake in both dividend income and valuation upside potential at current levels.

Meanwhile, AT&T offers a similar dividend payout structure at current levels with a 6.5% yield (T.PR.C 5.86%; T.PR.A 5.85%). Its yield differential to U.S. Treasury also remains consistent with the historical average of about 2.9 points. However, we remain cautious on the durability of its near-term cash flow prospects compared to Verizon’s. Paired with AT&T’s ongoing deleveraging requirements, the set-up offers a limited margin of error to protect dividends crucial to its income-focused investor base.

Is AT&T or Verizon the Better Dividend Stock in 2024?

While both names demonstrate improving cash flow prospects to support their respective yield structures at current levels, we believe there is greater durability to Verizon’s 2024 outlook. The stock has also restored its historical yield differential from 10-year U.S. Treasury (US10Y), after some divergence during the late December valuation upsurge. Verizon is also trading at a discount to peers still, despite an improving outlook. Taken together, the stock remains well-positioned for both dividend- and value appreciation-based income from current levels.

Read the full article here