I am in an awkward position. The one sector that I focus upon professionally, cannabis stocks, stinks. The New Cannabis Ventures Global Cannabis Stock Index is down 16.5% so far in 2023, while the S&P 500 is up 16.6%. The GCSI is down over 91% since February 2021.

I am not that surprised with the weakness, though I think cannabis stocks are very cheap. I expect the industry to do well over time, too. Near the end of May, right after I transitioned my 420 Investor service to Seeking Alpha, Rena Sherbill interviewed me, and I told her how it was not necessarily time to buy cannabis stocks.

The year got off to a strong start, with the GCSI rising sharply in January after getting destroyed in December. I warned investors to be careful, and I have continued to share my near-term caution. I began writing articles at Seeking Alpha again in late October (every week!), and I have had a good mix of negative perspectives as well as positive ones. Perhaps more importantly, I have been loud and clear with my subscribers about this not being a good time to bet big on cannabis stocks.

One of the problems I have seen with the sector is the AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS), which is down 23% year-to-date, which is worse than the market. Last week, I wrote a piece for my subscribers warning them that I remain very concerned about it. I first shared my negative perspective on MSOS here in mid-November, when it had closed at $11.54. It is now at $5.38, down 53.4% since the article.

At Seeking Alpha, I wrote about MSOS again in January, when I revealed extensive redemptions of the ETF, and in February, when I explained how the MSOS meltdown was hurting the entire sector. It was down only 3.9% then, and now it is down 23.0%. Today, I want to provide another update on MSOS and explain my continued concern.

MSOS Lacks Diversification

When I called out MSOS in mid-November, I pointed to its being extremely undiversified. Not only is this still the case, but it has gotten worse. Then, MSOS had 75% exposure to just five names, the five largest MSOs by revenue and market cap. Now, the exposure to those five companies is 79%. Add in another one, and it is 86.6%:

AdvisorShares

The most exposure is to Green Thumb Industries (OTCQX:GTBIF) and Curaleaf (OTCPK:CURLF), a total of 47%. Not only do these two stocks not represent that much of the space by revenue or by market cap, but they are not attractive. I recently explained why I think it is not time to buy GTI, and, while it has declined since I predicted it would fall, I find Curaleaf to be too expensive. Last week, I discussed why I am avoiding Verano Holdings (OTCQX:VRNOF). The only one of these stocks that I include in my 420 Investor model portfolios is Trulieve (OTCQX:TCNNF). I don’t include Cresco Labs (OTCQX:CRLBF) or TerrAscend (OTCQX:TSNDF), which I warned my subscribers about being overvalued.

I find more attractive stocks beyond TCNNF in the MSO space, and there are stocks in other parts of the cannabis sector too. Such excessive concentration should turn investors away from MSOS!

The Share Count Has Stabilized

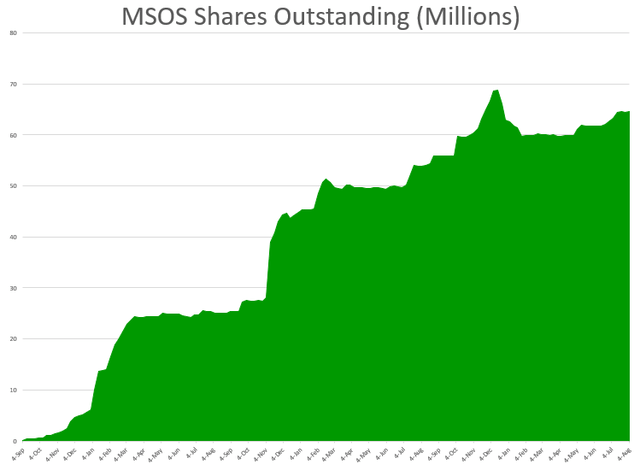

I continue to be grateful to AdvisorShares for how they helped the sector with the launch of the ETF in September 2020, but their growth is behind them. The share count peaked in December:

Alan Brochstein using AdvisorShares data

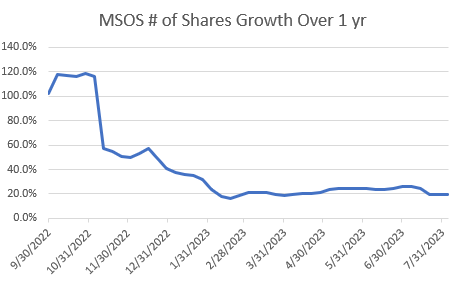

After bottoming in early April, the share count, at 64.615 million shares, has increased 2.6% since year-end. Compared to a year ago, it is up 19.9%. This, though, is a lot less growth than previously:

Alan Brochstein using AdvisorShares data

I don’t have a tool for predicting redemptions of shares. The lack of growth, though, is concerning. I think that redemptions again would be problematic. With so much of the ETF’s holdings in just six names, these would surely be sold. Trading volumes in the sector are way down, and this could be a problem.

Conclusion

It would be great if there were a good ETF for cannabis investors. In my view, MSOS is not one, but it remains very popular with investors. As I have discussed previously, the fund manager doesn’t seem very competent. Further, there is more to the sector than just American cannabis companies, including ancillary companies and Canadian LPs that I have highlighted favorably.

I don’t think there is any reason for investors to buy MSOS unless they are unable to buy OTC stocks. If they like the holdings, they should buy them instead of the ETF. This would save the management fee! More importantly, investors who buy their own stocks can avoid the very poor diversification that I discussed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here