Warren Buffett’s Berkshire Hathaway (NYSE:BRK.A) (NYSE:BRK.B) opened the books for the conglomerate’s Q2 2023/ 1H 2023 period on Saturday, 5th August, comfortably beating consensus expectations with $10.04 billion of operating profit. Interestingly, Berkshire posted a strong second quarter despite Buffett’s warning earlier this year that he expects the majority of Berkshire’s businesses to “report lower earnings this year than last year”. In addition to strong earnings, there are a few other key takeaways that BRK holders should not ignore: First, in Q2 2023, Berkshire’s balance sheet size topped $1 trillion for the first in history; Second, Buffett continues to prefer sitting in cash, or treasuries, as compared to buying businesses or public listed equity securities. Indeed, during the second quarter, Buffett was once again a net buyer of treasuries, and a net seller of equities. Third, Buffett still sees value in Berkshire’s equity, as indicated by $5.9 billion of share repurchases. In the following article, I will provide more context to these key takeaways and highlight to BRK investors everything they need to know about Berkshire Hathaway’s 1H 2023 results.

Earnings Top Expectations

Starting into the year, Buffett commented cautiously on the outlook for the U.S. economy, saying that “an incredible period for the American economy is likely coming to an end” and projecting that “the majority of Berkshire businesses will likely report lower earnings this year than last year”. Looking at Berkshire Hathaway’s results for Q2 2023/ 1H 2023, however, the pessimism turned out to be misplaced — highlighting once again Buffett’s long-held belief about the unpredictability of macro forecasts.

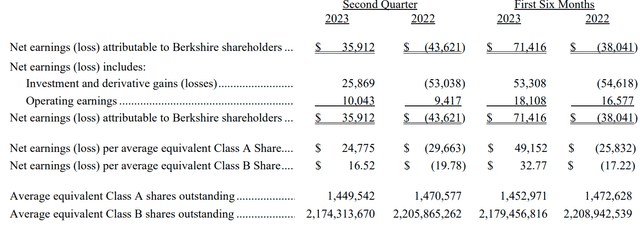

In the second quarter of 2023, Buffett’s Berkshire Hathaway generated revenues of approximately $92.5 billion, and accumulated operating income of $10.05 billion. This compares to Q2 2022 operating profits of $9.4 billion, indicating about 7% year-over-year growth.

For the first half of 2023, revenues came in at $179.9 billion. Operating income was $18.1billion, up 9% year over year.

BRK Q2 Results

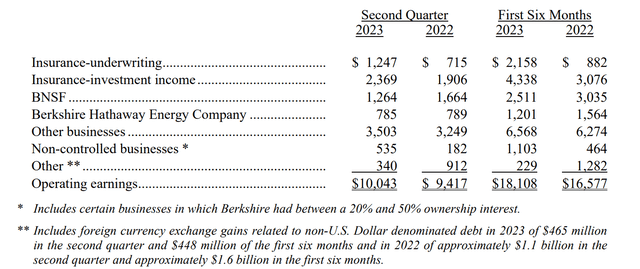

Berkshire Hathaway’s Q2 2023/ 1H 2023 was significantly influenced by a strong insurance business, given a 74% surge in insurance underwriting earnings, to $1.25 billion, combined with OPEX discipline at Geico, the auto insurer, and early signs of synergy tailwinds from the acquisition of Alleghany Corp. Notably, following profitability challenges in 2022, Geico’s insurance unit has now delivered net profitable results for two consecutive quarters, helped by higher underwriting premiums, reduced claim frequencies, and decreased advertising expenses.

Berkshire’s railroad business, BNSF, lagged expectations: In Q2 2023, the railroad business suffered from both a drop in freight volumes, as well as an increase in wage inflation, which led to a 24% drop in operating profits for the segment.

Again on the brighter side, Berkshire Hathaway benefitted from rate hikes, as the conglomerate’s cash holdings, invested in short-dated U.S. debt securities yielded attractive, almost equity-like, returns, generating close to $3 billion of interest earnings in 1H 2023.

BRK Q2 Results

The Balance Sheet, And Berkshire’s Cash

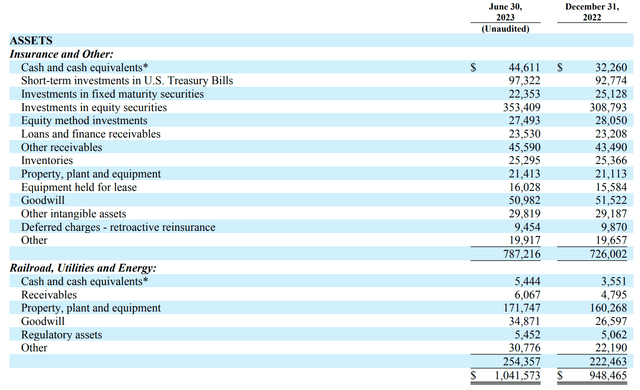

Highlighting Buffett’s steady steering towards value accumulation, it is worth pointing out that Berkshire Hathaway’s balance sheet size in Q2 2023 has topped the $1 trillion mark for the first time in history. Achieving this milestone was supported by buoyant equity markets through the second quarter, which pushed the value of Berkshire’s public listed equity portfolio up to $353.4 billion, vs. $308.8 billion for the comparable period in 2022, up about 15% year over year.

Another interesting takeaway in context of Berkshire’s balance sheet is in relation to the conglomerate’s cash and treasury position. As of June 30th 2023, Berkshire reported a massive $147.5 billion cash pile, approximately $17 billion higher than the $130.5 billion reported a year prior. Slightly more than $120 billion of Berkshire’s cash is invested in short-dated U.S. debt.

Buffett, apparently, continues to be a fan of Treasuries, despite the recent Fitch downgrade. In fact, according to CNBC’s Becky Quick, the Oracle of Omaha, does not consider adjusting his Treasury purchases on iota:

Berkshire bought $10 billion in U.S. Treasurys last Monday. We bought $10 billion in Treasurys this Monday. And the only question for next Monday is whether we will buy $10 billion in 3-month or 6-month

BRK Q2 Results

In short: Buffett’s cash position likely suggests the value of financial flexibility, especially considering the uncertain macro backdrop, allowing an investor to take advantage of attractive investment opportunities that may arise in the future and weather potential market downturns. Buffett maintained a similar tactical stance prior to the financial crisis.

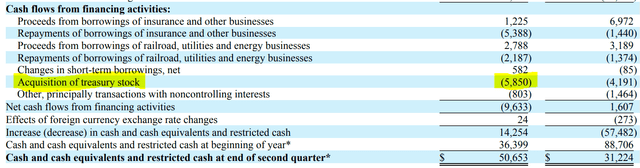

Buffett Is Likely Selling Equities, But Buying BRK

While Buffett’s Treasury position trends upwards, his stance towards equities is a slightly more complex, arguably pessimistic. During Q2 2023, Berkshire sold approximately $12.6 billion of public listed equities, while buying only $4.6 billion, suggesting net sales of $8 billion. Unfortunately, it is not yet possible to give details about which names moved in, and which names moved out, as Berkshire will release details through the 13F filing likely not before August 15th.

Buffett continues, however, to be a net buyer of Berkshire stock: During 1H 2023, Buffett repurchased $5.85 billion worth of BRK treasury stock, accelerating the pace of buybacks compared to 1H 2022, when he repurchased $4.2 billion.

BRK Q2 Results

Conclusion: Berkshire Is A Buy

Berkshire’s Q2 2023/ 1H 2023 results highlight once against that the conglomerate’s portfolio is composed of “exceptional businesses” that remain resilient even in the face of macroeconomic headwinds.

But why should you buy BRK stock when Buffett is sitting in cash anyways? Why not just sit in cash yourself? Here are two key considerations to reflect upon: First, it is worth pointing out that despite the cash position, Berkshire’s annualized Q2 2023 operating profits are about $40 billion, and as the conglomerates’ enterprise value currently trades somewhere around $860 billion, it suggested that BRK investors may reasonably expect a 4.6% operating earnings yield, which is higher than the 4.1% offered by 10-year treasuries, suggesting a positive spread. Second, as long as Berkshire Hathaway management style persists, BRK investors will likely benefit from an implied call option that gets exercised when equity markets fall, as Buffett will likely exercise value-accreditive capital allocation decisions on falling equity prices (I know it is counterintuitive, but this is how Berkshire is managed). Accordingly, unless you are a better capital allocator than Buffett, you won’t get this implied call option sitting on cash yourself.

Concluding, investing in Berkshire Hathaway continues to offer investors an exciting opportunity to gain exposure to a diversified portfolio of well-managed businesses, led by Warren Buffett’s prudent investment approach. Historically, BRK yielded strong long-term returns for shareholders, and, I am confident that this won’t change much in the future.

Read the full article here