SAN FRANCISCO — An established but promising group of cancer drugs was a red-hot market in 2023, and more companies could look to the treatments to fuel growth in the year ahead.

That was one clear takeaway from the JPMorgan Healthcare Conference in San Francisco, the nation’s largest gathering of biotech and pharmaceutical executives, analysts and investors.

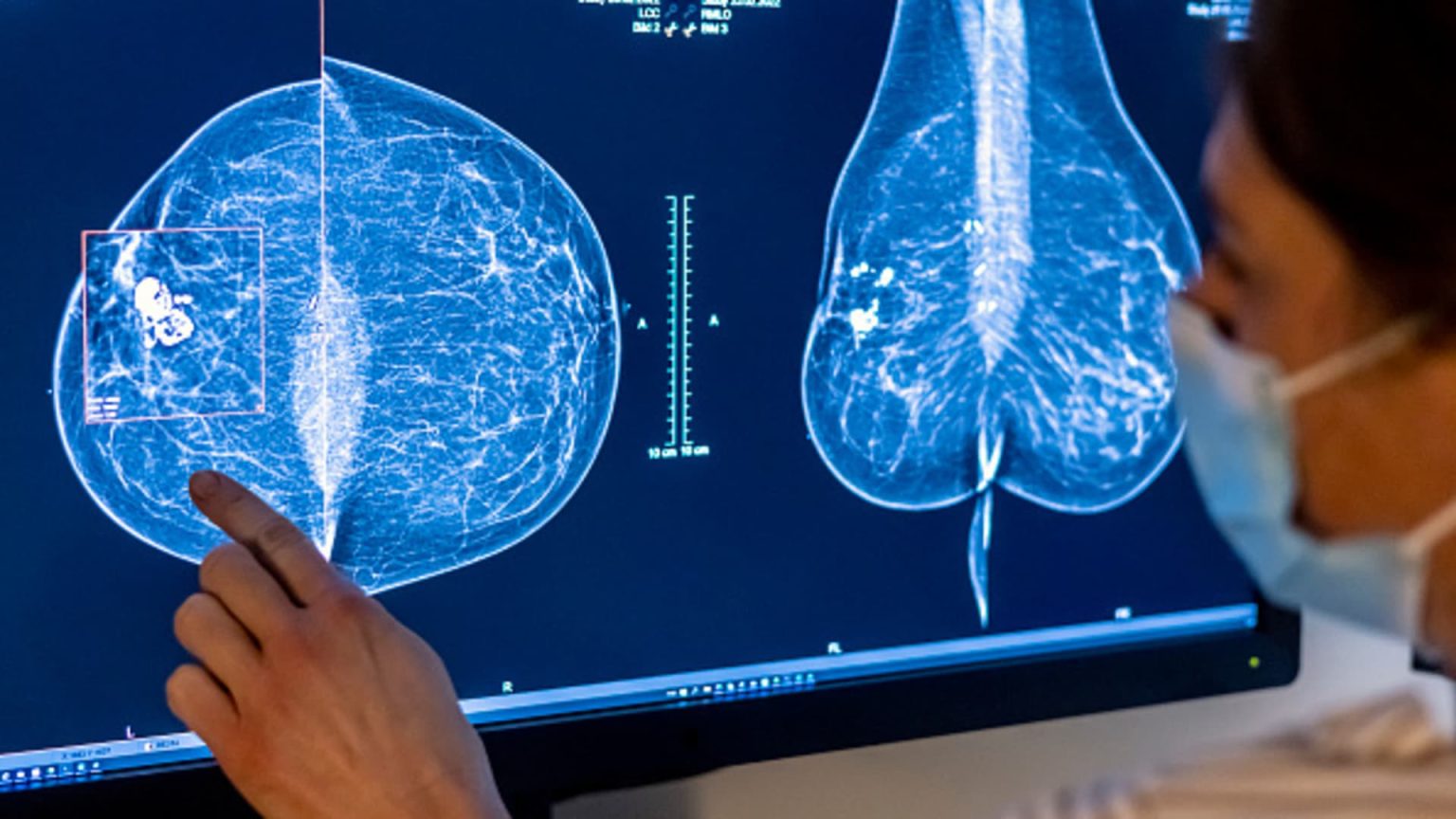

During the four-day event, the biotech and pharmaceutical industry signaled its enthusiasm for antibody-drug conjugates, or ADCs, which deliver a cancer-killing therapy to specifically target and kill cancer cells and minimize damage to healthy ones. Meanwhile, standard chemotherapy is less selective – it can affect both cancer cells and healthy cells.

Johnson & Johnson last week announced a $2 billion acquisition of ADC-developer Ambrx Biopharma to beef up its existing pipeline of ADCs, which some researchers believe could be heralding a “new era” for cancer treatment. Other drugmakers such as Pfizer and Merck, which closed some of the more than 70 ADC-related deals over the last year, said those drugs will be key growth drivers for their businesses.

Interest in the drugs will only continue this year, as some analysts expect more dealmaking and advancements in ADCs currently in development.

The factors fueling the recent rise of ADCs will not abate this year, and a fear of missing out among businesses that have not entered the market will only push more companies to enter the space, Andy Hsieh, an analyst at William Blair & Company, told CNBC.

Those factors include increased confidence in ADC technology among companies and researchers, the potentially longer market exclusivity of those drugs and the rise of attractive ADCs from drugmakers in Asia.

The drugs also have potential to draw huge profits: ADCs could account for $31 billion of the $375 billion worldwide cancer market in 2028, according to estimates from the drug market research firm Evaluate. The market for those drugs in 2023 was estimated to be worth around $9.7 billion, another report from research firm MarketsandMarkets said.

“It’s kind of like FOMO, right? Everyone wants to gain exposure to [ADCs] and basically make it a cornerstone of their entire corporate strategy,” Hsieh told CNBC. “I really don’t see any sort of slowing down and it will very much, in our view, be a continuation of the 2023 momentum.”

Why ADCs have become popular

ADCs aren’t new.

Roughly a dozen have won approvals from regulators worldwide, with the earliest coming in 2000. But dealmaking started to pick up in 2020 and “really take off” in 2022 and 2023, according to Daina Graybosch, senior research analyst at Leerink Partners covering immuno-oncology.

She called the recent rise of ADCs a “multi-decade innovation cycle,” where it took several years for the industry to make some “fundamental transformative innovation, which then unlocked more investment and a lot more potential.”

Improvements in ADC technology appeared to have made some newer iterations of the drugs more safe and effective, which boosted the industry’s confidence in their potential and encouraged more investments in the space. The steady surge of approvals and acquisitions over the last several years also contributed to that confidence, convincing some companies that ADCs have a “lower-risk development path,” Hsieh said.

Graybosch highlighted an ADC jointly developed by AstraZeneca and Japanese drugmaker Daiichi Sankyo called Enhertu, which she called the first of “the next-generation ADC” that had a greater breadth of treatment compared to older versions of the drugs. For example, Enhertu became the first ADC to show the ability to treat breast cancer patients with both high and low levels of a protein called HER2, which controls how breast cells grow, divide and repair damage.

Drugmakers have fine-tuned key components of ADCs over the last several years, such as the chemical bond that helps those drugs deliver a cancer-killing therapy to cancer cells, according to William Blair’s Hseih. He said companies are learning how to maximize the efficacy of those drugs “without getting into too much side effects.”

ADCs still have their drawbacks — for example, cancer tumors can develop resistance to them over time. And not all newer ADCs in development are successful: Last month, Sanofi scrapped its only experimental ADC after it fell short in a late-stage trial in lung cancer patients.

Graybosch also noted that companies from Japan and China have emerged as effective ADC developers that are rapidly “innovating tweaks” to the drugs and bringing ADCs to the market that could be better than older versions of the drugs.

U.S. and U.K.-based companies are inking deals with those international drugmakers, such as two licensing agreements GSK signed late last year with Chinese-based Hansoh Pharma for ADCs targeting several types of cancer.

The complexity of ADC technology has likely become another motivation for companies to invest in and develop the drugs, Hsieh noted. He said it could reduce the chances that other companies will create biosimilars, allowing drugmakers to keep ADC prices high for longer periods of time.

Gilead’s approved ADC for breast cancer, Trodelvy, has a U.S. list price of more than $2,000 per vial. But some ADCs on the market have far higher list prices: An advanced ovarian cancer drug from biotech company ImmunoGen costs more than $6,000 per vial as of 2022.

List prices are before insurance and other rebates.

How some drugmakers are betting on ADCs

Merck now expects $20 billion in new cancer drug sales by the early to mid-2030s, thanks in part to its recent investments in ADCs, executives announced during the conference. That’s double the estimate the company provided during the same conference last year.

The raised forecast signals Merck’s confidence in the future of its cancer drug offerings, even as its blockbuster immunotherapy Keytruda nears a loss of exclusivity in 2028. That will expose it to generic competition.

Merck executives highlighted its up to $5.5 billion licensing agreement with Daiichi Sankyo to jointly develop three of the Japanese drugmaker’s experimental ADCs. This year, the company hopes to win an approval for one of those ADCs for the treatment of non-small cell lung cancer.

“….We have a leading position now in antibody-drug conjugates, and we’ve done that through what I think is very smart deal-making,” Merck CEO Robert Davis said. He added that “what all of that really translates to is the potential for growth.”

Pfizer hopes ADCs will help the company turn around after a rocky 2023. Shares fell roughly 40% last year as Pfizer grappled with weakening demand for its Covid products and other commercial missteps.

Pfizer CEO Albert Bourla told reporters that the company’s $34 billion acquisition of ADC-developer Seagen would help restore investor confidence in Pfizer, especially now that the deal is officially closed.

Bourla noted that antibody-drug conjugates have become the hottest area of oncology, adding that Seagen’s expertise in ADCs will give Pfizer a huge advantage in developing those drugs further and establishing itself as a leader in cancer treatment.

Pfizer believes the Seagen acquisition will bring in more than $10 billion in risk-adjusted sales by 2030. Seagen specifically brings four approved cancer drugs, including three ADCs, which will beef up Pfizer’s own ADC portfolio.

Read the full article here