Investment thesis

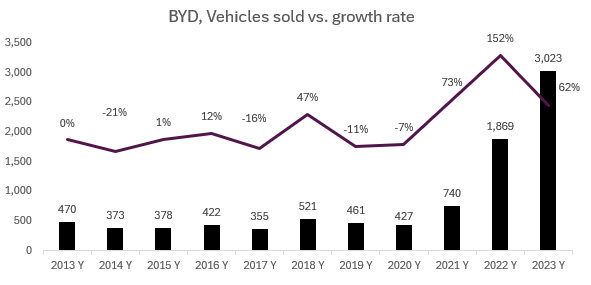

BYD Company Limited (BYD) is the largest manufacturer of electric vehicles (EVs) in the world with annual sales exceeding 3.0 million vehicles. The global electric vehicle market is in the midst of a price war, especially among various Chinese manufacturers, which has led to a decrease in the stock price of BYD. BYD stock lost over 35% in the past six months, even though the company has been strengthening its fundamental position in battery manufacturing. In the past ten years, BYD has managed to build respectable economies of scale through mastering vertical integration in the manufacturing process. Besides the leadership position in its domestic market, the company is slowly building new export markets in Europe, Southeast Asia, and South America. I believe that the current pull-back in BYD’s stock price is an attractive opportunity to build a position in this compounder, which will just increase its strength in years to come.

Bloomberg

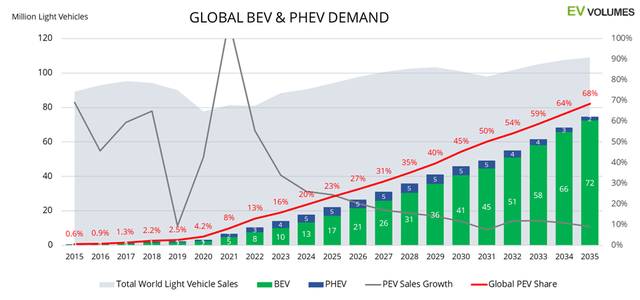

Favorable industry trends persist

In recent years, we have seen massive incentives from governments to transition from Internal Combustion Engines (“ICE”) to EVs. Even though global sales of EVs are still rising, the slowdown in growth is apparent. For the past six months, a slowdown in sales of EVs has been weighing on EV stocks across the board, but what some analysts are claiming to be a permanent slowdown, is actually a natural trajectory of a growing market getting bigger in size. According to the Economist Intelligence Unit (EIU), the global outlook for electric car sales remains unchanged, and the electric vehicle market is expected to grow by 21% in 2024 to 14.9 million units. In comparison, in 2023 EV sales rose 31% to 13.6 million units. In 2024, China will account for more than half of total sales with the main goal to expand sales in Europe, Southeast Asia, and South America. By the same token, BYD has the same aspirations to expand its productions in Europe (Hungary), South America (Brazil), and Southeast Asia (Thailand). According to EV-Volumes.com, the global EV market is expected to grow in the forecasted period within the range of 10% to 20% per annum. Comparing this growth with the historical growth of BYD, it is very probable that BYD will be able to outgrow the global EV market by a wide margin.

EV-volumes.com company reports

Main contender in the battery market

Battery is the major component in the total cost of the vehicle. Whoever can produce a cheaper, more powerful battery, can dominate in the battery market and subsequently in the production of EVs. Batteries can range anywhere from 13% up to 30% of the total cost of the vehicle. Two major battery types are either lithium-nickel-manganese-cobalt batteries (NMC) or lithium-iron-phosphate batteries (LFP). Historically NMC batteries have been used as a primary choice in EVs, that’s why they have approximately 60% market share. On the other hand, LFP batteries have been used only in 30% of EV models. BYD has bet on LFP batteries which have lower energy density, however, it can be produced more cheaply and have better safety characteristics than traditional NMC batteries. The main producers of batteries besides BYD are Panasonic, South Korea’s LG, and China’s CATL. BYD’s Blade battery is not only used in BYD vehicles, but is outsourced to third-party brands. The best evidence of BYD’s superb performance is Tesla, which switched to BYD batteries in its Model Y. Similarly, Mercedes-Benz announced plans to use BYD batteries in their EVs. The main reason to use BYD batteries is their faster charging times and better longevity. Strong manufacturing capabilities provide BYD with better economies of scale on one hand and a diversified customer base on the other. At the same time, BYD’s dominance in battery production allows it to directly participate in a strong EV growth trend despite intensifying competition in this segment. Additionally, deep vertical integration in battery production allows BYD to better withstand pricing pressure and defends its profitability margins. BYD was originally a battery manufacturer and its transformation into a car company came in 2008. BYD reports battery manufacturing and car production as one segment but in fact, those are two segments with different economics. BYD’s economic moat comes from the production of cheaper vehicles, but the true reason lies in cheaper and more reliable batteries.

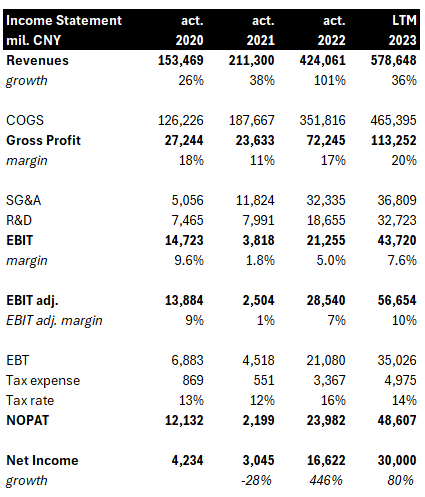

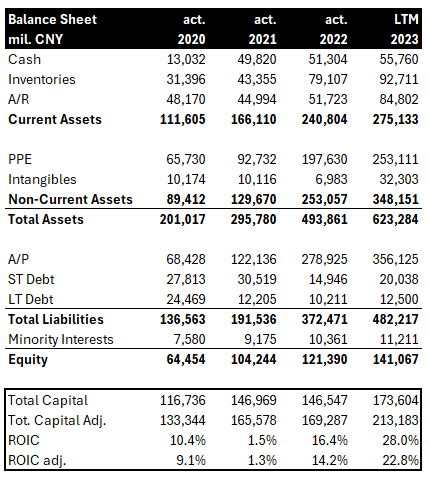

Financial Analysis

In the last four years, BYD experienced high growth in revenues, operating income as well as net income. Its operating margin, a key metric in measuring profitability in the automotive industry, was in FY23 at 9.8%, only a little behind Tesla’s 10%. BYD achieved these results with only a limited amount of debt. In 2023, BYD’s debt-to-equity ratio was at 23%, which is a very solid ratio for a capital-intensive industry. Additionally, BYD’s average Return on Invested Capital (“ROIC”) adjusted for R&D expenses was 11.8%, a very high return for a company still in its growth phase. On the other hand, the company received only in the last three years almost RMB 16 billion in government subsidies, helping BYD to subsidies its offer for the Chinese market.

Company filings Company filings

Valuation

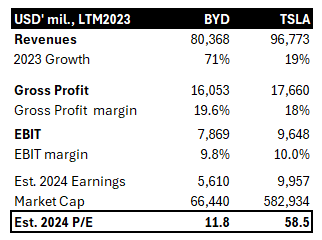

I believe that BYD belongs in the category of a great company for a fair price. With its forward estimated 2024 earnings of RMB 40.3 billion and a market cap of RMB 454.4 billion, the company is selling for 11.8x P/E. In comparison, its biggest competitor, Tesla, is trading with a multiple of 58.5x P/E. Even though the rivalry with Tesla will continue, the price gap between these two companies is unjust, even after the recognition of the discount for a country risk premium. To better highlight my argument, I compared BYD vs. TSLA on key financial metrics.

Company filings

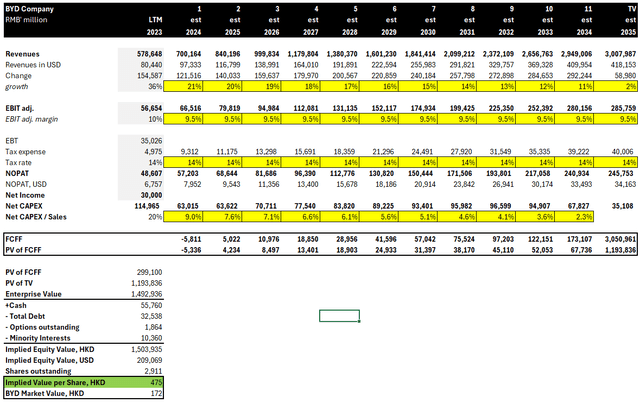

In my valuation of BYD, I used a DCF model based on several key assumptions. In my valuation story, I assume that: 1) growth of BYD will continue in the future but will slowly decline from 21% in 2024 to 11% in 2034 until it reaches the maturity phase in 2035. 2) BYD will earn an EBIT margin of 9.5%, which is slightly below Tesla’s 10%, but still reasonably high given that BYD is an automotive company 3) As BYD’s growth will slow, so will its NET CAPEX, from the current 20% of sales to industry standard of 2.3% in 2034. Under these assumptions, in 2032 BYD should be of similar size as Toyota Motor Corp. today (Revenues FY23: 300 billion US dollars). If these assumptions materialize, BYD’s fair value per share should be 475HKD per share, compared to 172HKD as of today. The implied value per share is 170% over current market value. However, this return will not happen overnight, it will take more time until investors gain confidence in BYD’s ability to deliver profitable growth.

Own Work

What could go wrong?

There are two crucial risks for the BYD thesis. One is the introduction of trade barriers for Chinese automakers by the European Union, which could severely impact BYD’s plans to expand in Europe. According to various sources, the European Commission is investigating whether Chinese manufacturers of cheaper Chinese-made EVs are benefiting from state grants and subsidies. The European Commission probe could lead to imposing tariffs on Chinese-made models and erase price advantage over European car manufacturers. The other potential risk is in slower adoption of EVs by regular consumers. Crucial factors responsible for the future adoption of EVs will be acceptable prices of new models, availability of charging infrastructure, and longevity of batteries. Investment analysts in the automotive industry predict, that the majority of profits in car manufacturing until 2030 will come from Internal Combustion Engine, however, governments in Europe, the US, and China are incentivizing EV adoption to reach climate goals set in the Paris Agreement. If the mentioned risks would materialize, it could have major consequences for smaller manufacturers without economies of scale. I assume that BYD would experience only limited financial impact, but the growth story behind the company could be endangered.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here