The following segment was excerpted from this fund letter.

Canadian Natural Resources (NYSE:CNQ)

For several reasons, we have always viewed the oil and gas industry with an especially skeptical eye. Commodity businesses are difficult to forecast, and the industry has long been plagued by poor incentive structures and principal-agent issues. The managements of many of the smaller companies in the industry are notable for seldom being burdened with an abundance of ethics.

Further, the entire industry has historically been dominated by a “drill at all costs” mentality, with little regard to returns on capital. That is, until recently, as social concerns have helped propel both a sell-off in oil and gas company stock prices and a massive reduction in capital expenditures. The lack of capital expenditures has created a favorable environment for higher commodity prices. As a result, we are beginning to see the sector as a more appealing hunting ground.

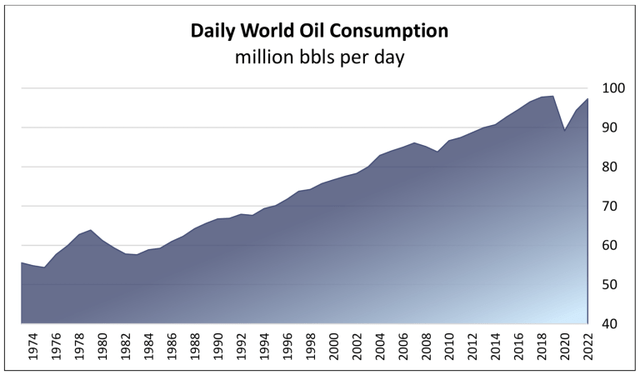

The move from fossil fuels may be inevitable, but it is in no way imminent, regardless of the political or social pressures demanding otherwise. While renewable energy sources will continue to take “market share” from fossil fuels, even the most ardent renewables supporters acknowledge that oil and gas will continue to be needed for at least the next 30 years to bridge the gap to even the most optimistic projections of a complete shift to renewables.

We recently purchased shares of Canadian Natural Resources, a diversified energy company that specializes in the acquisition, exploration, development, production, and sale of crude oil and natural gas. We consider CNQ to be one of the few companies in the industry that never needed to undergo either a capital allocation or ethical transformation. The company has long nurtured a culture of continuous improvement, emphasizing cost control to drive strong operational and financial results while working to maximize shareholder value.

CNQ’s remarkable growth can be attributed to a combination of organic initiatives and successful consolidation of the upstream Canadian oil and gas industry. Through strategic acquisitions, CNQ has secured significant reserve capacity and infrastructure, investing $50 billion (equivalent to 41% of sales) between 2010 and 2018. This has positioned CNQ as the largest acreage holder in the Canadian oil and gas industry (23 million acres), boasting more than twice the proven reserves of its closest competitor, Cenovus Energy.

Moreover, CNQ has shifted its production mix from natural gas to crude oil, which currently represents approximately 57% of its proven reserves. This strategic shift aligns with the strong structural tailwinds and pricing advantages associated with crude oil.

The capital investment undertaken by CNQ has enabled the company to achieve operational scale, top-tier efficiency, and vertical integration, positioning it as a low-cost producer with a long-life, low-decline reserve base. CNQ’s asset base also requires significantly less maintenance capital expenditures compared to its peers, as 78% of its liquid production comes from long-life reserve bases.

With major project spending completed, CNQ is now in a cash flow harvesting phase, allowing the company to maintain its production volume with minimal annual maintenance capital expenditures. Over the past five years, CNQ has generated free cash flow averaging 120% of its net income.

From a unit economics perspective, CNQ has historically spent approximately $17 per barrel on production expenses, $17 per barrel on transportation expenses, and 15% of revenues on royalties. This produces Earnings Before Interest Taxes and Depreciation (EBITDA) of $25 per barrel at $70 oil prices. Additionally, depreciation and depletion expenses amount to $12-15 per barrel, which significantly exceeds the company’s necessary maintenance capital expenditures.

On the natural gas side, CNQ’s position as the largest producer in Canada allows it to draw on a total resource base of approximately 13.6Tcf. This scale helps contribute to its position as a low-cost producer, with costs ranging from $1.00 to $1.20 per mcf. (The average breakeven price for Canadian natural gas producers is $2.30 per mcf.)

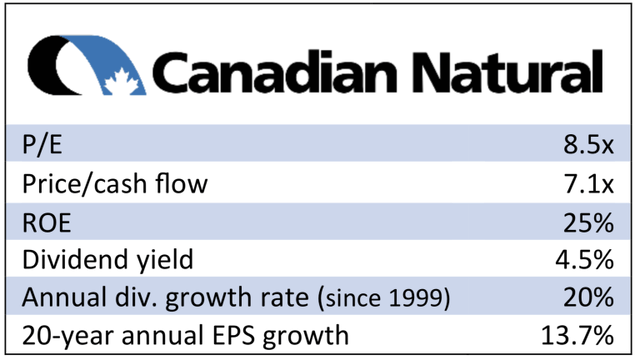

In terms of valuation, CNQ trades at a 14% yield on estimated FY’23 free cash flow, assuming $70/bbl oil prices. It also offers a 4.4% dividend yield and has reduced its leverage to less than 1x debt-to-EBITDA. Notably, CNQ has implemented a defined free cash flow allocation policy, directing 100% of free cash flow (after capital expenditures and dividends) to share repurchases when net debt falls below $10 billion. (The company currently has net long-term debt of less than $8 billion.)

Widely recognized for its superior management, CNQ has raised its dividend for 23 consecutive years, achieving a remarkable 21% compound annual growth rate, compared to the industry average of 5%. Unlike many industry peers, CNQ consistently prioritizes return on capital and earned an after-tax return on capital of 22% in 2022, up from 15.6% in 2021.

With a proven reserve life of 32 years, a dividend yield of 4.4%, and an incremental share repurchase program equivalent to 100% of free cash flow, CNQ represents one of the best royalty streams available for sale. Our estimate of the company’s fair value is $80/share, 45% higher than our purchase price of approximately $55.

It is possible that you may have noticed us occasionally mention that we can’t predict short-term moves in the stock market. No one else can either, although that doesn’t prevent people from claiming or believing otherwise. But we certainly recognize our inability to do so. Nonetheless, it is tempting to exercise even more caution than usual when stock prices jump so rapidly in a short period.

However, since pre-pandemic, the S&P 500 increase closely matches the increase in earnings of the companies in the index. Measuring from January 1, 2020 – that is, pre-pandemic – the S&P 500 has increased 36%, while the earnings of the S&P 500 companies have increased 33%. Over these past 30 months, the stock market has increased an average of 10.4% annually, almost perfectly equal to its long-term average.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here