Introduction

Expectations are high for Cantaloupe Inc (NASDAQ:CTLP) to grow earnings at a fast rate. The current p/e doesn’t do the company justice as the expectations are that by 2024 the EPS will reach $0.15, valuing CTLP at an earnings multiple of 49. This is by no means meaning that the current price could be appealing in my opinion. Such a premium should only be reserved for a very select few companies and I don’t think CTLP is one of them, unfortunately.

The company operates in the transaction & payment processing services industry where it has quickly grown revenues. The company could be described as a fintech company that offers customers digital and software payment services and solutions. The hype around fintech companies has been very high but a lot of them have seen their valuations crumble as they need to also back it up with strong bottom line growth. Even though CTLP seems to have a quite scalable business model this isn’t enough to make the growth appealing enough to invest right now I think. The company will have to have the share price stand still for several years for the bottom line to catch up. That leaves growth out and being invested in a more reasonably priced business seems far more beneficial right now. I like where CTLP is hedging though and will have a neutral rating on them as a hold.

Company Structure

Founded back in 1992 CTLP has made a name for itself as a fintech company that is delivering valuable financial and payment services to customers around the world. The company focuses on delivering these services and technology solutions to otherwise unattended retail markets. Their line of offerings is logistics and back-office management capabilities also included.

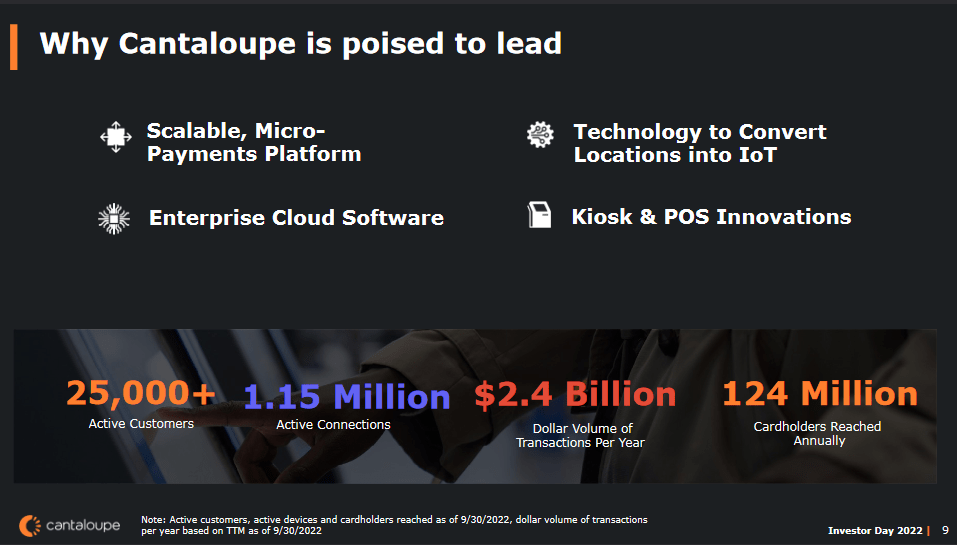

Company Overview (Investor Presentation)

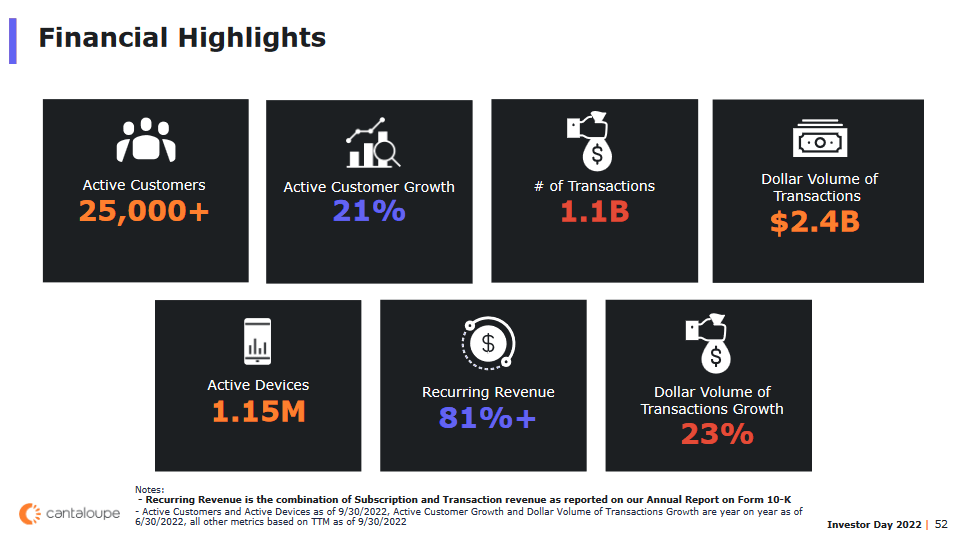

The company has developed a very scalable business model where it can take the lead and deliver strong results and bring shareholder value. Right now they have built up their customer base to over 25 000 and had over $2.4 billion in transaction volumes in 2022. The markets they serve are varied and customers range from arcades to amusement parks as their ePort payment device is an easily integrable piece that makes payment transactions better.

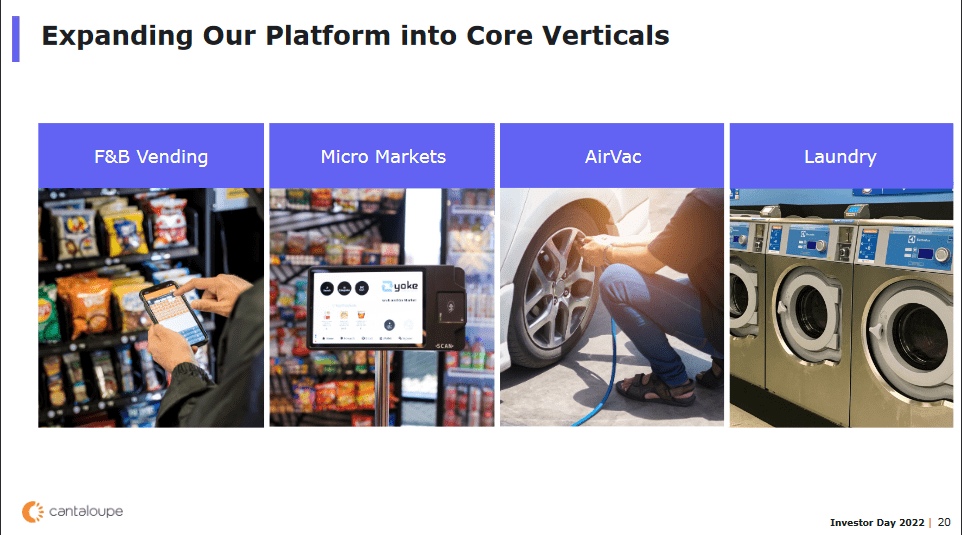

End Markets (Investor Presentation)

As more and more businesses are taking on the self-serving trend and cutting down on the need to have staff for every job CTLP is having its TAM growing quite rapidly. CTLP is anticipating a 10% CAGR of the TAM they have as some market verticals like food & beverage vending and EV car charging are increasing demand.

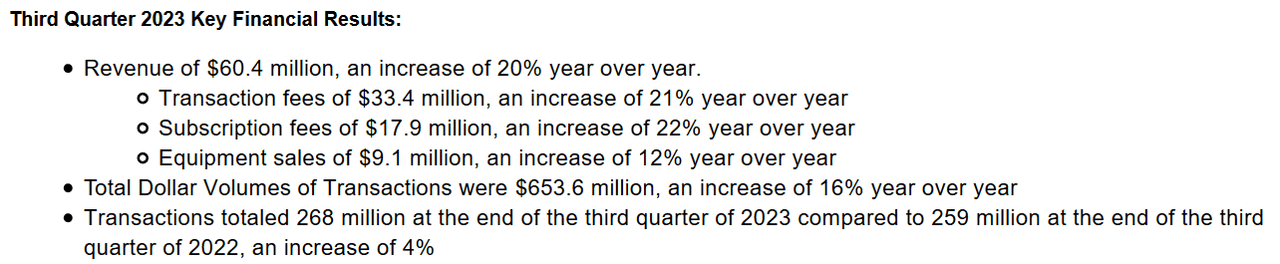

Q3 Highlights (Earnings Report)

What will be crucial for CTLP especially is to grow the margins at a decent rate and maintain strong transaction volume growth. The Q3 report showcased this very well and this is positive to see as even though higher interest rates have occurred in the last several quarters this hasn’t negatively affected the business of CTLP notably. I think as we see lower interest rates the spending of the average American will once again increase, benefiting the demand and revenues of CTLP.

Earnings Transcript

The last earnings report we got from CTLP was on May 4 and in the earnings call the company provided there were some comments I think are worth highlighting. The CEO of CTLP Ravi Venkatesan had the following to say.

“Transaction revenue grew 21% year-on-year, and subscription revenue grew 22% year-on-year for the third quarter. We continue to expect subscription revenue to ramp throughout the year, resulting in growth in the high teens for the full year. Equipment revenue grew 12% year-on-year for the third quarter“.

With steadily increasing transaction revenues the recurring revenues for CTLP look very solid and will lay the foundation for the business going forward. But also seeing solid growth in the equipment side of the business is indicating that perhaps areas where more “excess” spendings of everyday Americans occur are still experiencing demand. This paints a bright picture for CTLP I think.

Valuation & Comparison

In terms of valuing CTLP right now, it’s hard to do it from a GGM model which I like to apply when there is the availability of a dividend. But as CTLP is also very new and hasn’t gained a solid history of positive EPS results, I find it hard to put a true price target on it.

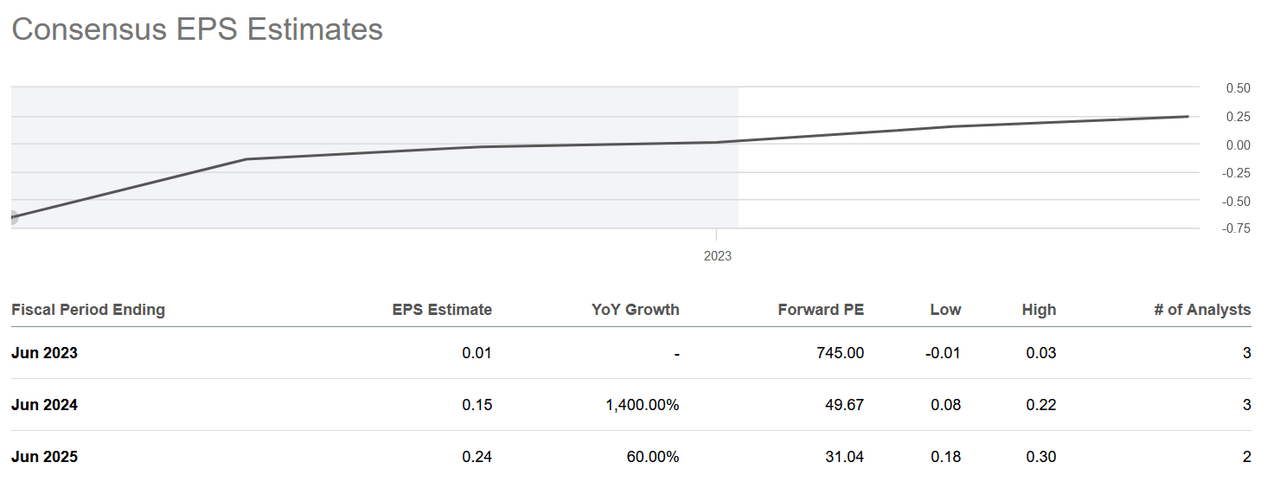

EPS Estimates (Seeking Alpha)

Earnings expectations are very positive, and by 2025, it might be a slightly more reasonable valuation than today. But paying 31x earnings is still by no means a good deal I think. I would be comfortable paying around 18 – 19x earnings multiple for the company. It’s a growth story but one I don’t want to overpay for either. With an 18x multiple and the 2025 EPS of $0.24, it gets us to $4.5, far below the current price of today. Investors should be aware here that any disruption or slowdown in transaction volumes will likely lead to the share price dropping to reflect the same assumptions and target as I have. I remain more pessimistic than the market but only in the effort of making sure I get in at good prices.

Risk Associated

It’s important to recognize that despite the company’s promising prospects, certain risk factors warrant attention. One such concern centers around the historical tendency of CTLP to generate cash through non-operational financing avenues, notably involving the issuance of additional debt or the sale of additional shares.

This financial approach, while providing short-term liquidity, could introduce implications for the company’s long-term financial health. The accumulation of debt may elevate interest expenses, potentially straining cash flows and eroding profitability. Similarly, frequent share issuances can dilute existing shareholders’ ownership and impact earnings per share.

Financial Highlights (Investor Presentation)

This practice can underscore the importance of scrutinizing the sustainability of CTLP’s cash generation methods. An overreliance on non-operational financing could pose risks to the company’s overall financial stability and flexibility, particularly in periods of economic uncertainty or shifting market dynamics.

Investor Takeaway

CTLP is a pretty interesting story to follow, as the company focuses on offering transaction and financial services in otherwise quite neglected and unattended retail markets. Some of those include vending machines but also laundry places too. Self-servicing machines are becoming more popular and finding its ways into new markets and areas. This leads CTLP to have a solid position to capitalize from this.

However, the valuation is far higher than what anyone should have to pay for it and the company gets a hold instead from me.

Read the full article here