Over the past 14 months, Carrier Global (NYSE:CARR) has been on an aggressive strategy to streamline its business into a company with a much more narrowed focus. In early 2023, the company announced a vision to transform itself into a pure-play leader in intelligent climate and energy solutions. Through acquisitions and divestments, Carrier has accomplished this vision at a remarkably fast pace, and now it needs to show the market it can capitalize on this transformation. This article will focus on the background of the transformation, how Carrier stacks up against its peers in the industry, and whether Carrier can reward shareholders going forward.

Viessman Climate Solutions

The cornerstone of Carrier’s vision to improve its renewed focus to become the global leader in heating and cooling solutions was the purchase of Viessman Climate Solutions in early 2023. Carrier paid €12 billion in cash and stock for Viessman. Viessman is a well-established and premium brand in Europe and drastically improves Carrier’s footprint in Europe. Viessman brings with it annual sales of roughly €4 billion, as well as a well-established direct-to-installer model that includes more than 75,000 installers in 25 countries. This bolt-on acquisition has grown 15% on a compounded annual growth rate basis since 2020 and Carrier expects to see double-digit growth to continue through 2030.

Key to Viessman’s continued success is the explosion of heat pump adoption across Europe. Russia’s invasion of Ukraine and subsequent halting of natural gas exports from Russia to Europe, sparked Europeans to electrify their home heating so they wouldn’t be reliant on natural gas and their inherent price spikes and fluctuations. In addition, European governments began offering enticing incentives. Due to this continued rapid adoption, Carrier projects the current €5 billion heat pump market to triple in size by 2030 to €15 billion.

Divestments

To help fund Carrier’s acquisition of Viessman, the company made the decision to divest all non-core businesses. The company identified 4 business segments for sale; Global Business Solutions, Commercial Refrigeration, Industrial Fire Solutions, and Residential and Commercial Fire Solutions.

Carrier kicked off its divestment spree by selling its Global Business Solutions to Honeywell (HON) for an enterprise value of $4.95 billion. At 17x 2023 EBITDA, Carrier was able to get a premium for the segment. Just one week later, Carrier was able to sell its Commercial Refrigeration unit to Haier for an enterprise value of $775 million. In 1Q2024, the company announced the sale of its Industrial Fire Business to Sentinel Capital Partners for $1.425 billion.

With the sale of 3 of its 4 identified business units, Carrier has received net proceeds of around $5.5 billion. This leaves only the residential and commercial fire business on the chopping block, and management is confident they can finalize a buyer in the next several months. Ever since the business transformation was announced, management made it clear that it would use the proceeds from any business sale to deleverage the balance sheet. In a recent presentation, CFO Patrick Goris stated,

What we have said is that $5.5 billion would go towards deleveraging the company. And so, we will first paydown our term loans, they carry the highest interest rate. After that, we’ll see what we will paydown, what makes the most economical sense. We actually might decide to keep cash on the books for a little while, because in today’s environment, the cash may earn more than some of our debt.

In addition to debt repayment, the company has also announced they plan to begin share repurchases toward the end of 2024 through the use of free cash flow and proceeds from the sale of the residential and commercial fire business. Carrier issued 58 million shares to help fund the acquisition of Viessman and the company intends to repurchase all dilution from that transaction.

Carrier streamlining its business to focus on its core competency of heating and cooling solutions makes a lot of sense. The move will allow the company to focus on revenue growth and margins in a much simpler manner. Carrier expects to realize $200 million in cost synergies by 2026 with around $75 million reduced in 2024. In addition, the acquisition will be accretive to EPS in 2025.

Investors need to determine if Carrier’s business transformation will reward shareholders going forward. There’s no question the acquisition of Viessman improved its market share in Europe, but can the new simplified company gain market share from industry titans like Lennox (LII) and Trane (TT) in the US and ex-US?

Valuation to Peers

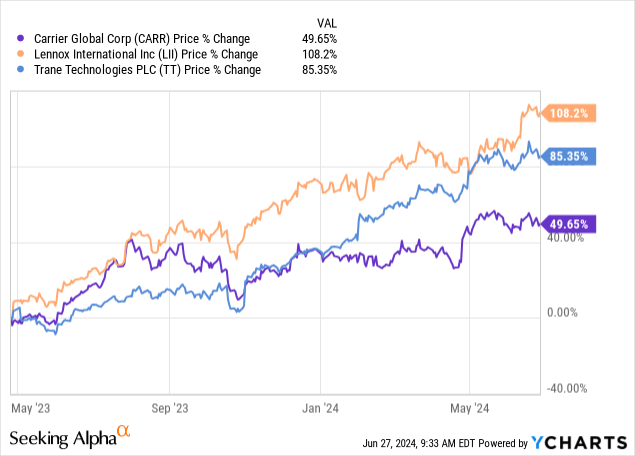

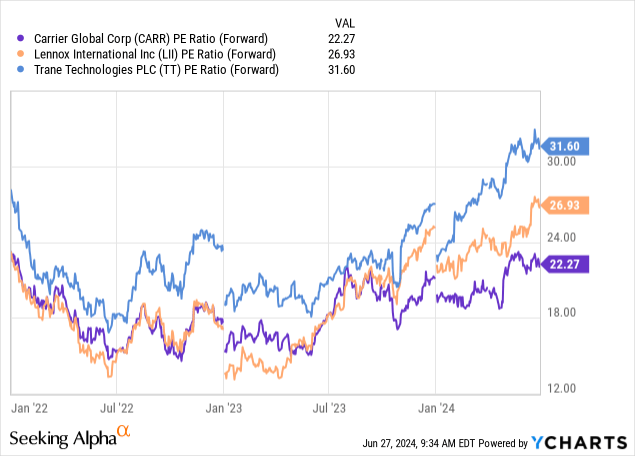

Since the announcement of the company’s business transformation and acquisition of Viessman, Carrier has drastically underperformed its peers. Unlike Carrier, Trane and Lennox have undergone a significant rerating in their valuations. Historically, these stocks have held a forward price/earnings multiple in the high teens to low twenties. However, over the past 12 months, these valuations have spiked as the shares rapidly appreciated.

Much of this outperformance from Trane likely comes from their leading organic growth rate of 8-9% compared to Lennox at 4-5% and Carrier at just 2% organic growth. For 2024, Carrier sees revenue up 12% including acquisitions and divestitures. It will take a few more quarters before investors get a clear view of Carrier operating solely within its new slimmed down company, similar to Lennox and Trane. However, investors can expect Carrier’s adjusted operating margin going forward will be similar to peers. Carrier expects Viessman adjusted operating margins around 15.5%, in-line with its existing heating/cooling solutions.

Buy Thesis

With Carrier underperforming its peers and trading at a lower valuation without meaningful differences in growth and margins, Carrier may be due for a catch-up trade. As the company completes its transformation, investors will have to take a second look at Carrier and make the decision if it truly deserves to trade at such a large discount to its peers.

The HVAC industry has numerous tailwinds and megatrends in its favor, and Carrier is set to capitalize. First, no analysis is complete without a clear picture of the effect of AI on the company and its industry. Obviously, cooling solutions are integral to AI data centers and the HVAC industry is seen as a clear beneficiary. During Carrier’s 1Q2024 earnings call, CEO David Gitlin, stated,

Today, AI makes up about 20% of the load of a typical data center, and some of our customers project that percentage to increase to 80% in the next few years, thus spurring huge demand on the grid and increasing the need for differentiated HVAC and control solutions.

Accordingly, the data center market for the HVAC business is projected to increase from roughly $7 billion in 2023 to $15 billion to $20 billion in 2027. For us, this vertical represents a low double-digit percentage of our global commercial HVAC applied business.

And we see a tremendous opportunity of increasing this segment to well over 20% of our commercial HVAC sales in the next few years. We doubled our backlog in Q1 alone, and in April, secured further key wins as we optimize the use of our global footprint to support our customers.

With Carrier expecting its data center business to grow from a low double-digit percentage of commercial HVAC business to over 20% in the next few years, it expects its data center business to essentially match the HVAC data center potential of 20% CAGR through 2027.

Another trend favoring Carrier is the increased prevalence of heat waves gripping large populations across the globe. Just this past weekend, over 100 million people across the east coast of the US were under heat advisory warnings. This punctuates the need for efficient HVAC systems in some areas that historically may not have always had an air conditioning unit in homes. It also increases the strain on older units, causing mechanical failure sooner than may be expected. In a bit of irony, as I started writing this article over the weekend in central Texas, my AC suddenly stopped working. This prompted a scramble for parts (in my non-Carrier unit) and bids for new AC units. As one might expect, Carrier sees lumpy quarterly revenue which is back-loaded with the majority of revenue coming in Q3 and Q4. But earlier and earlier heat waves may result in an increasing of the revenue across the back half of Q2 as well.

In a final trend seen across Europe, heat pumps are rapidly becoming the standard in HVAC installations as a result of government incentives and efficiency. Viessman puts Carrier at the forefront of this trend across Europe. Carrier projects the heat pump market to grow at 20% CAGR through 2030. While it may not be in a straight line and there could be lumpiness in growing the heat pump market from €5 billion to €15 by 2030, Carrier will be a leader in the space and capture significant market share.

At its current $62/share and 22 forward price/earnings, Carrier is trading at the higher end of its historical average valuation. I’d recommend investors with a 3-5 year timeline slowly accumulate shares to take advantage of any price volatility. While the stock could rally and catch up to the valuations of its peers, I believe it’s more likely Trane and Lennox trade back toward Carrier’s level. However, as Carrier transitions into a pure play heating and cooling business, the company has numerous growth levers it can take advantage of over the medium-to-long-term.

As Carrier completes its transformation and starts to see more and more of the tailwinds mentioned above, I expect Carrier to begin seeing improvement in organic growth to mid-to-high single digits and margins to stay steady around 15-16%. Also taking into account, Carrier will repurchase 58 million shares, or 6.5% of total outstanding shares, the company should see EPS growth in the low double-digits. Along with a deleveraged balance sheet, the fundamentals of Carrier will be much improved in 2025. As a result, I’d place a 12-18 month price target of $72/share.

Read the full article here