C&F Financial Corporation (NASDAQ:CFFI), incorporated in 1927 and headquartered in Toano, Virginia, provides banking services to individuals and businesses in Virginia.

Because of its attractive dividend profile, low valuation, strong liquidity, and hedging quality in rising-interest-rate environments, both dividend and value investors may want to consider the merits of CFFI as an investment opportunity.

Business & Portfolio

Though the bank was founded in 1927 under the name “Farmers and Mechanics Bank”, the current holding company was organized in 1994. Whenever I use “bank” in this article, I will be referring to the holding company.

C&F currently has around $2.4 billion in total assets, $2 billion in deposits, a market cap of $145 million, and it operates 30 branches, each located in a different county of Virginia.

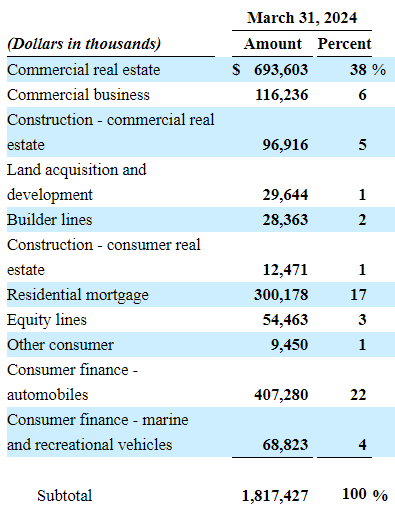

With 73.6% of revenue coming from loans (based on the last quarterly report), we should now take a look at the portfolio. While its commercial RE exposure is significant, it still doesn’t make for the majority of the loans. In fact, the portfolio is essentially well diversified among three major loan types; commercial real estate, residential mortgages, and auto loans:

10-Q

As of the end of March 31, 2024, only 0.95% of commercial RE loans were rated “Special Mention” and the majority of them go back to fiscal year 2021, reflecting no recent deterioration in the credit quality of that loan segment.

As for the residential loans, the Special Mention ones were of an insignificant amount. Moreover, 24.2% of the auto loans had a “Fair” credit rating and 7% of them had a “Marginal” one (the worst score).

After looking at the rest of the loan types, all of the Special Mention, Substandard, and Marginal loans represented 1.98% of the portfolio as of the end of the last quarter.

The company’s reserve coverage ratio was then appropriately at 2.21% on March 31, 2024. Last, its NPL ratio was 0.07% by the end of the last quarter, while the net charge-off ratio amounted to 0.01% during 2023, providing good basis for concluding that the reserve amount is too conservative; keeping in mind there is a decently wide leap from Special Mention and Substandard loans to end up being written off.

This information is going to provide some useful context when we talk about valuation later.

Performance

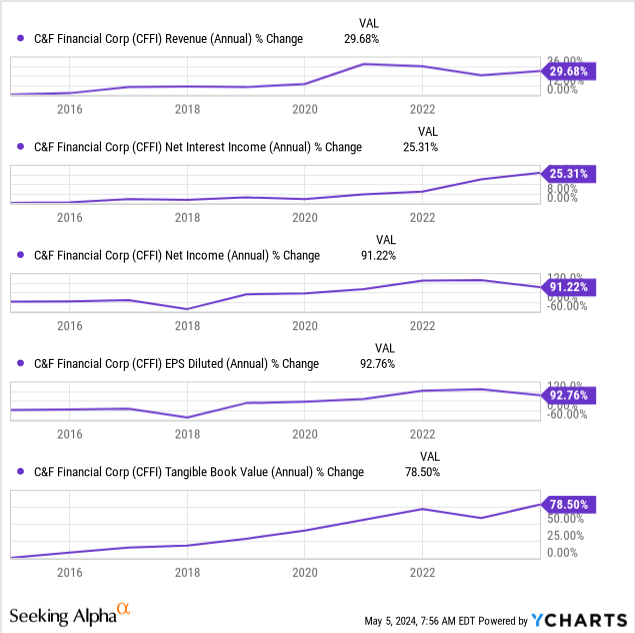

When it comes to its long-term performance, C&F has grown very slowly in the last decade:

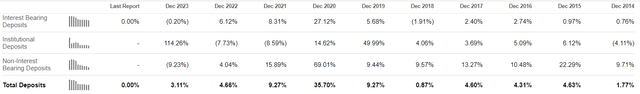

The same unimpressive growth can be observed in the deposits over the years:

Seeking Alpha

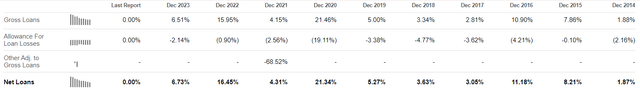

And the same goes for the loan portfolio, although the growth has been more stable here:

Seeking Alpha

In any case, the most recent results illustrate an edge over what you commonly see with regional banks. The deposit rate increased substantially, but it’s still relatively low and well below the yield on loans:

| 1Q24 | YoY Change | |

| Loan Portfolio Yield | 6.64% | 29 bps |

| Deposit Rate | 2.25% | 137 bps |

| Net Interest Spread | 3.4% | -76 bps |

| Net Interest Margin | 4.09% | -43 bps |

As a result, the interest spread narrowed but NIM is still quite high after a 43 bps YoY compression. Regardless, net interest income experienced a 14% decline in the last quarter on a YoY basis and net income was 47% lower:

| 1Q24 | YoY Change | |

| Interest Revenue | $32,708,000 | 12% |

| Net Interest Income | $19,658,000 | -14% |

| Non-Interest Income | $7,492,000 | -2% |

| Net Income | $3,435,000 | -47% |

| EPS Diluted | $1.01 | -46% |

| Tangible Book Value | $50.82 | 0% |

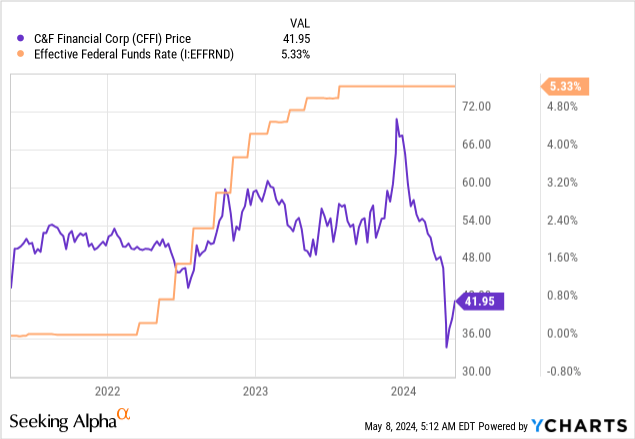

The market seems to have appreciated the resilience C&F has demonstrated during rising interest rates in 2022 and most of 2023 until, in 2024, it more than “corrected” the appreciation occurring at the end of the previous year:

Now, as this is an asset-sensitive bank, lower interest rates would result in lower net interest income in the short term. The Fed may not cut the rate as much as 75 bps in the short term however; inflation is still high and it made very clear that potential rate cuts depend on what the data shows going forward. However, one 25 bps cut is what many economists forecast to occur in 2024. Judging how the market reacted to the rate being held steady in 2023 and the hint that rate cuts are coming, a realization of a drop in the policy rate of interest should have a major impact here.

Solvency & Liquidity

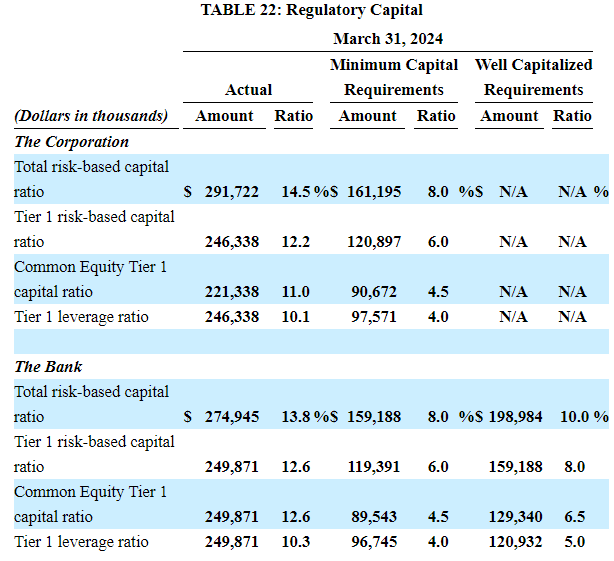

Regarding the capital position of C&F, capital ratios have been quite high at both the holding company and bank subsidiary levels, greatly surpassing the minimum capital ratios for “well-capitalized” status:

10-Q

Moreover, with an LDR of 87%, the bank shows a conservative use of capital by maintaining a significant margin of safety. While non-interest-bearing deposits being 25.62% of total deposits justify this, the bank is well-positioned to more aggressively grow the loan portfolio once the demand increases as 22% of total assets are liquid, providing adequate liquidity for the loan/deposit ratio to become more balanced.

Dividend & Valuation

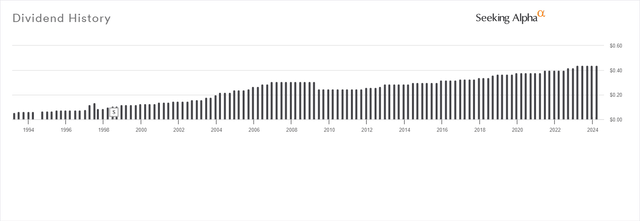

CFFI currently pays a quarterly dividend of $0.44 per share, resulting in a forward yield of 4.08%. While this is low these days, its 25.2% payout ratio and the outstanding payment record make the overall dividend profile very attractive:

Seeking Alpha

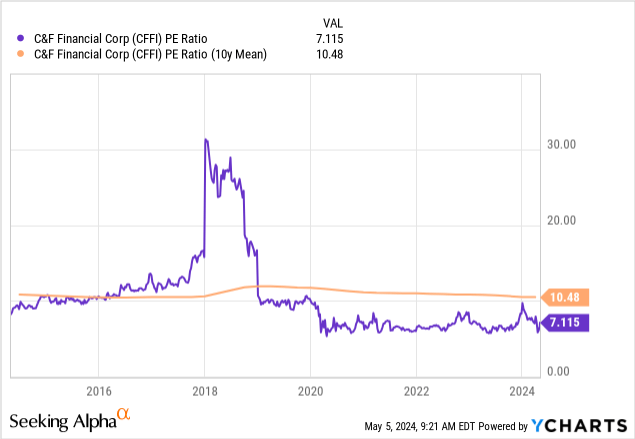

The dividend yield is actually high when you consider how much the bank allocates to distributions and indicates good value. Its earnings multiple comes to verify this as it’s only 7x and well below the 10-year mean:

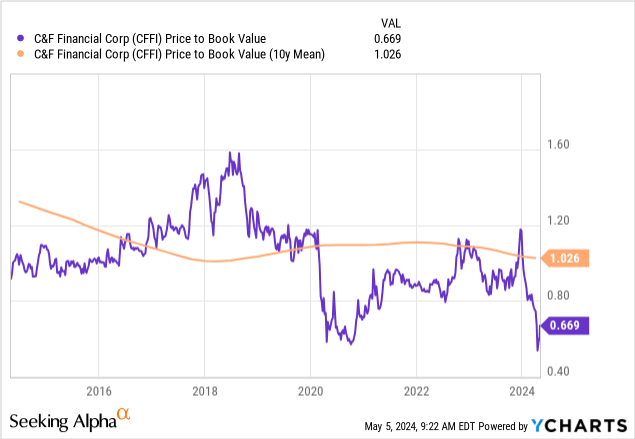

The same thing is reflected in the P/B ratio of 66% which is below the 10-year mean of 100%:

Also, the discount to tangible book value is currently 17.5%, providing an adequate margin of safety along with the solid solvency/liquidity profile of the bank.

Risks

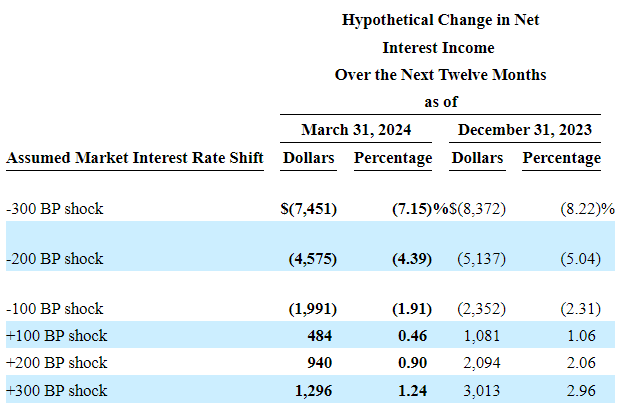

If interest rates drop in the short term, net interest income will decline according to the latest 10-Q. However, the bank is less asset-sensitive than it was at year-end 2023, so the potential pressure is minimal in a 100 bps reduction scenario:

10-Q

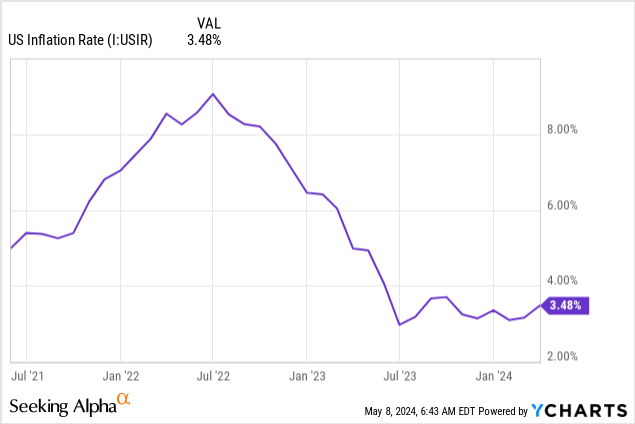

Besides, the rate cut we talked about earlier may not come in the short term if inflation doesn’t fall close to the 2% target of the Federal Reserve. There’s still some way to go even after so much progress has been made:

During the last meeting, the Federal Reserve held the rate steady since inflation increased recently. This battle on inflation may drag out long enough to make the primary risk that C&F is facing not so significant.

Verdict

All in all, I believe the risks are worth the potential gains because of the great dividend profile, resilience in high-interest environments, and great margin of safety. For these reasons, I am rating CFFI a buy at current levels.

What do you think? Do you own shares of this bank or intend to? Let me know in the comments. Thank you for reading.

Read the full article here