Pre-Earnings Stock Surge Driven by AI Enthusiasm

Chegg’s (NYSE:CHGG) stock price spiked nearly 30% in pre-market trading following the release of its latest quarterly earnings. This sudden surge was fueled primarily by investor enthusiasm around Chegg’s newly announced AI math solver initiative called CheggMate. Many investors hoped this partnership with OpenAI to leverage generative AI could catalyze a turnaround for the struggling education company.

Underlying Metrics Show Business Deterioration

However, we view this dramatic rally as unjustified and believe Chegg still faces substantial competitive disadvantages that new AI technologies alone cannot quickly overcome. Examining Chegg’s underlying financial and operating trends reveals persisting business deterioration that will likely continue hampering growth prospects regardless of the intriguing AI announcement.

During the earnings call, Chegg’s CEO enthusiastically introduced CheggMate, developed in collaboration with OpenAI. He expressed a strong conviction that Chegg’s proprietary assets including data, expert network, and experience position it as a leader in using AI to transform education.

“We believe we are in the best position to take advantage of the advancements in AI for the benefit of students because we can leverage our proprietary data, our 150,000+ experts, and our decade-plus years of experience as we launch CheggMate.”

However, Chegg’s financial and operating results depict a far less rosy picture. In the latest quarter, paying subscribers declined 9%, accelerating from a 5% drop last quarter. Chegg’s own guidance for next quarter called for a further 15% slide in subscription revenue, a 300 basis point contraction in gross margins, and a substantial 32% decrease in adjusted EBITDA.

This worsening operating metrics and financial performance matched up poorly with the CEO’s unrelentingly positive assertions around the new AI math solver. We initially warned in April that Chegg was neglecting to innovate its core tutoring business in favor of enriching shareholders, which would likely backfire. With shares down 38% since then, those concerns have clearly materialized.

Chegg Faces 3 Key Disadvantages in AI Space

Taking another look at the CEO’s earnings call remarks through this lens reaffirmed our strongly bearish thesis. We remain unconvinced that an unproven AI tool can turn around Chegg’s fortunes given three key disadvantages:

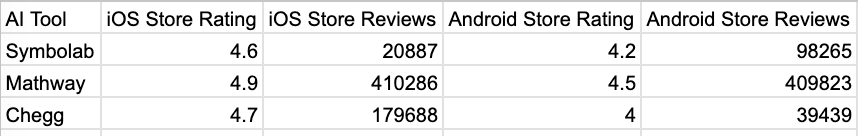

Firstly, Chegg is undeniably a late entrant into the increasingly competitive AI-powered math solver space. Well-funded rivals like Symbolab, Mathway, and others gained first-mover advantages by launching polished solver tools with advanced equation input and step-by-step solutions long before CheggMate’s nebulous launch. These competitors offer superior app store ratings and reviews, especially Mathway, indicating Chegg is already behind the curve and lacks differentiation.

AI tool ratings (Apple, Google)

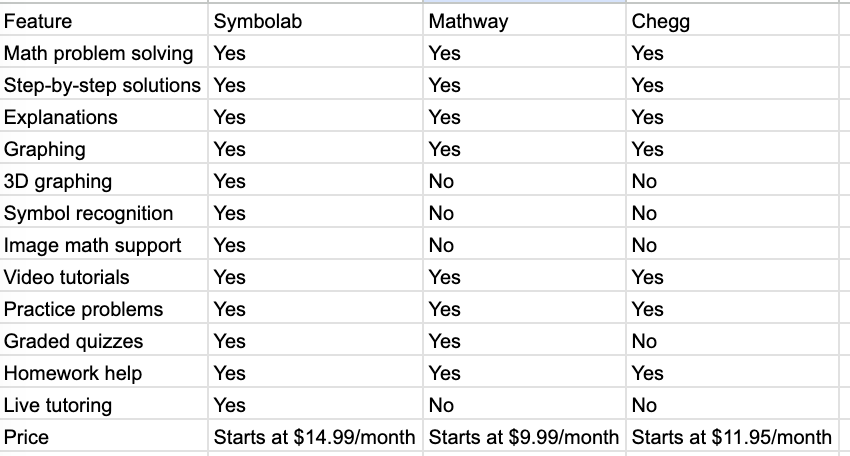

AI tool function (Symbolab, Mathway and Chegg)

Secondly, AI-based solving tools inherently lack durable and defendable competitive advantages. As we’ve detailed previously, generative AI technologies do not confer sustainable moats. Chegg wields almost no pricing power or margin control over the underlying API costs charged by AI providers like OpenAI. It also cannot materially improve or customize the core solving engine itself. Any innovations can spread instantly across all competitors.

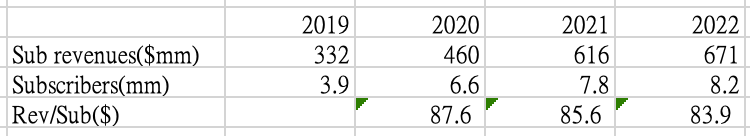

Lastly, the company’s acquisition-driven expansion has failed to deliver improving performance. While total revenue has increased over the past three years, revenue per subscriber has steadily declined. This ratio is a key metric in subscription businesses, signaling pricing power and customer retention. The data shows retention deteriorating over time.

Q1 2023 brought further concerns, with subscribers unexpectedly dropping 5% versus 8% growth in the previous quarter. This reversal into subscriber losses compounds the revenue per-user weakness. With the customer base now shrinking, revenue faces headwinds going forward.

The declining revenue per subscriber ratio indicates fading pricing strength and increased customer churn. Unless reversed, dwindling subscribers will accelerate revenue pressures. The company must reinvigorate retention and loyalty to restore positive operating trends. Acquisition-led growth has not translated into fundamental improvement so far.

Rev/subscribers (CHGG)

Unsurprisingly, Chegg’s financials reflect these harsh operating realities. Despite managing to generate $135 million in quarterly cash flow, Chegg maintains lavish and untargeted share buybacks rather than investing to fix core weaknesses. In the first half of 2023, the company incurred an operating loss of $23 million, marking a reduction of $35 million compared to the preceding year, 2022. Despite investing $67 million in sales and marketing efforts during the same period, the company’s subscriber count persisted in its decline. This observation points to an ongoing challenge posed by the contraction of the user base, creating unfavorable conditions for the company.

Valuation

Our prior $7.9 per share price target assumed no growth for Chegg, but the worsening user and revenue trends may warrant even steeper valuation multiples moving forward. Chegg must first demonstrate progress on stabilizing its accelerating subscriber losses before the stock warrants any serious upside reconsideration. Until then, Chegg appears materially overvalued, despite the alluring AI-driven turnaround narrative.

Conclusion

Chegg’s post-earnings stock price surge seems entirely unjustified given its late entry and limited competitive advantages within the AI math solver space. With paying subscribers dwindling steadily for years, flashy new technologies feel inconsequential without first executing better on the basic business foundations. Substantial challenges clearly remain for Chegg despite the alluring AI announcement. Investors would be wise to exercise caution before buying into the lofty turnaround hype. We firmly reiterate our “sell” rating.

Read the full article here