The C Investment Thesis Is Only For The Patient

We previously covered Citigroup Inc. (NYSE:C) in June 2023, discussing its well-diversified portfolio and the stickiness of its multinational client base, easily weathering the recent banking crisis.

The bank had also narrowed its operating efficiency to 68.6% and adj ROTCE to 9.3% by FQ1’23, nearing its medium-term target of ~60% and 11.5% at the midpoint.

For now, C records underwhelming FQ2’23 revenues of $19.4B (-9.3% QoQ/ -1% YoY) and adj EPS of $1.37 (-26.3% QoQ/ -36.8% YoY). Unfortunately, its ROTCE has also declined drastically to 6.6% (-2.7 points QoQ/ -4.6 YoY).

On the one hand, the bank’s operating expenses of $13.6B (+2.2% QoQ/ +9.6% YoY) have accelerated compared to its top-line, naturally explaining the profitability headwinds as above.

On the other hand, much of this cadence is attributed to the C management’s efforts in simplifying its platform while modernizing its infrastructure. This is demonstrated by the increased headcount in Technology, with tech related expenditures up by +13% YoY.

Combined with the bank’s ongoing divestitures, we believe this streamlining process is highly necessary as a way to extract improved efficiency and profitability in the long-term. Therefore, we believe that these headwinds are only temporary, further amplified by the rising inflationary pressures and ongoing severance.

C’s Treasury and Trade Solutions and Securities Services [TTS] have also outperformed in FQ2’23, with revenues of $4.7B (+4.4% QoQ/ +14.6% YoY), well balancing the impacted results in the Investment Banking at $1.2B (inline QoQ/ -42.8% YoY) and Market segment at $4.6B (-17.8% QoQ/ -13.2% YoY).

This is a testament of Jane Fraser’s stellar leadership, since the bank’s TTS segment recorded nearly 10% in global market share as the “undisputed leader.”

With C’s institutional business also growing tremendously by +24.3% YoY in H1’23 despite the peak recessionary fears, we share the CEO’s belief that TTS is “clearly the crown jewel of its global network,” potentially boosting the bank’s valuation moving forward.

Anyone concerned about C’s lower Market/Investment QoQ revenues may be rest assured that the same has been observed with Bank of America (BAC) in the latest quarter, with “clients standing on the sidelines while the US debt limit played out.”

Therefore, we believe things may return to normalcy by H2’23, allowing the bank to meet its FY2023 revenue guidance of $78.5B (+4.2% YoY) and NII of $46B at the midpoint (-5.4% YoY), despite the slower FQ2’23 performance.

For now, it may be prudent to give C some credit, especially given the challenging macro events over the past three years. While we agree that “the management needs to execute with more urgency,” it has also iterated an ongoing curve bending process through 2024, on top of a complete separation of the Banamex business then.

Investors need not be worried about the bank’s expanding Net Credit Losses of $1.5B (+15.3% QoQ/ +76.9% YoY) in the latest quarter as well, since the ratio of 2.47% remained below pre-pandemic levels of 2.6%.

In addition, the spread in C’s loan yield of 8.63% (+0.37 QoQ/ +2.82 YoY) and deposit costs of 3.09% (+0.37 points QoQ/ +2.56 YoY) remain highly profitable, boosting its FQ2’23 NIM to 2.48% (+0.07 points QoQ/ +0.24 YoY).

As a result, while the elevated interest rate environment remains a headwind, due to the increase in the bank’s credit losses and delinquency rates, the overall effect has been net positive thus far, further aided by Powell’s guidance of two more rate hikes in 2023.

Patience may be the key for investing in C for now.

So, Is C Stock A Buy, Sell, or Hold?

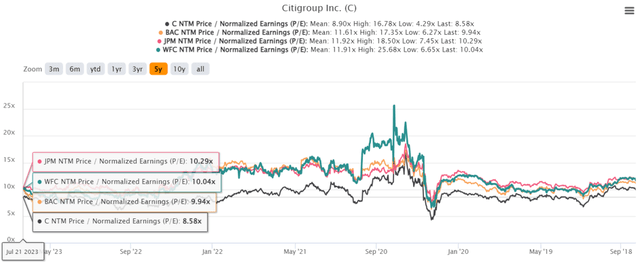

C 5Y P/E Valuations

S&P Capital IQ

For now, C trades at NTM Price/ Sales of 1.16x and NTM P/E of 8.58x, nearer to its pre-banking crisis of 1.31x/ 8.87x, though still moderated compared to its 3Y pre-pandemic mean of 2.30x/ 10.30x, respectively.

C also trades at a discounted NTM P/E valuation, compared to its US big bank peers, such as Bank of America at 9.94x, JPMorgan Chase & Co. (JPM) at 10.29x, and Wells Fargo (WFC) at 10.04x.

This is despite the market analysts expecting C to record a bottom line expansion at a CAGR of +3.8% through FY2025, near to BAC at +3.7%, though naturally lagging behind JPM at +8% and WFC at +20.3%.

Combined with the fact that C is trading way below its book value of 85.47 in the latest quarter, Mr. Market appears unwilling to reward the management’s efforts thus far. Assuming that this pessimism is not lifted moving forward, the stock may continue to underperform compared to its peers.

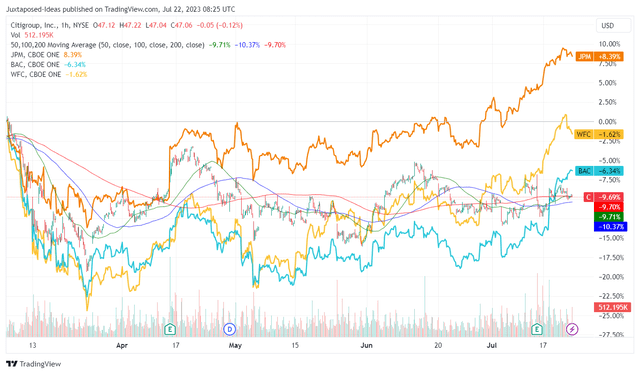

C 4M Stock Price

Trading View

Despite the more than decent FQ2’23 earnings call, the C stock also continued to trade sideways, compared to its big bank peers’ notable recovery since the March 2023 banking crisis bottom. We are surprised by this pessimistic cadence indeed.

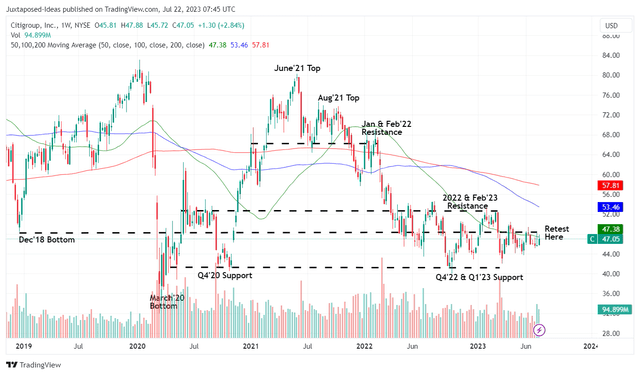

C 5Y Stock Price

Trading View

Then again, we believe this depressed level may offer an excellent margin of safety to our price target of $80.54, based on C’s normalized P/E and the market analysts’ FY2025 EPS projection of $7.82.

Naturally, due to the uncertain macroeconomic outlook, investors must also be very patient, since the path to its full recovery may take longer than expected.

However, this may be the time to aggressively bet on its long-term prospects, since this correction present great dollar cost averaging opportunities for long-term investors, or entry points for prospective investors.

Therefore, we continue to rate the C stock as a Buy for value-driven investors with long-term investing trajectories.

Investors should simply sit back and enjoy its expanded forward dividend yield of 4.51%, compared to its 4Y average of 3.62% and sector median of 3.7%, thanks to its compressed stock prices.

Read the full article here