Introduction

The energy sector is increasingly complex as a result of the expansion of sources and categories of production. The advent of renewable energy sources has split the space into traditional, fossil fuels (non-renewables) and the renewable entrants, including electric, wind and solar.

This shifting environment also impacts investors’ considerations and investment choices. Energy companies that are linked to fossil fuel production must pass a higher bar in the current environment. We already see companies turning to activities such as carbon conversion to adjust to a renewables-focused future.

A traditional operator such as ConocoPhillips (NYSE:COP) must factor these macro trends in its thinking. COP has worked on increasing efficiency to maximize future revenues and profits. It clearly believes that non-renewable energy will remain in strong demand for years to come.

ConocoPhillips in a Nutshell

ConocoPhillips (COP) is a fairly vanilla energy company with diversified energy assets and a solid, long-term strategic plan. Its determined strategic focus is perhaps the primary distinguishing factor between COP and competitors.

COP owns a relatively low-cost portfolio but with inherent flexibility to exploit tactical opportunities. Company leadership has demonstrated that it can and will deploy fiscal strength smartly if the right scenario arises.

The Business Strategy

ConocoPhillips has implemented a strategic 10-year plan that rests on multiple pillars: Restrained investment, steady growth, better returns and returning cash consistently to shareholders.

The company intends to maintain capital spending at about $11 billion per year while returning 30% of operating cash flow to shareholders. It seeks to accomplish this combination of prudent spending and healthy shareholder returns via: 1) Share buybacks 2) an ordinary annual dividend and 3) a variable component. In my view, the variable component is where investments tied to rising energy price environments come into play through mechanisms such as off-take* agreements.

*An offtake agreement is an arrangement between a producer and a buyer to purchase or sell portions of the producer’s upcoming goods.

Another aspect of COP’s business plan includes an emphasis on unconventional* assets – specifically in the Permian Basin, its largest resource position via the purchase of Concho Resources and shale assets from Shell’s Permian holdings.

*Companies may obtain conventional energy by unconventional means such as extracting from oil shale, shale gas and deepwater oil.

Outside of the Permian, COP holds steady production levels from Bakken and Eagle Ford holdings. Eagle Ford, while less than 30% of the approximately 700,000 acres in the Permian under the COP flag, features high-return oil and liquids. The Bakken includes 560,000 acres. Eagle Ford is actually currently more economical/profitable per barrel than the Permian sources.

COP also owns significant Alaska and Canada acreage that offer real promise – it expects significant growth in Alaska. In addition, COP is involved in Qatar LNG expansion work and producing LNG in Texas (Port Arthur). A large Australian LNG resource is APLNG, or Australia Pacific LNG.

The Qatar LNG is first-quality, while the Australian LNG production is appealing for its projected ability to drive massive sales to Asian customers for many years. Together, the two sources should drive COP LNG production close to 300 mboe/d by decade’s end.

*mboe/d means one thousand barrels of oil equivalent per day.

COP has improved its portfolio through cost reductions and sales of assets and through low-cost, non-conventional product growth. ConocoPhillips has reduced per-barrel operating costs almost 30% in 10 years.

Adding Permian resources bumped up the high-quality side of the COP portfolio. While production has been flat for the past nine years, divesting natural gas and shifting the emphasis to higher-margin crude (up to 53% from 39) enhances profits.

Add in off-take agreements such as the Saguaro site in western Mexico, and a picture of diverse production emerges within the strategic plan.

A combination of strategic planning, cost-consciousness and resource/field diversity create an attractive, compelling business case for potential investors.

The Q2 Earnings Call: A Treasure Trove

On Aug. 3, COP Chairman and CEO Ryan Lance and his executive team met with Wall Street analysts to discuss the company’s second quarter earnings. The report was generally positive and the crop of analysts on the call asked a number of relevant and challenging questions of Mr. Lance and his team.

Ryan Lance began by referring to the strategic 10-year plan, which had its official kickoff this past April, and noted how the plan guided COP decisions even quarter-by-quarter:

“…we committed to you that we would keep working to make the plan even better, and we’ve done that again this quarter.”

Having a long-term plan as a reference for a bevy of current actions and decisions is, in my view, a great advantage for COP. Lance then delved into specific company moves in regards to resource holdings, specifically Surmont in Alberta, Canada:

“We executed an agreement to purchase the remaining 50% of Surmont, which we expect to close in the fourth quarter. Surmont is a long life, low decline and low capital intensity asset that we know very well. In the current $80 per barrel WTI price environment, we expect incremental free cash flow from the additional 50% interest to approach $1 billion in 2024. We expect first production in early 2024 from Pad 267, our first new path since 2016, and we see debottlenecking potential at the facility to further improve our cash flows.”

Ryan Lance also addressed the role of global LNG in COP’s operations, which shows resource diversification and how its commercialization should impact ConocoPhillips and its bottom line:

“We also continue to progress our global LNG strategy. In the quarter, we finalized the acquisition of our interest in the Qatar North field South joint venture. And in North America, we executed agreements for 2.2 million tonnes per annum of off-take at the Saguaro LNG project on the West Coast of Mexico..in Germany, we…have secured a total of 2.8 million tonnes per annum of regasification capacity…and while it’s only been a few months since FID at Port Arthur, we are further progressing our off-take placement opportunities in both Europe and Asia.”

This statement demonstrates the scope of COP’s LNG expansion as well as its use of joint ventures and off-take deals that brighten the palette of LNG revenue sources.

The CEO addressed second quarter performance, including a raise in full-year production guidance based on capital efficiency improvements. Lance emphasized focus on return-focused value and distribution of $5.8 billion through dividends and buybacks year-to-date while funding shorter and longer-term organic growth opportunities.

The company’s Executive V-P and CFO, William Bullock highlighted cost cutting in a step-down in capex for 2023:

“Second quarter capital expenditures were $2.9 billion, which included $624 million for long-cycle projects. Now through the first half, we have now funded $700 million for Port Arthur LNG of the planned $1.1 billion for the year, which we expect to lead to a step down in overall capital in the second half. We also expect to see a step down in Lower 48 capital in the second half of the year. And as a result, we have narrowed our full year capital guidance range to $10.8 billion to $11.2 billion, with no change to the midpoint.”

Guidance also was conservative:

“We have also increased the midpoint of our full year production guidance. Our new full year range is 1.8 million to 1.1 million barrels of oil equivalent per day up 15,000 barrels per day from the prior midpoint of $1.78 billion to $1.8 million previously. For APLNG, we expect distributions of $400 million in the third quarter and $1.9 billion for the full year.”

“Consistent with our higher production guidance for the year, we have raised our full year adjusted operating cost and our DD&A* guidance by $100 million each to $8.3 billion and $8.2 billion, respectively. We have also lowered our corporate cost guidance by $100 million to $800 million due to higher interest income.”

*DD&A is depreciation, depletion and amortization. Depreciation relates to the cost of a tangible asset, depletion to the cost of extracting natural resources, and amortization to the deduction of an intangible asset.

The Analysts Dig In

As with any useful earnings report call, the most compelling portion is often the Q & A that provides give-and-take between Wall Street analysts and company leaders. Analysts asked about production momentum, dividend policies, deflationary trends and LNG expansion strategy.

Executive V-P Dominic Macklon addressed production momentum:

“…that’s the second quarter that we’ve increased in a row. Our production guidance were up 25,000 BOEs equivalent since the beginning of the year, and what’s interesting about 80% of that increase is actually oil. And so our full year underlying growth is expected to be 3% to 4% this year, and that would be 7% to 8% in the Lower 48. Now there is a lot of focus on product mix right now in the sector.”

Macklon was asked whether COP would be increasing its dividend in the wake of the enormous cash flow benefit ($1 billion) from the Surmont property. The answer was “no” with consideration of a dividend raise in the future.

He also handled a query about deflationary trends in the energy sector. Macklon confirmed that production costs in the Lower 48 had fallen:

“…We’ve seen some significant price relief on any oil price-related commodities, fuel and chemicals and things. We’ve seen some material reductions in sand and proppant. Rig rates have softened a bit…driven by the gas basin…we are beginning to see some examples of frack spread rates coming down in some basins.”

Questions about LNG strategy and expansion, clearly a recent focus, fell mostly to CFO Bullock.

“We’re really focused on building up both our market and our originating highly competitive supply on a pretty stair-step basis. And we’re making excellent progress on both those fronts…we’ve secured million tons of re-gas in Germany. That supports our 2 million-ton off-take from our LNG SPAs with Qatar. That leaves 0.8 for our commercial LNG business. And putting that in perspective, that’s 16% of Port Arthur LNG right there. And we are continuing to make excellent progress advancing off-take into Europe, and [in] discussions with several Asian buyers.”

“And against that backdrop, we are pretty thrilled to be adding 2.2 million tons of off-take on the West Coast of Mexico. That’s obviously pending successful FID by Mexico Pacific…This particular facility adds diversity to our off-take options. It avoids the Panama Canal. It’s supportive of volumes into Asia. And from a supply perspective, it really does complement our off-take from Port Arthur very nicely. It creates some excellent optimization opportunities.”

The takeaways suggest a company moving deliberately and strategically, husbanding its financial resources and allocating cash flow “bonanzas” (as from Surmont) opportunistically.

COP mixes expansion of properties in the Permian with cost-efficient production in static (in terms of size) Bakken and Eagle Ford. It invests in fields from Canada to Qatar to Australia, combining high-quality production (Qatar) with lower quality fields (Australia) whose primary advantage is proximity to “thirsty” Asian markets. The company also is nimble enough to apply its balance sheet resources to deals like the off-take agreement with the Saguaro facility in Mexico.

Company leadership is direct and no-nonsense. I detect an absence of hype along with pragmatic execution of an intelligent long-term strategy.

Metrics

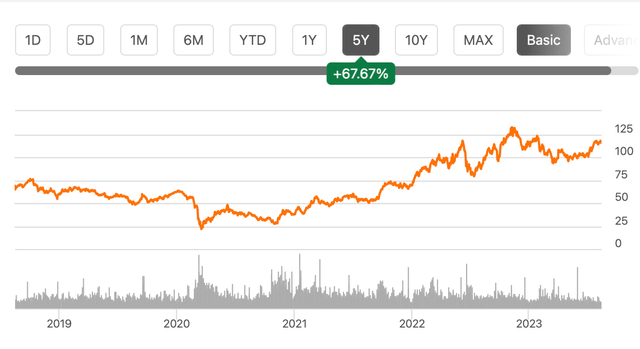

Let’s first consider share price performance over the past five years for COP:

Seeking Alpha

Doubling shares in this period of time is solid performance. Current company improvements suggest a strong possibility of enhanced returns over the next several years.

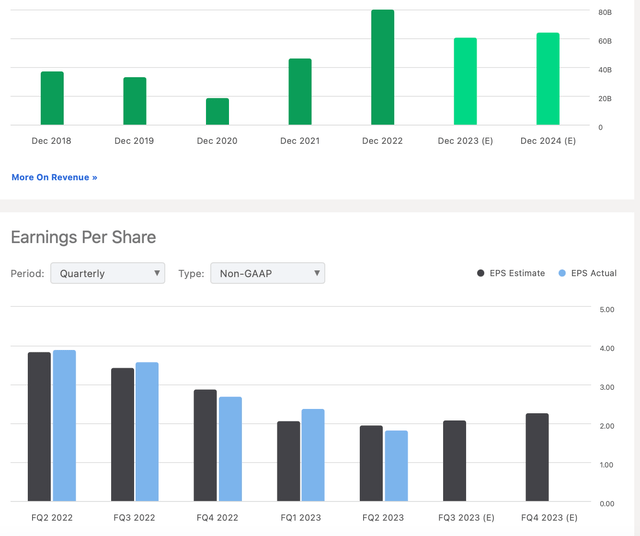

Next, we will look at revenues and earnings per share, both historic and near-term-future projections:

Seeking Alpha

Lumpiness exists for both measures, with the revenue levels varying considerably. Yet 2023 and 2024 full-year projections are positive and above those of most previous years (save 2022).

For EPS, the chart displays a much shorter time (as against five years for revenues). The projections are modestly encouraging for ’23-’24.

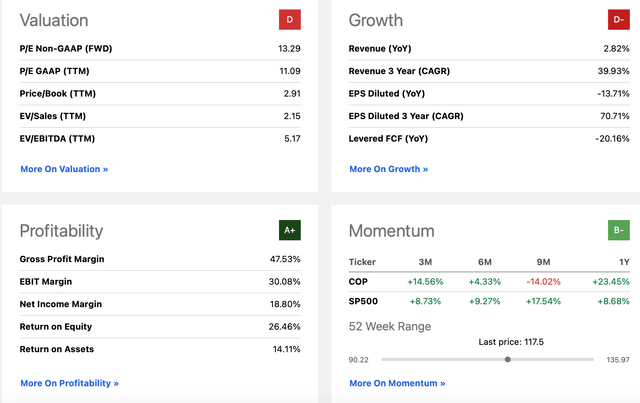

A combined look at some standard metrics follows:

Seeking Alpha

Valuation falls into the mediocre range for energy companies. Growth, including levered FCS, has disappointed and casts some doubt on earnings call statements.

Profitability is exceptional, earning the rare Seeking Alpha A+. Share price momentum gets a B- and exceeds the S&P 500 average momentum (3x for the past year).

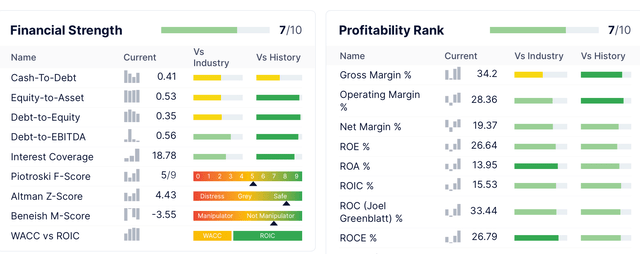

Finally, let’s take a look at the ConocoPhillips financial strength and profitability ratings from GuruFocus:

GuruFocus

Combined metric categories produce a nice 7 of 10 for COP.

The useful safety scores packaged in the Altman Z-score and Beneish M-score are reassuring to those with lower risk appetites.

On the profitability side, gross margins are somewhat anemic compared to industry rivals; remaining metrics are good and green.

Risks

ConocoPhillips risk factors include:

- Disappointing results and/or production difficulties from specific holdings

- Changes in particular markets for specific products or product types

- A sudden and prolonged decrease in energy prices resulting in lower revenues and profits/free cash flow declines

- The macro transition to renewable energy

- A failure of one or more pieces of the 10-year strategic plan or the failure to adjust to same

- Corporate leadership changes

I see COP strategy as quite sound, diversified and conservative. Issues with production or revenues tied to specific resources should be minor in nature. Target markets seem well understood, and fluctuations in demand should be minimized by smart logistical implementations such as “partnering” specific assets with markets. The best example may be Australian LNG at high production rates able to be delivered swiftly to Asian customers.

Energy prices may remain high into the foreseeable future. Just as relevantly, ConocoPhillips emphasis on strategic low-cost production will mitigate any macro price declines.

The risk of COP suffering from the ongoing transition to renewable energy sources accelerates is real. Nonetheless, I see a continued strong demand for traditional (even if unpopular) sources of energy for years to come.

The 10-year plan is a strong one. It’s diversified and provides an umbrella or dome within which flexible tactical decisions may occur. COP has already shown how it takes cash flows and deploys them in off-take agreements as with Saguaro in Mexico.

I do not expect significant C-suite changes any time soon. Based on the content of the Q2 earnings call, company leadership appears well-rounded, determined and hard-nosed.

Summary

When I thought about a rating for ConocoPhillips before researching the company, I would have guessed a Hold would emerge.

My look into COP, its structure, strategic planning and execution, leadership and philosophy changed that. I would recommend COP as a Buy for investors willing to hold shares for three-to-five years.

While I do not own any COP personally, I am considering adding shares to my personal portfolio.

Read the full article here