Investment Thesis

CSP Inc (NASDAQ:NASDAQ:CSPI) has seen a massive rally over the past few years, up over 200% giving investors massive gains if they got in early. However at today’s prices, I believe the valuation is excessive and recommend a sell rating because all of the growth prospects seem to be priced in. While growth prospects seem decent, I doubt that they are enough to justify today’s share price. The risk/reward profile has gotten unfavorable so investors should take profits while they can and potentially redeploy the capital elsewhere. While I like the company and their products, the valuation seems too pricey and warrants a sell rating.

Company Overview

The company develops IT solutions to meet customers needs in diverse industries such as manufacturing, financial services, and utilities. CSP Inc offers innovative solutions through selling software and hardware to empower customers by optimizing their IT infrastructure. According to the annual report, the company “operates in two segments: Technology Solutions and High Performance Products.”

Technology solutions, or TS, refers to their subsidiary Modcomp Inc, and “generates service revenues by the delivery of professional services for complex IT solutions, including advanced security; unified communications and collaboration; wireless and mobility; data center solutions; and network solutions as well as managed IT services that primarily serve the small and mid-sized business market” (Annual Report, Page 2). I like to think of this segment simply as helping customers manage their data, security, and cloud infrastructure to make sure their business runs smoothly.

High Performance Products, or HPP makes revenue from “three distinct product lines: ARIA Software-Defined Security, Myricom network adapters, and their legacy Multicomputer product portfolio” (Annual Report, Page 2). These products seem to me very critical to customer’s security operations as they detect threats, protect critical digital assets and information, and provide extra defense against cyber attacks.

Main Website of CSP Inc.

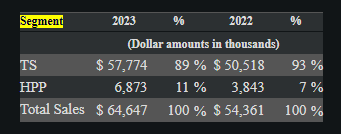

For 2023, TS made the majority of revenues, coming in at $58 million compared to $50.5 million in 2022. The company recorded a modest increase of 19% in revenues, but the share price seems to have jumped too far ahead with an increase of over 150% in the past year. Just based on this I can see the stock is pretty expensive as the fundamentals haven’t really caught up to the share price.

Annual Report, Page 3

My take on the company is that the products seem very attractive and valuable with strong lock-in. Once customers utilize the TS, they are dependent on the constant service to make sure their HR, IT, data centers, and digital cloud are running all the time. The company’s main website showcases numerous awards which leads me to believe their technology is advanced and solutions effective. Their reputation seems solid as many notable partners include Hewlett Packard (HPQ), Dell (DELL), and Cisco (CSCO) for their Technology Solutions. Overall, a solid IT solutions provider with a good track record of creating valuable products for customers across many industries.

Industry Demand Remains Robust

I believe the market for consistent IT solutions is growing, with demand remaining robust due to the growing necessity for secure IT infrastructure. As the world moves more digital and data is being stored in more places, companies need effective solutions to manage their networks, cloud, and data centers.

According to Check Point, “Q1 2024 saw a marked 28% increase in the average number of cyber attacks per organization from the last quarter of 2023, though a 5% increase in Q1 YoY.” I believe this trend will only continue as more hackers and thieves are interested in stealing data and exploiting company’s information to make money. As AI becomes more advanced, the scams should become even more sophisticated, leading me to believe demand for products like Vital Managed Detection will grow.

Companies are doubling down on investments in IT solutions to make sure their operations are state of the art. Gartner predicts “IT services will continue to see an increase in growth in 2024, becoming the largest segment of IT spending for the first time. Spending on IT services is expected to grow 8.7% in 2024, reaching $1.5 trillion…” I expect many of these dollars to help CSP Inc. grow as they have the reputation of providing technology solutions that create more efficiency and security.

Finally, more and more companies want to have a SOC, or Security Operations Center, to better manage the organization for cyber threats. However, the challenge with these SOCs can be “operational overhead, a shortage of cybersecurity skills, and too many alerts” (Check Point). I feel that the company’s ARIA portfolio is therefore extremely attractive to customers who want to have an SOC but don’t have the skills, resources, or experience. Their ARIA portfolio consists of AI driven solutions that seem to work together cohesively to make sure data is protected. The fact that it’s virtual and fully automated leads me to believe it is much cheaper than a traditional SOC, so a lot of companies may be interested in the ARIA solutions to save money and time.

Shrinking Backlog, Competitive Market

Despite my optimism in rising demand for IT solutions, I do see some weaknesses that may hold CSP Inc. back from consistent growth. I noticed that their backlog has shrunk dramatically, which signals to me a weakness in finding new customers. It seems that the company relies too much on old clients and simply upselling them with new products, but struggles in finding new business.

According to the annual report on page 6,

The gross backlog of customer orders and contracts for the TS segment was approximately $7.5 million at September 30, 2023, as compared to $18.2 million at September 30, 2022. Our backlog can fluctuate greatly and in the prior year there were supply chain issues which caused a relatively large backlog compared to historical years.

I feel that the company seems too prone to supply chain issues, and that their large backlog was more due to temporary disruption rather than actual business growth. So once those supply chain issues were resolved, the backlog shrunk dramatically. Going forward, revenues may be under pressure as backlog is pretty small now. Investors should be careful about projecting past growth indefinitely into the future. My analysis tells me the competition is very fierce and the shrinking backlog is a weakness to future growth.

Furthermore, limited resources in research and development put CSP Inc in a vulnerable spot. Big companies with deep pockets such as Palo Alto (PANW) or VMWare have significant dollars to spend on developing new technology. Compared to the billions that bigger companies spend on R&D, CSP Inc. has $3 million for 2023 R&D. I remain skeptical if that is enough to sustain the optimistic growth the share price suggests.

Finally, competition is a major weakness as a lot of companies are fighting for a piece of the growing pie. While I see CSP Inc. growing revenues, it seems like most of it is concentrated in a small customer base and that base isn’t growing. According to the annual report on page 13,

We have experienced fluctuations in operating results in large part due to the sale of products and services in relatively large dollar amounts to a relatively small number of customers.

It may be difficult for CSP Inc as a smaller player to gain the trust of bigger companies as they may view having all their IT solutions tied up with CSP Inc a risk factor as they lack the resources, employee base, or track record for large orders. I view the limited R&D and customer base to be a weakness that may impede revenue growth.

While in the first section I mention industry demand remains robust, I question whether it is enough to justify CSP Inc’s valuation. Given the sky high share price I remain skeptical if fundamentals can catch up. It seems to me the company is overpriced and expectations are far too high, and in the future a downward correction may happen.

CSP Inc. Is Overvalued – $12 Fair Value

Assuming revenues grow at 10% year over year, which is above the sector median of 7%, I still think the stock is dramatically overvalued. By 2027 I expect sales to reach over $80 million. Assuming net margin of 5%, which is optimistically over the sector median of 2.68%, profits should be $4 million annually. Divide by shares outstanding of 10 million gets me EPS of $0.40 by 2027.

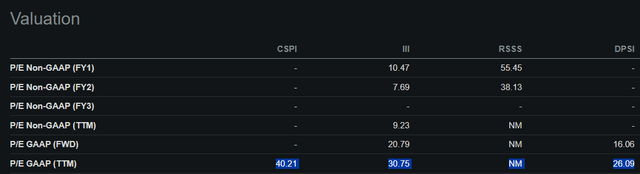

Apply an aggressive earnings multiple of 30x (which is above the sector median of 24x) is $12 per share fair value, which is still below today’s current price of $17. I think the stock is therefore overvalued and expectations are far too high. At 45x TTM earnings (above the sector median of 22x), it is a very expensive stock and growth may not catch up in the future.

Against peers, I see CSP Inc. being the most expensive. At 42.5x FWD earnings ($17/$0.40=42.5x), it is much higher than Information Services Group (III) at 20x FWD PE, and Decision Point Systems (DPSI) at 16x FWD PE. Investors may choose to deploy capital elsewhere where the valuations are much more attractive.

Seeking Alpha

For such a low margin business, I can’t justify paying such a high earnings multiple especially when competition is so fierce. The company announcing a 2 for 1 stock split in the form of a dividend sent the shares soaring up 11%, which seems to me unwarranted given that stock splits create no fundamental value for a company. This further evidence leads me to believe the shares are overvalued as even something neutral as a stock split creates unjustifiable optimism.

Potential Upsides

Some potential upsides may justify this share price, such as continued growth in revenues and a potential profit margin expansion. In order to justify today’s share price, profits really need to catch up. The company could potentially find new customers, increase backlog, and have more resources to deploy into research and development.

The company could also potentially enter new industries, gain more reputation, and continue to upsell current customers with more offerings. According to a recent press release,

“We are excited with the early success and demand of the ARIA Zero Trust PROTECT offering, surpassing our initial expectations and culminating in the first multi-million dollar contract with a global pharmaceutical corporation,” commented Victor Dellovo, Chief Executive Officer. “We believe the initial achievements of the AZT offering, coupled with high customer satisfaction, are greatly enhancing our reputation and allowing us to compete at the highest level, and among some of the largest companies and organizations in the world as they seek to protect their enterprises from cyberattack threats.

It’s possible that revenues from new contracts could drive revenues high enough to justify today’s current share price. Maybe I underestimate the company’s potential to leverage AI, experienced partners, and the growing demand for cybersecurity. And despite being a small company, CSP has proven to be able to secure lucrative contracts and may be able to continue this streak in the future.

Sell CSP Inc.

Ultimately, the company seems to be strong and continue to secure very good contracts with customers who want increased cybersecurity solutions. I don’t doubt the company’s track record, instead I doubt the share price. At $17 a share, it is very expensive and I struggle to find any way to justify the share price with any intrinsic valuation methods. Plus, a very competitive market and shrinking backlog makes me worry about the true potential of this company going forward. Investors should be careful about projecting past growth into the future and sell (some or all) their shares now, locking in their profits.

Read the full article here